VCTFX

abstrak:VCTFX, an unregulated Chinese company, raises significant concerns for potential traders. The lack of regulatory oversight, high leverage options, and unclear spreads make it a risky choice. Their web-based platform is not recommended, and the overall transparency and credibility of their operations are questionable. While they offer a variety of tradable assets, including Forex, Stocks, Indices, Commodities, and Cryptocurrencies, the absence of regulation makes it difficult to trust their offerings. Customer support may not be as responsive as expected, and the presence of in-person support doesn't guarantee effective assistance. Additionally, traders should be cautious of fees associated with payment methods. Despite offering educational resources, the lack of regulatory oversight and transparency should lead traders to approach VCTFX with caution.

| Aspect | Information |

| Registered Country/Area | China |

| Company Name | VCTFX |

| Regulation | Unregulated |

| Minimum Deposit | Micro Account: $100 Standard Account: $1,000 Classic Account: $5,000 VCT Premium Account: $15,000 VCT VIP Account: $30,000 |

| Maximum Leverage | Micro Account: 1:200 Standard Account: 1:300 Classic Account: 1:500 VCT Premium Account: 1:1000 VCT VIP Account: 1:1000 |

| Spreads | Micro Account: Starting from 2 pips Standard Account: Starting from 1.5 pips Classic Account: Starting from 1 pip VCT Premium Account: Starting from 0.5 pips VCT VIP Account: Starting from 0.3 pips |

| Trading Platforms | Web-based platform (not recommended) |

| Tradable Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Account Types | Micro Account, Standard Account, Classic Account, VCT Premium Account, VCT VIP Account |

| Customer Support | Email: support@vctfx.com Phone: +152 534-468-854 Location (in-person support): Available (effectiveness not guaranteed) |

| Payment Methods | Deposit: Bank Wire, PayPal, Skrill, Neteller, Cryptocurrency (fees applicable) Withdrawal: Bank Wire, PayPal, Skrill, Neteller, Cryptocurrency (fees applicable) |

| Educational Tools | Technical analysis, Fundamental analysis, Forex trading strategies, Copy trading, Fast order execution (information provided) |

Overview

VCTFX, an unregulated Chinese company, raises significant concerns for potential traders. The lack of regulatory oversight, high leverage options, and unclear spreads make it a risky choice. Their web-based platform is not recommended, and the overall transparency and credibility of their operations are questionable. While they offer a variety of tradable assets, including Forex, Stocks, Indices, Commodities, and Cryptocurrencies, the absence of regulation makes it difficult to trust their offerings. Customer support may not be as responsive as expected, and the presence of in-person support doesn't guarantee effective assistance. Additionally, traders should be cautious of fees associated with payment methods. Despite offering educational resources, the lack of regulatory oversight and transparency should lead traders to approach VCTFX with caution.

