2025-02-12 21:05

Industriarole of investor capital & angel investor in start

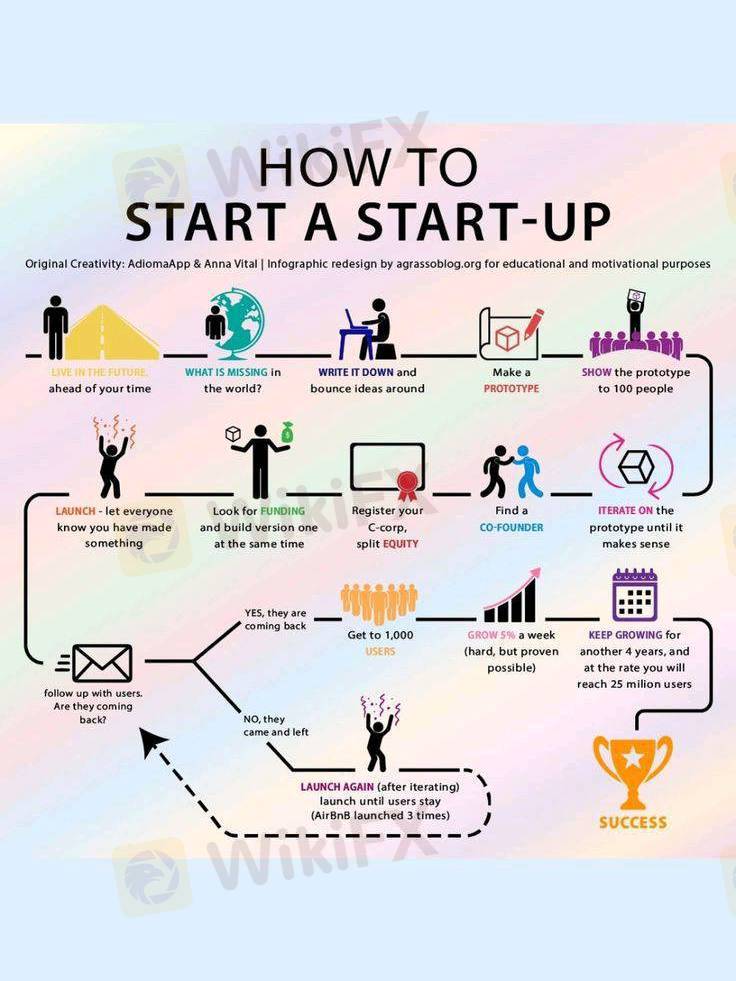

Venture capital (VC) firms and angel investors play crucial roles in funding and supporting startups. Here’s how they contribute:

1. Angel Investors

Angel investors are high-net-worth individuals who invest their own money into early-stage startups, usually in exchange for equity. Their role includes:

Early-stage funding: They provide seed capital to help startups develop prototypes, conduct market research, or launch operations.

Mentorship & networking: Many angel investors offer guidance and connect startups with industry experts.

Higher risk tolerance: They invest in high-risk ventures that may not yet be attractive to VCs.

Flexible investment terms: Unlike VCs, angel investors may be less rigid in their requirements.

2. Venture Capitalists (VCs)

VCs are professional investment firms that manage pooled funds from investors to finance high-growth startups. Their role includes:

Growth-stage funding: They invest in startups that have demonstrated traction and potential for scaling.

Large capital infusion: VC funding typically comes in multiple rounds (Series A, B, C, etc.), supporting expansion, hiring, and product development.

Strategic guidance: VCs provide expertise in scaling businesses, entering new markets, and refining business strategies.

Access to resources: Startups backed by VCs benefit from extensive networks, partnerships, and potential customer introductions.

Exit planning: VCs expect a return on investment (ROI) through exits like IPOs, mergers, or acquisitions.

Key Differences

Both types of investors play essential roles in startup success, with angels helping businesses take off and VCs fueling their growth and scalability.

#firstdealofthenewyearastylz

Me gusta 0

Jeddy352

Brokers

Contenido delicado

Industria

Trabajo de WikiFX

Industria

Trabajo a tiempo parcial

Industria

gana sin invertir solo por usar una app

Industria

Evento de subsidio en México

Industria

gana 100 dólares con un minimo de inversión de 4 dólares

Industria

Evento de subsidio de Colombia

Categoría del foro

Plataforma

Exposición

Agente

Contratación

EA

Industria

Mercado

Índice

role of investor capital & angel investor in start

Nigeria | 2025-02-12 21:05

Nigeria | 2025-02-12 21:05Venture capital (VC) firms and angel investors play crucial roles in funding and supporting startups. Here’s how they contribute:

1. Angel Investors

Angel investors are high-net-worth individuals who invest their own money into early-stage startups, usually in exchange for equity. Their role includes:

Early-stage funding: They provide seed capital to help startups develop prototypes, conduct market research, or launch operations.

Mentorship & networking: Many angel investors offer guidance and connect startups with industry experts.

Higher risk tolerance: They invest in high-risk ventures that may not yet be attractive to VCs.

Flexible investment terms: Unlike VCs, angel investors may be less rigid in their requirements.

2. Venture Capitalists (VCs)

VCs are professional investment firms that manage pooled funds from investors to finance high-growth startups. Their role includes:

Growth-stage funding: They invest in startups that have demonstrated traction and potential for scaling.

Large capital infusion: VC funding typically comes in multiple rounds (Series A, B, C, etc.), supporting expansion, hiring, and product development.

Strategic guidance: VCs provide expertise in scaling businesses, entering new markets, and refining business strategies.

Access to resources: Startups backed by VCs benefit from extensive networks, partnerships, and potential customer introductions.

Exit planning: VCs expect a return on investment (ROI) through exits like IPOs, mergers, or acquisitions.

Key Differences

Both types of investors play essential roles in startup success, with angels helping businesses take off and VCs fueling their growth and scalability.

#firstdealofthenewyearastylz

Me gusta 0

Yo también quiero comentar.

Enviar

0Comentarios

No hay comentarios todavía. Haz el primero.

Enviar

No hay comentarios todavía. Haz el primero.