Equiti

Extracto:Equiti, a company registered in Seychelles, offers a range of trading services while claiming regulation by the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles, though there are suspicions about the authenticity of these licenses. It provides two main account types: Standard, with no minimum deposit, spreads from 1.4 pips, and no commission; and Premier, requiring a minimum deposit of $100, offering spreads from 0.0 pips and a $3.5 per lot per side commission. The firm operates on the MT5 trading platform, catering to various tradable assets including Forex pairs, cryptocurrencies, shares & ETFs, indices, and commodities. Equiti emphasizes customer support with email communication and potentially multilingual assistance, and offers diverse payment methods such as credit cards, bank transfers, e-Wallets, crypto wallets, and local solutions, catering to a wide range of traders' needs while encouraging caution and verification of its re

| Broker Name | Equiti |

| Registered Country | Seychelles |

| Company Name | Equiti |

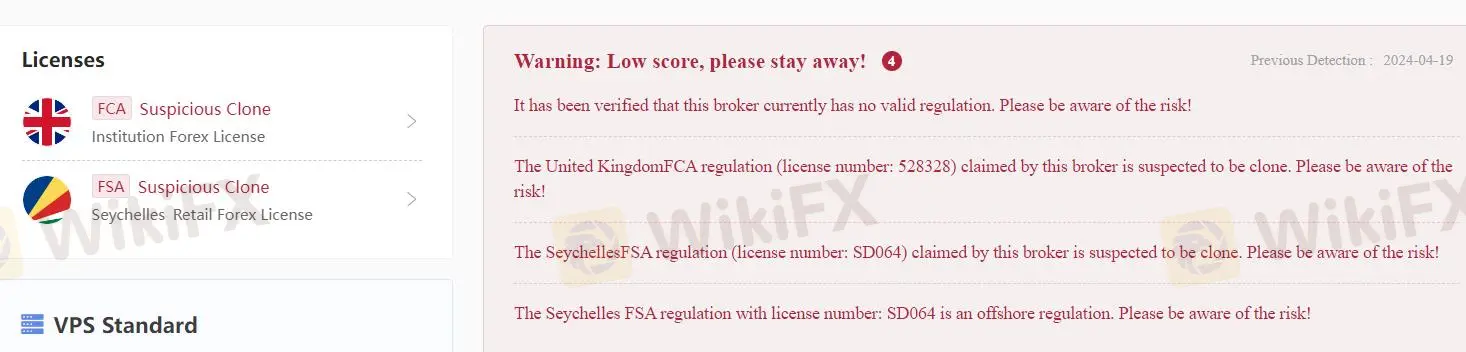

| Regulation | FCA(Suspicious Clone) , FSA (Suspicious Clone) |

| Minimum Deposit | Standard Account: No minimum deposit; Premier Account: $100 |

| Maximum Leverage | 1:2000 |

| Spreads or Fees | Standard Account: Spreads from 1.4 pips, $0 commission;Premier Account: Spreads from 0.0 pips, $3.5/lot per side commission |

| Trading Platforms | MT5 |

| Tradable Assets | Forex Pairs, Cryptocurrencies, Shares & ETFs, Indices, Commodities |

| Account Types | Standard, Premier |

| Payment Methods | Credit Cards, Bank Transfers, e-Wallets, Crypto Wallets, Local Solutions |

| Customer Support | Email support at support.sey@equiti.com, potentially multilingual |

Overview

Equiti, a company registered in Seychelles, offers a range of trading services while claiming regulation by the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles, though there are suspicions about the authenticity of these licenses. It provides two main account types: Standard, with no minimum deposit, spreads from 1.4 pips, and no commission; and Premier, requiring a minimum deposit of $100, offering spreads from 0.0 pips and a $3.5 per lot per side commission. The firm operates on the MT5 trading platform, catering to various tradable assets including Forex pairs, cryptocurrencies, shares & ETFs, indices, and commodities. Equiti emphasizes customer support with email communication and potentially multilingual assistance, and offers diverse payment methods such as credit cards, bank transfers, e-Wallets, crypto wallets, and local solutions, catering to a wide range of traders' needs while encouraging caution and verification of its regulatory status.

Regulation

Equiti says they're regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles. But there's doubt whether Equiti's licenses from these regulators are real. It's wise to be careful when dealing with a broker if their regulatory claims are questionable. Always double-check before investing to stay safe.

