XMMARHET

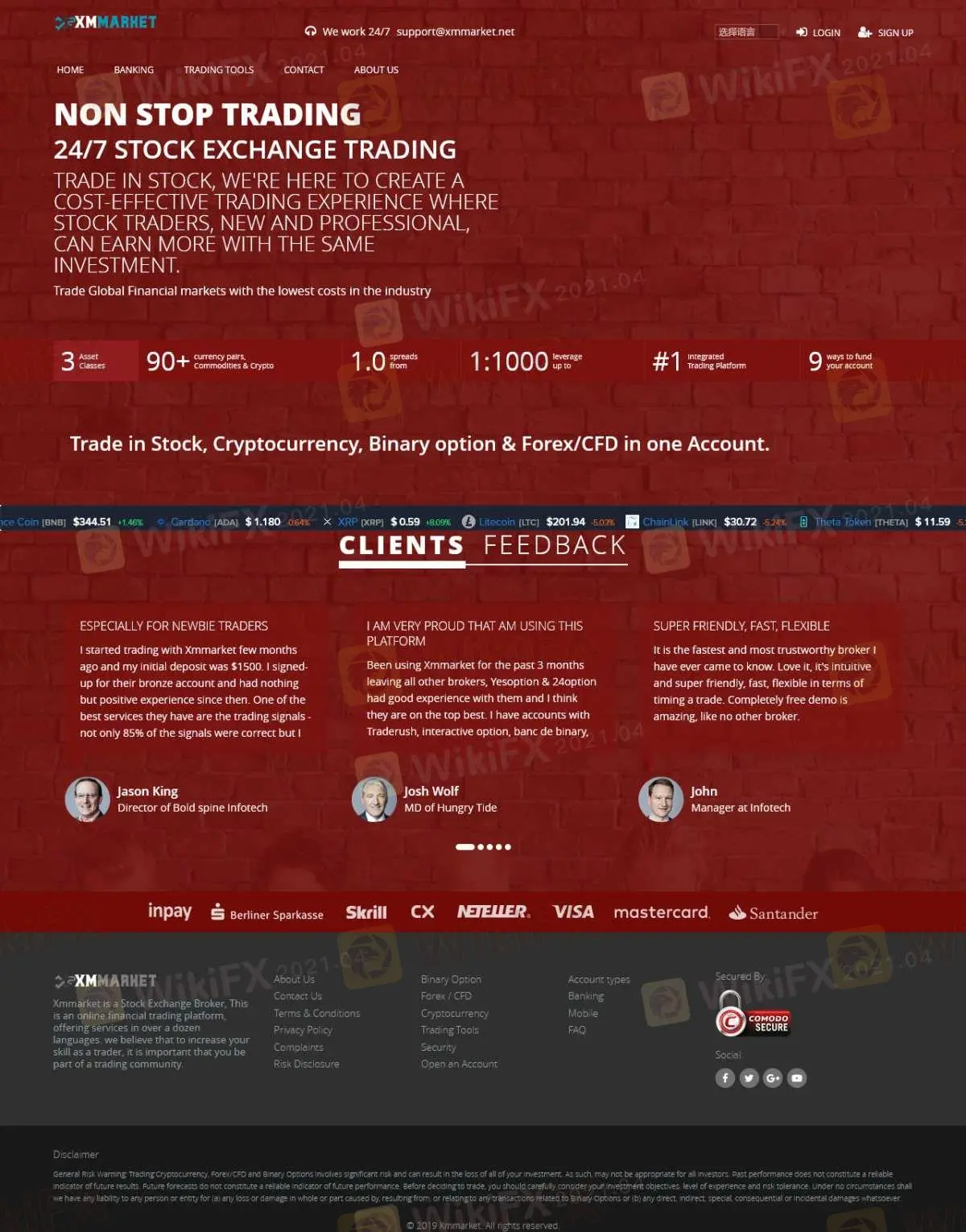

Abstract:XMMARHET is a brokerage offering trading in stocks, cryptocurrencies, binary options, and forex/CFDs. The platform provides leverage up to 1:1000 and spreads as low as 1.0. However, the platform is not regulated by any official regulatory body, and its website is inaccessible.

Note: XMMARHET's official website: https://xmmarket.net/ is currently inaccessible normally.

XMMARHET Information

XMMARHET is a brokerage offering trading in stocks, cryptocurrencies, binary options, and forex/CFDs. The platform provides leverage up to 1:1000 and spreads as low as 1.0. However, the platform is not regulated by any official regulatory body, and its website is inaccessible.

Is XMMARHET Global Legit?

XMMARHET is not regulated by any official platform, which means trading activities on XMMARHET are not protected by any regulatory authority. Investors need to be aware of the associated trading risks.

Downsides of XMMARHET

- Unavailable WebsiteXMMARHET's official website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of TransparencyThe inaccessibility of XMMARHET's official website prevents obtaining the latest information about the platform, such as commission details. This results in a risk of information opacity for investors.

- Regulatory ConcernsXMMARHET is not regulated by any regulatory body, which means that the platform's funds and transactions are not protected by any official institution.

Conclusion

Although XMMARHET claims to offer leverage up to 1:1000 and spreads as low as 1.0, the absence of regulatory oversight and the inaccessibility of its website make trading on this platform extremely risky. We do not recommend engaging in financial activities on this platform.

Read more

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

NovaTech Scam Alert: Avoid Unregulated Forex & Crypto Fraud

Novatech FX Ltd. (“Novatech”), founded in 2019, was registered in St. Vincent and the Grenadines, a jurisdiction known for its minimal regulations and booming unlicensed brokers. NovaTech, which said it was a leading forex and crypto trading platform, claimed to have its own trading software with deep liquidity. Mostly active from 2020 to 2023, they attracted investors by promising monthly returns of 3% to 5%. Accusing them of a $600 million investment fraud, the SEC filed charges on August 12, 2024, against NovaTech FX, Cynthia and Eddy Petion, and several promoters.

Maxxi Markets Review

Maxxi Markets is a forex broker founded in Comoros that offers traders access to a diverse range of financial instruments. With product offerings spanning commodities, forex, indices, metals, cryptocurrencies, and bonds, the broker caters to a wide spectrum of trading interests. Backed by the Mwali International Services Authority (MISA) under an offshore Retail Forex License (license number T2023425), Maxxi Markets combines innovative technology with varied account options to serve both novice and experienced traders.

JustForex vs JustMarkets: A Comprehensive Comparison in 2025

Selecting the right forex broker can make the difference between trading success and frustration for most investors, especially retail investors. As retail traders gain unprecedented access to global markets, the choice between platforms like JustForex and JustMarkets becomes increasingly significant. Both brokers offer some shining features within the forex and CFD trading space, but their approaches differ in some areas.

WikiFX Broker

Latest News

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

What Impact on Investors as Oil Prices Decline?

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Rate Calc