Monyxa -Overview of Minimum Deposit, Leverage, Spreads

Abstract:Monyxa is an offshore forex broker offering a series of trading assets, such as forex, stocks, cryptos, and more. Monyxa is the trading name of Monyxa Ltd, and it is an offshore broker registered in Saint Vincent and the Grenadines.

General Information

Monyxa is an offshore forex broker offering a series of trading assets, such as forex, stocks, cryptos, and more. Monyxa is the trading name of Monyxa Ltd, and it is an offshore broker registered in Saint Vincent and the Grenadines.

Regulatory Details

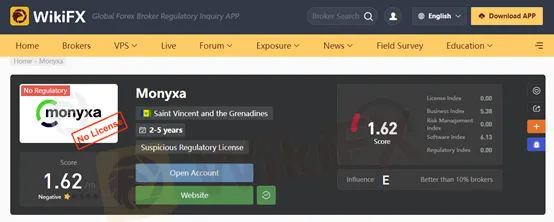

The regulatory status of Monyxa on the WikiFX website is displayed as “No License”, as it has been verified that this broker is not subject to any valid regulation. Besides, it got a low score of 1.62/10 on WikiFX based on Regulatory Index, Business Index, Risk Management Index, Business Index, and License Index. Please be aware of the risk.

Market Instruments

When it comes to trading instruments, different classes of assets can be traded through this brokerage platform, such as FX Majors, FX Cross, FX Minors, Spot Metals, CFDs, Spot Indices, and Shares.

Account Types

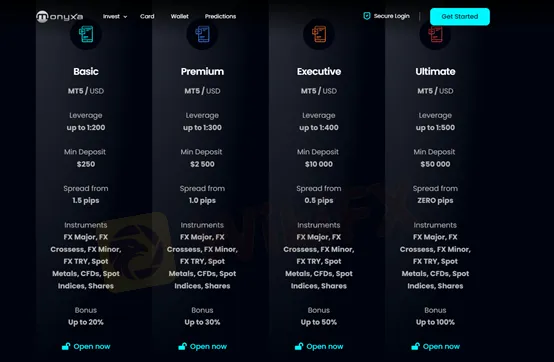

Monyxa offers four tiered trading accounts for both retail and professional traders, including Basic, Premium, Executive and Ultimate. To open a Basic account, you need to fund at least $250, which sounds acceptable. While another three accounts require much higher initial deposits from $2,500, $10,000, and $50,000, respectively.

Various amount of bonuses is offered along with these four accounts, with the Basic account up to 20%, the Premium up to 30%, the Executive up to 50%, and the Ultimate up to 100%.

Furthermore, Islamic Swap-free accounts are applicable for all the above tiers.

Leverage

Trading leverage differs depending on different trading accounts, ranging from 1:200 to 1:500, which is quite generous. High leverage typically is preferred by professional traders and scalpers, as it presents more trading flexibility. While for inexperienced traders, it is important for them to choose the proper amount that they feel most at ease, as leverage can amplify gains as well as losses.

Spreads & Commissions

Spreads are determined by trading accounts. More account balance you have, the more competitive spreads you can enjoy. The first three accounts, Basic, Premium, and Executive offers spread from 1.5 pips, 1.0 pip, and 0.5 pips, respectively, with no commission charged. While the Ultimate account, it offers competitive spreads, as low as 0.0 pips, accompanied by a certain commission.

Trading Platform

Monyxa offers its clients access to the leading MT5 Trading platform, as well as a WebTrader.

Deposit & Withdrawal

The minimum deposit is $250, and traders can make a deposit and withdrawal through Credit Card, E-wallets. Withdrawal requests take up to 8 business days to process. The time taken to receive your payment may vary depending on payment processors.

Monyxa VISA Card

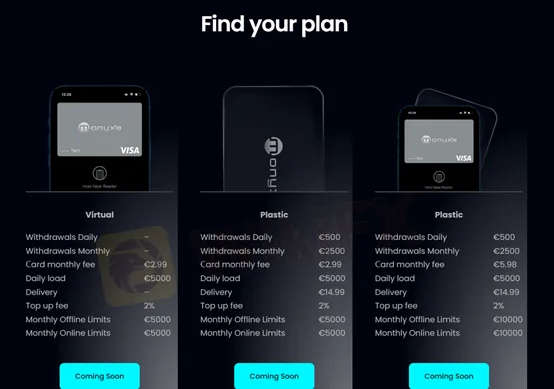

Monyxa issued a virtual Monyxa VISA Card, and it says clients can pay with this card in over 42 million retailers, spending up to €10,000 per month. This Monyxa VISA Card is free, with delivery starting at €14.99. Below is the tiered plan for this card.

Customer Support

Monyxa only can be contacted by telephone: +1(888)344-0351.

Or you can also follow this broker on some popular social media platforms, including Facebook, Twitter, Instagram, and Youtube.

Company Address: Suite 305, Griffith Corporate Center, Beachmont, Kingstown, St. Vincent & Grenadines

Risk Warning

Online trading in leveraged Forex and CFD instruments contains a high level of risk and may not be suitable for all investors.

Please note that the information contained in this article is for general information purposes only.

Read more

T&D vs AvaTrade: Which Broker Suits Your Trading Needs in 2025?

In this article, we compare these brokers based on basic information, regulatory status, leverage, trading platforms, account types, spreads and commissions, customer service, AI tools, and recent updates. Our goal is to provide an objective overview so you can decide which broker aligns better with your trading style and requirements.

5 Arrested in the TriumphFX Investment Scam Investigation

Malaysian authorities have intensified their investigation into the TriumphFX foreign exchange investment scam, resulting in the arrest of five individuals linked to the fraudulent scheme.

Notice: The WikiFX Simulated Trade Weekly Competition has been suspended for one week

Due to an upcoming product upgrade to enhance your overall trading simulation experience, the WikiFX Simulated Trading Weekly Contest will be temporarily suspended from March 10 to March 16. The contest will resume on March 17 with a host of improvements.

Nifty 50 Index Futures Now Available at Interactive Brokers

Trade Nifty 50 Index Futures with Interactive Brokers. Access India’s top 50 firms, diversify portfolios, and manage risk on a powerful trading platform.

WikiFX Broker

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FINMA Opens Bankruptcy Proceedings

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Rate Calc