UTS-Overview of Minimum Deposit, Spreads & Leverage

Abstract:UTS, owned by Union Trader Society, is an online Forex broker registered in the United States with around 5 years of experience in business, in addition, with the focus on providing you with the purest and most insightful trading insights and markets, UTS is carrying out a decent trading environment, which has been satisfying several clients.

| Registered Country | United States |

| Regulation | No License |

| Incorporated Years | 2- 5 Years |

| Company Name | Union Trader Society |

| Trading assets | Currency Trading |

| Payment Methods | N/A |

| Customer support | Email: support@uniontradersociety.biz |

General Information

UTS, owned by Union Trader Society, is an online Forex broker registered in the United States with around 5 years of experience in business, in addition, with the focus on providing you with the purest and most insightful trading insights and markets, UTS is carrying out a decent trading environment, which has been satisfying several clients.

Here is the screenshot of UTSs official website:

Pros and Cons

UTS (Universal Trading System) offers a range of pros and cons for traders to consider. On the positive side, UTS provides the potential for profitable trading by granting access to global markets and allowing traders to track investments and gain valuable trading insights. The web-based platform enables users to stay updated on global market trends and news, which can be beneficial for making informed trading decisions. Additionally, UTS offers insights on currency trading, providing valuable information for forex traders. However, it's important to note the cons as well. Trading through UTS involves high volatility and risk, which may not be suitable for all investors, especially those with limited experience. The platform's complexity can be challenging for inexperienced traders, and there may be concerns about reliability during peak trading or volatile conditions. The lack of proper regulation raises potential concerns regarding security and investor protection. Furthermore, UTS has limited customization options, and there is a risk of misinterpreting sourced information. Traders should carefully evaluate these pros and cons to determine if UTS aligns with their trading goals and risk tolerance.

| Pros | Cons |

| Potential for profitable trading | Involves high volatility and risk |

| Provides access to global markets | Can be complex for inexperienced traders |

| Web-based platform for trading | Reliability concerns during peak trading or volatile conditions |

| Access to insights on currency trading | Lack of proper regulation raises concerns |

| Stay updated on global market trends and news | Limited customization options |

| Track investments and gain trading insights | Potential misinterpretation of sourced information |

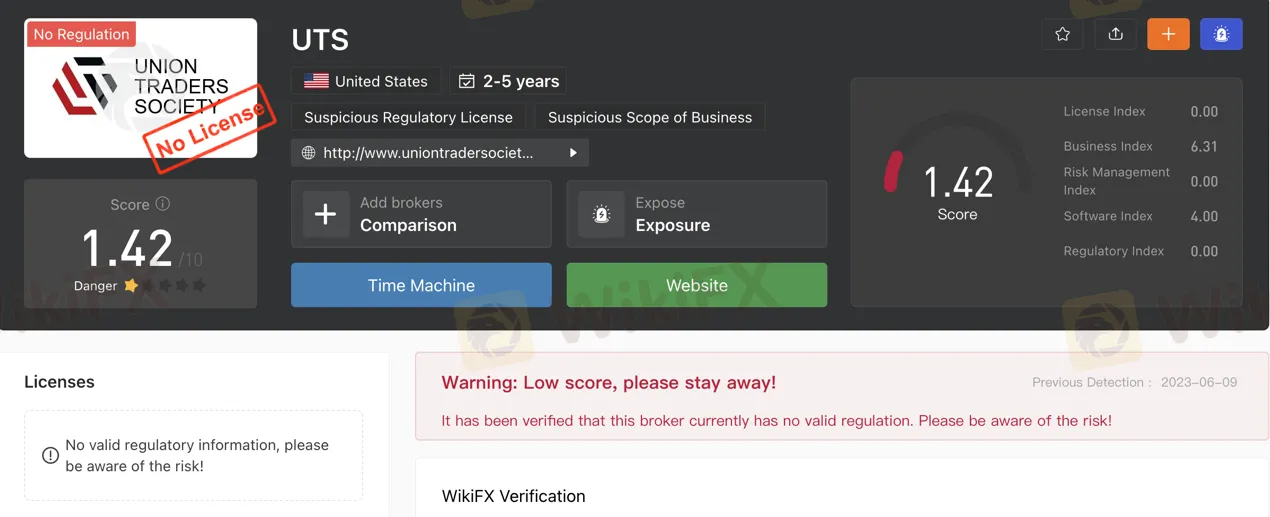

Is UTS Legit?

