CAPITALFX

Abstract:CAPITALFX, a trading name of Aegion Group Ltd, is allegedly a forex broker registered in Saint Vincent and the Grenadines that claims to provide its clients with four different live account types.

Note: CAPITALFX is to operate via the website - https://www.capital-fx.info/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No regulation |

| Market Instrument | forex |

| Account Type | Bronze, Silver, Gold and Black |

| Demo Account | N/A |

| Maximum Leverage | N/A |

| Spread | N/A |

| Commission | N/A |

| Trading Platform | N/A |

| Minimum Deposit | $500 |

| Deposit & Withdrawal Method | N/A |

CAPITALFX, a trading name of Aegion Group Ltd, is allegedly a forex broker registered in Saint Vincent and the Grenadines that claims to provide its clients with four different live account types.

As this brokerage's website cannot be accessed, we were unable to obtain further details about its trading assets, leverage, spreads, trading platforms, etc.

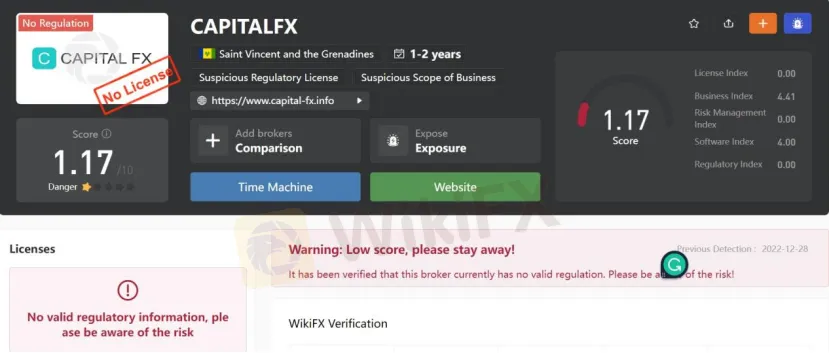

As for regulation, it has been verified that CAPITALFX currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.17/10. Please be aware of the risk.

Market Instruments

CAPITALFX advertises that it is a forex broker that mainly offers forex trading. However, more specific information about tradable assets cannot be found on the Internet.

Account Types

CAPITALFX claims to offer four types of trading accounts, namely Bronze, Silver, Gold and Black, with minimum initial deposit requirements of $500, $3,000, $7,000 and $50,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of c100 or even less.

Deposit & Withdrawal

The minimum initial deposit requirement at CAPITALFX is said to be $5000. However, the broker says nothing about the deposit and withdrawal methods.

Customer Support

The only way you can approach CAPITALFX is via email: info@capital-fx.info. However, this broker doesnt disclose other more direct contact information like telephone numbers or the company address that most transparent brokers offer.

Pros & Cons

| Pros | Cons |

| • Multiple account types can be chosen from | • No regulation |

| • Website inaccessible | |

| • High minimum deposit (500) | |

| • Lack of transparency |

Frequently Asked Questions (FAQs)

| Q 1: | Is CAPITALFX regulated? |

| A 1: | No. It has been verified that CAPITALFX currently has no valid regulation. |

| Q 2: | What is the minimum deposit for CAPITALFX? |

| A 2: | The minimum initial deposit at CAPITALFX to open an account is as high as $500. |

| Q 3: | Is CAPITALFXa good broker for beginners? |

| A 3: | No. CAPITALFX is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website and high initial deposit. |

Read more

Oleg Mukhanov Steps Down as TradingView CEO Amid Leadership Shakeup

In a surprising announcement on Thursday, Oleg Mukhanov, who has been at the forefront of TradingView’s growth over the past few years, revealed his decision to step down as CEO. Mukhanov, who ascended to the role in January 2024 after joining the technology giant in mid-2022 as Group Chief Financial Officer, will continue to serve as an advisor to TradingView’s board.

The Hidden Tactics Brokers Use to Block Your Withdrawals

In the fast-paced world of online trading, liquidity is everything. Traders and investors must have unrestricted access to their funds at all times. Any broker that imposes unnecessary conditions or delays when it comes to withdrawals is raising a glaring red flag.

Forex Trading: Scam or Real Opportunity?

Meta: Explore forex trading: Is it a scam or real opportunity? Learn how it works, debunk myths, manage risks, and avoid scams with tools like WikiFX App. Start trading safely today!

Trade Nation 2025 Most Comprehensive Review

This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

WikiFX Broker

Latest News

Is $CORONA Memecoin a Legit Crypto Investment?

Is Pi Network the Next Big Crypto Opportunity?

Is Linkbex a Scam? SFC Warns of Virtual Asset Fraud in Hong Kong

Donald Trump’s Pro-Crypto Push Boosts PH Markets

5 Best Copy Trading Brokers: You Can Trust in 2025

3 EXCLUSIVE Ramadan Offers That Won’t Last Long! ACT NOW

The Next Crypto Giants: 5 Altcoins to Watch

Japan’s Shift in Crypto Policy and What It Means for Investors

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Rate Calc