Bosctime

Abstract:Bosctime started in 2022 as an unregulated broker company with registration in China.

Note: You can't access Bosctime's official website: https://www.bosctime.com/prepage/fxtrade right now.

Bosctime Information

Bosctime started in 2022 as an unregulated broker company with registration in China.

Is Bosctime Legit?

Bosctime is seen to operate without regulatory control. Lack of regulation might increase risks among investors as no established framework for monitoring and ensuring fair practices exist.

Downsides of Bosctime

- Unavailable Website

Bosctimes official website cannot be accessed at present. This raises concerns about reliability and accessibility.

- Lack of Transparency

Investor understanding regarding what Bosctime remains limited due to insufficient information concerning this platforms operations and dependability.

- Regulatory Concerns

It is unclear whether the company has any regulatory status, which makes it hard to trust its overall integrity and protect investors interests at large thus such matters have left its regulative position in doubt.

- Withdrawal Difficulty

A user on WikiFX left a report on using the application where he cited many challenges in the process of withdrawal of funds. This concern was still unsolved after one week and more with the request still pending.

Negative Bosctime Reviews on WikiFX

On WikiFX, “Exposure” is indicated as a word of mouth; gotten from the users.

The recommendation for traders is to check the information and risks before engaging in dealing with the unregulated platform. If fraudulent brokers persist, you can report in our Exposure section and our team will help to solve such problems.

As of now, there was 1 piece of Bosctime exposure in total. I will introduce it.

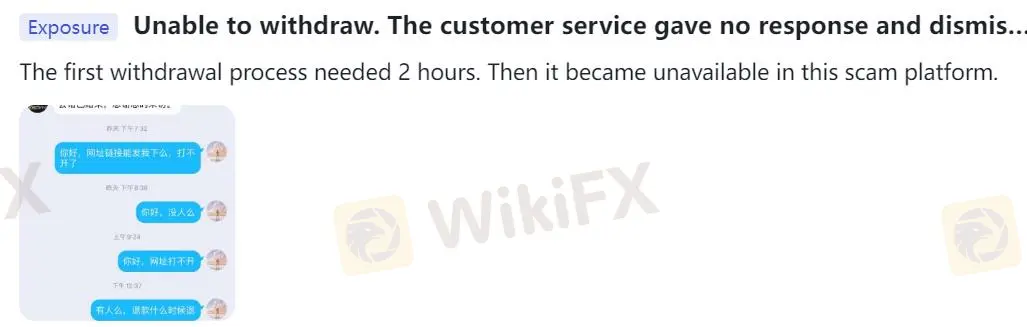

Exposure 1. Cannot withdraw money

| Classification | Cannot withdraw money |

| Date | Jan 8, 2020 |

| Post Country | Hong Kong |

Conclusion

Trading with Bosctime might not be safe because no one watches over them. Investors should pick brokers that follow rules and are open about what they do to keep the money safe and follow the law. When you choose a trading site, go for ones that big rule-makers keep an eye on. This will help you feel safer and more at ease.

Read more

BREAKING: The WikiFX Simulated Trade Weekly Competition has been suspended for one week

Due to an upcoming product upgrade to enhance your overall trading simulation experience, the WikiFX Simulated Trading Weekly Contest will be temporarily suspended from March 10 to March 16. The contest will resume on March 17 with a host of improvements.

Nifty 50 Index Futures Now Available at Interactive Brokers

Trade Nifty 50 Index Futures with Interactive Brokers. Access India’s top 50 firms, diversify portfolios, and manage risk on a powerful trading platform.

Trade245 Review 2025: Live & Demo Accounts, Withdrawals to Explore

Trade345, a young South African broker, has gained some regional popularity, but lacks an established reputation. Trade245 offers access to FX pairs, indices, stocks and commodities CFDs with operation on both MetaTrader 4 and MetaTrader 5. Although this broker only asks for a modest minimum deposit, it does not shine on trading costs. Besides, this broker heavily relies on bonuses to attract new investors and it does not provide trading signals.

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Canada is striking back! If U.S. tariffs persist, Canada will impose retaliatory duties, escalating tensions in North American trade.

WikiFX Broker

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FINMA Opens Bankruptcy Proceedings

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Rate Calc