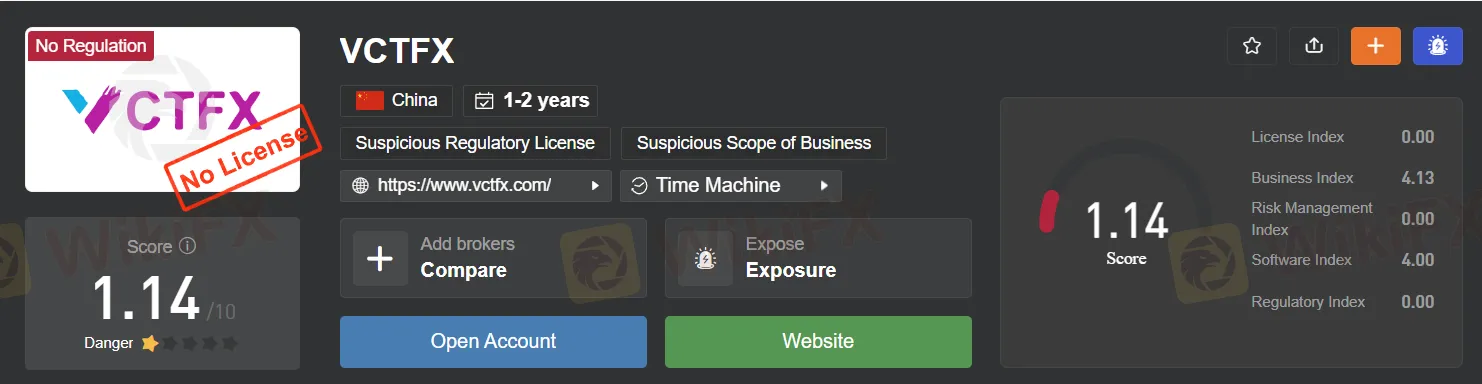

Regulation

VCTFX operates in an unregulated environment, meaning it functions without oversight from established financial regulatory authorities. This lack of regulatory supervision gives rise to noteworthy concerns. Unregulated firms like VCTFX are not subject to strict rules, standards, or the oversight that regulated entities must follow. As a result, there is an increased risk of fraudulent activities, financial mismanagement, and unethical practices. Customers engaged with unregulated brokers may find themselves with limited options in case of disputes or issues, underscoring the importance of prioritizing regulated and reputable alternatives for financial transactions and investments.

Pros and Cons

| Pros | Cons |

| Wide range of trading instruments | Unregulated environment raises significant risks |

| Diverse account types for traders | High leverage can lead to substantial losses |

| Educational resources available | Lack of transparency in spreads and commissions |

| Various deposit and withdrawal options | Questionable reliability of trading platform |

| Comprehensive guide to technical and fundamental analysis | Unreliable customer support |

VCTFX presents both advantages and disadvantages for traders to consider. On the positive side, they offer a diverse array of trading instruments, catering to different investment preferences. Their range of account types allows traders to choose options suited to their skill levels. Additionally, they provide educational resources, including technical and fundamental analysis guides.

However, significant drawbacks exist. VCTFX operates in an unregulated environment, which raises concerns about potential fraudulent activities and unethical practices. The broker relies on high leverage, which can result in substantial losses for traders. The lack of transparency in spreads and commissions adds to the uncertainty. The reliability of their trading platform is questionable, and customer support appears to be unreliable. Traders should carefully weigh these pros and cons when considering VCTFX as their broker.

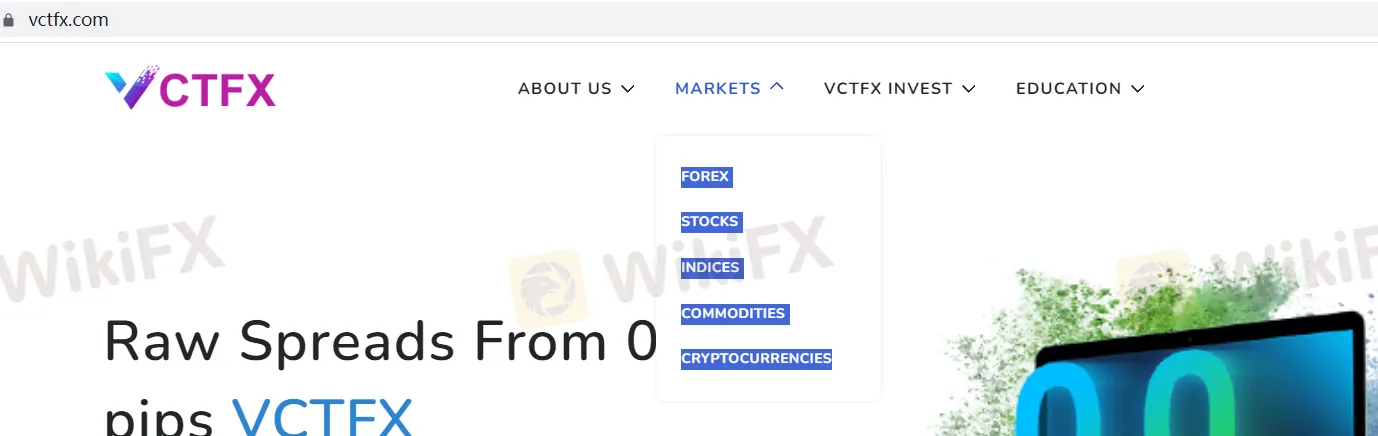

Market Instruments

The broker offers a wide range of trading instruments, catering to diverse investment preferences and strategies. These instruments encompass the following categories:

FOREX (Foreign Exchange):

The Forex market is a cornerstone of the broker's offerings. It involves the trading of currency pairs, where investors can speculate on the relative strength of one currency against another. Forex trading provides opportunities for both short-term and long-term strategies, making it a preferred choice for traders seeking high liquidity and market access.