UTS (Union Trading Services) is a brokerage firm that, as the name suggests, lacks any valid regulation. This means that it operates without oversight from a reputable financial authority or regulatory body. The absence of regulation is a significant red flag when it comes to financial services, especially in the realm of trading and investment.

Regulatory bodies are responsible for ensuring that brokerage firms adhere to certain standards and guidelines, which are designed to protect investors and maintain the integrity of the financial markets. These regulations often include measures to prevent fraud, safeguard client funds, and promote transparency.

Market Instruments

UTS is primarily focused on providing retail forex trading services. While specific details regarding the available forex pairs are not publicly disclosed, it claims to offer a range of forex pairs for clients. Forex trading involves the buying and selling of currencies, allowing traders to speculate on the exchange rate movements between different currency pairs.

| Pros | Cons |

| Offers diversification opportunities | Involves high volatility and risk |

| Potential for profitable trading | Can be complex for inexperienced traders |

| Provides access to global markets | Lack of proper regulation raises concerns |

| Market instruments can be susceptible to manipulation or fraud |

Accounts & Leverage

Unfortunately, we cannot gain the info about UTS accounts as well as leverage.

Trading Platform

What is worth mentioning, UTS is non MT4/MT5 provider, the information and details we gathered are that this broker provides traders or investors with the web-based trading platform, which is not as reliable as MT4/MT5, instead clients could apply this trading platform with multiple time frames, charts, and some of the most popular drawing tools and price indicators.

Deposit & Withdrawal

The same goes for accounts, UTS has not elaborated on the payment methods they accept.

Customer Support

We could not get relevant contact information due to failing to visit the official website, if clients would like to know about this broker in-depth, please try to visit the official website.

Educational Resources

UTS offers a range of educational resources to its users, aimed at providing valuable insights and information for traders. These resources are designed to help users make informed decisions and stay updated on market trends and news. Let's take a look at the different types of educational resources available:

1. Currency Trading: UTS provides insights and analysis on leading currency trades, allowing users to capitalize on potential gains and mitigate losses. This information can be valuable for traders looking to navigate the foreign exchange market effectively.

2. News: UTS offers global trends and news that impact the financial markets. By staying informed about the latest developments, traders can make more informed decisions and adjust their strategies accordingly.

3. User Insights: UTS allows users to build a profile and track their investments intelligently. This feature helps traders keep a record of their gains and losses, providing them with valuable insights into their trading activities.

4. Market Forums: UTS provides a platform for traders to connect with fellow traders, fostering discussion and the exchange of ideas. By participating in these forums, users can gain insights into existing and upcoming market trends, enhancing their understanding of the financial markets.

5. Blog: UTS maintains a blog section where they share trading-related articles. It's important to note that these blogs are sourced from another website and are provided for reference purposes. Readers should exercise caution and avoid taking information out of context.

| Pros | Cons |

| Access to insights on currency trading | Reliance on external blog content |

| Stay updated on global market trends and news | Incomplete coverage of all trading aspects |

| Track investments and gain trading insights | Lack of personalized guidance and support |

| Connect with fellow traders in market forums | Potential misinterpretation of sourced information |

