FinvizPro-Overview of Minimum Deposit, Leverage, Spreads

Abstract:FinvizPro is an unregulated brokerage company registered in the United Kingdom engaged in more than 300 trading instruments, including forex, stock indices & oil, metals, and bonds.

Note: FinvizPro's official website: https://finvizpro.org/ is normally inaccessible.

FinvizPro Information

FinvizPro is an unregulated brokerage company registered in the United Kingdom engaged in more than 300 trading instruments, including forex, stock indices & oil, metals, and bonds.

The company also offers various account types with a minimum deposit of $250 and a maximum leverage of 1:400. While the broker's official website has been closed, traders cannot obtain more security information.

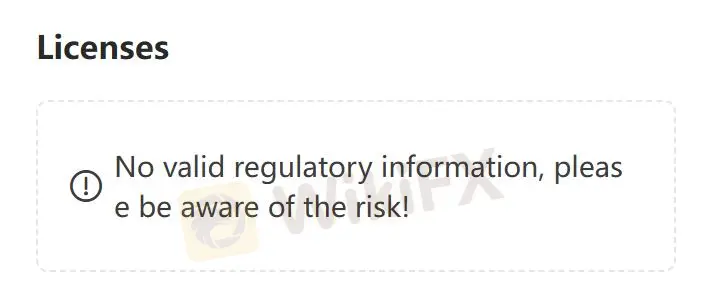

Is FinvizPro Legit?

FinvizPro is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with the company.

Downsides of FinvizPro

- Unavailable Website

The website of FinvizPro is inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since FinvizPro does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

FinvizPro is not regulated, which is less safe than a regulated one.

Conclusion

FinvizPro Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that the trading risks of the broker are high. It is advisable to choose regulated brokers with transparent operationsto ensure the safety of your investments and compliance with legal standards. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Read more

Vault Markets Review 2025: Live & Demo Accounts, Withdrawal to Explore

Vault Markets, a South African-based broker, has attracted much attention in recent days, particularly within its region. This online broker only offers access to focused trading opportunities on Indices, Currencies, Energies, and Metals, yet it shines on low minimum deposits plus various bonus programmes, which would encourage more investors, especially beginners, to trade with a small budget. However, Vault Markets operates outside of the authorized scope, so we don't consider it solid to trade with.

Australian Dollar Surges as Trade Surplus Hits 11-Month High: A Golden Opportunity for Forex Traders

Australia's trade surplus has surged to an 11-month high, reaching $5.62 billion in January 2025. The unexpected boost in trade surplus was primarily driven by a 1.3% month-over-month increase in exports, with non-monetary gold playing a starring role.

ECB Set to Cut Rates, But Future Path Uncertain Amid Global Tensions

- ECB expected to cut interest rates on March 6 - Future rate decisions unclear due to ongoing inflation and global trade issues - Markets expect more cuts, but some ECB officials urge caution

T&D vs AvaTrade: Which Broker Suits Your Trading Needs in 2025?

In this article, we compare these brokers based on basic information, regulatory status, leverage, trading platforms, account types, spreads and commissions, customer service, AI tools, and recent updates. Our goal is to provide an objective overview so you can decide which broker aligns better with your trading style and requirements.

WikiFX Broker

Latest News

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FINMA Opens Bankruptcy Proceedings

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Famous Olympic Breakdancer’s Brother Faces Crypto Fraud Charges

Gold Surge News: Central Banks Expand Gold Reserves—Will Prices Rise?

Denmark\s postal service to stop delivering letters

Rate Calc