2025-02-18 01:13

IndustriaHow to calculate position sizing.

#forexrisktip

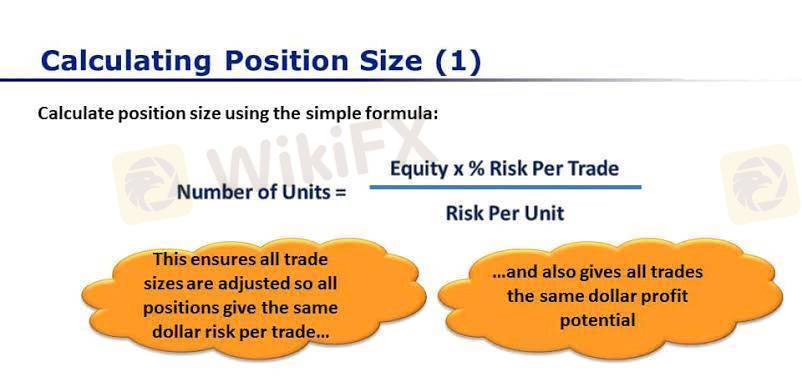

Position sizing is a risk management technique used by traders and investors to determine the appropriate number of units of an asset to buy or sell in order to control the potential loss from a trade. It involves calculating the position size based on the trader's account balance, risk tolerance, and the stop-loss level for the trade.

The basic formula for calculating position size is:

Position size = (Account balance * Risk percentage) / (Entry price - Stop-loss price)

For example, if a trader has an account balance of $10,000, a risk tolerance of 2%, an entry price of $100, and a stop-loss price of $95, the position size would be:

Position size = ($10,000 * 2%) / ($100 - $95) = 200 shares

This means that the trader should buy 200 shares of the asset. If the trade goes wrong and the price falls to the stop-loss level of $95, the trader will lose $1,000, which is 2% of their account balance.

Position sizing is an important risk management tool that can help traders to limit their losses and protect their capital. By carefully calculating the position size for each trade, traders can ensure that they are not risking more than they can afford to lose.

Me gusta 0

Forextrederr73

Trader

Contenido delicado

Industria

Trabajo de WikiFX

Industria

Trabajo a tiempo parcial

Industria

gana sin invertir solo por usar una app

Industria

Evento de subsidio en México

Industria

gana 100 dólares con un minimo de inversión de 4 dólares

Industria

Evento de subsidio de Colombia

Categoría del foro

Plataforma

Exposición

Agente

Contratación

EA

Industria

Mercado

Índice

How to calculate position sizing.

India | 2025-02-18 01:13

India | 2025-02-18 01:13#forexrisktip

Position sizing is a risk management technique used by traders and investors to determine the appropriate number of units of an asset to buy or sell in order to control the potential loss from a trade. It involves calculating the position size based on the trader's account balance, risk tolerance, and the stop-loss level for the trade.

The basic formula for calculating position size is:

Position size = (Account balance * Risk percentage) / (Entry price - Stop-loss price)

For example, if a trader has an account balance of $10,000, a risk tolerance of 2%, an entry price of $100, and a stop-loss price of $95, the position size would be:

Position size = ($10,000 * 2%) / ($100 - $95) = 200 shares

This means that the trader should buy 200 shares of the asset. If the trade goes wrong and the price falls to the stop-loss level of $95, the trader will lose $1,000, which is 2% of their account balance.

Position sizing is an important risk management tool that can help traders to limit their losses and protect their capital. By carefully calculating the position size for each trade, traders can ensure that they are not risking more than they can afford to lose.

Me gusta 0

Yo también quiero comentar.

Enviar

0Comentarios

No hay comentarios todavía. Haz el primero.

Enviar

No hay comentarios todavía. Haz el primero.