Aron Groups Broker-Overview of Minimum Deposit, Spreads & Leverage

Extracto:Aron Groups Broker, a trading name of Aron Groups LLC, is an online broker registered in Saint Vincent and the Grenadines that has been offering diverse trading instruments to the financial markets. It offers variable spreads and flexible leverage up to 1:1000 on the MetaTrader5 trading platforms.

| Aron Markets Review Summary | |

| Founded | 2020 |

| Registered Country/Region | Marshall Islands |

| Regulation | Not regulated |

| Market Instruments | Forex, Indices, Commodities, Crypto (CFDs) |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | Fixed spread on Nano account; Floating spread on Standard/VIP (e.g., EUR/USD) |

| Trading Platform | MetaTrader 5 (MT5) |

| Min Deposit | $1 |

| Customer Support | UK: +44 2037475808 |

| Cyprus: +357 25654181 | |

| Email: aronsupport@arongroups.co | |

| Address: 59 Agios Athamasios Ave, Limassol, Cyprus | |

Aron Markets Information

Aron Markets, established in 2020 and registered in the Marshall Islands, is an unregulated broker offering CFD trading across Forex, commodities, indices, and cryptocurrencies. While it provides flexible account types with very low entry costs and high leverage, it lacks oversight from reputable regulatory bodies.

Pros and Cons

| Pros | Cons |

| Very low minimum deposit ($1) | Not regulated by any trusted authority |

| Islamic and demo accounts available | No stock or ETF trading options |

| Supports MetaTrader 5 | MT4, WebTrader, and proprietary apps not supported |

Is Aron Markets Legit?

Aron Markets is not a regulated broker. Although registered in the Marshall Islands, it lacks oversight from any recognized regulators like FCA, ASIC, or CySEC.

The domain arongroups.co was registered on July 15, 2020, last updated on July 25, 2024, and is active until July 15, 2025. Its current status is “ok”, indicating its operational but not evidence of legitimacy.

What Can I Trade on Aron Markets?

Aron Markets offers a diverse range of CFD instruments across major asset classes. Users can trade 7+ forex pairs, 5+ indices, 5+ commodities, and 6+ cryptocurrencies. No information is available regarding stocks or ETFs.

| Tradable Instruments | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Crypto | ✅ |

| CFD | ✅ |

| Indexes | ✅ |

| Stock | ❌ |

| ETF | ❌ |

Account Types

Aron Markets offers four types of live accounts: Nano (Islamic), Standard (ECN), Islamic (Swap-Free), and VIP (ECN)—each tailored to different trader needs. The Nano account starts from just $1, making it ideal for beginners. Both Nano and Islamic accounts are swap-free, aligning with Islamic finance principles. Additionally, a demo account is available for users to practice trading in a risk-free environment.

| Account Type | Min Deposit | Leverage | Spread Type | Swap-Free | Best For |

| Nano (Islamic) | $1 | Up to 1:1000 | Fixed | ✅ | Beginners, Islamic traders |

| Standard (ECN) | $50 | Up to 1:400 | Floating | ❌ | Intermediate traders |

| Islamic (Swap-Free) | $100 | Up to 1:400 | Fixed | ✅ | Traders seeking swap-free options |

| VIP (ECN) | $2,500 | Up to 1:200 | Floating | ❌ | Advanced or high-volume traders |

| Demo Account | Free | Customizable | Simulated | ✅ | Practice & learning |

Leverage

Aron Markets offers flexible leverage based on account type and trading instrument. The maximum leverage goes up to 1:1000 for Nano accounts, while Standard and Islamic accounts can access up to 1:400, and VIP accounts offer up to 1:200. Leverage also varies depending on the trading volume and asset class (e.g., Forex, Metals, Crypto, Shares). While high leverage can increase profits with little capital, it also increases the danger of significant losses without appropriate risk management.

