Tixee-Overview of Minimum Deposit, Spreads & Leverage

Extracto:Tixee under GVD KORIMCY LTD, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), is a broker that engages in providing investors with various financial products and services.

| Aspect | Information |

| Company Name | tixee |

| Registered Country/Area | Seychelles |

| Founded Year | 2022 |

| Regulation | Unregulated |

| Minimum Deposit | $10 |

| Maximum Leverage | 1:1000 |

| Spreads | 0.0pips-1.5pips |

| Trading Platforms | MT5 |

| Tradable Assets | Forex,indices,commodities,stocks,cryptocurrencies |

| Account Types | Standard,premium,raw,vip |

| Demo Account | Available |

| Customer Support | Phone, email, and social media |

| Deposit & Withdrawal | Credit/Debits Cards,Alternative Payment Methods(like Neteller),Bank Wire Transfer |

| Educational resource | New,analysis,economy calendar |

Overview of Tixee Limited

Tixee, established in 2022 and based in Seychelles, provides a diverse trading platform, notably unregulated, that enables users to engage in trading a wide array of assets including Forex, indices, commodities, stocks, and cryptocurrencies through the user-friendly MT5 trading platform. Catering to varied trading preferences, Tixee offers four account types—Standard, Premium, Raw, and VIP—with the added advantage of a demo account for risk-free strategy testing.

With a minimum deposit of just $10, a maximum leverage of 1:1000, and spreads between 0.0 and 1.5 pips, the platform extends a competitively accessible financial trading environment. Tixee ensures a streamlined user experience by providing a plethora of educational resources and multifaceted customer support via phone, email, and social media, though the absence of regulatory oversight necessitates prudent risk management from its users.

Is Tixee Limited Legit or a Scam?

Tixee is unregulated, meaning it does not hold a license from or is not overseen by a regulatory authority. In the world of financial trading, regulation is pivotal as it ensures the brokerage adheres to strict standards of operation, provides transparency in its dealings, and offers some level of security and peace of mind to the investors.

Potential traders and investors on the Tixee platform should be cognizant of the additional risks that can be associated with trading on an unregulated platform. It is always advisable to exercise caution and perhaps seek additional information or conduct further due diligence before investing through platforms that lack regulatory oversight. Always remember that investing always comes with risks, and it's essential to manage risk appropriately, especially in the context of an unregulated platform.

Pros and Cons

Pros of Tixee:

Diverse MSG Assets:Tixee offers a broad array of tradable assets, such as Forex, indices, commodities, stocks, and cryptocurrencies, providing traders with numerous options and the ability to diversify their portfolio.

Low Minimum Deposit:The low minimum deposit of $10 makes it accessible for traders with various financial capacities to start trading, making it an inclusive platform.

High Leverage:With a maximum leverage of 1:1000, Tixee offers traders the possibility to manage larger positions with a smaller amount of capital, potentially leading to enhanced profit opportunities.

Variety of Account Types:Tixee provides a range of account types (Standard, Premium, Raw, VIP) catering to different trader needs and preferences, alongside a demo account for practice and strategy testing.

Multifaceted Customer Support:Providing customer support through various channels like phone, email, and social media ensures that traders can easily reach out for assistance or inquiries.

Cons of Tixee:

Unregulated Platform:The lack of regulatory oversight can be a significant risk for traders as there is no authoritative body ensuring the firm adheres to standard financial protocols.

Young Company:Being founded in 2022, Tixee is relatively new to the trading industry, and thus might lack the established trust and reputation that comes with more seasoned platforms.

Potential for Higher Risk with High Leverage:While high leverage (1:1000) can be an advantage, it also comes with significant risk, potentially leading to rapid, significant losses.

Limited Platform Choice:Tixee only offers the MT5 trading platform, limiting traders who may prefer other platforms like MT4 or proprietary trading software.

Lack of Detailed Educational Content:Although educational resources are provided, there is no specific detail about the depth and quality of these materials, which may not sufficiently cater to both novice and experienced traders.

| Pros | Cons |

| Diverse MSG Assets | Unregulated Platform |

| Low Minimum Deposit | Young Company |

| High Leverage | Potential for Higher Risk with High Leverage |

| Variety of Account Types | Limited Platform Choice |

| Multifaceted Customer Support | Lack of Detailed Educational Content |

Market Instruments

Tixee offers a range of market instruments across various asset classes that traders can capitalize on to potentially diversify their investment portfolios. Here is a breakdown of the market instruments available on Tixee:

