XA Markets

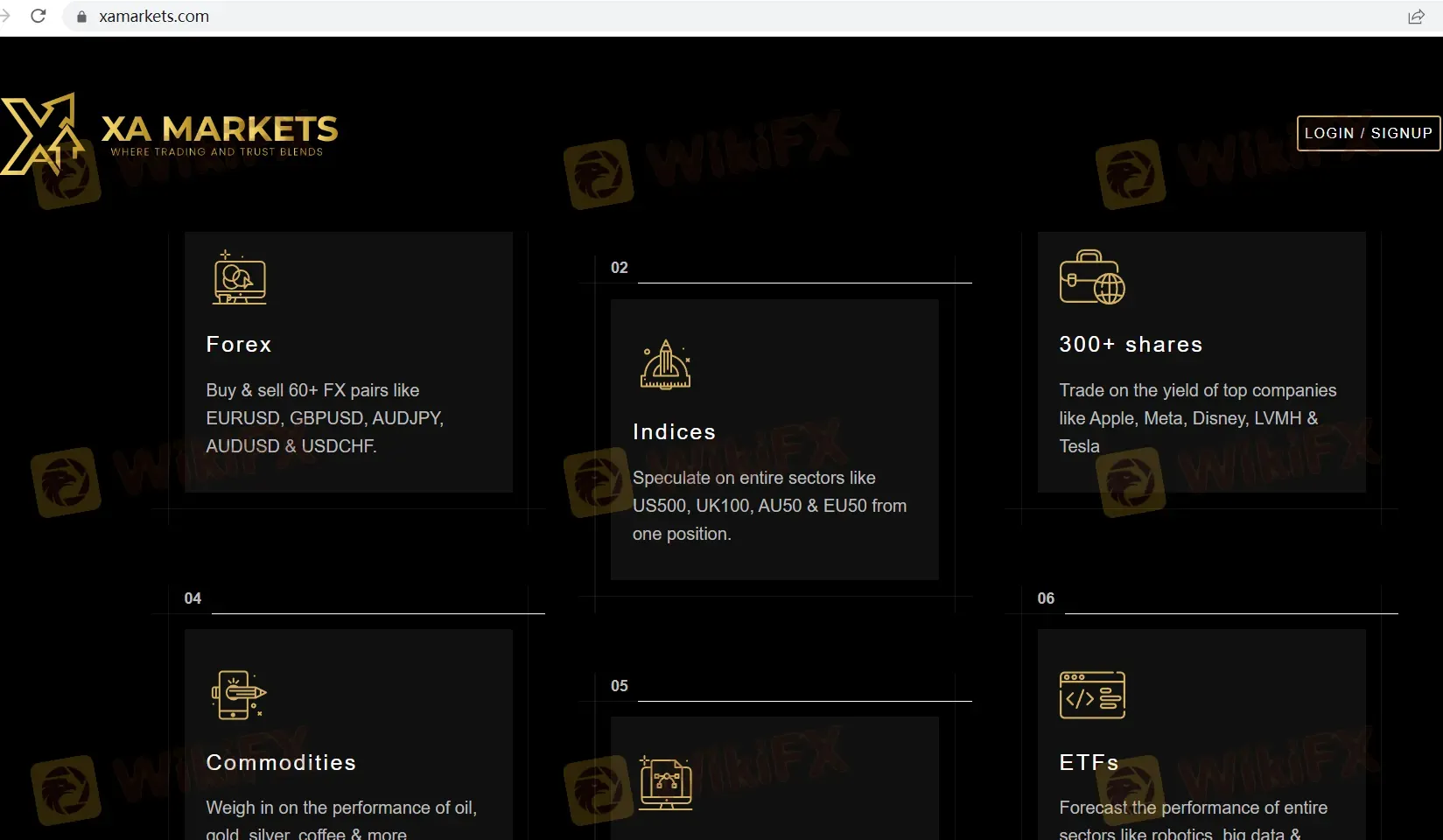

Abstract:Founded in 2023, XA Markets is an Indian broker, offering trading in forex, metals, shares, indices, commodities, cryptocurrencies, and ETFs with leverage up to 1:500 and spread from 0.0 pips via the MT5 platform. Demo accounts are available and the minimum deposit requirement to open a live account is just 10 USD.