STOCKS:

Stocks represent ownership in publicly traded companies. This trading instrument allows investors to buy and sell shares of these companies, thereby participating in their performance and potential profits. The broker likely offers access to a wide array of global stocks, enabling traders to diversify their portfolios and capitalize on market movements.

INDICES:

Stock indices, such as the S&P 500, NASDAQ, or FTSE 100, are baskets of stocks representing various sectors or regions. Trading indices allows investors to speculate on the overall performance of a group of stocks rather than individual companies. It's an excellent instrument for tracking market trends and managing risk.

COMMODITIES:

Commodities include physical goods like gold, oil, wheat, and more. They are traded in various forms, such as spot contracts or futures. Commodity trading offers exposure to real-world assets and can serve as a hedge against inflation or geopolitical events.

CRYPTOCURRENCIES:

The cryptocurrency market is known for its volatility and potential for substantial returns. It involves digital currencies like Bitcoin, Ethereum, and Ripple. Cryptocurrencies have gained popularity as speculative assets and alternative investments.

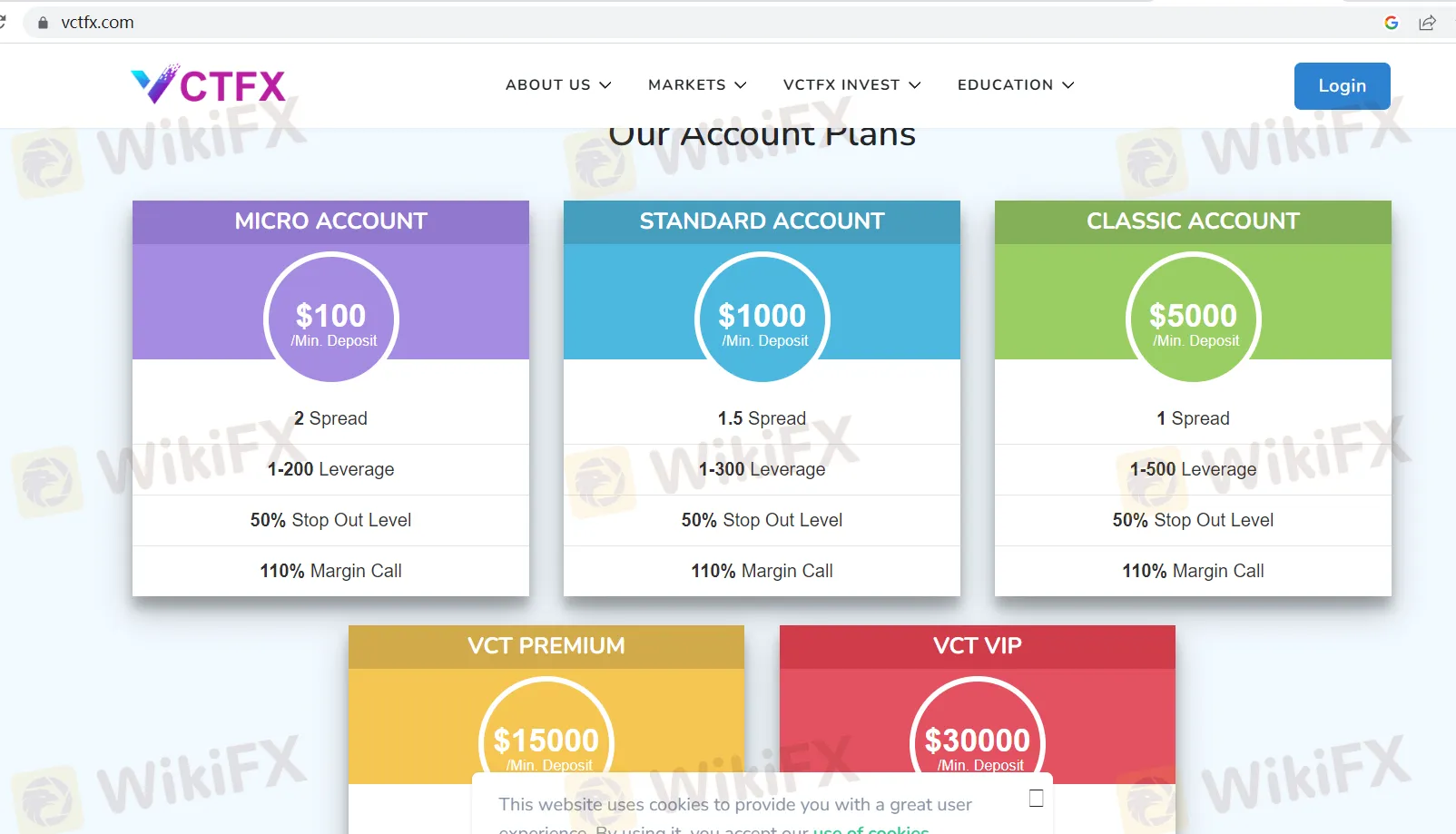

Account Types

This broker offers a diverse range of trading account types, each tailored to meet the specific needs and preferences of traders at various skill levels. The tiered trading account structure includes five distinct account types:

Micro Account:

Minimum Deposit: $100

Spread: 2 pips

Leverage: 1:200

Stop Out Level: 50%

Margin Call: 110%

The Micro Account is designed for beginners and those looking for a low-cost entry into the world of online trading. With a modest minimum deposit requirement of $100, it offers accessible access to the financial markets. This account type features competitive spreads and a leverage ratio of 1:200, allowing traders to manage their risk while gaining exposure to various trading opportunities.

Standard Account:

Minimum Deposit: $1,000

Spread: 1.5 pips

Leverage: 1:300

Stop Out Level: 50%

Margin Call: 110%