Reviews

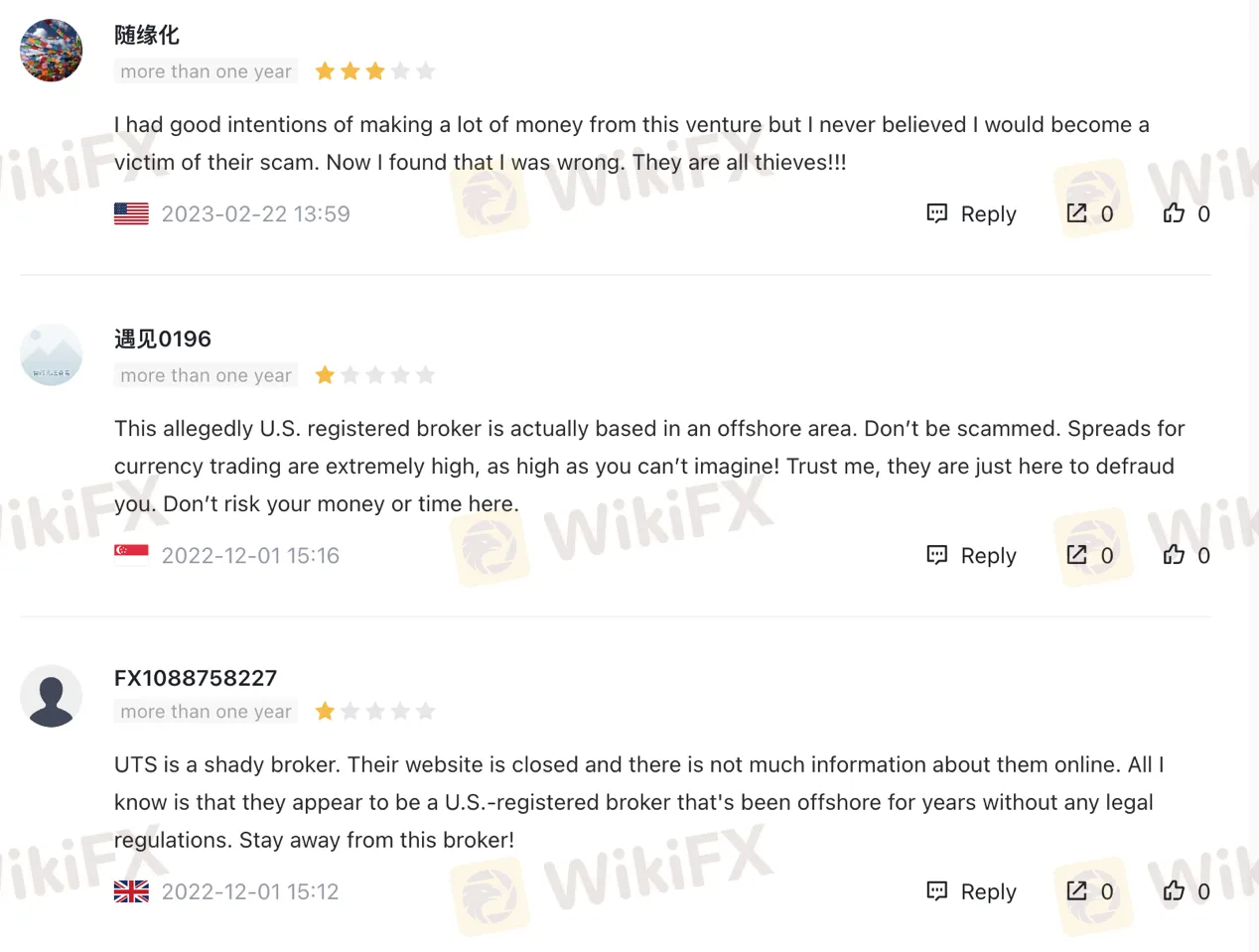

According to reviews on WikiFX, UTS has received negative feedback. Users describe it as a scam, warning others to stay away. They mention that UTS claims to be a U.S.-registered broker but operates offshore, with high spreads and limited information available. Overall, the reviews advise against investing with UTS due to concerns about fraudulent practices and lack of proper regulation.