Aron Markets Fees

Compared to industry standards, Aron Markets trading fees are relatively low, especially on higher-tier accounts. They offer tight spreads, zero commissions on some accounts (especially Nano and Islamic), and provide discounted or zero swap fees on Islamic accounts.

| Account Type | Spreads (EUR/USD) | Commission | Notes |

| Nano | Fixed | No | Ideal for micro traders |

| Standard | Floating | Yes | Commission rate not specified clearly |

| Islamic | Fixed | No | Swap-free with grace period |

| VIP | Floating | Yes | Lower commission (e.g., 0.035%) |

Non-Trading Fees

| Non-trading Fees | |

| Deposit Fee | Ziraat Bank: 3% fee (minimum $2); other methods may be free |

| Withdrawal Fee | IRT Exchange: 0.5% (min $2); Iraq Exchange: 1% (min $1); Tether TRC20/BEP20: refer to platform-specific rates |

| Inactivity Fee | Not mentioned |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| MetaTrader 5 (MT5) | ✔ | Windows, macOS, Android, iOS | Traders seeking multi-asset access, advanced tools, and automation |

| MetaTrader 4 (MT4) | ❌ | – | – |

| Web Trader | ❌ | – | – |

| Proprietary App | ❌ | – | – |

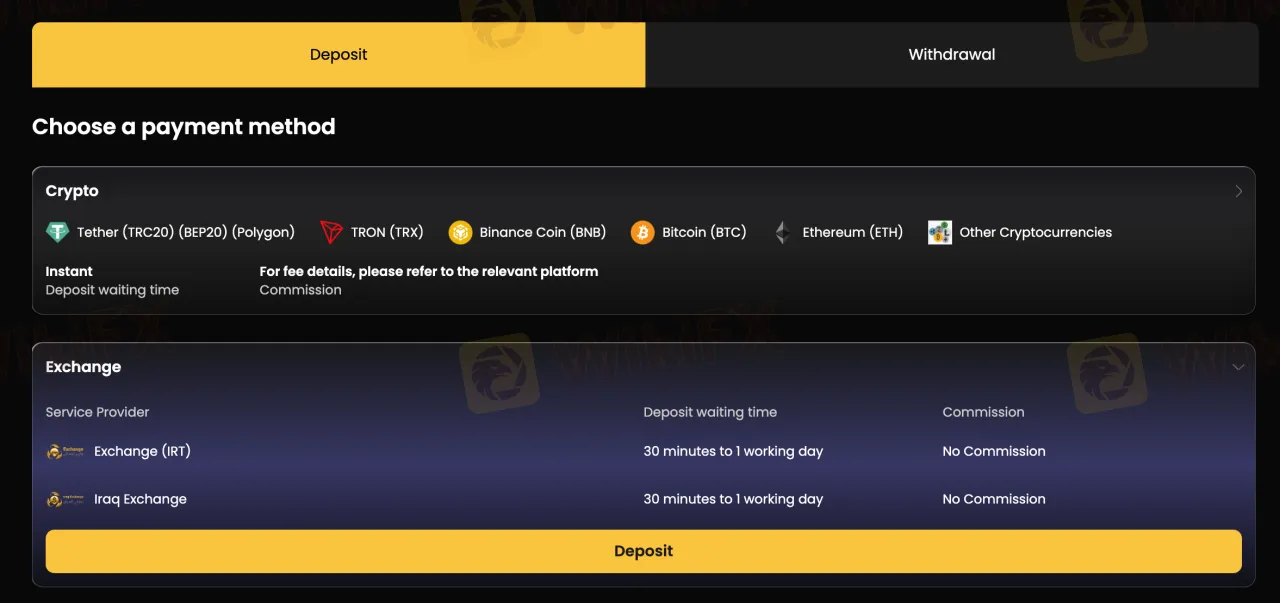

Deposit and Withdrawal

Aron Markets does charge deposit and withdrawal fees depending on the method used. The minimum deposit required is $1.

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Tether (TRC20/BEP20) | $25 | Refer to platform | Instant |

