Valbury-The overview of minimum deposit, leverage, spreads

abstrak: Valbury is a financial institution headquartered in the United Kingdom. Established in 2010, it is regulated by the Financial Conduct Authority (FCA) under license number 540418. Valbury offers various tradable assets such as Forex, Index CFDs, Gold & Silver, and Crude Oil. The company provides access to the MetaTrader 4 platform and a mobile trading platform. They offer 24-hour customer support through online chat and have educational resources including a calendar, news resources, and research reports. Valbury also provides bonus offerings such as a Welcome Bonus and a Refer a Friend program.

| Valbury Review Summary | |

| Founded | 1990 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA & BAPPEBTI & JFX |

| Market Instruments | ForexIndicesPrecious MetalsCommodities |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.28 pips |

| Trading Platform | Mobile Trading Platforms (Acuity) |

| Min Deposit | / |

| Customer Support | Phone:(021) 255 33 777+62 (811) 870 2875 |

| 24/7 service | |

| Physical Address: Menara Karya Lt 9 Jl. H.R. Rasuna Said Block X-5 Kav 1-2 Jakarta, 12950. | |

| Email: cso@ Valbury .co.id | |

| Social Media: YouTube, TikTok, Twitter, Facebook, Instagram. | |

Valbury Information

Valbury was established in 1990 and registered in the United Kingdom, Valbury is regulated by the Badan Pengass Perdagangan Berjangka Komoditi Kementerian Perdagangan (BAPPEBTI), the Financial Conduct Authority (FCA), and the Jakarta Futures Exchange(JFX).

The company offers four asset classes: forex, indices, precious metals, and commodities. It also provides access to the mobile trading platforms and supports demo accounts.

Pros and Cons

| Pros | Cons |

| Available demo accounts | Not support MT4 and MT5 |

| 24/7 service | Lack of deposit and withdrawal method information |

| Support swap-free account |

Is Valbury Legit?

Valbury is under the regulation of the Financial Conduct Authority (FCA), holding License number 540418.

Valbury is also under the regulation of the Badan Pengass Perdagangan Berjangka Komoditi Kementerian Perdagangan (BAPPEBTI) and the Jakarta Futures Exchange(JFX), holding License number 184/BAPPEBTI/SI/II/2003 and SPAB-046/BBJ/06/02.

| Regulator | Regulatory Status | Licence Type | Licence Number |

| Financial Conduct Authority (FCA) | Regulated | Straight Through Processing(STP) | 540418 |

| Badan Pengass Perdagangan Berjangka Komoditi Kementerian Perdagangan (BAPPEBTI) | Regulated | Retail Forex License | 184/BAPPEBTI/SI/II/2003 |

| Jakarta Futures Exchange(JFX) | Regulated | Retail Forex License | SPAB-046/BBJ/06/02 |

What Can I Trade on Valbury?

Valbury provides trading products including forex, indices, precious metals, and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Precious Metals | ✔ |

| Commodities. | ✔ |

| Energies | ❌ |

| Shares | ❌ |

| ETF | ❌ |

Account Types

Valbury offers three types of accounts: Alpha Account, Sirius Account, and Vega Account. It also offers demo accounts for traders.

The Alpha Account, Sirius, and Vega Account all offer leverage up to 1:500, free swap options, and varying spreads. Specifically, the Alpha Account has a spread starting from 0.35, Sirius from 0.30, and Vega Account from the lowest at 0.28.

| Alpha Account | Sirius | Vega Account | |

| Transaction Size | Starts from 0.01 lot | Starts from 0.01 lot | Starts from 0.01 lot |

| Fee/Lot | $1 | $10 | $33 |

| Spread | Starts from 0.35 | Starts from 0.30 | Starts from 0.28 |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Free Swap | Available | Available | Available |

| Trading Signal | Yes | Yes | Yes |

| Trading Tool | Limited Access | Full Access | Full Access |

| 24/7 Customer Service | Yes | Yes | Yes |

| Personal Relationship Manager | - | Yes | Yes |

| Education and News | Full Access | Full Access | Full Access |

| Loyalty Points | 0.5 point / lot | 1.0 point / lot | 1.5 point / lot |

Valbury does not offer a direct way to open an account on its website.

