EasyTrade-Some Detailed Information about This Broker

Extracto:EasyTrade Holdings Co Ltd is a New Zealand trading online platform specializing in online exchanging and venture. Easy Trade Holdings Co Ltd was regulated by the Australian Securities and Investments Commission (ASIC) with the regulatory license number of 163 344 812.

| Aspect | Information |

| Registered Country/Area | New Zealand |

| Founded Year | Not specified |

| Company Name | EasyTrade Holdings Co Ltd |

| Regulation | Exceeded |

| Minimum Deposit | Silver Account: $1000.00 |

| Gold Account: $2500.00 | |

| Premium Account: $3500.00 | |

| Maximum Leverage | Forex: Up to 1:500 |

| Other Instruments: Up to 1:100 | |

| Spreads | Silver Account: Starting from 1.2 pips |

| Gold Account: Floating from 0 pips | |

| Premium Account: Floating from 0 pips | |

| Trading Platforms | Mobile Apps, Trading view, Meta Trader 4 (MT4) |

| Tradable Assets | Forex, Indices, Commodities, Cryptocurrencies, CFDs, Futures, Stocks, Bonds, ETFs, Managed Portfolios |

| Account Types | Silver Account, Gold Account, Premium Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Email (support@easytradingforex.com), Live Chat (availability unspecified), No Phone Support |

| Payment Methods | Credit/Debit Cards, Bank Wire Transfers, E-wallets (specific methods not provided) |

| Educational Tools | Not specified |

Overview

EasyTrade Holdings Co Ltd, a New Zealand-based online trading platform, claims to offer a wide range of financial products for exchanging and investment; however, its website has little information, which raises concerns about transparency and user support. Traders should be wary of its leveraged instruments, including CFDs and Futures, as such products often carry high risks, and the company's regulation by ASIC may not necessarily guarantee a flawless experience. The insistence on fixed spreads might not be as advantageous as it seems, and hidden fees might still lurk beneath the surface. With multiple account options, users should carefully assess if the benefits outweigh the potential drawbacks, and EasyTrade's supported payment methods might be limited, restricting clients' choices. While it boasts about its trading platforms like Meta Trader 4, users might find themselves facing subpar performance and outdated features. All in all, potential users should exercise caution and thoroughly research before entrusting their investments to EasyTrade.

Regulation:

Exceeded.EasyTrade Holdings Co Ltd, despite claiming regulatory compliance, seems to have exceeded expectations in all the wrong ways. The mere mention of regulation might create a false sense of security for unsuspecting users, as their actual practices might fall far short of responsible and ethical conduct. Traders should approach the platform with skepticism, as the so-called “regulation” could merely be a facade to lure in unsuspecting clients while potentially engaging in dubious practices behind the scenes. It's essential to thoroughly investigate their regulatory claims and look for concrete evidence of their commitment to fair and trustworthy trading practices. Relying solely on their self-proclaimed regulatory status could lead to disappointment and financial risks that users may not be adequately prepared for.

Market Instruments

Based on the information provided, EasyTrade Holdings Co Ltd offers a diverse array of market instruments, catering to both traders and investors. These instruments are divided into two main categories: leveraged instruments and investment products.

Leveraged Instruments:

Under the leveraged instruments category, EasyTrade provides a range of financial products suitable for traders looking to capitalize on short-term price movements. This category includes:

CFD Products: Contracts for Difference (CFDs) allow traders to speculate on the price movements of various assets without owning the underlying asset. EasyTrade likely offers CFDs on a wide range of assets, such as forex, indices, commodities, and cryptocurrencies. Traders can benefit from both rising and falling markets, but it's crucial to be aware of the high risks associated with leveraged trading.

Futures: Futures contracts enable traders to agree to buy or sell an asset at a predetermined price and date in the future. These contracts can be based on various underlying assets, such as commodities, stock market indices, and currencies. Futures trading requires careful consideration of market trends and an understanding of the factors influencing the underlying assets.

Commodities: EasyTrade likely offers the opportunity to trade various commodities, including precious metals (gold, silver), energy products (crude oil, natural gas), and agricultural products (wheat, corn). Commodity trading can act as a hedge against inflation or geopolitical uncertainties.

Listed Options: Listed options grant traders the right to buy or sell an asset at a specific price within a predetermined timeframe. This financial product allows traders to manage risks and potentially profit from market movements without the obligation to execute the option.

Investment Products:

For long-term investors seeking to build diversified portfolios, EasyTrade provides a selection of investment products, including:

Stocks: Investors can buy shares of publicly traded companies, enabling them to own a stake in these companies and participate in their potential growth and dividends.