The Standard Account is suitable for traders with some experience in the markets who are looking for enhanced trading conditions. With a minimum deposit of $1,000, it offers tighter spreads and increased leverage, providing traders with more flexibility in their trading strategies.

Classic Account:

Minimum Deposit: $5,000

Spread: 1 pip

Leverage: 1:500

Stop Out Level: 50%

Margin Call: 110%

The Classic Account is designed for intermediate to advanced traders who require even more favorable trading terms. With a minimum deposit of $5,000, this account type offers exceptionally tight spreads and a higher leverage ratio of 1:500, allowing for precision and control in trading.

VCT Premium Account:

Minimum Deposit: $15,000

Spread: 0.5 pips

Leverage: 1:1000

Stop Out Level: 50%

Margin Call: 110%

The VCT Premium Account is ideal for experienced traders seeking top-tier trading conditions. With a minimum deposit of $15,000, it provides access to incredibly tight spreads and a substantial leverage ratio of 1:1000, offering advanced traders a competitive edge.

VCT VIP Account:

Minimum Deposit: $30,000

Spread: 0.3 pips

Leverage: 1:1000

Stop Out Level: 50%

Margin Call: 110%

The VCT VIP Account is the pinnacle of the broker's offerings, designed for seasoned professionals and high-net-worth individuals. With a minimum deposit of $30,000, it offers the lowest spreads and the highest leverage, catering to traders who demand the utmost in trading performance.

Here's a table summarizing the key features of these account types:

| Account Type | Minimum Deposit | Spread | Leverage | Stop Out Level | Margin Call |

| Micro Account | $100 | 2 pips | 1:200 | 50% | 110% |

| Standard Account | $1,000 | 1.5 pips | 1:300 | 50% | 110% |

| Classic Account | $5,000 | 1 pip | 1:500 | 50% | 110% |

| VCT Premium Account | $15,000 | 0.5 pips | 1:1000 | 50% | 110% |

| VCT VIP Account | $30,000 | 0.3 pips | 1:1000 | 50% | 110% |

These account types cater to traders of varying experience levels and capital sizes, providing a wide range of choices to suit individual trading goals and risk tolerance. By offering multiple account tiers, the broker aims to accommodate the diverse needs of its clientele and enhance their trading experience.