| XA Markets Review Summary | |

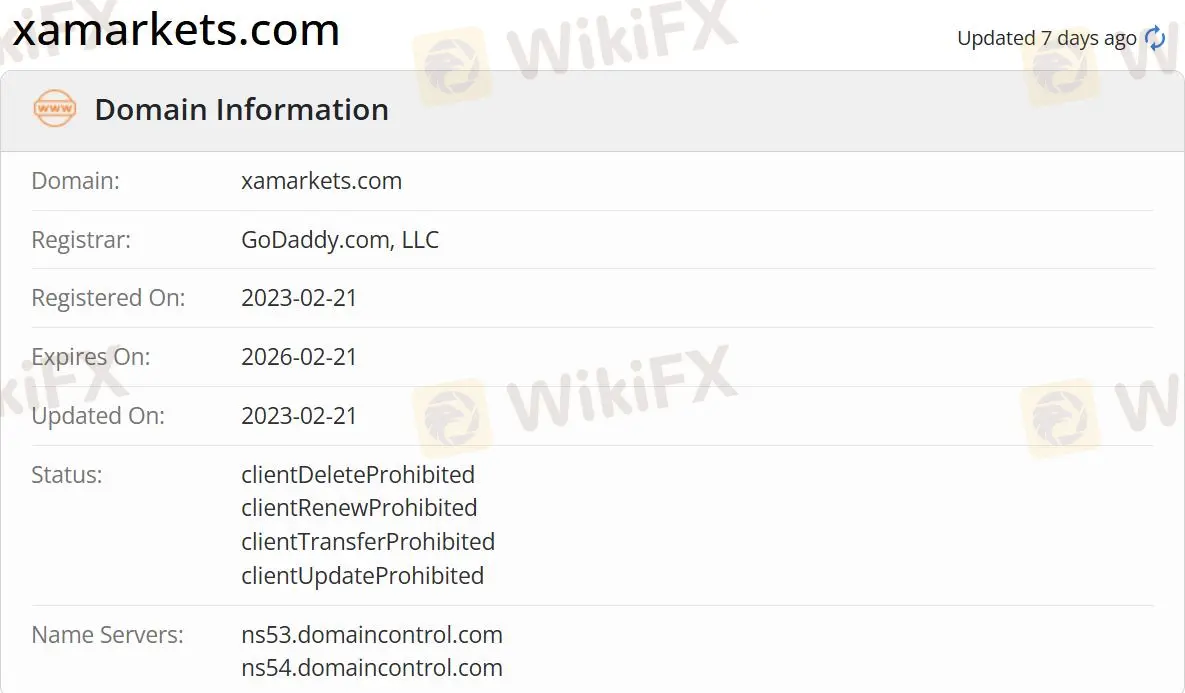

| Founded | 2023 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Market Instruments | Forex, metals, shares, indices, commodities, cryptocurrencies, ETFs |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0 pips |

| Trading Platform | MT5 |

| Social Trading | ✅ |

| Min Deposit | $10 |

| Customer Support | 24/7 support |

| Tel: +914953501103 | |

| Email: info@xamarkets.com | |

| Twitter: https://twitter.com/xamarkets | |

| Facebook: https://www.facebook.com/xamarketss | |

| Instagram: https://www.instagram.com/xamarkets | |

| Office address: 1401, 2/1149-A73, 4Th Floor, Hilite Business Park, Thondayad Bypass, Kozhikode, Kerala, India | |

Founded in 2023, XA Markets is an Indian broker, offering trading in forex, metals, shares, indices, commodities, cryptocurrencies, and ETFs with leverage up to 1:500 and spread from 0.0 pips via the MT5 platform. Demo accounts are available and the minimum deposit requirement to open a live account is just 10 USD.

Pros and Cons

| Pros | Cons |

| Various trading products | New to the market |

| Demo accounts | No regulation |

| MT5 platform | |

| Social trading | |

| 24/7 support |

Is XA Markets Legit?

No, XA Markets does not have any licenses from regulatory institutions. Please be aware of the risk!

What Can I Trade on XA Markets?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