Pros and Cons

Equiti offers a comprehensive trading experience with various pros and cons to consider. On the positive side, traders benefit from access to diverse financial instruments, competitive spreads, and flexible account options. Equiti's customer support is also praised for its responsiveness and multilingual assistance. However, there are potential drawbacks, including uncertainty regarding regulatory licenses, which traders should verify before investing. Overall, Equiti strives to provide traders with a secure and seamless trading environment, although careful consideration of both pros and cons is essential.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Market Instruments

Equiti offers a range of trading products across various financial markets:

Forex Pairs: Trade on the foreign exchange market by speculating on the value of one currency against another. For example, you can trade on whether the US dollar (USD) will be worth more or less than the euro (EUR).

Cryptocurrencies: Engage in the trading of digital currencies like Bitcoin, Ethereum, and others. You can capitalize on the price movements of these cryptocurrencies, either rising or falling.

Shares & ETFs: Trade individual shares of companies such as Tesla or Disney, or invest in Exchange-Traded Funds (ETFs). ETFs allow you to trade on a basket of stocks selected to represent a particular market sector or index, providing exposure to multiple companies through a single investment.

Indices: Invest in indices, which represent the performance of a group of companies from one open trading position. For instance, you can trade on indices like the S&P 500, which tracks the performance of 500 large-cap US companies, or the FTSE 100, representing the UK's top 100 companies.

Commodities: Trade on the price movements of commodities such as gold, oil, and agricultural products. You can speculate on whether the value of these commodities will increase or decrease over time.

Equiti provides access to these trading products, allowing traders to diversify their portfolios and take advantage of various opportunities in the financial markets. It's important for traders to conduct thorough research and analysis before engaging in trading activities to manage risks effectively.

Account Types

Equiti offers two main account types: Standard and Premier. Here's a breakdown of each:

Standard Account:

Ideal for New to Intermediate Traders: Suited for traders who are starting out or have some experience in trading.

Instant Notifications: Receive immediate notifications about market movements.

Live Market News: Stay updated with real-time market news.

Market Analytics: Access to advanced market analysis tools.

Trading Platforms: Supports popular platforms like MT4, MT5, and MQ WebTrader, compatible with mobile, desktop, and tablet devices.

$0 Commission: No commission charges for trades.

No Minimum Deposit: No minimum amount required to start trading.

Average Spreads of 1.4 pips: Competitive spreads starting from 1.4 pips.

Leverage up to 1:2000: Allows traders to control larger positions with a smaller amount of capital, up to 2000 times the initial deposit.

USD Account: Denominated in US dollars for easy trading.

Free to Sign Up: No initial fees to open this account.

Premier Account:

Ideal for Advanced and High Volume Traders: Tailored for experienced traders and those trading in larger volumes.

Instant Notifications: Receive immediate notifications about market movements.

Live Market News: Stay updated with real-time market news.

Market Analytics: Access to advanced market analysis tools.

Trading Platforms: Supports MT4, MT5, and MQ WebTrader, compatible with various devices.

US$3.5/Lot Per Side Commission: Charges a commission of US$3.5 per lot traded on each side.

Deposits from $100: Requires a minimum deposit of $100 to open the account.

Spreads from 0.0 pips: Offers tighter spreads starting from 0.0 pips.

Leverage up to 1:2000: Similar to the Standard account, offering high leverage.

USD Account: Operates in US dollars.

Free to Sign Up: No initial fees for account registration.

Both account types provide access to essential trading features and platforms, but the Premier account offers tighter spreads and requires a minimum deposit. Traders can choose the account type that best suits their trading style, experience level, and preferences.

Leverage

Equiti offers leverage of up to 1:2000 for trading. Leverage allows traders to control larger positions with a smaller amount of capital. With leverage of 1:2000, traders can potentially magnify their profits or losses by up to 2000 times their initial investment. However, it's important to note that while leverage can amplify potential gains, it also increases the risk of significant losses, as even small market movements can result in substantial changes in account balances. Therefore, traders should exercise caution and use leverage responsibly, ensuring they have a thorough understanding of its implications before trading with leverage.

Spreads and Commissions

Equiti offers varying spreads and commissions depending on the type of trading account:

Standard Account:

Commission: There is no commission charged for trades in the Standard account, meaning traders only pay the spread when executing trades.

Spreads: The Standard account offers average spreads starting from 1.4 pips. Spreads represent the difference between the buying and selling prices of a currency pair and are one of the main costs associated with trading.

