Atlass

Abstract:Founded in 2018, Atlass is an unregulated financial firm based in Nigeria. It claims to offer Stock Broking, Reconciliation, Verification & Collection of Outstanding Benefit, Investment Advisors, Investment Analysis, and Portfolio Managers.

Note: Atlass's official website: https://www.atlassportfolios.com is currently inaccessible normally.

| Atlass Review Summary | |

| Founded | 2018 |

| Registered Country/Region | Nigeria |

| Regulation | No Regulation |

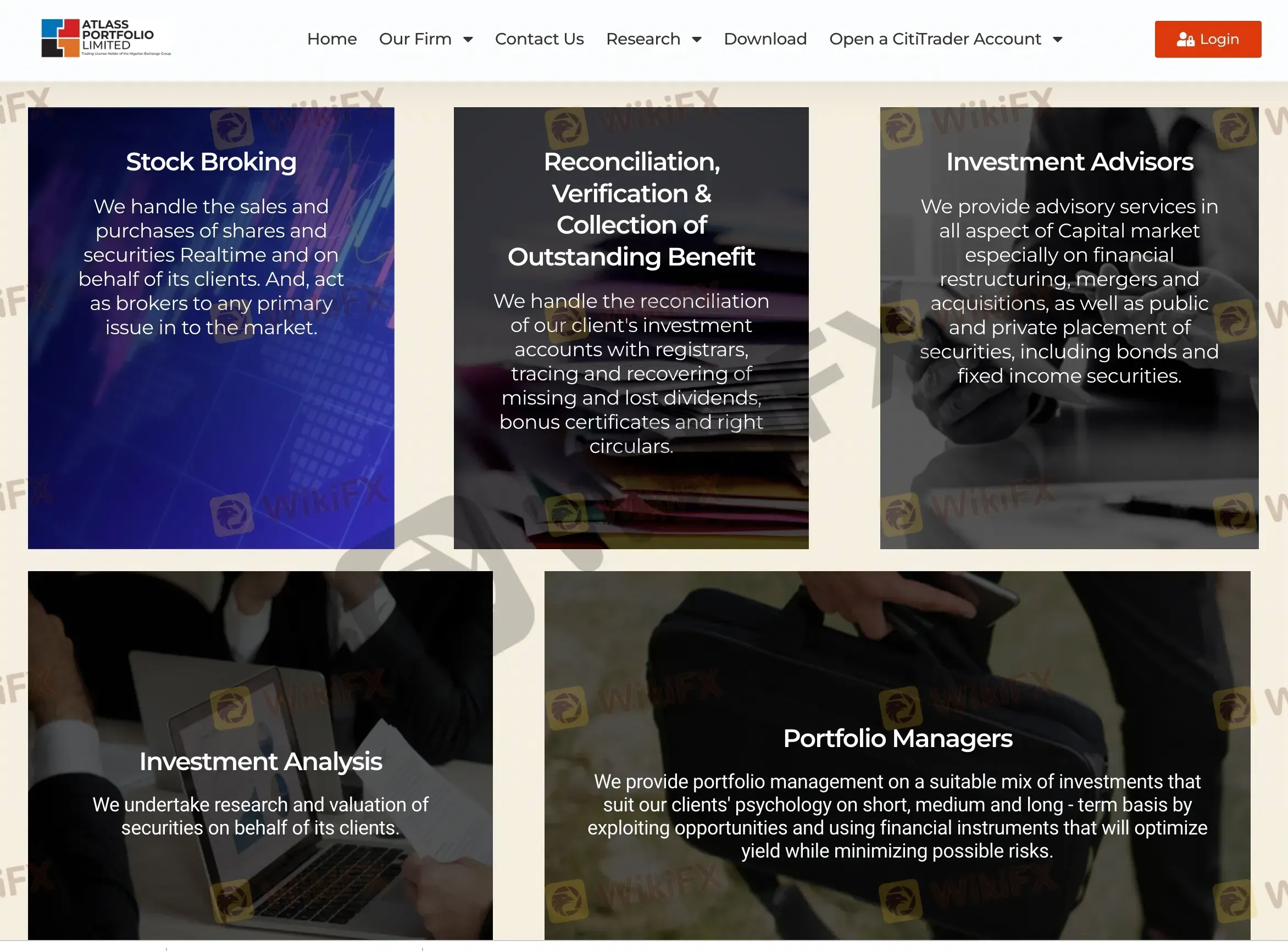

| Service | Stock Broking, Reconciliation, Verification & Collection of Outstanding Benefit, Investment Advisors, Investment Analysis, Portfolio Managers |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | CitiTrader |

| Minimum Deposit | / |

| Customer Support | Phone: +2347025005058 |

| Email: info@atlassportfolios.com | |

| Address: 80, Norman Williams Street, Off Awolowo Road, Ikoyi, Lagos | |

Founded in 2018, Atlass is an unregulated financial firm based in Nigeria. It claims to offer Stock Broking, Reconciliation, Verification & Collection of Outstanding Benefit, Investment Advisors, Investment Analysis, and Portfolio Managers.

Pros and Cons

| Pros | Cons |

| / | Non-functional Website |

| Lack of transparency | |

| No regulation | |

| Limited info on trading fees | |

| No demo accounts |

Is Atlass Legit?

At present, Atlass lacks valid regulation. Its domain was registered on Aug 14, 2018, and the current status is “client Transfer Prohibited”. We suggest you look for regulated brokers.

Service

Atlass provides services such as Stock Broking, Reconciliation, Verification & Collection of Outstanding Benefit, Investment Advisors, Investment Analysis, and Portfolio Managers.

Account Type

Atlass offers Joint Accounts, Individual Accounts, and Corporate Accounts.

Trading Platform

Atlass provides CitiTrader as its trading platform.

Read more

FCA Warns of Trading212 Clone Scam Targeting Investors

