XO

Abstract:Registered in 1995 in Malaysia, XO is an unregulated brokerage, and its official website is currently inaccessible. It is flagged as a scam.

XO Information

Registered in 1995 in Malaysia, XO is an unregulated brokerage, and its official website is currently inaccessible. It is flagged as a scam.

Is XO Global Legit?

XO is an unregulated platform, which means it lacks regulatory oversight. The platform could potentially run away with funds at any time, making it impossible for investors to recover their money. Trading on unregulated platforms carries high risks, and investors need to exercise caution.

Downsides of XO

- Unavailable WebsiteXO's official website is currently inaccessible, indicating a lack of transparency and reliability.

- Lack of TransparencySince XO's website cannot be accessed, there is also limited and potentially inaccurate information available online through search engines. This makes it difficult for investors to make informed decisions.

- Regulatory ConcernsXO is not regulated by any official platform, which may expose it to issues such as fraudulent activities, false information, and difficulties in seeking recourse.

- Fraudulent Operations

Historical user feedback indicates that invested funds could not be recovered and withdrawn, which is a red flag for traders.

Negative XO Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders are encouraged to review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there were 2 pieces of XO exposure in total. The details are as follows:

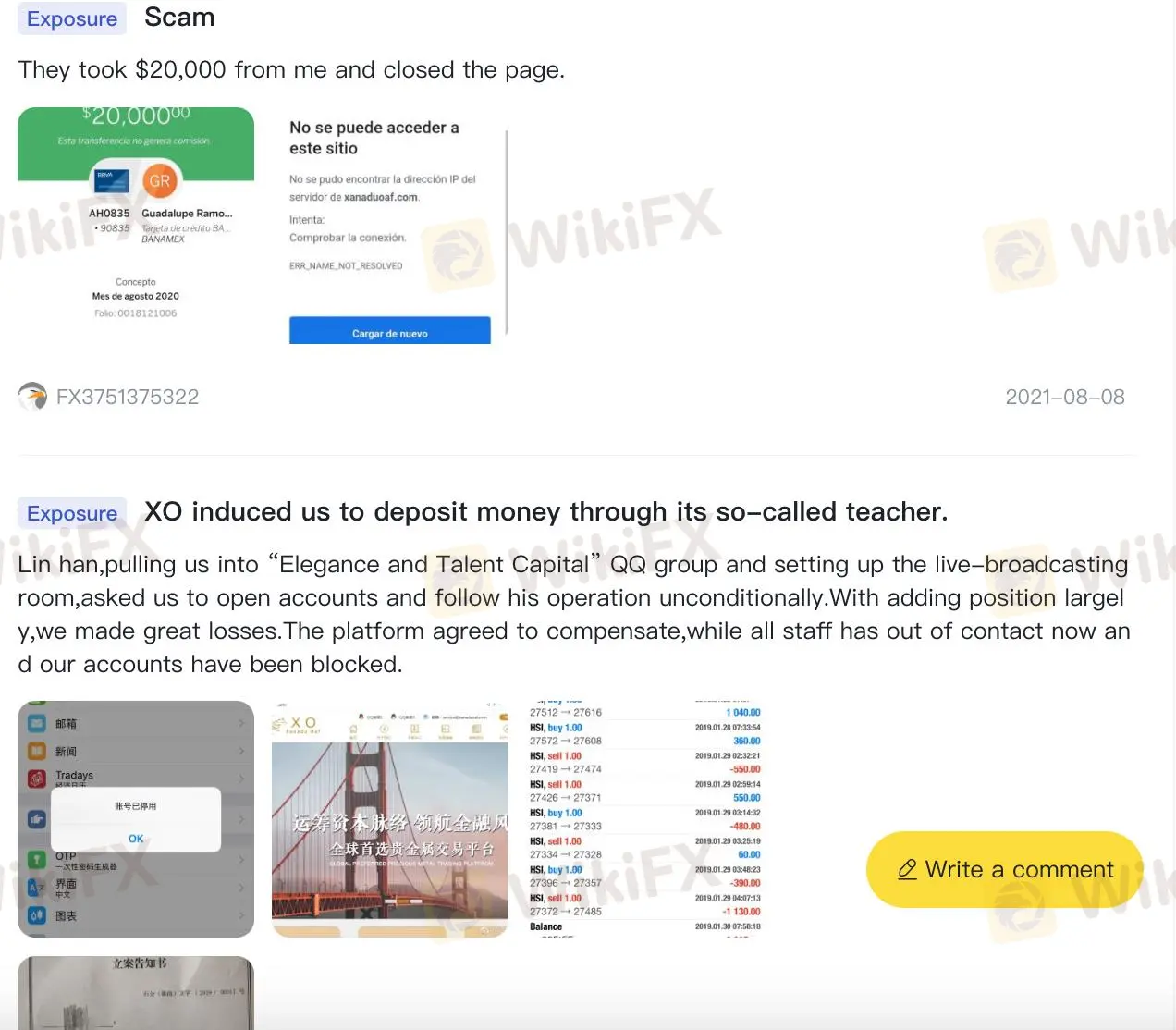

Exposure 1.Fund Fraud

| Classification | Fund Fraud |

| Date | 2021-08-08 |

| Post Country | Colombia |

The user reported that after investing $20,000, the platform can't be loggin again, and the funds could not be recovered.

Exposure 2.Fraudulent Operations

| Classification | Fraudulent Operations |

| Date | 2021-08-08 |

| Post Country | Colombia |

The user reported that the platform's operators deceived them into continually increasing their position, resulting in significant losses. The platform initially agreed to provide compensation, but now all related personnel have gone dark, and the account has been frozen.

Conclusion

XO is flagged as a scam because of its lack of regulatory oversight and the fact that its website is inaccessible. Historical user feedback indicates that invested amounts could not be recovered. It is not recommended to use this platform for trading. Investors should choose regulated trading platforms to ensure trading safety.

Read more

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

What Impact on the Forex Market as Former Philippine President Rodrigo Duterte is Arrested.

The sudden arrest of former Philippine President Rodrigo Duterte on an International Criminal Court (ICC) warrant has sent shockwaves through global markets and regional investors alike. While Duterte’s arrest is being hailed by human rights groups as a decisive step toward accountability for his controversial “war on drugs,” it also raises significant questions about factors that can strongly influence the forex market.

How Can Fintech Help You Make Money?

Fintech – short for financial technology – is rapidly transforming the way people manage, invest, and even earn money. In this article, we’ll explore various ways fintech can help you make money, from smarter investing to launching a side hustle, while also reducing costs and boosting your financial health.

What’s the Secret in Trading Chart Behind 90% Winning Trades?

Discover the secret to 90% winning trades with chart patterns, indicators, and pro strategies. Master trading charts for consistent wins!

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Rate Calc