Premier Account:

Commission: Traders using the Premier account are charged a commission of US$3.5 per lot traded on each side. This commission is applied in addition to the spread and is a fixed amount per lot traded.

Spreads: The Premier account offers tighter spreads, starting from 0.0 pips. Tighter spreads can result in lower trading costs, as traders pay less for each trade.

It's important for traders to consider both spreads and commissions when evaluating the overall cost of trading with Equiti. While tighter spreads can lead to lower trading costs, commissions should also be factored in, especially for high-volume traders. Additionally, traders should be mindful of how spreads and commissions impact their trading strategy and profitability.

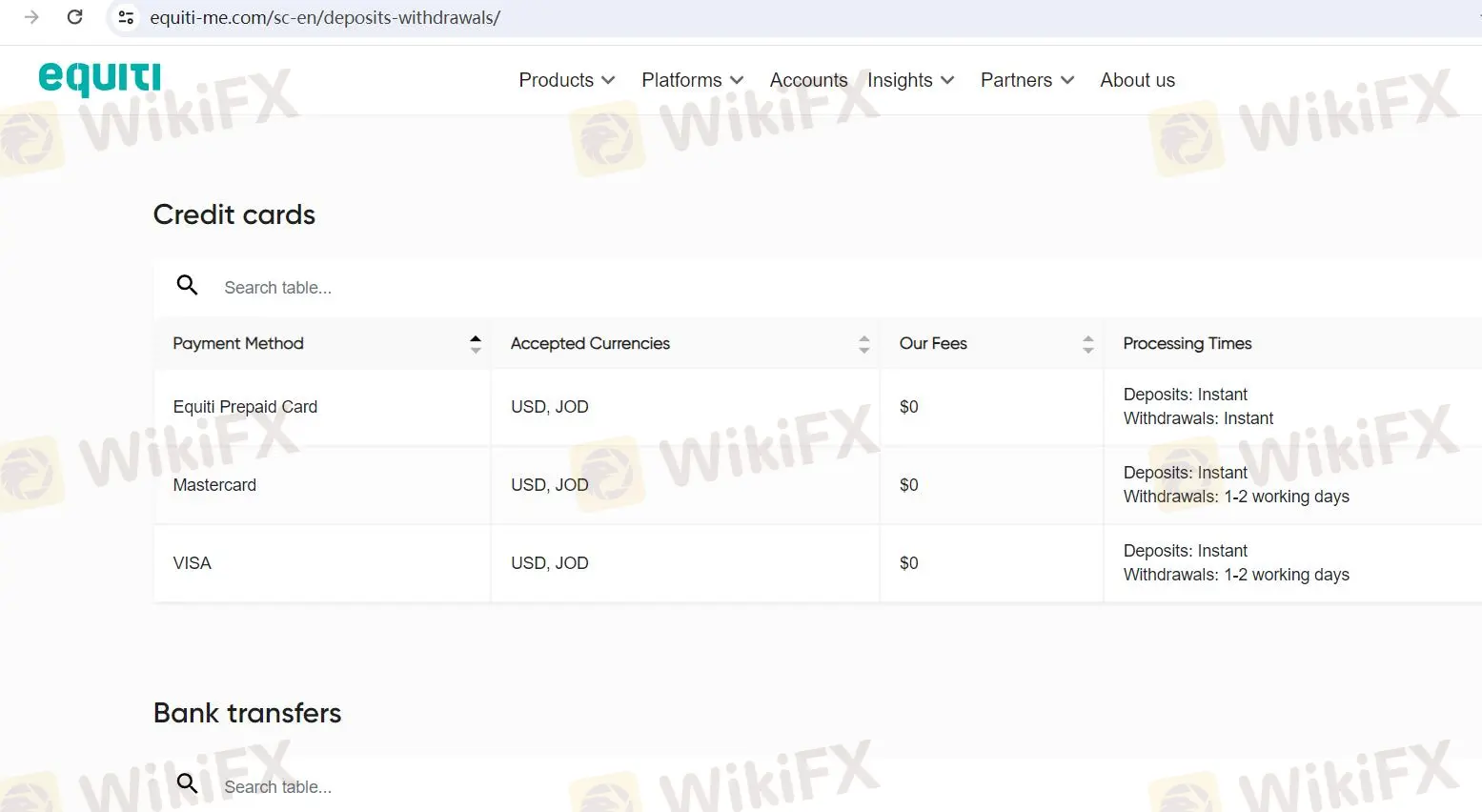

Deposit & Withdrawal

Equiti provides a secure and convenient platform for depositing and withdrawing funds, offering a variety of payment methods to cater to clients' needs. Here's a description of Equiti's deposit and withdrawal process:

Payment Methods:

Credit Cards: Equiti accepts Equiti Prepaid Card, Mastercard, and VISA for instant deposits and withdrawals.