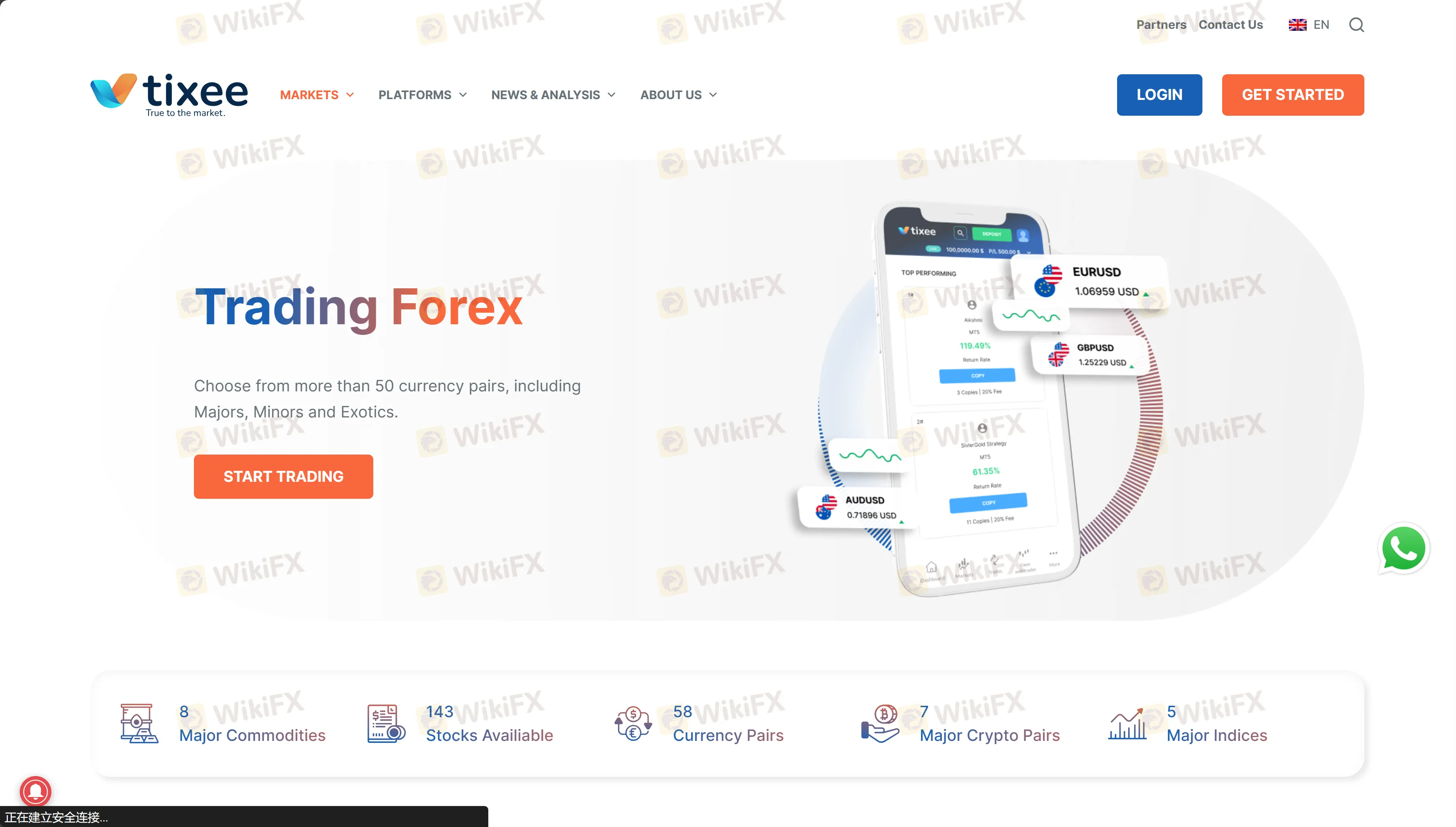

Forex:

Tixee allows traders to access the foreign exchange market, providing the opportunity to trade various currency pairs, potentially including major, minor, and exotic pairs. Forex trading involves speculating on the price movements between two currencies.

Indices:

Traders on Tixee can engage in trading indices, which are composed of a collection of leading stocks from a particular country or sector, allowing them to speculate on the price movements of these aggregated assets without having to buy each stock individually.

Commodities:

The platform enables trading in commodities, which may encompass a variety of hard and soft commodities, such as oil, gold, silver, wheat, or coffee, providing opportunities to speculate on the price fluctuations of these fundamental goods.

Stocks:

Tixee provides access to the stock market, enabling traders to speculate on the price movements of individual company stocks, potentially from various sectors and geographic regions.

Cryptocurrencies:

Cryptocurrency trading is also available on Tixee, offering opportunities to engage in the dynamic and often volatile digital currency market, where traders can potentially trade various cryptocurrencies like Bitcoin, Ethereum, and more.

These market instruments provide Tixee's users with a broad spectrum to navigate and develop a multifaceted trading strategy, catering to different risk tolerances, and investment goals. Each instrument type offers unique opportunities and comes with specific risks, and hence, traders are encouraged to perform thorough research or seek advice from a professional before engaging in trading activities.

Account Types

Tixee Limited offers various types of accounts.