Conclusion

In conclusion, UTS (Union Trading Services) operates as an unregulated brokerage firm, which raises significant concerns regarding the safety and reliability of its services. While UTS offers a web-based trading platform, insights on currency trading, access to global market trends and news, user insights for tracking investments, and market forums for connecting with fellow traders, these advantages are overshadowed by the absence of proper regulation, potential reliance on external blog content, incomplete coverage of trading aspects, lack of personalized guidance and support, and the risk of misinterpreting sourced information. Therefore, caution is advised when considering UTS as a brokerage option, and it's recommended to choose regulated and authorized brokers that provide a more secure and transparent trading environment.

FAQs

Q: Is UTS a regulated brokerage firm?

A: No, UTS lacks any valid regulation and operates without oversight from a reputable financial authority.

Q: What trading instruments are available with UTS?

A: UTS primarily focuses on retail forex trading, but specific details regarding available forex pairs are not disclosed publicly.

Q: What trading platform does UTS offer?

A: UTS offers its own web-based trading platform, distinct from the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Q: What educational resources does UTS provide?

A: UTS offers insights on currency trading, global market trends and news, user insights for tracking investments, and market forums for connecting with fellow traders. They also maintain a blog section for trading-related articles.

Q: How can I contact UTS for customer support?

A: UTS offers customer support primarily through a website message gateway where users can submit their details and message.

Q: Are there any reviews or feedback about UTS?

A: According to reviews on WikiFX, UTS has received negative feedback, with users cautioning against investing with the broker due to concerns about fraudulent practices and lack of proper regulation.

Read more

Tag Markets Exposed: Withdrawal Issues, Inflated Spreads & Market Manipulation Concerns

Did you encounter the sudden disappearance of Tag Markets’ MT5 one-click button? Did it result in wiping out your forex trading account balance? Does the broker disallow you profit withdrawals? Do you frequently witness price mismatches on the Tag Markets login? Has this piled on your capital losses? These experiences sum up the below-standard forex trading journey many traders have had with the broker. Some of them discussed such experiences while sharing the Tag Markets review. Take a look!

Exnova Exposed: Reports of Failed Deposits & Withheld Withdrawals from Traders

Does your deposit amount fail to reflect in your Exnova forex trading account? Does the same thing happen even when withdrawing? Does the Exnova bonus lure lead to a NIL account balance? Has the broker terminated your account without any explanation? These trading issues have become synonymous with traders here. Some traders have openly criticized the broker on several review platforms online. In this Exnova review article, we have highlighted the miserable forex trading experiences.

FXCM Broker ASIC Stop Order Halts CFD Sales

FXCM Broker ASIC Stop Order blocks new CFD trading for retail clients in Australia due to TMD flaws. Explore FXCM Broker CFD Trading Ban Australia impacts, retail client restrictions, and next steps for traders.

FortuixAgent Review: A Tale of Account Restrictions & Withdrawal Denials

Has your FortuixAgent app for forex trading been restricted? Does the broker not allow you to withdraw your initial deposits? Does the UK-based forex broker demand payment out of your earnings to allow withdrawals? These issues refuse to leave traders, as they come out expressing their frustration on broker review platforms. In this Fortuixagent review article, we have shared many complaints made against the broker.

WikiFX Broker

Latest News

Identity Theft in FX: FCA Flags New 'Clone' Broker Mimicking Fortrade

Oron Limited Regulation: A Complete 2025 Review of Its License and Safety

Trade.com Review & Complaints Hidden from New Investors! Tell Different Story

Is Tiger Brokers Regulated? Investor Protection Guide

FXCM Broker ASIC Stop Order Halts CFD Sales

The "Profit Eraser" Clause: Why Traders Are Losing Their Gains with Admirals

Souq Capital Exposed: DFSA Warns of Fake Licensing Claims and Unauthorized Status

Is FXCC Regulated? Full FXCC Regulation Overview

Exnova Exposed: Reports of Failed Deposits & Withheld Withdrawals from Traders

Tag Markets Exposed: Withdrawal Issues, Inflated Spreads & Market Manipulation Concerns

Rate Calc