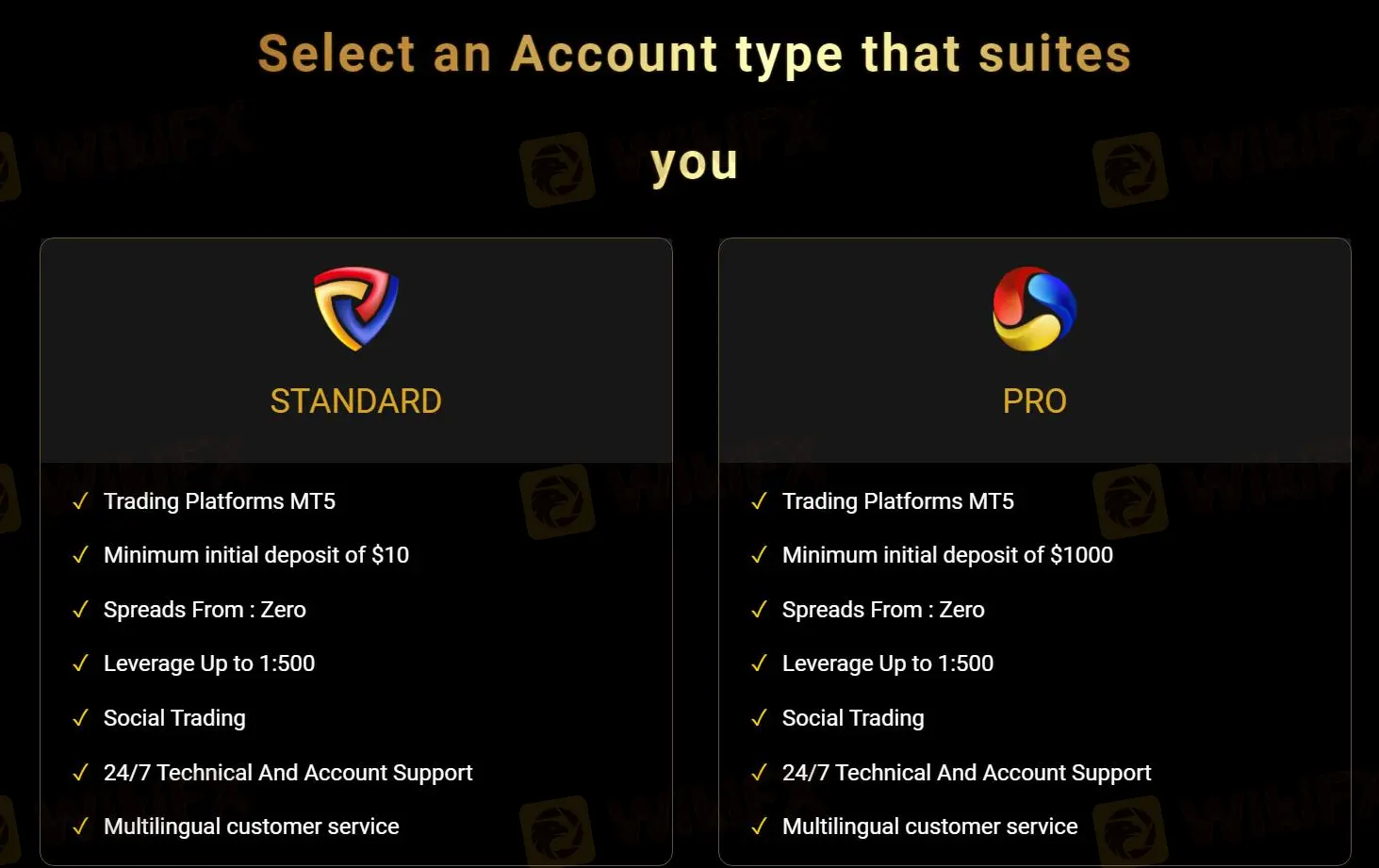

Account Type

| Account Type | Min Deposit |

| Standard | $10 |

| Pro | $1,000 |

Leverage

The leverage is capped at 1:500 for both account types. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

| Asset Class | Max Leverage |

| Forex | / |

| Metals | 1:500 |

| Shares | 1:10 |

| Indices | 1:100 |

| Commodities | / |

| Cryptocurrencies | 1:50 |

XA Markets Fees

| Asset Class | Spread | Commission | Margin | Swap |

| Forex | Tightest | ❌ | Low | ❌ |

| Metals | Tightest on gold and silver | / | / | |

| Shares | / | ❌ | ||

| Indices | Tightest on all commodities | |||

| Commodities | Tightest | ❌ | Low | |

| Cryptocurrencies | / | |||

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

XA Markets accepts payments via VISA, Mastercard, M-PESA, and Bank Transfer.

Read more

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

NovaTech Scam Alert: Avoid Unregulated Forex & Crypto Fraud

Novatech FX Ltd. (“Novatech”), founded in 2019, was registered in St. Vincent and the Grenadines, a jurisdiction known for its minimal regulations and booming unlicensed brokers. NovaTech, which said it was a leading forex and crypto trading platform, claimed to have its own trading software with deep liquidity. Mostly active from 2020 to 2023, they attracted investors by promising monthly returns of 3% to 5%. Accusing them of a $600 million investment fraud, the SEC filed charges on August 12, 2024, against NovaTech FX, Cynthia and Eddy Petion, and several promoters.

Maxxi Markets Review

Maxxi Markets is a forex broker founded in Comoros that offers traders access to a diverse range of financial instruments. With product offerings spanning commodities, forex, indices, metals, cryptocurrencies, and bonds, the broker caters to a wide spectrum of trading interests. Backed by the Mwali International Services Authority (MISA) under an offshore Retail Forex License (license number T2023425), Maxxi Markets combines innovative technology with varied account options to serve both novice and experienced traders.

JustForex vs JustMarkets: A Comprehensive Comparison in 2025

Selecting the right forex broker can make the difference between trading success and frustration for most investors, especially retail investors. As retail traders gain unprecedented access to global markets, the choice between platforms like JustForex and JustMarkets becomes increasingly significant. Both brokers offer some shining features within the forex and CFD trading space, but their approaches differ in some areas.

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Rate Calc