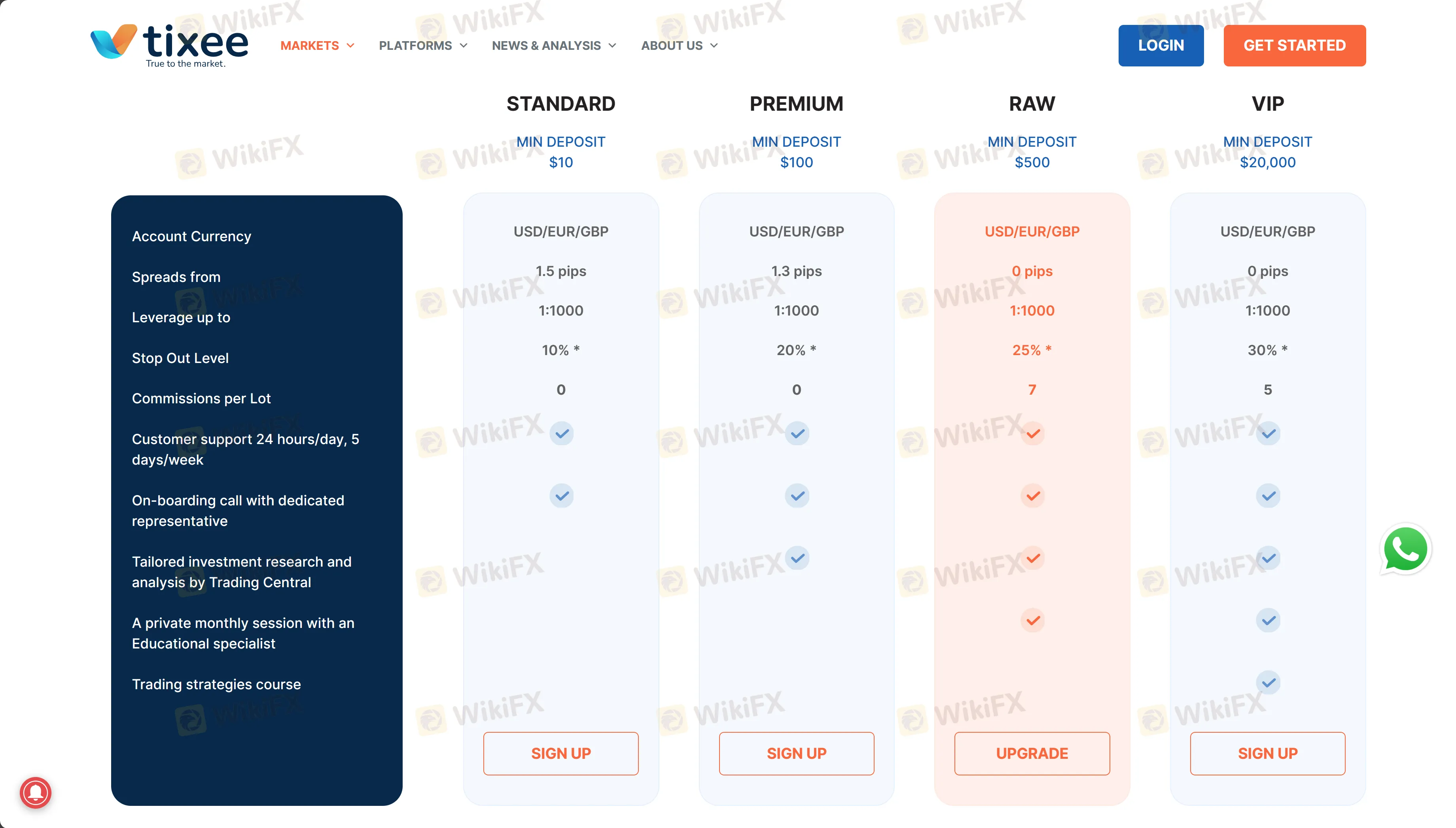

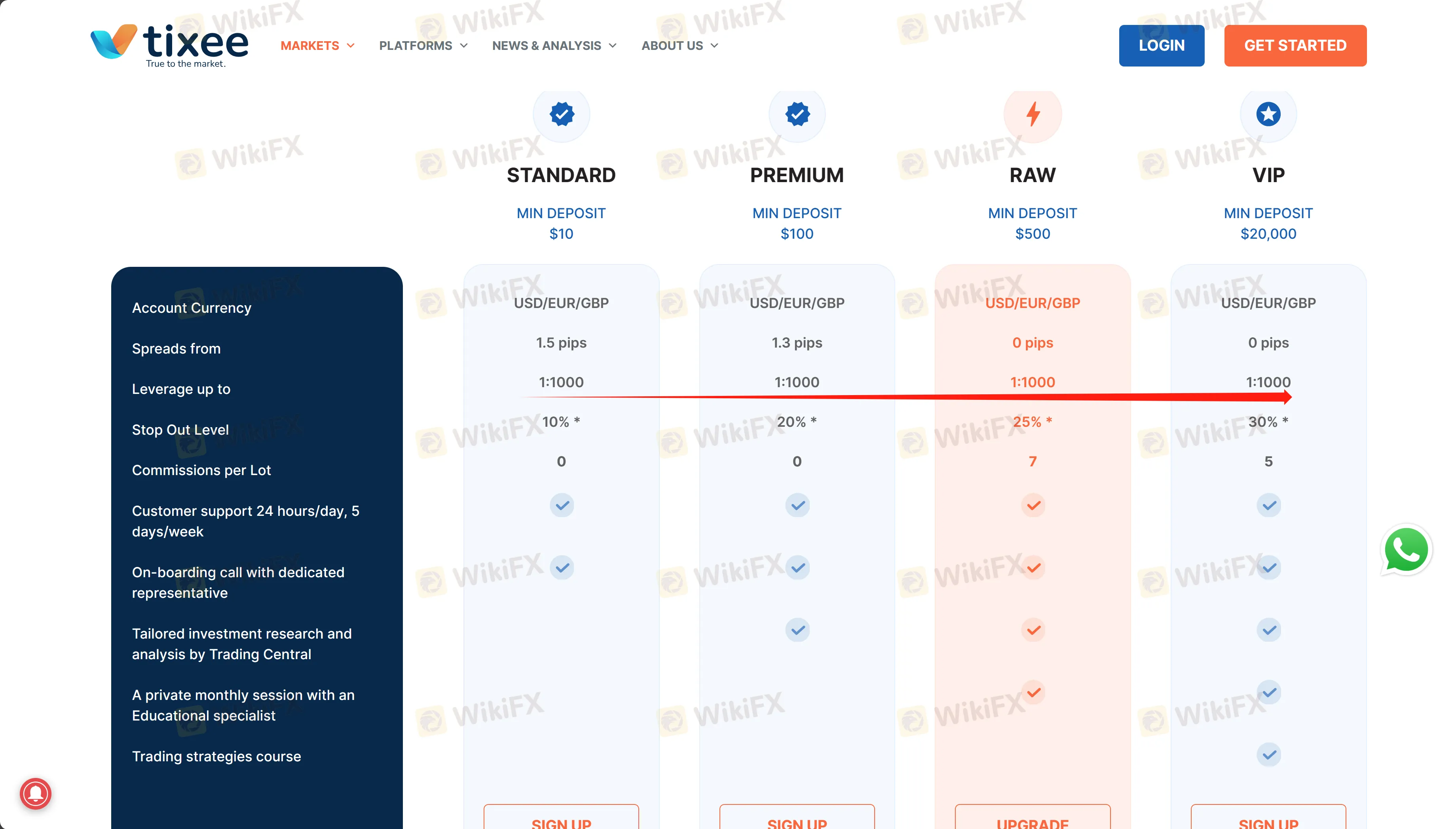

Standard Account:The Standard Account at Tixee aims to provide a welcoming environment for traders, particularly those who are new to the financial markets or prefer a lower entry threshold. With a modest minimum deposit of $10, it offers accessibility to various trading assets while accommodating USD, EUR, and GBP as account currencies. The spreads start from 1.5 pips, enabling relatively cost-effective trading, and it provides a maximum leverage of up to 1:1000, ensuring ample trading opportunities. However, users should be mindful of the leverage due to the accompanied risk, especially with a stop-out level set at 10%.

Premium Account:Tixees Premium Account serves traders seeking more favorable trading conditions with a slightly higher financial commitment of $100 minimum deposit. The spreads are slightly more competitive, starting from 1.3 pips, and maintaining leverage of up to 1:1000, offering enhanced possibilities for opening larger positions in the market. The account features a 20% stop-out level, which provides a modest cushion against market volatility and positions closing prematurely.

Raw Account:The Raw Account is tailored for intermediate to advanced traders, demanding a minimum deposit of $500 and providing exceptionally tight spreads, starting from 0 pips. This account type is designed to cater to traders who engage in high-frequency trading or employ scalping strategies. With a slightly elevated stop-out level of 25%, the Raw Account introduces commissions per lot, set at 7, a common practice with raw spread accounts to compensate for the tightened spreads.

VIP Account:Aiming to cater to professional and high-net-worth traders, the VIP Account necessitates a significant minimum deposit of $20,000, providing spreads from 0 pips and a slightly more forgiving stop-out level of 30%. With a commission per lot set at 5, this account type seems oriented towards providing a premium trading experience, coupled with high leverage of up to 1:1000, thus enabling substantial market exposure and trading potential, albeit with correlating risks.

| Account Type | Min Deposit | Account Currency | Spreads from | Leverage up to | Stop Out Level | Commissions per Lot |

| Standard | $10 | USD/EUR/GBP | 1.5 pips | 1:1000 | 10% | 0 |

| Premium | $100 | USD/EUR/GBP | 1.3 pips | 1:1000 | 20% | 0 |