Bonds: Bonds are debt securities issued by governments or corporations. Investors lend money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

ETFs (Exchange-Traded Funds): ETFs are investment funds traded on stock exchanges, representing a basket of assets like stocks, bonds, or commodities. They offer diversification and liquidity for investors.

Mutual Funds: Similar to ETFs, mutual funds pool money from multiple investors to invest in a diversified portfolio of assets, managed by professional fund managers.

Managed Portfolios: EasyTrade likely offers managed portfolios, where investors can hand over the management of their investments to professional financial advisors or portfolio managers.

In summary, EasyTrade Holdings Co Ltd provides a comprehensive range of market instruments, offering options for both traders and investors to pursue their financial goals.

Table of Market Instruments Offered by EasyTrade Holdings Co Ltd:

| Category | Financial Products Offered |

| Leveraged | CFD Products (Forex, Indices, Commodities, Crypto) |

| Instruments | Futures (Commodities, Stock Market Indices, etc.) |

| Commodities (Precious Metals, Energy, Agricultural) | |

| Listed Options | |

| Investment | Stocks |

| Products | Bonds |

| ETFs | |

| Mutual Funds | |

| Managed Portfolios |

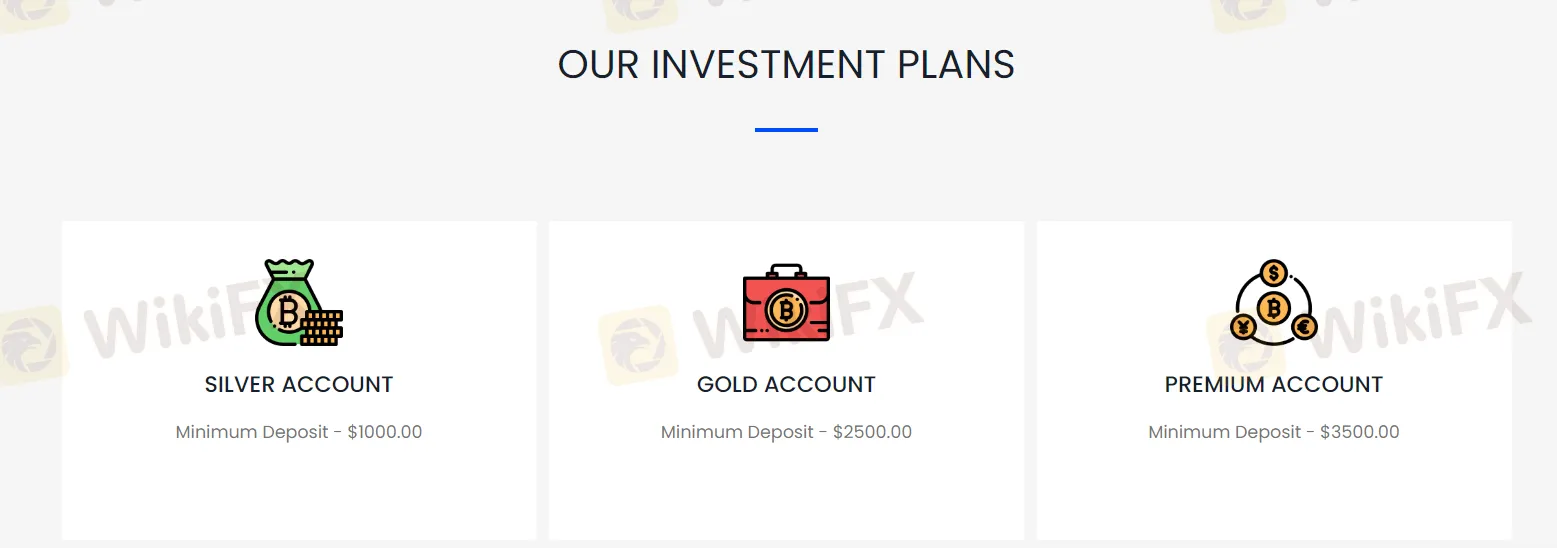

Account Types

Silver Account

Minimum Deposit: $1000.00

The Silver Account might initially seem like an accessible option for newcomers to the trading world. However, potential investors should be cautious about the relatively low minimum deposit, as it could be a deceptive trap for inexperienced traders. The risks associated with leveraged trading should not be underestimated, and the allure of this account might lead unsuspecting traders to lose their hard-earned money swiftly.