Leverage

This broker offers varying levels of leverage depending on the specific trading account type chosen by the trader. The maximum trading leverage provided by this broker can go up to a substantial 1:1000. Leverage is a crucial tool in trading as it allows traders to control a larger position size with a relatively smaller amount of capital. However, it's important to note that higher leverage also amplifies both potential profits and potential losses.

For instance, a 1:1000 leverage means that for every $1,000 in your trading account, you can control a position size of up to $1,000,000 in the market. While this high leverage can magnify gains when the market moves in your favor, it also increases the risk of significant losses if the market moves against your position.

Traders should use leverage with caution and consider their risk tolerance, trading strategy, and risk management techniques when determining the appropriate level of leverage for their trades. Different account types may offer different leverage options to cater to traders with varying risk profiles and trading preferences.

Spreads & Commissions

Micro Account: Suitable for beginners with a $100 minimum deposit, offering spreads starting from 2 pips. Commissions are not explicitly mentioned, but trading costs can vary based on activity.

Standard Account: Requires a $1,000 minimum deposit and features spreads starting from 1.5 pips. Like the Micro Account, commissions are not specified, and costs may fluctuate depending on trading volume.

Classic Account: Geared towards traders with $5,000 as the minimum deposit, with spreads beginning at just 1 pip. Commissions are not detailed, but spreads can change based on trading actions.

VCT Premium Account: Aimed at traders with $15,000 as the minimum deposit, offering ultra-tight spreads starting at 0.5 pips. Commissions are not explicitly mentioned, but trading costs can vary with activity.

VCT VIP Account: Designed for high-net-worth individuals and professionals with a $30,000 minimum deposit. This account boasts the tightest spreads at 0.3 pips. Commissions are not specified, but spreads may adjust based on trading behavior.

In conclusion, the choice of trading account should align with a trader's capital, experience, and trading style, as each account type offers different spreads and cost structures that can impact overall trading expenses.

Deposit & Withdrawal

Deposit Options:

Bank Wire: VCTFX accepts deposits via bank wire, which typically takes 2-5 business days to process. It's important to note that there may be a deposit fee of $25 or more.

PayPal: For faster deposit processing, you can use PayPal, which takes approximately 1 hour to complete. However, there is a 2% fee associated with PayPal deposits.

Skrill: Skrill is another e-wallet option for depositing funds, offering a processing time of around 1 hour. Similar to PayPal, there is a 2% fee for using Skrill.

Neteller: Neteller, like Skrill, has a 1-hour processing time for deposits and also carries a 2% fee.

Crypto: Cryptocurrency deposits are an option for those who prefer digital assets. These deposits are usually processed within 24 hours, but the fee depends on the specific cryptocurrency used and can vary.

Withdrawal Options:

Bank Wire: Withdrawals via bank wire take 2-5 business days to process. The withdrawal fee is not specified, but it's advisable to check with the broker for the exact fee.

PayPal: Withdrawals through PayPal have a processing time of 24 hours and may be subject to fees. The exact withdrawal fee is not provided in the information.

Skrill: Withdrawals via Skrill also take 24 hours to complete. Similar to PayPal, the withdrawal fee is not specified here.

Neteller: Neteller withdrawals have a processing time of 24 hours, and the withdrawal fee is not explicitly mentioned.

Crypto: Cryptocurrency withdrawals typically take 24 hours, and the fees for cryptocurrency withdrawals are variable, depending on the specific crypto being withdrawn.

It's important to exercise caution and thoroughly research any broker before making deposits, especially if there are concerns about their reputation. Additionally, be aware of the associated fees when choosing your preferred deposit and withdrawal methods. Cryptocurrency deposits and withdrawals, while convenient, come with their own set of risks, so it's crucial to understand these risks before using them for transactions.