| Raw | $500 | USD/EUR/GBP | 0 pips | 1:1000 | 25% | 7 |

| VIP | $20,000 | USD/EUR/GBP | 0 pips | 1:1000 | 30% | 5 |

How to Open an Account?

Opening an account on a trading platform like Tixee typically involves a few standard steps.Below is a guide :

Visit the Official Website: Navigate to the official Tixee website. Look for the “start trading” button, typically located at the top right corner of the homepage, and click on it to initiate the account creation process.

Complete the Registration Form:Fill out the registration form with the required personal information. This usually includes your full name, email address, contact number, and may also ask for your employment status, financial situation, and trading experience to comply with regulatory requirements. Ensure all details are accurate to avoid issues with account verification.

Submit Verification Documents:Verify your identity and address by providing the requisite documentation. Generally, a government-issued photo ID (such as a passport or drivers license) and a proof of residence (like a utility bill or bank statement) are needed. This step is crucial to ensure security and adherence to financial regulations.

Choose Account Type & Deposit Funds:Select your preferred account type from the options available (Standard, Premium, Raw, or VIP). Once chosen, proceed to fund your account using one of the available deposit methods (Credit/Debit Cards, Alternative Payment Methods like Neteller, or Bank Wire Transfer). Ensure the deposit aligns with the minimum requirement for your chosen account type.

Set Up Trading Platform & Start Trading:After your account is activated and funded, set up your trading platform by downloading and installing any necessary software (like MT5, in the case of Tixee). Configure your trading preferences, explore the platforms features, and when you're ready, you can begin exploring trading opportunities within the platform.

Leverage

Tixee offers a notably high level of leverage, up to 1:1000 across its various account types (Standard, Premium, Raw, and VIP).

Leverage in trading refers to the ability to control a large position in the market with a comparatively smaller amount of money deposited in your trading account. In the context of Tixee:

1:1000 Leverage: For every $1 you have in your trading account, you can control a position size of $1000 in the market.