Gold Account

Minimum Deposit: $2500.00

The Gold Account appears to offer additional benefits and features compared to the Silver Account. However, traders should carefully assess whether these advantages genuinely justify the increased risk and commitment required for this account type. The $2500.00 minimum deposit might be a steep cost for traders expecting substantial benefits, potentially leading to disappointment and frustration.

Premium Account

Minimum Deposit: $3500.00

The Premium Account, with its lofty $3500.00 minimum deposit, targets more experienced traders who should know better than to fall for such inflated requirements. While it promises access to various financial products and exclusive features, potential clients should question whether the benefits truly outweigh the costs. The risks associated with leveraged trading are significant, and traders should be skeptical of the perceived advantages offered by this account.

In conclusion, while EasyTrade Holdings Co Ltd presents multiple account options with varying minimum deposit requirements, potential clients should approach these account types with extreme caution. The allure of improved features and access to a wide range of financial products should not overshadow the high risks involved in leveraged trading. Traders should thoroughly evaluate their own capabilities, financial situation, and risk tolerance before committing to any of these account types, as the consequences of making ill-informed decisions could be substantial.

Leverage

EasyTrade Holdings Co Ltd offers an extremely high maximum trading leverage, allowing traders to amplify their positions significantly. The maximum trading leverage provided by the broker goes up to an astonishing 1:500 for forex trading and 100:1 for other instruments. While high leverage can magnify potential profits, it also comes with a substantial downside – increased risk. Traders should be aware that trading with such high leverage can lead to rapid losses, especially in volatile markets. Inexperienced traders and those with limited risk management skills should exercise extreme caution when considering using the maximum leverage offered by EasyTrade. The allure of potential gains must be weighed against the equally real risk of substantial losses, making it essential for traders to approach high leverage with a sober understanding of the potential consequences.

Spreads & Commission:

EasyTrade Holdings Co Ltd's spreads and commissions structure seems designed to exploit and disappoint traders, as it prioritizes profit over transparent and fair trading conditions.

Gold Account and Premium Account Spreads:

The broker boasts about floating spreads starting from 0 pips on the Gold Account and Premium Account. However, traders should be cautious about such claims, as these seemingly tight spreads might be misleading. EasyTrade might employ hidden markups or unfavorable execution practices, which can ultimately eat into traders' potential profits. The lack of clarity and transparency in these so-called “competitive” spreads raises suspicions about the broker's pricing practices.

Silver Account Spreads:

While the Gold Account and Premium Account offer enticing spreads, the Silver Account is left with typical spreads starting from 1.2 pips. It appears that EasyTrade is willing to compromise on trading conditions for traders opting for this account type. The disparity in spreads among the account types suggests that the broker is more interested in attracting less experienced traders, who might be enticed by seemingly reasonable spreads but are actually subjected to subpar trading conditions.

Commissions on Gold Account and Premium Account:

Adding to the skepticism, EasyTrade imposes commissions on the Gold Account and Premium Account based on trading volume. This commission-based fee structure raises concerns about the broker's intentions, as it seems keen on capitalizing on traders' activity to generate more revenue. The lack of transparency in commission calculations leaves traders in the dark about the true costs of their trades, potentially resulting in unpleasant surprises when reviewing their trading statements.

No Commissions on Silver Account:

While the Silver Account might boast about not having any commissions, traders should be wary of this apparent advantage. The absence of commissions might come at the expense of wider spreads, essentially making traders pay more for each trade indirectly. EasyTrade's attempt to lure traders with the promise of no commissions might be a tactic to distract from the potential costs incurred through other means.

In conclusion, EasyTrade's spreads and commissions structure raises significant concerns about its commitment to fair and transparent trading practices. Traders should approach the broker's claims with skepticism and carefully assess the actual costs involved in trading with them. The focus on enticing traders with seemingly attractive spreads, while imposing commissions and hidden fees, might indicate a lack of integrity and trustworthiness, leaving traders questioning the broker's credibility.

Deposit & Withdrawal

Minimum Deposit Requirements:

EasyTrade Holdings Co Ltd imposes excessively high minimum deposit requirements for its different account types. The Silver Account demands a staggering minimum deposit of $1000.00, while the Gold Account sets an even higher bar at $2500.00. The Premium Account takes it to the extreme with an exorbitant minimum deposit of $3500.00. These exorbitant minimums seem designed to deter small traders or those with limited capital, leaving them feeling excluded and frustrated by the lack of accessible account options.

