esayMarkets-some details about this broker

Abstract: esayMarkets was launched in 2001, is a reputable financial services provider. From its inception, easyMarkets has been committed to providing innovative products, tools, and services to its clients. easyMarkets, through its subsidiary Easy Forex Trading Ltd, is authorized by the Cyprus Securities and Exchange Commission (license number 079/07), and Easy Markets Pty Ltd is authorized by the Australian Securities and Investments Commission (license number 246566).

| Basic | Information |

| Registered Country/Region | Cyprus |

| Regulation | CySEC, ASIC |

| Founding Time | 2001 |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:400 |

| Minimum Spreads | 0.9 pip on EUR/USD pair |

| Trading Platform | MT4, WebTrader, Mobile App |

| Trading Assets | Forex instruments, global indices, energies, metals and cryptocurrencies including Bitcoin, Ripple and Ethereum. |

| Payment Methods | Bank Wire Transfer, Local Bank Credit/Debit Cards, NetellerSkrill, and more. |

| Customer Support | 5 /24 Live Chat, Phone, Emails |

General Information & Regulation

esayMarkets was launched in 2001, is a reputable financial services provider. From its inception, easyMarkets has been committed to providing innovative products, tools, and services to its clients. easyMarkets, through its subsidiary Easy Forex Trading Ltd, is authorized by the Cyprus Securities and Exchange Commission (license number 079/07), and Easy Markets Pty Ltd is authorized by the Australian Securities and Investments Commission (license number 246566).

Pros & Cons of easyMarket

Account opening on easyMarekts is simple, and the platform offers a variety of useful features like comprehensive educational resources, a robust set of analytical tools, and a flexible selection of trading instruments. Payments are primarily based on typical spreads.

However, Forex and CFDs are the only instruments available, and there is no round-the-clock customer service.

| Pros | Cons |

| Multiple Regulation | High spreads compared to other brokers |

| Deposit Bonus Offered | Not accepting clients from USA and over 20 other countries. |

| High Leverage | Only supports 4 languages |

| Fixed spreads, no commissions | Demo account only valid for 7 days |

| Rich tradable assets | |

| Additional educarional resources, trading tools | |

Market Instruments

easyMarkets offers investors a wide range of tradable financial instruments, including forex currency pairs, precious metals (gold, silver, palladium, platinum, copper), energies (West Texas light crude oil, heating oil, and natural gas), stocks, stock indices, commodities, digital currencies (Bitcoin, Ethereum, and Ripple), standard options and more.

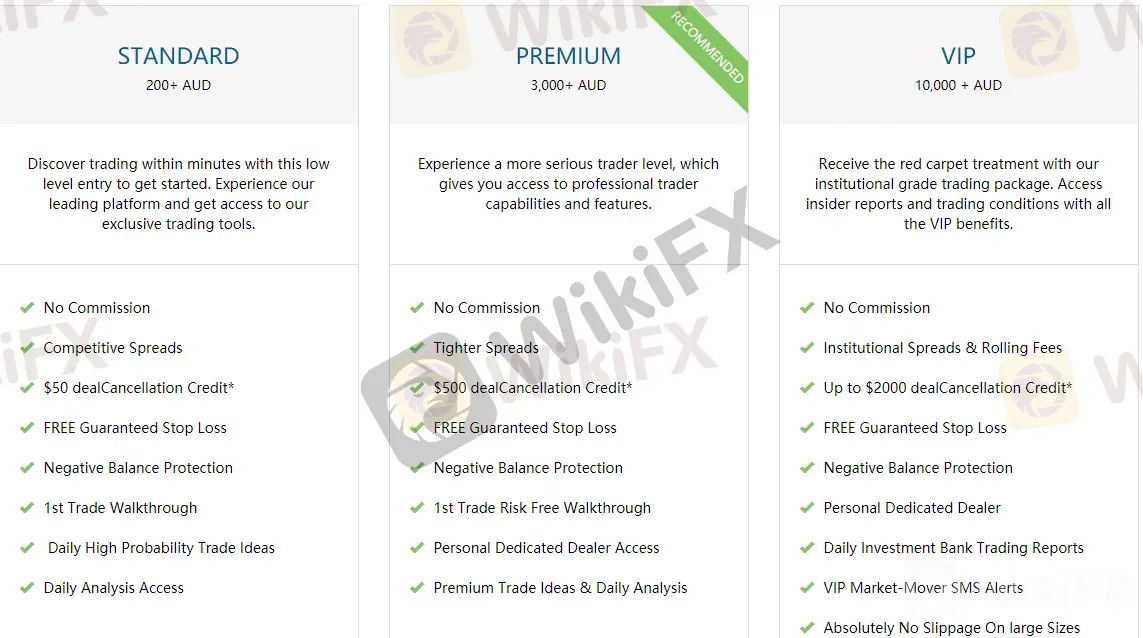

Account Types

easyMarkets offers three account options for traders, namely the Standard, the Premium and the VIP accounts. The Standard account requires a minimum deposit of 200 AUD, and it should be noted that the initial deposit requirement for the premium and the VIP account seem way too high, 3000 AUD and 10,000 AUD respectively.

