Millonarium FX

Abstract:Millonarium FX is allegedly a forex and CFD broker registered in the United States that claims to provide its clients with leverage up to 500:1 and variable spreads from 0.3 pips on the leading MetaTrader4 trading platform, as well as a choice of two different real account types.

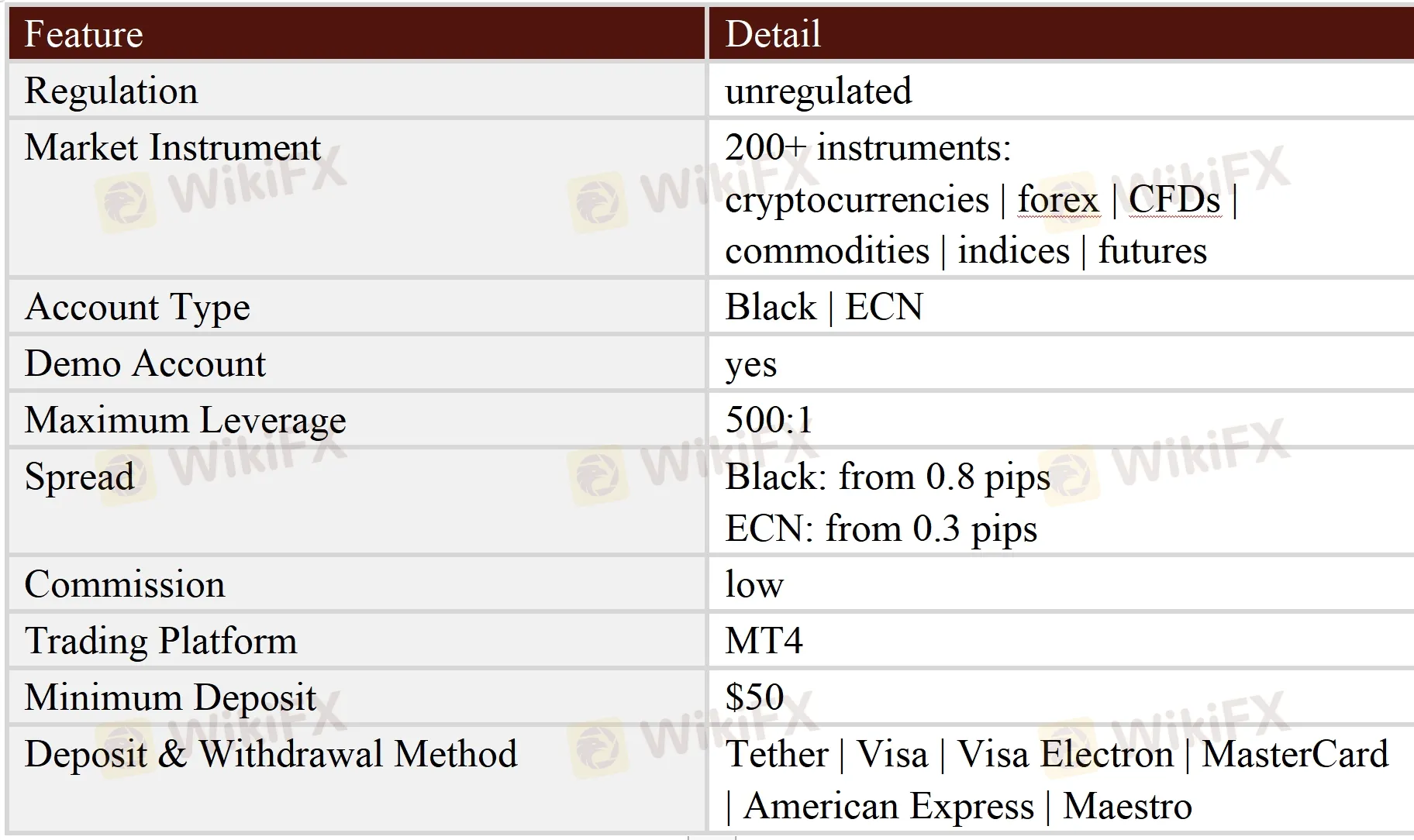

General Information & Regulation

Millonarium FX is allegedly a forex and CFD broker registered in the United States that claims to provide its clients with leverage up to 500:1 and variable spreads from 0.3 pips on the leading MetaTrader4 trading platform, as well as a choice of two different real account types. Here is the home page of this brokers official site:

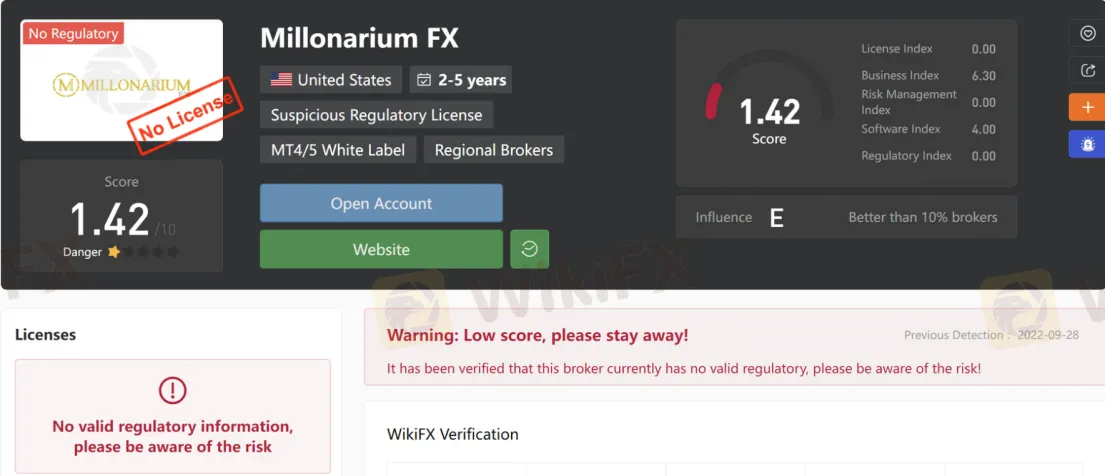

As for regulation, it has been verified that Millonarium FX does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and it receives a relatively low score of 1.42/10. Please be aware of the risk.