FCA alerts investors about a Trading212 clone scam using fake details. Learn how to spot clones and protect your funds with the WikiFX app.

Vault Markets Review 2025: Live & Demo Accounts, Withdrawal to Explore

Vault Markets, a South African-based broker, has attracted much attention in recent days, particularly within its region. This online broker only offers access to focused trading opportunities on Indices, Currencies, Energies, and Metals, yet it shines on low minimum deposits plus various bonus programmes, which would encourage more investors, especially beginners, to trade with a small budget. However, Vault Markets operates outside of the authorized scope, so we don't consider it solid to trade with.

Australian Dollar Surges as Trade Surplus Hits 11-Month High: A Golden Opportunity for Forex Traders

Australia's trade surplus has surged to an 11-month high, reaching $5.62 billion in January 2025. The unexpected boost in trade surplus was primarily driven by a 1.3% month-over-month increase in exports, with non-monetary gold playing a starring role.

FBK Markets Review 2025: Live & Demo Accounts, Withdrawals to Explore

FBK Markets, a young South African forex broker, targets both beginners and experienced traders within this region. This broker shines at its low minimum deposit required, 100% deposit bonus, and flexible account options, yet we cannot consider it reliable as it operates without any regulation. Furthermore, it features an approximately 70% withdrawal failure rate.

WikiFX Broker

Latest News

Is $CORONA Memecoin a Legit Crypto Investment?

Is Pi Network the Next Big Crypto Opportunity?

Is Linkbex a Scam? SFC Warns of Virtual Asset Fraud in Hong Kong

Donald Trump’s Pro-Crypto Push Boosts PH Markets

5 Best Copy Trading Brokers: You Can Trust in 2025

3 EXCLUSIVE Ramadan Offers That Won’t Last Long! ACT NOW

The Next Crypto Giants: 5 Altcoins to Watch

Japan’s Shift in Crypto Policy and What It Means for Investors

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Rate Calc