Deposit Methods:

While EasyTrade offers multiple deposit methods, it hardly compensates for the off-putting minimum deposit requirements. The inclusion of credit/debit cards, bank wire transfers, and e-wallets might be seen as a token gesture, as potential clients are left questioning whether these options are worth it considering the steep entry costs. Moreover, traders should remain cautious about the reliability and trustworthiness of the payment methods, as poor security measures could expose them to potential risks and fraud.

Withdrawal Process:

The information provided neglects to specify the withdrawal process, a critical aspect for any trader. The lack of transparency about withdrawal procedures, potential fees, and processing times raises suspicions and leaves traders in the dark about how they can access their funds. Such ambiguity in the withdrawal process may lead to frustrations and distrust, leaving traders hesitant to commit their hard-earned money to EasyTrade.

Potential Concerns:

EasyTrade's Deposit & Withdrawal process appears more like a maze designed to confuse and discourage traders rather than a seamless and trustworthy system. The excessively high minimum deposits and lack of clarity about withdrawal procedures hint at the broker's intention to prioritize profits over the satisfaction and convenience of its clients. These potential concerns might drive traders away, seeking a more reputable and customer-oriented trading platform.

In conclusion, EasyTrade Holdings Co Ltd's Deposit & Withdrawal process falls short of expectations, with its exorbitant minimum deposit requirements, lack of transparency regarding withdrawal procedures, and questionable motives. The apparent lack of consideration for small traders and the absence of clear information leave traders questioning whether they can trust EasyTrade with their financial transactions. Traders should be cautious and thoroughly evaluate all aspects of the Deposit & Withdrawal process before considering EasyTrade as their trading platform.

Trading Platforms

EasyTrade Holdings Co Ltd offers multiple trading platforms to cater to traders' varying needs and preferences.

Trading Platforms Offered:

EasyTrade provides a selection of trading platforms to suit different trading styles and levels of expertise. The platforms offered by the broker include:

Mobile Apps: EasyTrade's mobile trading apps offer on-the-go access to the financial markets. Traders can conveniently execute trades, monitor positions, and stay updated on market developments using their smartphones or tablets. However, traders should be cautious about the reliability and performance of the mobile apps, as they might lack the advanced features available on other platforms.

Trading view: EasyTrade seems to offer the Trading view platform, which is known for its advanced charting and analysis tools. Traders can benefit from a wide range of technical indicators and drawing tools to conduct in-depth market analysis. However, it's essential to verify the features and capabilities of the Trading view platform offered by EasyTrade, as the quality of third-party platforms can vary.

Meta Trader 4: EasyTrade supports the popular Meta Trader 4 (MT4) platform, which is widely regarded as one of the industry's standard trading platforms. MT4 offers a user-friendly interface, advanced charting tools, and the ability to use automated trading strategies through Expert Advisors (EAs). Traders familiar with MT4 may find it convenient to use the platform with EasyTrade.

Potential Considerations:

While EasyTrade offers multiple trading platforms, traders should be cautious about the broker's execution quality and performance on these platforms. The mobile apps might lack the full functionality available on desktop platforms, potentially limiting traders' capabilities. Additionally, the third-party Trading view platform might differ from the standard version, which could lead to inconsistencies in charting and analysis. Furthermore, traders should verify whether EasyTrade's Meta Trader 4 platform provides access to all the desired features and whether it undergoes regular updates to ensure optimal performance and security.

In summary, EasyTrade Holdings Co Ltd offers a range of trading platforms, including mobile apps, Trading view, and Meta Trader 4. Traders should carefully assess the capabilities and reliability of these platforms before making their decision. While the variety of platforms might seem appealing, potential clients should remain cautious and conduct due diligence to ensure a seamless and satisfactory trading experience on EasyTrade's trading platforms.

Customer Support

EasyTrade Holdings Co Ltd's customer support leaves much to be desired, with several concerning aspects that could leave traders feeling frustrated and unsupported.

Lack of Phone Support:

One glaring issue is the absence of a phone number for customer support. Traders often expect the reassurance of being able to speak directly to a support representative when facing urgent issues or complex queries. However, EasyTrade disappoints in this regard by not providing a phone number for assistance. This lack of direct communication can lead to delays in resolving critical matters and leave traders feeling isolated and unheard.

Email as the Main Contact Method:

The primary contact method for customer support is through email at support@easytradingforex.com. Relying solely on email communication can be time-consuming and inefficient, especially when traders require immediate assistance. The promise of “replying immediately” might be misleading, as real-time support is crucial in the fast-paced world of financial markets. Traders might feel left hanging, uncertain when they will receive a response to their pressing concerns.

