CEO Trading

Abstract:CEO Trading is a forex broker that has been operational since 2015 and is registered in Belize. The brokerage firm provides an array of account options to traders, ranging from Mini to Premium accounts. One of the platform's key features is its utilization of the well-known MetaTrader4 (MT4) trading software. The firm has evidently set its sights on attracting high-net-worth individuals, as indicated by the high minimum deposit requirements that start at $1,000 and go up to $120,000 for their Premium account. CEO Trading only accepts bank transfers for deposits and withdrawals, and those transfers are routed through a bank in Thailand, despite no other evident connections to the country.

| Company Name | CEO Trading International Corporation |

| Registered In | Belize |

| Regulation Status | Not regulated |

| Years of Establishment | Since 2015 |

| Trading Instruments | Forex pairs, CFDs, Precious Metals |

| Account Types | Mini, Standard, Pro, Premium |

| Minimum Initial Deposit | $1,000 (Mini) |

| Maximum Leverage | 1:500 (Mini) |

| Minimum Spread | From 2.3 pips* |

| Trading Platform | MetaTrader4 (MT4) |

| Deposit & Withdrawal Method | Bank Transfers |

| Customer Service | Email support, Monday-Friday 10:00am - 9:00pm (GMT) |

Overview of CEO Trading

CEO Trading is a forex broker that has been operational since 2015 and is registered in Belize. The brokerage firm provides an array of account options to traders, ranging from Mini to Premium accounts. One of the platform's key features is its utilization of the well-known MetaTrader4 (MT4) trading software.

The firm has evidently set its sights on attracting high-net-worth individuals, as indicated by the high minimum deposit requirements that start at $1,000 and go up to $120,000 for their Premium account. CEO Trading only accepts bank transfers for deposits and withdrawals, and those transfers are routed through a bank in Thailand, despite no other evident connections to the country.

Is CEO Trading Legit or a Scam?

The legitimacy of CEO Trading is a topic of concern due to several red flags. The most glaring issue is the absence of regulation. Regulatory oversight serves to protect clients and ensure fair trading practices. Unfortunately, CEO Trading operates without such oversight, making it a risky choice for traders. While the firm claims to have been in business since 2015, the absence of regulation means there is no third-party verification to confirm this or any of the companys other claims.

Unregulated brokers are not bound by the same strict financial standards and ethical practices as regulated entities. In the event of disputes or fraudulent activities, clients may find it challenging to seek recourse or recover their investments, making it a risky choice for anyone seeking a trustworthy and secure trading environment.

Pros and Cons

| Pros | Cons |

| - Availability of MT4 platform | - Not regulated, lacking oversight |

| - High leverage options | - High minimum deposit requirements |

| - Range of account types | - Unspecified target spreads and high demo spreads |

| - Limited payment options (bank transfers) | |

| - Does not support Expert Advisors (EAs) |

Pros:

Availability of MT4 Trading Platform: CEO Trading offers the well-known MetaTrader4 platform, which is popular among traders for its user-friendly interface, advanced charting capabilities, and customization options.

High and Variable Leverage: The brokerage offers various leverage options according to the type of account, ranging from 1:500 for Mini accounts to a more conservative 1:25 for Premium accounts. This approach somewhat mitigates risks associated with high leverage but requires understanding the basics of risk management.

Cons:

Lack of Regulation: The most critical drawback of CEO Trading is its lack of regulation. This makes it difficult to ensure the safety of deposited funds and calls into question the brokerage's overall credibility.

High Minimum Deposit: The steep entry requirements, with the minimum deposit starting at $1,000, make it less accessible for average traders and raise concerns about the platform's target audience.

Unclear Spreads: The platform does not specify target spreads, and our tests revealed higher-than-average spreads, which could impact profitability.

Limited Payment Options: CEO Trading only accepts bank transfers, narrowing the convenience of transactions for potential clients.

No EA Support: Despite offering MT4, CEO Trading strangely does not support Expert Advisors (EAs), which limits automated trading options.

Market Instruments

CEO Trading provides its clients with access to a range of market instruments including Forex pairs, CFDs, and precious metals. While this offering is somewhat standard in the industry, it's still worth noting for traders who are looking for diversified investment opportunities.

