Globalix-Overview of Minimum Deposit, Leverage, Spreads

Abstract:Globalix is an online broker that was established in 2013 and is owned and run by Globalix LTD, a company that is registered on Ajeltake Island in Majuro, Marshal Islands. Globalix was created to provide customers who want to enter the CFD and cryptocurrency markets with personalized one-on-one account management, claims the official website. Through its own WebTrader platform, the broker provides a variety of tradeable assets. However, it's crucial to remember that there are several key distinctions between digital currency robots like Bitcoin Trader and Bitcoin Era and online brokers. Since its founding in 2013, Globalix has provided trading in indices, equities, cryptocurrencies, forex, and CFDs. We assume the company lacks a trustworthy regulatory body because it doesn't provide any information regarding its regulation. The broker claims to store all client funds at top-tier European banks, but since it is neither based in the EU nor regulated by any EU regulator, it is not permitt

BASIC INFORMATION

Globalix is an online broker that was established in 2013 and is owned and run by Globalix LTD, a company that is registered on Ajeltake Island in Majuro, Marshal Islands. Globalix was created to provide customers who want to enter the CFD and cryptocurrency markets with personalized one-on-one account management, claims the official website. Through its own WebTrader platform, the broker provides a variety of tradeable assets. However, it's crucial to remember that there are several key distinctions between digital currency robots like Bitcoin Trader and Bitcoin Era and online brokers. Since its founding in 2013, Globalix has provided trading in indices, equities, cryptocurrencies, forex, and CFDs. We assume the company lacks a trustworthy regulatory body because it doesn't provide any information regarding its regulation. The broker claims to store all client funds at top-tier European banks, but since it is neither based in the EU nor regulated by any EU regulator, it is not permitted by law to provide its financial resources to people who live in the EU.

Additionally, Globalix was prohibited in Spain by the CNMV, the country's regulator, in May 2019:

“GLOBALIX LTD is not authorized to provide investment services, including investment advice, or to provide auxiliary services in regard to the financial instruments, including, for those reasons, foreign currency transactions,” the statement reads.

LICENSE

Since trading in FX and CFDs has not yet been permitted by the Marshall Islands government, Globalix is not subject to any formal regulatory bodies. However, the broker works hard to give its clients financial security and make sure their money is always protected. These consist of:

The broker's entire website is encrypted using 256-bit SSL.

Globalix uses COMODO Secure to stop identity theft and credit card fraud.

The broker keeps client funds in Europe's top-tier banks.

Client funds are kept in segregated accounts throughout Europe, the Middle East, and Canada.

Globalix employs 3D-secure when processing credit card payments.

BUSINESS SCALE

You can choose from a wide variety of tradable assets at Globalix. These are divided into the following categories: cryptocurrencies, commodities, stocks, indices, and forex. A wide range of products, including some of the most exotic international equities and indexes, are available from the broker. The trading instruments that Globalix offers are listed below:

· 23 Indices, 55 currency pairings

· 17 products

· 190 stocks

· 50 cryptocurrency pairs

TRADING PLATFORM

On any PC, Macintosh, or Linux workstation as well as on mobile devices, Globalix provides its own web trading interface, known as Globalix WebTrader. Despite lacking some of the more sophisticated features found on professional trading platforms, the trading platform has an easy-to-use layout that makes it acceptable for both novice and seasoned users.

Additionally, the platform can be accessed through a web browser, so there's no need to download a desktop application; you can simply join in through Globalix's website. In order to transmit order confirmation and alerts, the WebTrader additionally incorporates a push notification system.

ACCOUNT TYPES

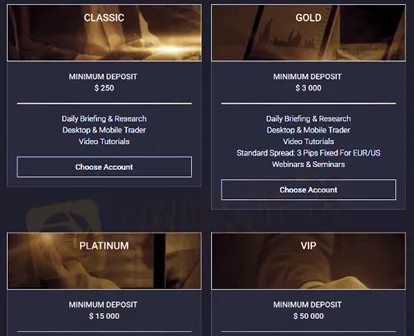

Globalix has four different account types – Classic, Gold, Platinum, and VIP. The minimum deposit requirement for the Classic account is $250. Each upgrade provides different benefits as you can see in the image below.

Globalix also provides as many demo accounts as you wish to practice the platform and its functionality for an unlimited period of time.

LEVERAGE

Leverage ratios up to 1:100 are available through Globalix, however they vary based on the instrument you choose. A leverage, in plain English, enables you to open trades with more money than you initially placed. However, you should be aware that the risk of losing your capital increases with more leverage.

COMMISSIONS AND SPREADS

Globalix does not provide much information about its commission and fees. The broker, however, does state that it does not charge commission or fee as a result of your trading except the Bid/Ask spread.

EDUCATION AND RESOURCES

To help both novice and seasoned traders maximize their trading experience, Globalix provides a wealth of instructional tools. Daily headlines, a trading academy, video tutorials, a CFD glossary, a trading school, and an educational FAQ section are all accessible through Globalix.

Customer Support

Globalix has excellent customer service which is available 24/7. You can contact a member of staff via phone, email, submit a ticket, and live chat.

Users who have tried this broker are satisfied with the service they received and the speed at which Globalix agents respond to their queries.

Read more

What Impact on the Forex Market as Former Philippine President Rodrigo Duterte is Arrested.

The sudden arrest of former Philippine President Rodrigo Duterte on an International Criminal Court (ICC) warrant has sent shockwaves through global markets and regional investors alike. While Duterte’s arrest is being hailed by human rights groups as a decisive step toward accountability for his controversial “war on drugs,” it also raises significant questions about factors that can strongly influence the forex market.

How Can Fintech Help You Make Money?

Fintech – short for financial technology – is rapidly transforming the way people manage, invest, and even earn money. In this article, we’ll explore various ways fintech can help you make money, from smarter investing to launching a side hustle, while also reducing costs and boosting your financial health.

What’s the Secret in Trading Chart Behind 90% Winning Trades?

Discover the secret to 90% winning trades with chart patterns, indicators, and pro strategies. Master trading charts for consistent wins!

Maxxi Markets Review

Maxxi Markets is a forex broker founded in Comoros that offers traders access to a diverse range of financial instruments. With product offerings spanning commodities, forex, indices, metals, cryptocurrencies, and bonds, the broker caters to a wide spectrum of trading interests. Backed by the Mwali International Services Authority (MISA) under an offshore Retail Forex License (license number T2023425), Maxxi Markets combines innovative technology with varied account options to serve both novice and experienced traders.

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Rate Calc