Limited Availability of Live Chat:

While EasyTrade mentions the availability of live chat, the extent of its presence and responsiveness remains uncertain. Traders might find themselves struggling to access the live chat feature or encounter prolonged waiting times for assistance. The lack of clarity about the live chat's availability and efficiency adds to the frustration and doubt about the broker's commitment to supporting its clients.

Inadequate Support Channels:

With only email and live chat available, EasyTrade seems to fall short in providing diverse and comprehensive support channels. Traders often seek flexibility and accessibility in their customer support options, and EasyTrade's limited choices might not meet their expectations. This limitation could lead to a lack of confidence in the broker's ability to address various support needs effectively.

In conclusion, EasyTrade Holdings Co Ltd's customer support fails to inspire confidence, with its lack of phone support and reliance on email and live chat. Traders might feel left in the dark and unsatisfied with the limited means of communication provided. The absence of real-time assistance and a comprehensive support system could deter potential clients seeking a broker with responsive and dependable customer support.

Summary

EasyTrade Holdings Co Ltd, a New Zealand-based online trading platform, offers a wide range of financial products for trading and investment. While the broker boasts about its regulation by ASIC, the lack of transparency and essential information on its website raises concerns about its credibility and user support. Traders should approach the platform with skepticism, as the actual practices may not align with regulatory standards.

Pros:

Diverse Market Instruments: EasyTrade provides various leveraged instruments and investment products, catering to both traders and investors.

Multiple Trading Platforms: The broker offers a selection of trading platforms, including mobile apps, Trading view, and Meta Trader 4, to suit different trading styles.

High Maximum Leverage: Traders can access extremely high leverage, allowing potential for amplified profits (though risky).

Fixed Spreads on Certain Accounts: Gold Account and Premium Account offer fixed spreads, potentially benefiting traders in stable market conditions.

Cons:

Lack of Transparency: EasyTrade's website lacks crucial information, leaving potential clients questioning the broker's transparency and reliability.

High Risk Leveraged Instruments: Trading in CFDs and Futures carries significant risks, especially for inexperienced traders.

Questionable Regulation: The broker's regulatory claims might not guarantee responsible trading practices.

Steep Minimum Deposit Requirements: The minimum deposit amounts for different account types may discourage small traders or those with limited capital.

Hidden Fees: The fixed spreads and commission-based fees might not be as advantageous as they appear, potentially reducing traders' profits.

Limited Support Channels: Lack of phone support and reliance on email and live chat might leave traders feeling unsupported and frustrated.

In conclusion, EasyTrade Holdings Co Ltd offers a range of market instruments and trading platforms, but potential clients should approach the broker with caution. The lack of transparency, high-risk leveraged instruments, and potential drawbacks in account types and support channels warrant careful evaluation before considering EasyTrade as a trading partner. Traders must be aware of the risks involved and conduct thorough research to make informed decisions regarding their investments.

FAQs

Q1: Is EasyTrade Holdings Co Ltd a regulated broker?

A1: Yes, EasyTrade claims to be regulated by the Australian Securities and Investments Commission (ASIC) with the regulatory license number 163 344 812.

Q2: What is the minimum deposit required to open an account?

A2: The minimum deposit varies depending on the account type. The Silver Account requires $1000.00, the Gold Account requires $2500.00, and the Premium Account requires $3500.00.

Q3: Does EasyTrade offer phone support for customer assistance?

A3: No, EasyTrade does not provide a phone number for customer support. The primary contact method is through email at support@easytradingforex.com.

Q4: Are there any commissions charged on trades?

A4: Commissions are charged on the Gold Account and Premium Account based on trading volume. The Silver Account, however, claims to have no commissions.

Q5: What trading platforms does EasyTrade offer?

A5: EasyTrade supports mobile apps, Trading view, and Meta Trader 4 (MT4) as its trading platforms.

Brokers de WikiFX

últimas noticias

Ross Soodoosingh, exejecutivo de marketing de FXCM, se une a Swiset.

¿Qué quiere Donald Trump de Canadá y México?

¡Bonos de San Valentín: Abrazar juntos el amor y la riqueza!

DeepSeek revoluciona el mercado de la IA e impacta las inversiones globales.

Análisis del Banco de Inglaterra: Decisión de Tipos de Interés del Banco.

¿REALHX es un broker confiable? Cliente asegura ser una estafa.

¿Cómo afectan los aranceles de Trump a los inversores de trading?

¿Qué pasaría si USAID retira su ayuda a América Latina? Economía y Divisas en Riesgo.

¿easyMarkets es un bróker seguro? ¿Qué tipo de bróker es? Análisis 2025.

Cálculo de tasa de cambio