This high leverage amplifies both the potential profits and potential losses. Here's a little breakdown:

Potential for Greater Profits: High leverage can significantly increase the profit potential because any gain on the position is calculated based on the full size of the position, not just the amount of capital the trader has invested.

Risk of Greater Losses: Conversely, high leverage can amplify losses, and in cases where the market doesnt move in the direction anticipated by the trader, the loss incurred will be correspondingly higher. Losses can even exceed the initial deposit.

Given the high level of leverage available, traders should approach with caution and ensure they have a solid understanding of the risks involved in leveraged trading, as well as a robust risk management strategy in place to safeguard against substantial losses. This might include using stop-loss orders to manage potential losses and only risking a small percentage of trading capital on a single trade. Especially in an unregulated platform like Tixee, it is paramount to be cautious and well-informed to navigate through the volatile landscapes of trading markets effectively.

Spreads & Commissions

-

Spreads:

Tixee offers varying spreads depending on the account type chosen by the trader:

Standard Account: Spreads start from 1.5 pips.

Premium Account: Spreads are slightly tighter, beginning from 1.3 pips.

Raw Account: Offers the tightest spreads, starting from 0 pips.

VIP Account: Also available spreads from as low as 0 pips.

Spreads are the difference between the bid and the ask price of a trading instrument and can impact the cost-effectiveness of your trades, especially in a high-frequency trading environment. Tighter spreads are generally preferable for traders, as they reduce the cost of entering and exiting trades.

Commissions:

Tixee implements different commission structures across its various account types:

Standard Account: $0 commission per lot.

Premium Account: $0 commission per lot.

Raw Account: Commission of $7 per lot.

VIP Account: Commission of $5 per lot.

Traders must astutely select trading accounts, either opting for Raw and VIP accounts that feature lower spreads but charge commissions, ideal for high-volume or high-frequency trading, or Standard and Premium accounts with no commissions and wider spreads, which may benefit infrequent or low-volume traders.

