2025-02-18 01:02

IndustriaFinancial Market Bubbles and Crashes

#firstdealofthenewyearastylz

A financial market bubble occurs when asset prices rise far above their intrinsic value due to speculation and investor euphoria. When sentiment shifts, the bubble bursts, leading to a market crash—a rapid price decline.

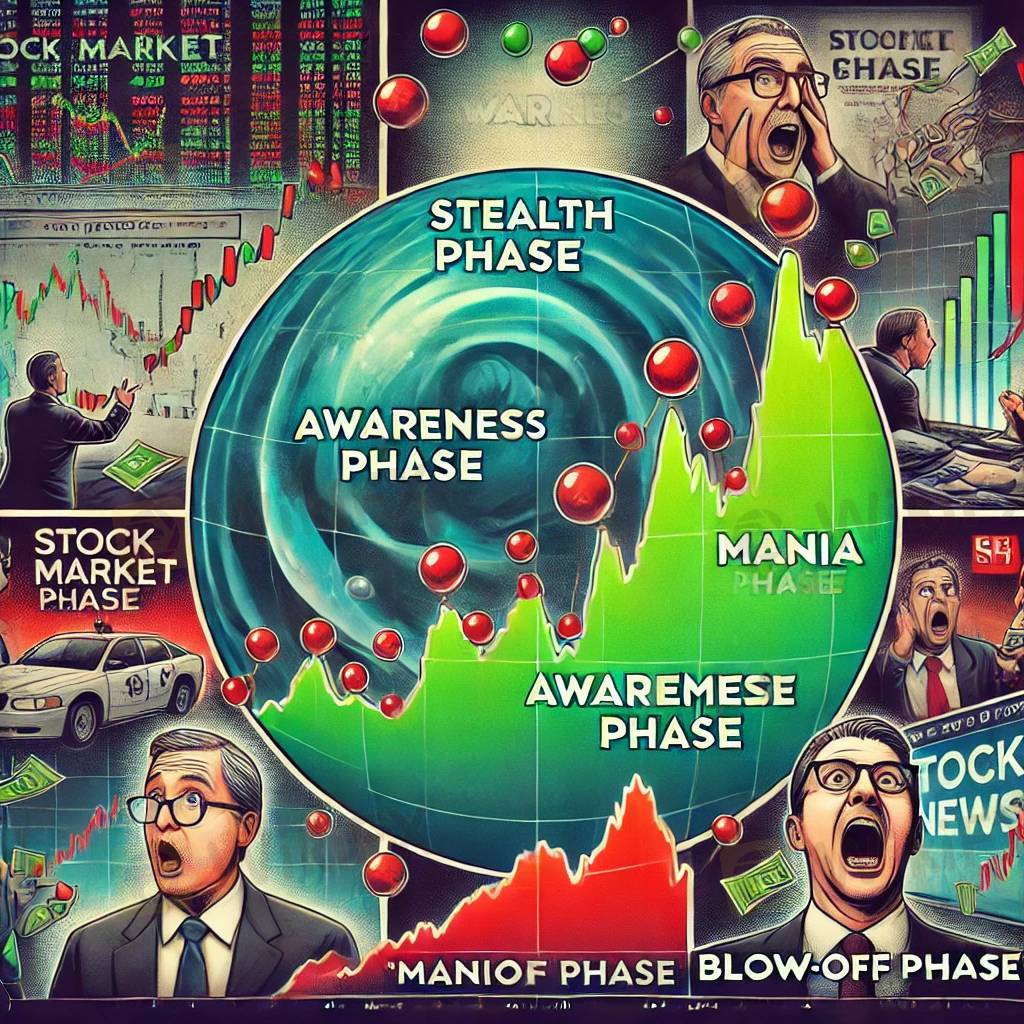

Phases of a Bubble:

1. Stealth Phase – Early investors buy in.

2. Awareness Phase – Institutions and media drive interest.

3. Mania Phase – Retail investors push prices to extremes.

4. Blow-off Phase – Panic selling causes a crash.

Examples:

Tulip Mania (1637) – Overpriced tulips led to a collapse.

Dot-com Bubble (2000) – Internet stocks crashed after hype faded.

2008 Financial Crisis – Housing market collapse triggered a global recession.

Bubbles repeat due to greed, speculation, and market psychology.

Me gusta 0

Oleks5519

Brokers

Contenido delicado

Industria

Trabajo de WikiFX

Industria

Trabajo a tiempo parcial

Industria

gana sin invertir solo por usar una app

Industria

Evento de subsidio en México

Industria

gana 100 dólares con un minimo de inversión de 4 dólares

Industria

Evento de subsidio de Colombia

Categoría del foro

Plataforma

Exposición

Agente

Contratación

EA

Industria

Mercado

Índice

Financial Market Bubbles and Crashes

Hong Kong | 2025-02-18 01:02

Hong Kong | 2025-02-18 01:02#firstdealofthenewyearastylz

A financial market bubble occurs when asset prices rise far above their intrinsic value due to speculation and investor euphoria. When sentiment shifts, the bubble bursts, leading to a market crash—a rapid price decline.

Phases of a Bubble:

1. Stealth Phase – Early investors buy in.

2. Awareness Phase – Institutions and media drive interest.

3. Mania Phase – Retail investors push prices to extremes.

4. Blow-off Phase – Panic selling causes a crash.

Examples:

Tulip Mania (1637) – Overpriced tulips led to a collapse.

Dot-com Bubble (2000) – Internet stocks crashed after hype faded.

2008 Financial Crisis – Housing market collapse triggered a global recession.

Bubbles repeat due to greed, speculation, and market psychology.

Me gusta 0

Yo también quiero comentar.

Enviar

0Comentarios

No hay comentarios todavía. Haz el primero.

Enviar

No hay comentarios todavía. Haz el primero.