BtcMarketCap

abstrak:BtcMarketCap is an unregulated broker registered in Australia. The broker sets up many accounts distinguished by different opening conditions and provides various instruments, including FX, stocks, crypto, and more. However, traders do not get any information because of the closed official website.

Note: BtcMarketCap's official website: https://btcmarketcap.com/ can not open.

BtcMarketCap Information

BtcMarketCap is an unregulated broker registered in Australia. The broker sets up many accounts distinguished by different opening conditions and provides various instruments, including FX, stocks, crypto, and more. However, traders do not get any information because of the closed official website.

Is BtcMarketCap Legit?

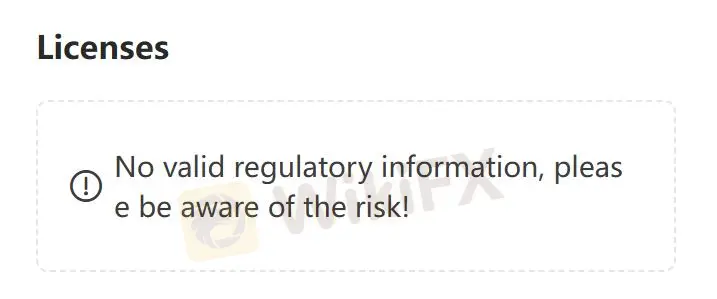

BtcMarketCap is not regulated, which will increase trading non-compliance and reduce traders investment security.

Downsides of BtcMarketCap

- Unavailable Website

BtcMarketCap's official website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since BtcMarketCap does not explain more transaction information, especially in terms of fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

BtcMarketCap is not regulated by other institutions, which increases the possibility of danger.

Conclusion

BtcMarketCap Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that this brokers trading risks are high. It is advisable to choose regulated brokers with transparent operations to ensure the safety of your investments and compliance with legal standards.

Broker ng WikiFX

Exchange Rate