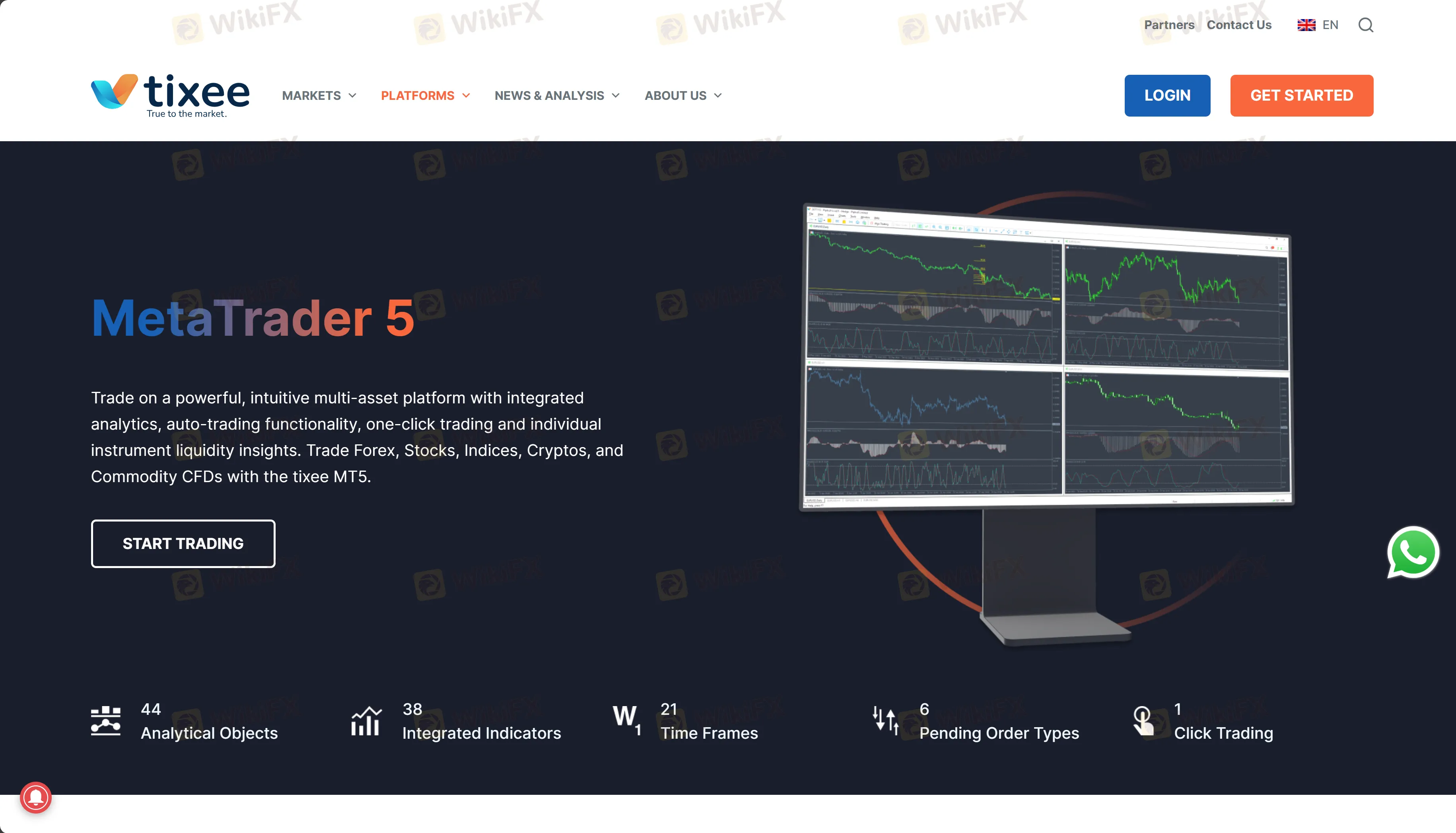

Trading Platform

Tixee utilizes MetaTrader 5 (MT5) as its trading platform, offering traders a robust, secure, and user-friendly environment to navigate through various financial markets. MT5, acclaimed for its sophisticated technical analysis, algorithmic trading capabilities, and comprehensive charting tools, supports diverse trading assets including Forex, indices, commodities, stocks, and cryptocurrencies. Its advanced features also include a real-time economic calendar, various order management options, and the ability to employ automated trading strategies via Expert Advisors (EAs).

MT5 is accessible across multiple devices, ensuring that traders can engage with the market anytime and anywhere, complementing different trading styles and strategies. With an intuitive interface and multilingual support, MT5 ensures that both novice and seasoned traders on the Tixee platform can manage their trading activities effectively, albeit it's crucial to maneuver cautiously on an unregulated platform.

Deposit & Withdrawal

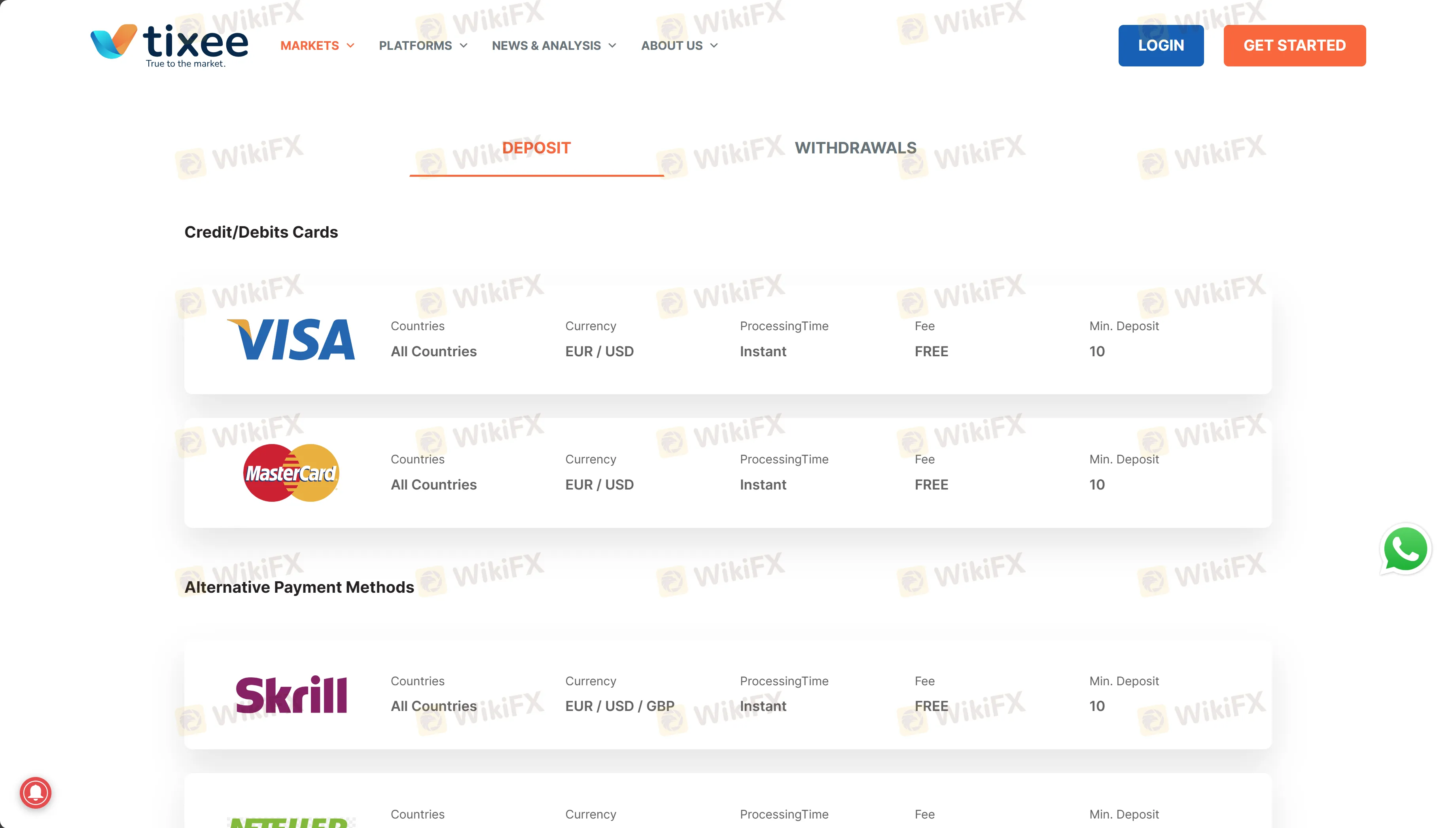

deposit

Tixee offers a comprehensive array of deposit methods, accommodating various geographical and currency preferences to facilitate ease of account funding for its global clientele.

