2025-02-06 15:30

IndustriaTrading with Elliott Wave Theory

#firstdealofthenewyearFateema

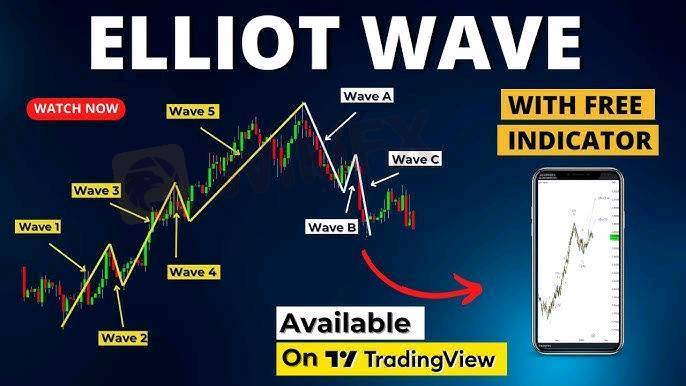

Elliott Wave Theory (EWT) is a powerful technical analysis tool used in trading to predict market movements by identifying repeating wave patterns. Developed by Ralph Nelson Elliott in the 1930s, the theory suggests that financial markets move in fractal patterns based on investor psychology.

Basic Structure of Elliott Wave Theory

Elliott Wave Theory divides price movements into two main phases:

1. Impulse Waves (5-Wave Pattern)

These waves move in the direction of the main trend.

Consists of five waves:

Wave 1: Initial move in the direction of the trend.

Wave 2: Retracement but not beyond the start of Wave 1.

Wave 3: Strongest and longest wave (often extends).

Wave 4: Shallow correction, often sideways.

Wave 5: Final wave in the trend, completing the move.

2. Corrective Waves (3-Wave Pattern)

These waves move against the main trend.

Consists of three waves:

Wave A: Initial move against the trend.

Wave B: Temporary retracement.

Wave C: Final move completing the correction.

Elliott Wave Trading Strategies

1. Identifying the Trend (Impulse Wave Trading)

Enter during Wave 2 pullback or Wave 4 correction.

Ride Wave 3 (strongest move) for maximum profit.

Use Fibonacci retracements to identify entry points.

2. Trading the Correction (Counter-Trend Trading)

Identify corrective patterns (Zigzag, Flat, Triangle).

Short-sell at the end of Wave B or enter long at the end of Wave C.

3. Using Fibonacci for Confirmation

Wave 2 often retraces 50%-61.8% of Wave 1.

Wave 3 often extends 161.8% of Wave 1.

Wave 4 retraces 23.6%-38.2% of Wave 3.

Wave 5 can extend 61.8%-100% of Wave 1-3.

Best Indicators to Use with Elliott Wave

Fibonacci Retracement/Extension (for price targets)

RSI (Relative Strength Index) (divergence at Wave 5)

MACD (Moving Average Convergence Divergence) (momentum confirmation)

Volume (higher in Wave 3, lower in Wave 4)

Challenges in Elliott Wave Trading

Requires experience in wave counting.

Market structure can be subjective.

Works best in trending markets.

Would you like me to analyze a specific chart or asset using Elliott Wave Theory?

Me gusta 0

Aniema30

ブローカー

Contenido delicado

Industria

Trabajo de WikiFX

Industria

Trabajo a tiempo parcial

Industria

gana sin invertir solo por usar una app

Industria

Evento de subsidio en México

Industria

gana 100 dólares con un minimo de inversión de 4 dólares

Industria

Evento de subsidio de Colombia

Categoría del foro

Plataforma

Exposición

Agente

Contratación

EA

Industria

Mercado

Índice

Trading with Elliott Wave Theory

Nigeria | 2025-02-06 15:30

Nigeria | 2025-02-06 15:30#firstdealofthenewyearFateema

Elliott Wave Theory (EWT) is a powerful technical analysis tool used in trading to predict market movements by identifying repeating wave patterns. Developed by Ralph Nelson Elliott in the 1930s, the theory suggests that financial markets move in fractal patterns based on investor psychology.

Basic Structure of Elliott Wave Theory

Elliott Wave Theory divides price movements into two main phases:

1. Impulse Waves (5-Wave Pattern)

These waves move in the direction of the main trend.

Consists of five waves:

Wave 1: Initial move in the direction of the trend.

Wave 2: Retracement but not beyond the start of Wave 1.

Wave 3: Strongest and longest wave (often extends).

Wave 4: Shallow correction, often sideways.

Wave 5: Final wave in the trend, completing the move.

2. Corrective Waves (3-Wave Pattern)

These waves move against the main trend.

Consists of three waves:

Wave A: Initial move against the trend.

Wave B: Temporary retracement.

Wave C: Final move completing the correction.

Elliott Wave Trading Strategies

1. Identifying the Trend (Impulse Wave Trading)

Enter during Wave 2 pullback or Wave 4 correction.

Ride Wave 3 (strongest move) for maximum profit.

Use Fibonacci retracements to identify entry points.

2. Trading the Correction (Counter-Trend Trading)

Identify corrective patterns (Zigzag, Flat, Triangle).

Short-sell at the end of Wave B or enter long at the end of Wave C.

3. Using Fibonacci for Confirmation

Wave 2 often retraces 50%-61.8% of Wave 1.

Wave 3 often extends 161.8% of Wave 1.

Wave 4 retraces 23.6%-38.2% of Wave 3.

Wave 5 can extend 61.8%-100% of Wave 1-3.

Best Indicators to Use with Elliott Wave

Fibonacci Retracement/Extension (for price targets)

RSI (Relative Strength Index) (divergence at Wave 5)

MACD (Moving Average Convergence Divergence) (momentum confirmation)

Volume (higher in Wave 3, lower in Wave 4)

Challenges in Elliott Wave Trading

Requires experience in wave counting.

Market structure can be subjective.

Works best in trending markets.

Would you like me to analyze a specific chart or asset using Elliott Wave Theory?

Me gusta 0

Yo también quiero comentar.

Enviar

0Comentarios

No hay comentarios todavía. Haz el primero.

Enviar

No hay comentarios todavía. Haz el primero.