2025-02-18 01:03

IndustriaTHE EFFECTS OF THE EUROPEAN SOVEREIGN DEBT CRISIS

#firstdealofthenewyearastylz

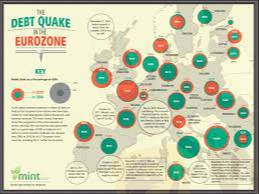

The European Sovereign Debt Crisis (2009–2012) had a significant impact on forex markets, mainly affecting the euro (EUR) and global currency stability. Here’s how it influenced forex trading:

1. Euro (EUR) Depreciation

Investors lost confidence in the euro due to rising debt in Greece, Spain, Italy, and other European nations.

Many traders sold off euros, causing the EUR/USD to decline sharply.

Example: In 2011, the EUR/USD fell from around 1.49 to 1.20, showing a major loss in value.

2. Flight to Safe-Haven Currencies

Traders shifted funds to safer currencies like:

US Dollar (USD) → Strengthened as investors saw the U.S. as a stable economy.

Swiss Franc (CHF) → Surged in value, forcing the Swiss National Bank (SNB) to intervene and cap its exchange rate.

Japanese Yen (JPY) → Gained strength as investors moved capital to Japan.

3. Increased Forex Volatility

The crisis caused panic selling and high uncertainty, leading to unpredictable swings in forex prices.

Central banks, like the European Central Bank (ECB), had to intervene with bailouts and stimulus programs, which also affected forex trends.

4. Weakening of Eurozone Trade Partners

Countries with close economic ties to Europe (e.g., the UK) saw their currencies affected.

The British pound (GBP) also faced pressure due to exposure to European debt.

5. Policy Actions Shaped Forex Trends

The ECB introduced quantitative easing (QE) and lower interest rates, making the euro less attractive to investors.

International financial institutions like the IMF and the EU bailout funds helped stabilize the euro over time.

Bottom Line

The European Sovereign Debt Crisis led to:

✅ Euro depreciation

✅ Strengthening of safe-haven currencies (USD, CHF, JPY)

✅ High forex market volatility

✅ Policy interventions that shaped currency movements

Me gusta 0

Momo403

ब्रोकर्स

Contenido delicado

Industria

Trabajo de WikiFX

Industria

Trabajo a tiempo parcial

Industria

gana sin invertir solo por usar una app

Industria

Evento de subsidio en México

Industria

gana 100 dólares con un minimo de inversión de 4 dólares

Industria

Evento de subsidio de Colombia

Categoría del foro

Plataforma

Exposición

Agente

Contratación

EA

Industria

Mercado

Índice

THE EFFECTS OF THE EUROPEAN SOVEREIGN DEBT CRISIS

Hong Kong | 2025-02-18 01:03

Hong Kong | 2025-02-18 01:03#firstdealofthenewyearastylz

The European Sovereign Debt Crisis (2009–2012) had a significant impact on forex markets, mainly affecting the euro (EUR) and global currency stability. Here’s how it influenced forex trading:

1. Euro (EUR) Depreciation

Investors lost confidence in the euro due to rising debt in Greece, Spain, Italy, and other European nations.

Many traders sold off euros, causing the EUR/USD to decline sharply.

Example: In 2011, the EUR/USD fell from around 1.49 to 1.20, showing a major loss in value.

2. Flight to Safe-Haven Currencies

Traders shifted funds to safer currencies like:

US Dollar (USD) → Strengthened as investors saw the U.S. as a stable economy.

Swiss Franc (CHF) → Surged in value, forcing the Swiss National Bank (SNB) to intervene and cap its exchange rate.

Japanese Yen (JPY) → Gained strength as investors moved capital to Japan.

3. Increased Forex Volatility

The crisis caused panic selling and high uncertainty, leading to unpredictable swings in forex prices.

Central banks, like the European Central Bank (ECB), had to intervene with bailouts and stimulus programs, which also affected forex trends.

4. Weakening of Eurozone Trade Partners

Countries with close economic ties to Europe (e.g., the UK) saw their currencies affected.

The British pound (GBP) also faced pressure due to exposure to European debt.

5. Policy Actions Shaped Forex Trends

The ECB introduced quantitative easing (QE) and lower interest rates, making the euro less attractive to investors.

International financial institutions like the IMF and the EU bailout funds helped stabilize the euro over time.

Bottom Line

The European Sovereign Debt Crisis led to:

✅ Euro depreciation

✅ Strengthening of safe-haven currencies (USD, CHF, JPY)

✅ High forex market volatility

✅ Policy interventions that shaped currency movements

Me gusta 0

Yo también quiero comentar.

Enviar

0Comentarios

No hay comentarios todavía. Haz el primero.

Enviar

No hay comentarios todavía. Haz el primero.