Demo Accounts Available

Demo accounts, also known as practice accounts, give traders the chance to test out a broker's services without actually risking any money.

Traders new to the market can practice their skills in a simulated trading environment by opening a “demo” account. Even if you are an experienced trader, you can benefit from a demo account and see what EasyMarkets has to offer.

esayMarkets Leverage

The leverage level depends on instruments and platform traders trade, and maximum levearge offered by easyMarket is up to 1:400, the 1:50 for major crypto currency, quite high leverage, indeed.

| Standard Account | Premium Account | VIP Account | ||||

| Max. Leverage (Web) | 1:200 | 1:200 | 1:200 | |||

| Max. Leverage (MT4) | 1:400 | 1:400 | 1:400 | |||

Spreads & Commissions

The spreads on the easyMarkets platform are 0.9 pips for EURUSD, 1.3 pips for GBPUSD, 1 pips for USDJPY, 1.5 pips for USDCHF, 2 pips for USOIL, and 1.8 pips for GER30. Moreover, easyMarkets has launched a series of promotions for new traders: investors are awarded a 30% (minimum $30, maximum $60) tradable bonus on their first deposit of $100-$199, a 50% (minimum $100, maximum $500) tradable bonus on their first deposit of $200-$1,000, a 50% (minimum $100, maximum $500) tradable bonus on their first deposit of 1000-$5000, 40% (min $400, max $2000) tradable bonus.

Trading Platforms

easyMarkets offers traders the flexibility to choose from the easyMarkets web platform, mobile app, and easyMarkets MT4 trading software. The easyMarkets platform is user-friendly, and feature-rich, also suitable for experienced traders. Traders can access easyMarkets' free guaranteed stop loss, no slippage, fixed spreads, and access fees. The easyMarkets trading application offers various trading options based on the trader's objectives and strategies, providing access to market dynamics and real-time prices without leaving the application. The easyMarkets MT4 includes over 80 markets in currencies, metals, commodities, indices, and cryptocurrencies with the ability to trade CFDs with one click, create custom trading templates, or select pre-involved templates. MT4 is available for iPhone, iPad, Android phones, tablets, and PCs.

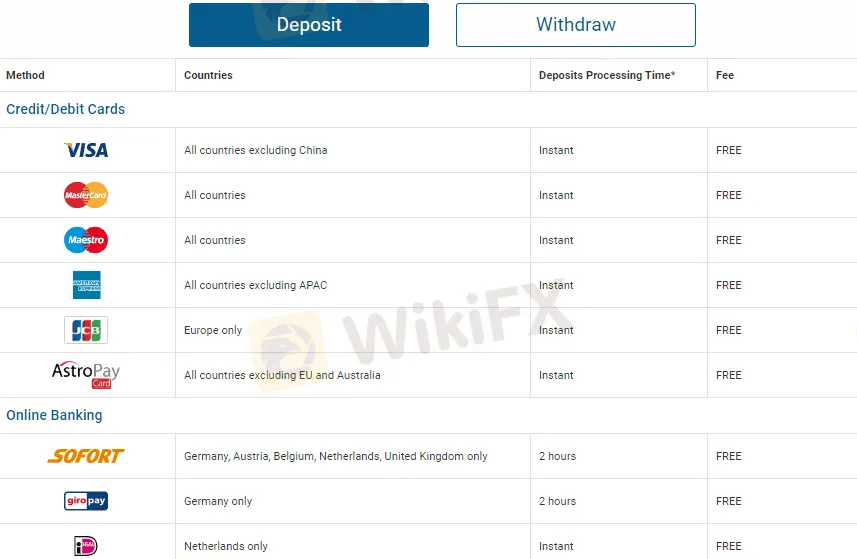

Deposit & Withdrawal

easyMarket supports multiple payment options, including bank transfer, credit, debit, online cards, and a variety of eWallets, including Sofort, giropay, iDeal, WebMoney, BPAY, Neteller, Skrill, and fasapay.

easyMarkets' minimum deposit requirement is $100, however larger accounts with VIP and premium conditions require a greater minimum amount.

easyMarkers does not charge any fees for depositing or withdrawing funds. The fees are covered for all easyMarkets payment options; however, you should verify with your payment provider to determine whether or not they waive fees.

Customer Support

The EASYMARKETS customer service team can be reached via a number of different chat channels, email, phone, and web forms. The help desk is open around the clock and can communicate with customers in a wide variety of tongues.

Educational Resources

Traders new to the field will find a wealth of helpful information in the learning center at easyMARKETS. This includes movies that provide a thorough introduction to the Forex market. Traders have access to downloadable eBooks, which largely consist of a Frequently Asked Questions (FAQ) part. The instructional component is promising but might use more work.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

New SEC Chair Paul Atkins Targets Crypto Regulation Reform

ED Exposed US Warned Crypto Scam ”Bit Connect”

Rate Calc