Market Instruments

Millonarium FX advertises that it offers access to more than 200 trading instruments, covering cryptocurrencies, forex, CFDs, commodities, indices and futures.

Account Types

Apart from demo accounts, Millonarium FX claims to offer two types of real trading accounts, namely Black and ECN. The minimum initial deposit amount is $50 for the Black account, while the ECN account has a much higher minimum initial capital requirement of $500.

Leverage

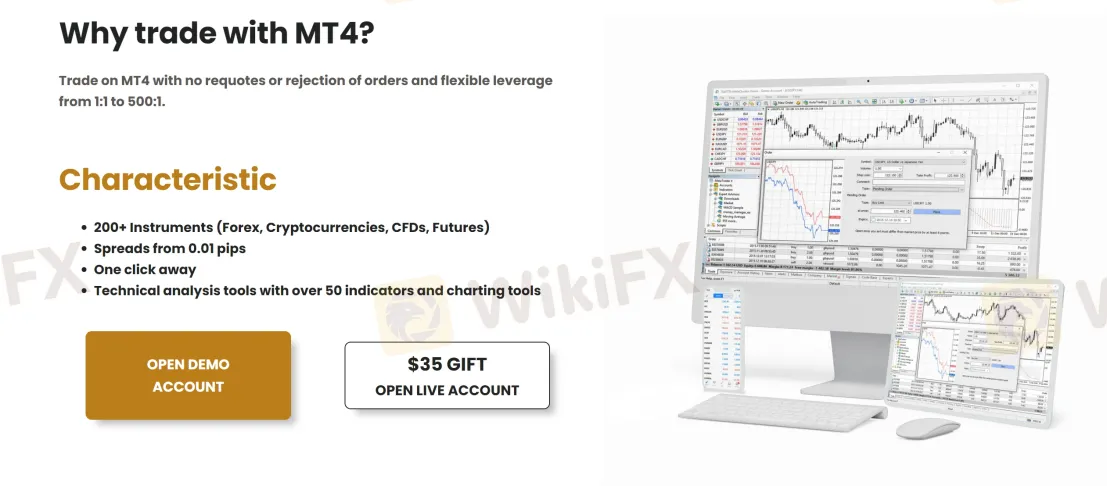

The leverage provided by Millonarium FX is flexible from 1:1 to 500:1. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Millonarium FX claims that the spread is different for different account types. Specifically, the spread from 0.8 pips on the Black account and from 0.3 pips on the ECN account. As for commissions, the brokers website reveals that the commission is low, yet no more specific is involved.

Trading Platform Available

The platform available for trading at Millonarium FX is the industry-standard MetaTrader4. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

From the logos shown at the foot of the home page on Millonarium FXs official website, we found that this broker seems to accept numerous means of deposit and withdrawal choices, consisting of Tether, Visa, Visa Electron, MasterCard, American Express and Maestro. The minimum initial deposit requirement is said to be $50.

Customer Support

Millonarium FXs customer support can be reached by telephone: +51 946 072 472, +51 979 395 839, email: contact@millonariumfx.com. You can also follow this broker on social networks such as Facebook and Instagram. Company address: Av. Santo Toribio 173–Vía Principal 125–Torre Real 8–Of. 1628. San Isidro.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Read more

Oanda Shines As Frop Trading Firm After Being Acquired By FTMO

FTMO enhances prop trading with the OANDA Prop Trader Community and loyalty program, integrating CRM automation and rewards post-acquisition.

2025 WikiFX Forex Rights Protection Day Preview

The annual WikiFX "Forex Rights Protection Day" is approaching! Following the successful launch of the inaugural event in 2024, WikiFX continues to hold it this year, aiming to expose the truth about fraudulent platforms in the forex market through in-depth investigations and broad dissemination of information. Meanwhile, it strives to enhance investors' risk recognition capabilities, collectively building a robust defense for trading security. WikiFX is always committed to protecting investors' rights and interests!

Webull: A Comprehensive Review from Accounts to Withdrawal 2025

Webull Financial stands as a digital trading platform founded in 2017, offering commission-free trading across multiple asset classes including stocks, options, ETFs, cryptocurrencies, and forex. The platform targets primarily intermediate traders seeking a balance of analytical tools and straightforward execution capabilities. While Webull provides robust charting tools and an intuitive mobile experience, its forex offering remains at industry average levels with certain limitations in currency pair selection compared to some other forex brokers.

Quotex Review 2025:Live & Demo Accounts, Withdrawal to Explore

Quotex is an online trading platform specializing in digital options, offering access to various assets, including currencies, commodities, and cryptocurrencies. It operates with a proprietary web-based platform. The platform's user interface, while basic, is generally functional, and the availability of numerous short-term trading options may appeal to those seeking rapid trading opportunities. While it presents a user-friendly interface and a low minimum deposit, it's important to note that the regulatory landscape surrounding Quotex involves offshore registration, which may present different levels of investor protection compared to more strictly regulated financial jurisdictions.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

What Can Expert Advisors Offer and Risk in Forex Trading?

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

The Most Effective Technical Indicators for Forex Trading

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Rate Calc