2025-02-06 23:38

IndustriaCORRELATION BETWEEN FOREX PAIRS

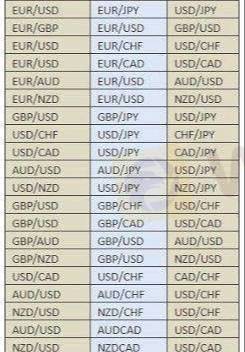

Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

Me gusta 0

BeastBoy2159

Trader

Contenido delicado

Industria

Trabajo de WikiFX

Industria

Trabajo a tiempo parcial

Industria

gana sin invertir solo por usar una app

Industria

Evento de subsidio en México

Industria

gana 100 dólares con un minimo de inversión de 4 dólares

Industria

Evento de subsidio de Colombia

Categoría del foro

Plataforma

Exposición

Agente

Contratación

EA

Industria

Mercado

Índice

CORRELATION BETWEEN FOREX PAIRS

Argelia | 2025-02-06 23:38

Argelia | 2025-02-06 23:38Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

Me gusta 0

Yo también quiero comentar.

Enviar

0Comentarios

No hay comentarios todavía. Haz el primero.

Enviar

No hay comentarios todavía. Haz el primero.