TECHNICAL AND FUNDAMENTAL FACTORS SIGNAL THE GROWTH IN SHARES OF GENERAL ELECTRIC COMPANY

Abstract: Industry, USA General Electric Company is an American industrial conglomerate, a large manufacturer of various industrial equipment, such as power plants, locomotives, turbines, aircraft engines, lighting equipment, etc.

Financial indicators of the company:

Index – S&P 500;

Market Cap – 56.68 B;

Income – 5.37 B;

P/E – 10.46;

Beta – 0.97;

ROA – 2.30%;

Avg Volume – 118.71 M;

ATR – 0.35.

The investment idea is to capitalize on the correction of the issuer after a significant collapse. Technical and fundamental factors signal a possible increase in #GE quotes.

Analytical review:

1. The company's shares have moved away from annual lows, adding more than 15% in value. Demand for #GE has resumed after the US government announced a tender for the replacement of Boeing (BA) B-52 engines. The tender involves the re-equipment of the entire aircraft fleet during 2021-2035. The contract sum may count to $5-7 billion.

2. Support for institutional funds. Large investment funds and banks (Citigroup, Argus, JP Morgan) estimate the value of the General Electric Company shares at 8-9 USD.

Analysis of financial indicators and company multiples indicates the possibility of further growth of the issuer.

Trading Recommendations for General Electric Company Shares

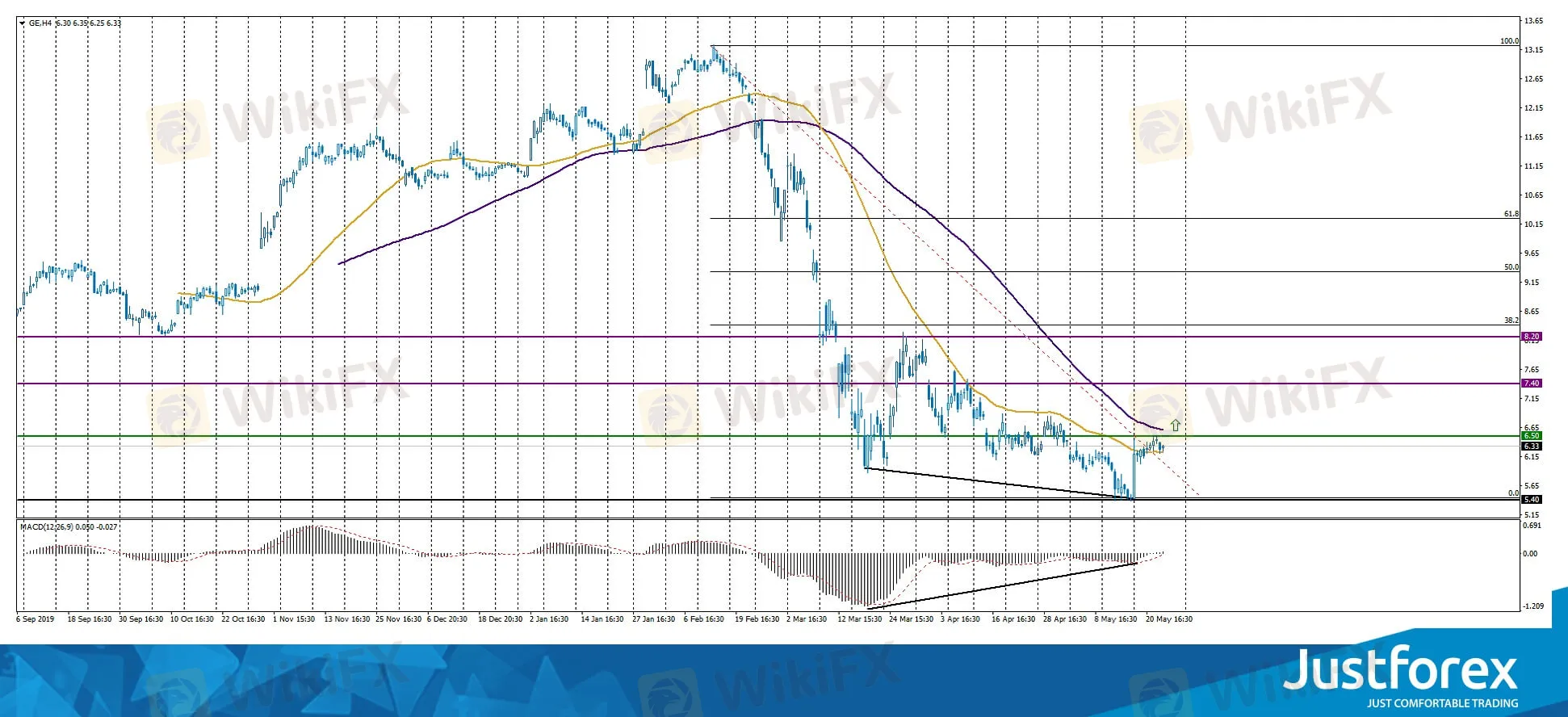

Support Levels: 5.40

Resistance Levels: 6.50, 7.40, 8.20

The company's shares have become stable after a prolonged fall. The current technical pattern signals a possible correction of #GE quotes. A classic reversal formation, the divergence of price and MACD histogram, has been formed in the issuer. At the moment, the trading instrument is testing the local resistance of 6.50. Indicators signal the power of buyers:

- The price has crossed 50 MA;

- The MACD histogram is located near the 0 mark.

We recommend opening positions from key levels.

If the price fixes above 6.50, the companys shares are expected to recover. The nearest goal for profit-taking is 7.40-8.20. The movement is tending to the 50.0%-61.8% correctional zone. When following positions, we recommend using a trailing stop.

An alternative could be a decrease in #GE quotes to the zone of 5.00-4.00.

WikiFX Broker

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

Malaysia’s EPF Declares Highest Dividend Since 2017 Amid Market Resilience

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

Rate Calc