Accepting a minimum deposit of just $10 and imposing no fees on transactions, Tixee allows instant deposits through universally recognized methods such as Visa, Skrill, and Neteller, which accommodate EUR, USD, and GBP.

Notably, Tixee provides numerous localized payment methods, catering to specific countries and regions in Africa and Asia, such as VirtualPay, ONLINE NAIRA, UPI, XPay, and more, even including options for currencies like INR, VND, and others.

Certain options like ZOTAPAY, AOPAY, and DIVEPAY might necessitate up to 48 hours for processing. Furthermore, the platform enables Bank Wire Transfers, which have a varied processing time from instant up to 5 business days, again without imposing fees.

This extensive and diverse range of deposit options underscores Tixees commitment to providing accessible and convenient financial solutions to traders worldwide, albeit with different processing times depending on the method utilized.

| Method | Countries/Regions | Currency | Processing Time | Fee | Min. Deposit |

| Visa | All | EUR/USD | Instant | Free | 10 |

| Skrill | All | EUR/USD/GBP | Instant | Free | 10 |

| Neteller | All | EUR/USD/GBP | Instant | Free | 10 |

| VirtualPay | Kenya, Uganda, Tanzania | EUR/USD/GBP | Instant | Free | 10 |

| ONLINE NAIRA | Multiple African Countries | EUR/USD/GBP | Up to 48 hours | Free | 10 |

| UPI | India | INR | Instant | Free | 10 |

| Bank Wire | All | EUR/USD | Up to 5 business days | Free | 10 |

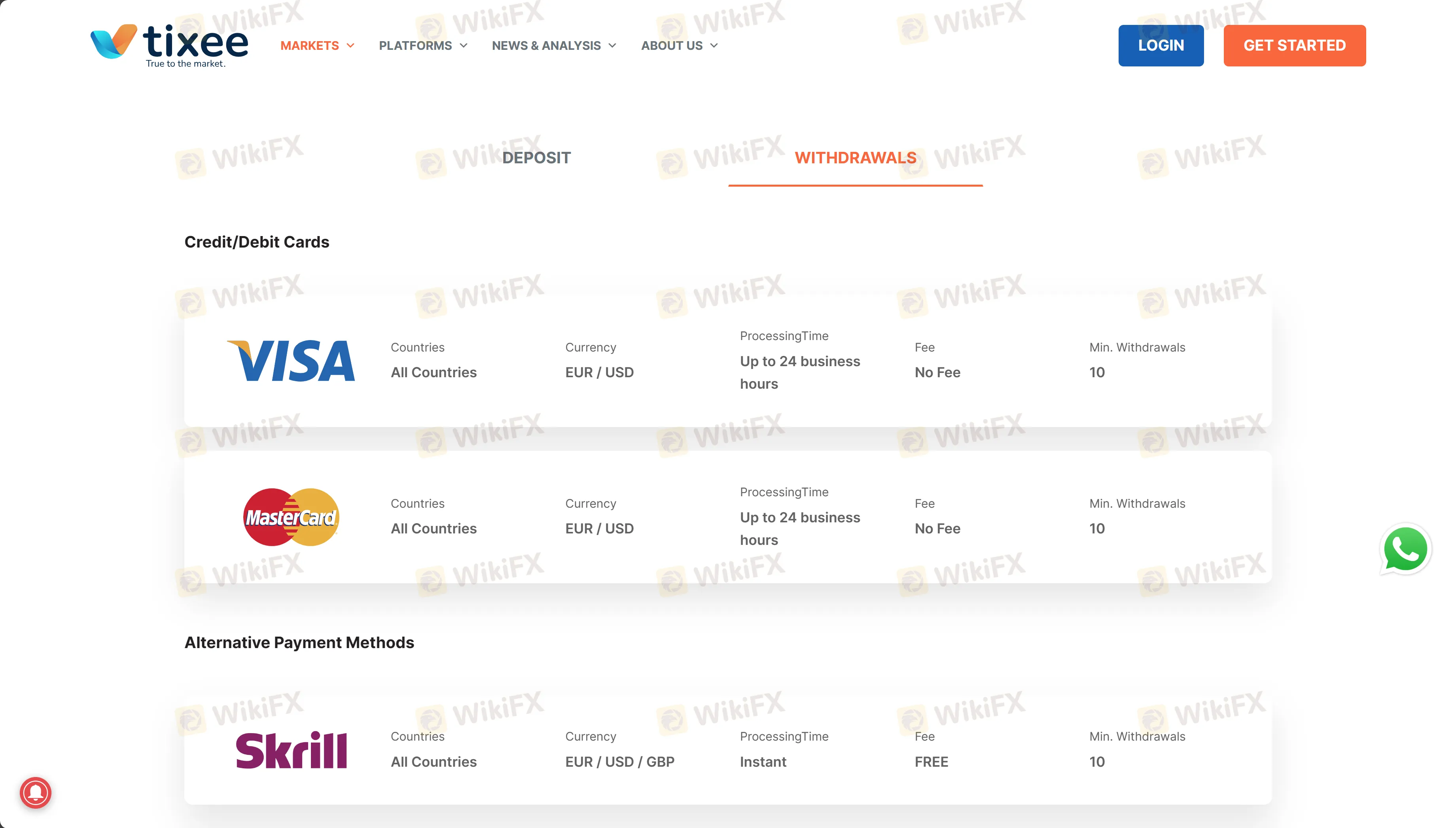

withdrawal

Tixee offers a diverse range of withdrawal options for its users across various countries and regions, ensuring accessibility and convenience in accessing their funds.