| Bitcoin, Ethereum, BNB | $25 | Refer to platform | Instant |

| Ziraat Bank | $50 | 3% (min $2) | Not stated |

| Toman Platform | 1 million tomans | Not specified | Not stated |

| Exchange (IRT) | Not stated | No Commission | 30 min to 1 working day |

| Iraq Exchange (Dollar) | $200 | No Commission | 30 min to 1 working day |

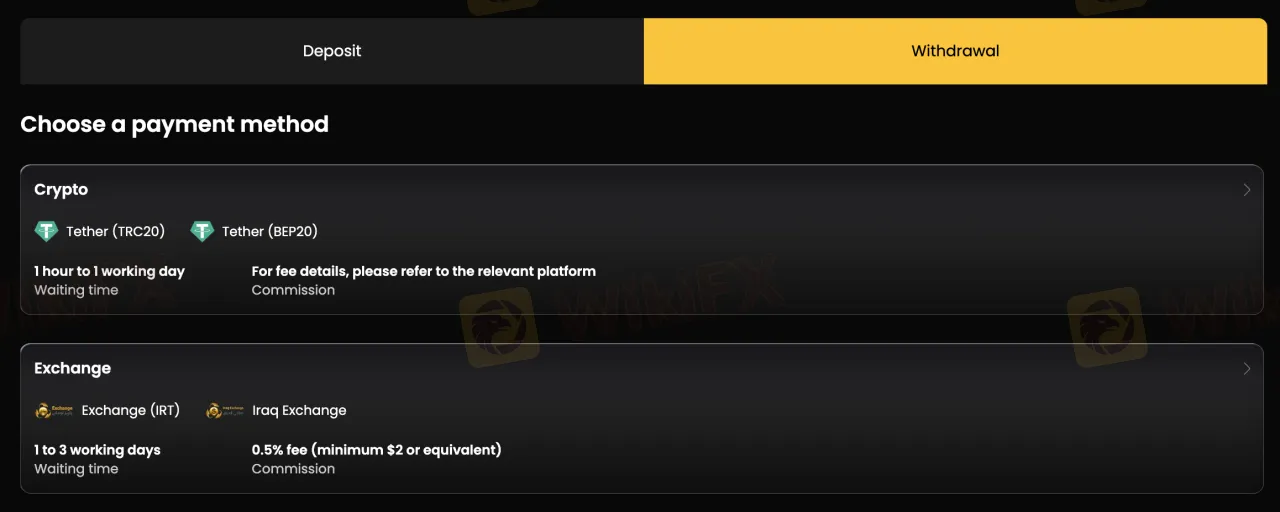

Withdrawal Options

| Withdrawal Method | Min–Max Withdrawal | Fees | Processing Time |

| Tether (TRC20/BEP20) | $20 – $15,000 | Refer to platform | 1 hour to 1 working day |

| Exchange (IRT) | 1 million – 100 million IRT | 0.5% (min $2 or equivalent) | 1–3 working days |

| Iraq Exchange | $100 – $3,000 | 1% (min $1 or equivalent) | 1–3 working days |

leer más

¡La competencia semanal de Demo Trading está de vuelta con premios mejorados!

Hemos relanzado la "Competencia Semanal de Simulación de Trading en Forex", ¡que te permite perfeccionar tus habilidades de trading sin riesgos y competir contra miles de traders!

PU Prime lanza nuevos CFD sobre índices en MT4/MT5.

PU Prime, proveedor mundial de servicios de negociación en línea, ha anunciado la ampliación de su gama de instrumentos de negociación con la introducción de nuevos Contratos por Diferencia (CFD) en las plataformas MT4 y MT5. A partir del 9 de junio de 2025, los clientes tendrán acceso a cuatro nuevos productos basados en índices, mejorando aún más la ya diversa oferta del broker.

¿Betgit es un bróker seguro? Análisis 2025.

Bitget es una plataforma de intercambio de criptomonedas con sede en Seychelles que ofrece servicios como trading spot, futuros, copy trading y productos financieros como staking y préstamos cripto. Opera en más de 100 países y posee licencias en EE. UU., Lituania y Polonia. Ofrece cuentas estándar, VIP e institucionales, con herramientas como bots de trading y una academia educativa. Bitget implementa medidas de seguridad como almacenamiento en frío, autenticación 2FA y un fondo de protección de $350 millones. Este artículo es informativo y no constituye una recomendación de inversión.

MetaQuotex lanza nueva actualización para MT5 en dispositivos iOS.

La empresa fintech MetaQuotes ha lanzado la última versión de la aplicación móvil MetaTrader 5 para dispositivos con iOS. Esta actualización introduce una variedad de funciones gráficas mejoradas, además de importantes mejoras en la estabilidad para garantizar una experiencia de usuario más fluida y eficiente.

Brokers de WikiFX

últimas noticias

¿Equiti es una estafa o un broker seguro? Análisis de regulación, opiniones y reportes

¿Qué es el NFP en trading y qué tan confiable es para operar en los mercados financieros?

¡ALERTA! La CNMV advierte de 47 entidades no registradas

¿Qué está pasando con GMI Markets y por qué el broker ya no permite nuevos registros?

¿IUX es una estafa o un bróker confiable? Análisis completo de regulación, riesgos y opiniones.

¡Las tareas del Points Mall ya se han actualizado!

¿Qué pasa con el dólar hoy y cómo afecta a la economía latinoamericana?

Cálculo de tasa de cambio