However, the absence of regulation makes it risky to trade even with a wide range of market instruments at your disposal.

Account Types

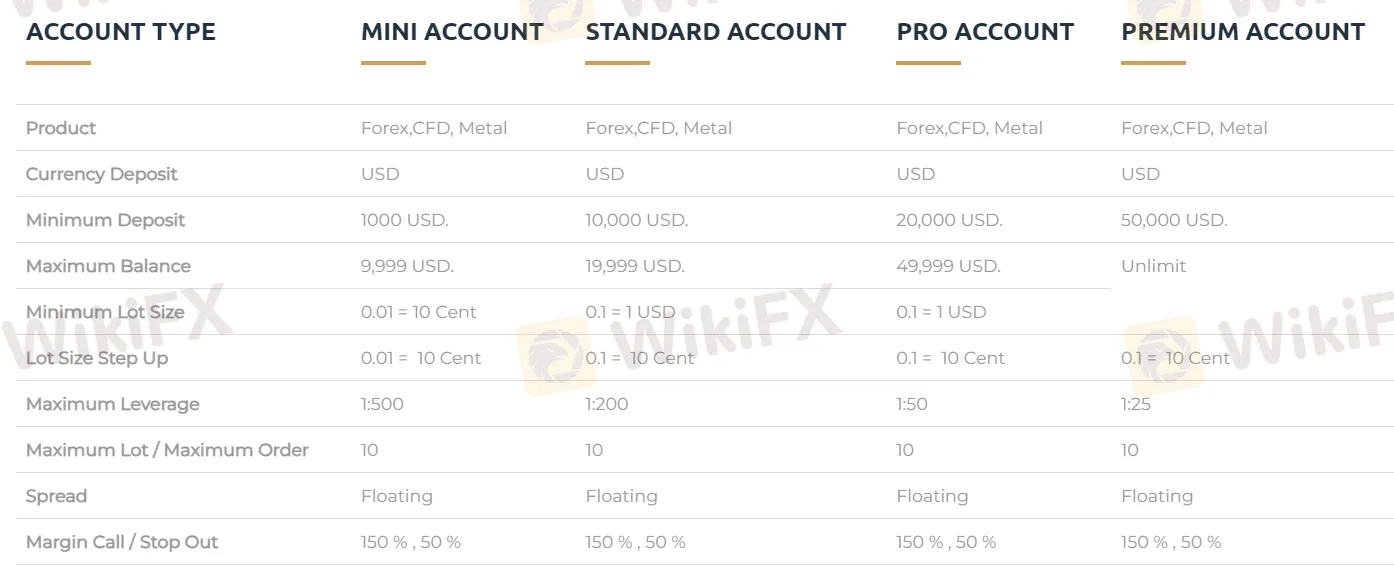

CEO Trading offers four types of accounts to meet the needs of different investors:

Mini Account: Requires a minimum deposit of $1,000 and offers a maximum leverage of 1:500.

Standard Account: Minimum deposit is set at $30,000 with a maximum leverage of 1:200.

Pro Account: A deposit of at least $60,000 is required, and the maximum leverage is 1:50.

Premium Account: This account requires a whopping $120,000 minimum deposit and offers a leverage of 1:25.

| Account Type | Minimum Deposit | Maximum Leverage | Minimum Trade Size | Typical Spread |

| Mini | $1,000 | 1:500 | 0.01 | From 2.3 pips |

| Standard | $30,000 | 1:200 | 0.1 | From 2.3 pips |

| Pro | $60,000 | 1:50 | 0.1 | From 2.3 pips |

| Premium | $120,000 | 1:25 | 0.1 | From 2.3 pips |

How to Open an Account?

Opening an account with CEO Trading typically involves the following five steps:

Registration: Visit CEO Trading's official website and click on the “Open Account” or “Sign Up” button. You'll be directed to a registration page where you'll need to provide your personal information, including your name, email address, phone number, and residence details.

Account Selection: Choose the type of trading account you wish to open. CEO Trading offers several account types with varying minimum deposit requirements and leverage options. Select the account type that best suits your trading preferences and financial capacity.