Bank Transfers: Clients can deposit and withdraw funds using local or international bank wire transfers in various currencies. Deposits are usually free, but withdrawals may incur a fee of USD$30.

e-Wallets: Options like Neteller, SenhorMoney (Brazil only), and Skrill are available for instant deposits with varying withdrawal fees.

Crypto Wallets: Clients can deposit and withdraw funds using cryptocurrencies like USDT, BTC, and ETH with no fees for deposits and withdrawals.

Local Solutions: Equiti provides various local payment solutions, including mobile money, cash payments, online wire transfers, and QR code payments, with fees and processing times depending on the solution chosen.

Withdrawal Fees:

Equiti generally does not charge for withdrawals, but withdrawal fees may apply under certain circumstances, such as low, inactive, non-performing, suspicious, or irregular trading activity. These fees may range between 0.5% to 1% per withdrawal, as specified in the terms and conditions.

Equiti Prepaid Card:

Clients can apply for an Equiti Prepaid Card, offering extra convenience and security for trading and withdrawals.

Overall, Equiti prioritizes the security and convenience of its clients' funds, providing various payment methods and support services to facilitate seamless transactions.

Trading Platforms

Equiti offers the MetaTrader 5 (MT5) trading platform, providing traders with a comprehensive suite of tools and resources to navigate the financial markets effectively. MT5 boasts a user-friendly interface, equipped with advanced charting capabilities, technical indicators, and analytical tools, empowering traders to conduct in-depth market analysis and execute trades seamlessly. With access to a diverse range of assets, including forex pairs, stocks, commodities, and cryptocurrencies, Equiti's MT5 platform enables traders to capitalize on global market opportunities across various asset classes. Whether on desktop, mobile, or web-based platforms, Equiti ensures traders can access MT5 anytime, anywhere, providing flexibility and convenience for all trading preferences.

Customer Support

Equiti's customer support is comprehensive and responsive, catering to the needs of traders through various channels, including email support. Traders can reach out to Equiti's customer support team via email at support.sey@equiti.comto address any inquiries, concerns, or assistance they may require regarding their trading accounts, platform functionalities, deposits and withdrawals, technical issues, or general questions about trading. Equiti is committed to providing timely and helpful responses to ensure a smooth and satisfactory trading experience for its clients. Additionally, Equiti may offer multilingual support, allowing traders to communicate in their preferred language for enhanced convenience and accessibility.

Conclusion

Equiti offers traders a robust platform with diverse financial instruments and account types, empowering them to navigate the markets with confidence. While regulated by reputable authorities like the FCA and FSA, it's crucial to exercise caution and verify regulatory claims. The platform's pros include access to various market instruments, competitive spreads, and flexible account options. However, traders should consider potential cons such as uncertainty regarding regulatory licenses. Equiti's customer support is comprehensive, ensuring traders receive timely assistance. With secure deposits and withdrawals, along with the powerful MT5 trading platform, Equiti strives to provide traders with a seamless and satisfying trading experience.

FAQs

Q1: How can I fund my Equiti trading account?

A1: Equiti offers various payment methods, including credit cards, bank transfers, e-wallets, and crypto wallets for depositing funds.

Q2: Is there a minimum deposit requirement for opening an Equiti account?

A2: Equiti's Standard account has no minimum deposit requirement, while the Premier account requires a minimum deposit of $100.

Q3: What trading platforms does Equiti support?

A3: Equiti supports popular platforms like MT4, MT5, and MQ WebTrader, accessible on desktop, mobile, and web-based devices.

Q4: Are there any fees associated with withdrawals?

A4: Equiti generally does not charge for withdrawals, but fees may apply under certain circumstances, detailed in the terms and conditions.

Q5: How can I contact Equiti's customer support?

A5: You can reach Equiti's customer support team via email at support.sey@equiti.com, available 24/6 for assistance with trading inquiries and platform support.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

Brokers de WikiFX

últimas noticias

Los 3 Mejores Brokers ECN para Latam en 2025.

TradingView lanza gráficos de estacionalidad

FCA cancela el registro de Easy Exchange como Small Payment Institution

Cálculo de tasa de cambio