To open a demo account, the user will be prompted to fill in personal information on this page, including name, email, and phone number.

Then press the ‘REGISTER NOW’ button to complete the account creation process.

Leverage

The leverage ratio varies by equity: 1:500 for equity up to 50,000, 1:200 for equity 50,000 or more, and 1:100 for equity 100,000 or more.

| Equity | Leverage | Margin Call | Autocut |

| < $50,000 | 1:500 | <= 100% | 50% |

| >= $50,000 | 1:200 | <= 100% | 50% |

| >= $100,000 | 1:100 | <= 100% | 10% |

Valbury Fees

The official website does not state whether the commission is charged.

Valbury's spread structure differs across account types.

Alpha Account has a spread starting from 0.35, Sirius from 0.30, and Vega Account from the lowest at 0.28.

Here is the specific spreads table of different trading assets:

| Symbol | Spread start from | ||

| Alpha | Sirius | Vega | |

| AUDJPY | 2 | 1.8 | 1.7 |

| AUDNZD | 2.8 | 2.6 | 2.5 |

| AUDUSD | 2 | 1.7 | 1.5 |

| CHFJPY | 2.4 | 2.2 | 2.1 |

| EURAUD | 2.8 | 2.6 | 2.4 |

| EURCAD | 2.8 | 2.6 | 2.4 |

| EURCHF | 2.2 | 2.1 | 2 |

| EURGBP | 2.2 | 2 | 1.9 |

| EURJPY | 2.2 | 2 | 1.8 |

| EURUSD | 1.8 | 1.6 | 1.4 |

| GBPAUD | 3.8 | 3.5 | 3.2 |

| GBPCHF | 2.8 | 2.6 | 2.5 |

| GBPJPY | 2.8 | 2.6 | 2.5 |

| GBPUSD | 2.2 | 2.1 | 2 |

| NZDJPY | 2.4 | 2.2 | 2 |

| NZDUSD | 2.2 | 2 | 1.8 |

| USDCAD | 2.4 | 2.1 | 1.8 |

| USDCHF | 2.4 | 2.1 | 1.8 |

| USDJPY | 2 | 1.8 | 1.6 |

| XAGUSD | 0.035 | 0.03 | 0.028 |

| XAUUSD | 0.35 | 0.3 | 0.28 |

| CLR | 0.05 | 0.05 | 0.05 |

| Index Nikkei | AM 5, PM 10 | AM 5, PM 10 | AM 5, PM 10 |

| Index Hangseng | 10 | 10 | 10 |

| Index Dow Jones | 10 | 10 | 10 |

| Index Nasdaq | 3 | 3 | 3 |

| Index S&P 500 | 1 | 1 | 1 |

Trading Platform

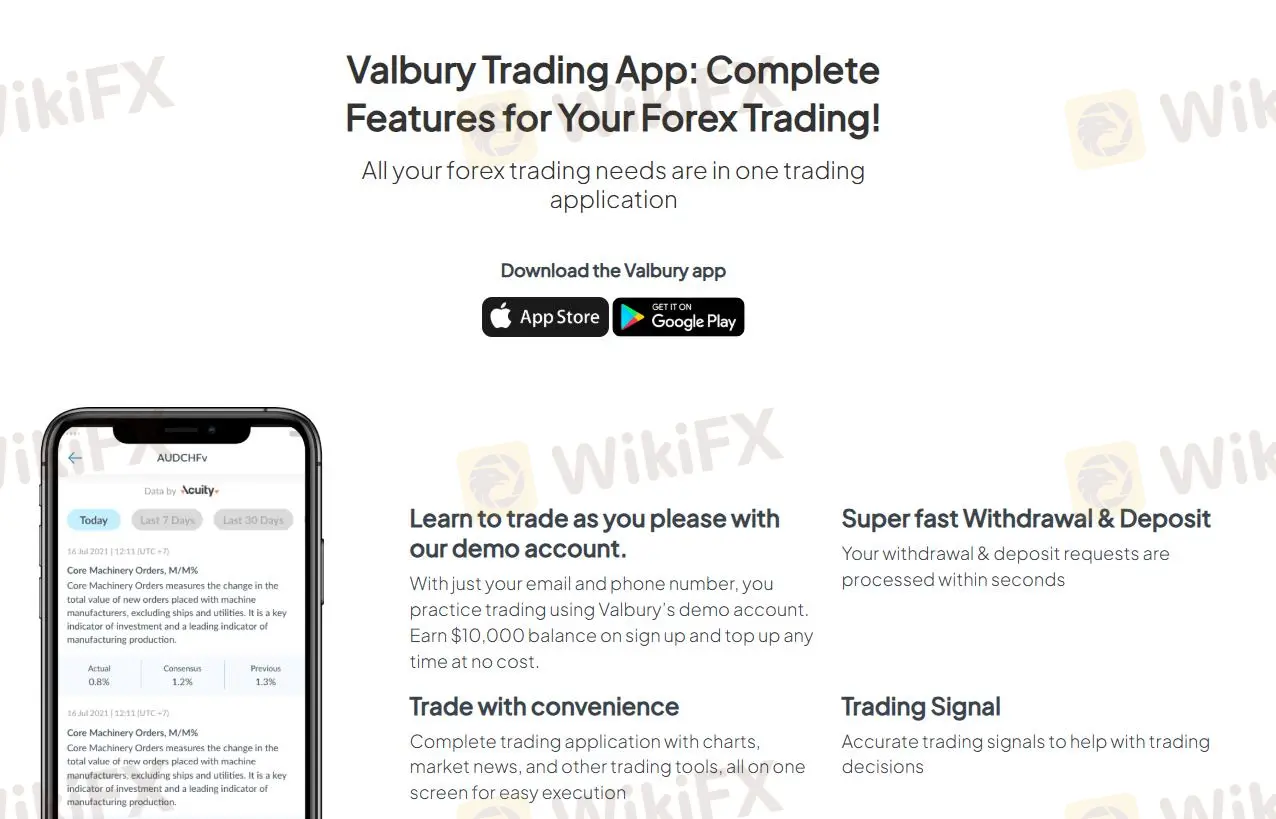