Document Verification: To comply with Know Your Customer (KYC) regulations, you'll need to submit identification documents for verification. This typically includes a copy of your passport or ID card, proof of address (e.g., utility bill or bank statement), and potentially additional documents depending on the broker's requirements.

Deposit Funds: After your account is verified, you can proceed to fund your trading account. CEO Trading accepts bank transfers as the primary payment method. Transfer the desired amount of funds to the provided bank account.

Start Trading: Once your account is funded, you can log in to the trading platform provided by CEO Trading (typically MetaTrader 4), and begin trading. Ensure you understand the trading conditions, including spreads, leverage, and any other relevant terms, before executing your trades.

Leverage

CEO Trading offers a range of leverage options depending on the account type. High leverage of up to 1:500 is available for Mini accounts, which could be attractive to some traders. However, high leverage comes with increased risk, especially for inexperienced traders. On the other end, the Premium accounts offer a more conservative leverage of 1:25. The varying leverage options appear to be an attempt to implement some form of risk management, but it still places the onus on the trader to fully understand these risks.

Spreads & Commissions

CEO Trading has not been transparent about its spread and commission structure. Our demo account tests revealed spreads of over 2.3 pips for the EUR/USD pair, which is higher than industry standards. High spreads can have a detrimental effect on a trader's profitability, making this an essential factor to consider.

Trading Platform

CEO Trading offers MetaTrader 4 as its primary trading platform. MT4 is known for its robust charting tools, indicators, and a friendly user interface. The platform also allows the development of custom indicators and trading robots, although CEO Trading does not support Expert Advisors, which limits its utility.

Deposit & Withdrawal

The broker restricts payment methods to bank transfers only, which severely limits flexibility and could also slow down the process of funding and withdrawing from accounts.

The bank transfer is routed to a bank in Thailand, which seems somewhat incongruent as the company is registered in Belize and does not specify any other associations with Thailand.

Customer Support

CEO Trading International Corporation provides customer support primarily via email at support@ceotrading.com. They operate during standard business hours from Monday to Friday, with a support window from 10:00 a.m. to 9:00 p.m. However, it's important to note that their support services are unavailable on weekends, with both Saturday and Sunday marked as closed.

This limited support availability during weekends may pose challenges for traders who require assistance during non-business days. Therefore, clients should plan their inquiries and requests accordingly, taking into account the specified operating hours and days of the week when seeking support from CEO Trading.

Educational Resources

The educational resources offered by CEO Trading are limited in scope, which may pose challenges for traders seeking to improve their knowledge and skills. A robust educational section is a valuable asset for brokers, particularly for novice traders looking to build a solid foundation in forex trading.

CEO Trading's lack of comprehensive educational materials, including webinars, tutorials, and market analysis, may leave traders feeling underserved in terms of learning opportunities. A more extensive educational offering can contribute to a trader's success by providing valuable insights and guidance.

FAQs

Q: Is CEO Trading a regulated broker?

A: No, CEO Trading is not a regulated broker, which means it lacks oversight by financial regulatory authorities.

Q: What is the minimum deposit required to open an account with CEO Trading?

A: The minimum initial deposit varies based on the account type, starting at $1,000 for the Mini account.

Q: What trading platform does CEO Trading offer?

A: CEO Trading provides the MetaTrader 4 (MT4) trading platform, known for its advanced charting tools and customization options.

Q: Does CEO Trading support automated trading with Expert Advisors (EAs)?

A: No, CEO Trading does not support Expert Advisors (EAs), limiting automated trading options.

Q: Are there any limitations on deposit and withdrawal methods?

A: CEO Trading primarily accepts bank transfers as the method for deposit and withdrawal.

Q: Does CEO Trading offer educational resources for traders?

A: CEO Trading's educational resources are limited, which may not be sufficient for traders seeking comprehensive learning materials.

WikiFX Broker

Latest News

DOJ Investigates LIBRA Memecoin Scam: $87M Lost by Investors

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Beyond the Hype: The Three Pillars of a Profitable Crypto Investment

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

TD Bank Appoints Guidepost Solutions for AML Compliance Oversight

Malaysia’s EPF Declares Highest Dividend Since 2017 Amid Market Resilience

Rate Calc