A universal characteristic across these methods is the maintenance of a minimum withdrawal amount of 10 and the absence of processing fees. Visa card withdrawals, applicable globally, are processed within 24 business hours in EUR or USD.

Alternative payment methods such as Skrill, Neteller, VirtualPay, ONLINENAIRA, MOPESA, and several others generally offer instant processing times in various currencies, although some may take up to 48 hours.

There are also options for users in specific regions such as payretailers in Latin American countries, DRAGONPAY in the Philippines, and ZOTAPAY in multiple locations, each with its own currency specifications.

Furthermore, bank wire transfers are globally applicable, taking up to 2-5 business days for processing in EUR or USD.

The wide-ranging withdrawal methods signify Tixee's commitment to providing versatile financial management to its global user base.

| Method | Countries/Regions | Currency | Processing Time | Fee | Min. Withdrawals |

| Visa | All | EUR/USD | Up to 24 business hours | FREE | 10 |

| Skrill | All | EUR/USD/GBP | Instant | FREE | 10 |

| Neteller | All | EUR/USD/GBP | Instant | FREE | 10 |

| VirtualPay | Kenya, Uganda, Tanzania | EUR/USD/GBP | Instant | FREE | 10 |

| ONLINENAIRA | Select African countries | EUR/USD/GBP | Up to 48 hours/Instant | FREE | 10 |

| MOPESA | Kenya, Tanzania | EUR/USD/GBP | Instant | FREE | 10 |

| payretailers | Select Latin American countries | EUR/USD/GBP | Up to 48 hours | FREE | 10 |

| DRAGONPAY | Philippines | PHP | Instant | FREE | 10 |

| ZOTAPAY | Multiple Countries | Various | Up to 48 hours | FREE | 10 |

| Bank Wire Transfer | All | EUR/USD | Up to 2-5 business days | No Fee | 10 |

Customer Support

Pipbull Ltd, commonly recognized by their trading name “tixee”, operates without a regulatory status and is registered in Seychelles, with its physical address at Angel Fish Bayside Marina complex, office Block A/A01, Roche Caiman, Seychelles. The company can primarily be accessed through their online platforms, which include their websites: https://tixee.com/ and https://tixee.eu.

Consequently, for customer support, inquiries, or further engagement, individuals are advised to utilize the contact or support section available on the aforementioned websites, which might facilitate email communications, live chat, or provide additional details on how to get in touch with their customer service team. Always ensure to engage with financial platforms with caution, especially when they lack regulatory oversight.

Educational Resources

Tixee provides a comprehensive suite of educational resources for traders, ensuring they have access to essential market information and analytical tools. The platform delivers real-time “News & Analysis,” insightful “Market News,” and expert “Trading Central Analysis” to help traders make informed decisions. Through “tixeeLive!,” traders can join live streams with the Global Head of Market Research during key market openings, while “Live Market Reports” offer direct insights into the New York Stock Exchange activities. Regular “Insights” on various trading strategies and an “Economic Calendar” are also available to assist traders in planning their trades, managing risks, and staying abreast of market developments and opportunities.

Conclusion

Tixee, operated by Pipbull Ltd and based in Seychelles, offers traders a platform unregulated but enriched with various resources for informed trading. It provides a plethora of withdrawal options across numerous countries and currencies, enhancing global accessibility.

Additionally, Tixee prioritizes trader education and timely market information through an extensive assortment of analytical tools, news, and live market insights, aiding both novice and experienced traders in navigating through the financial markets effectively.

FAQs

Q: What Resources Are Available for Traders on Tixee?

A: Tixee offers numerous trading resources including news & analysis, live market reports, insights, an economic calendar, and live streams to keep traders informed and support effective trading strategies.

Q: How Can I Withdraw Funds from Tixee?

A: Tixee provides numerous withdrawal methods with varied processing times, currencies, and available countries, including Credit/Debit Card options, E-wallets like Skrill and Neteller, and other alternative payment methods tailored for different regions.

Q: What Educational Content Does Tixee Provide?

A: The platform provides an educational hub with resources like market news, Trading Central Analysis, live market reports, insights, and an economic calendar to assist traders in enhancing their market understanding and trading capabilities.

Q: Is There a Minimum Withdrawal Limit on Tixee?

A: Yes, the platform stipulates a minimum withdrawal limit of 10 units for the respective currencies across various withdrawal methods.

Q: What Leverage Options Does Tixee Offer to Traders?

A: In all kinds of accounts,Tixee provides a leverage of 1:1000 to all users.

Brokers de WikiFX

últimas noticias

¿Exnova es estafa o bróker confiable para invertir en 2025?

La CNMV alerta de 18 entidades no registradas.

¿Cómo se comportó hoy la bolsa latinoamericana y qué esperar en los próximos meses?

¿Cuál es el precio del petróleo hoy y qué oportunidades ofrece para el trading?

¿Nuevas estafas del broker Libertex? Cliente no puede retirar su dinero.

Cambio de Carácter en el Trading ¿Cómo identificar un cambio de tendencia en trading?

Cálculo de tasa de cambio