Valbury offers the Valbury Trading App, which provides demo accounts, fast deposit and withdrawal processing, trading charts and market information, and accurate trading signals. It can be downloaded through the Apple Store and Google Play.

However, it does not offer the popular MT4 or MT5 on the market.

| Trading Platform | Supported | Available Devices |

| Acuity | ✔ | APP Store, Google Play |

| MT4 | ❌ | |

| MT5 | ❌ |

Deposit & Withdrawal

Information about deposit and withdrawal methods is not disclosed on the official website.

Magbasa pa ng marami

Sa likod ng Orfinex Prime Brokerage: Isang kaso ng pagsalangsang at negligencia

Orfinex Prime: Mga Allegasyon ng Negligencia at Paglabas | Ang mga problema ng mga kliyente ay nagpapahayag ng mga hindi ligtas na pamamaraan sa pagbebenta, malinaw na presensya sa Dubai, at mga alalahanin ng pagsalangsang. Gumawa ng mga aksyon para sa proteksyon ng mga mamimili.

The pound, gilts and renewables: the winners and losers under Britain’s future PM

The race to be the next leader of Britain’s ruling-Conservative Party and the country’s prime minister is into its final leg, with the September outcome likely to shape the fortunes of sterling, gilts and UK stocks in coming months.

IMF cuts global growth outlook, warns high inflation threatens recession

The International Monetary Fund cut global growth forecasts again on Tuesday, warning that downside risks from high inflation and the Ukraine war were materializing and could push the world economy to the brink of recession if left unchecked.

Starting Forex Trading: Creating A Profit Plan

A key factor in building a successful and profitable trading career is making your own plans. Your transaction plan will provide a good framework for guiding ever-changing currency prices to profit.

Broker ng WikiFX

Exchange Rate