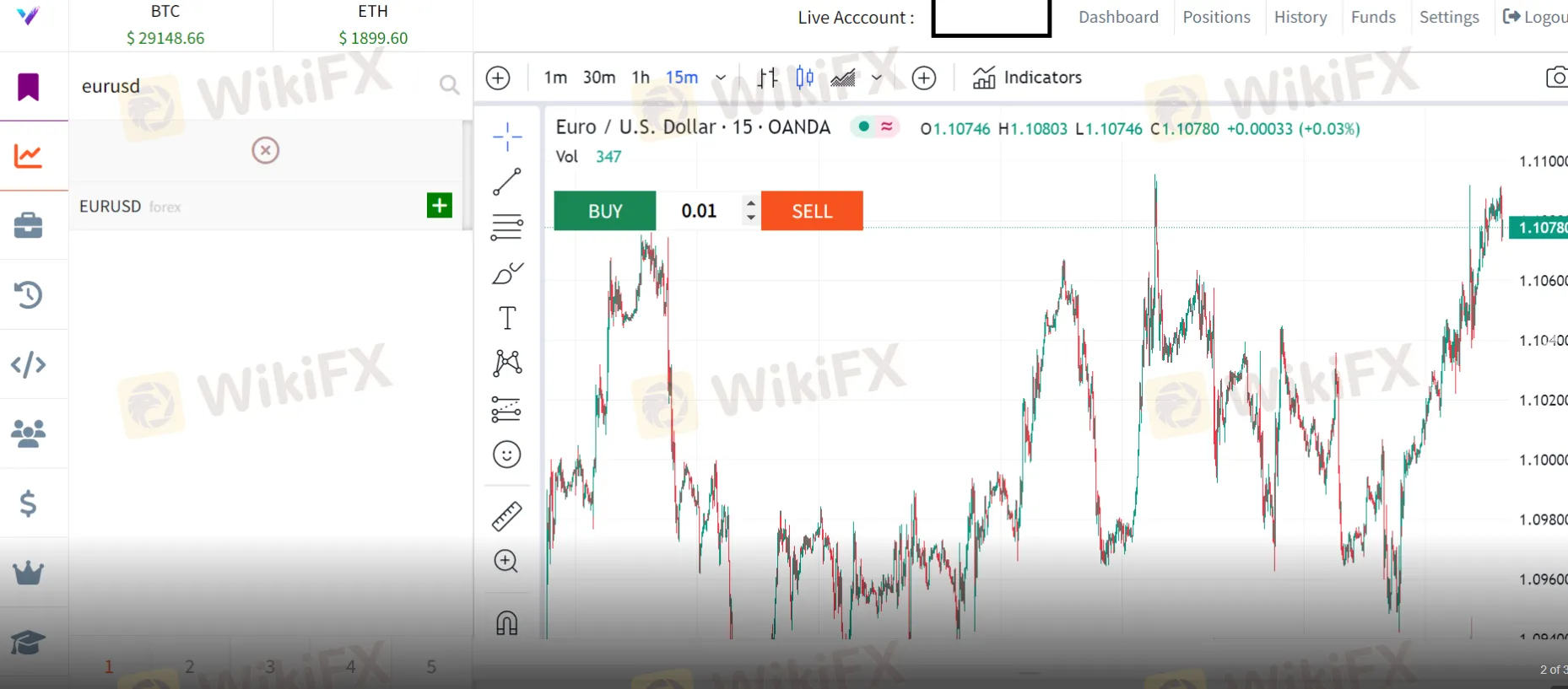

Trading Platforms

VCTFX's web-based platform raises serious concerns about its reliability, mirroring the doubts surrounding the company itself. Upon closer examination, it becomes apparent that this software is far from trustworthy. The trading activity showcased on this platform appears to be deceptive, leaving traders with little to no chance of making any profits. Instead, they are at risk of losing their investments rapidly. The platform's charting data is highly questionable, lacking credibility as it doesn't reflect actual market conditions. Essentially, it is a work of fiction.

For a superior and reputable trading experience, it's strongly advisable to steer clear of dubious brokers and platforms. Opt for industry-standard solutions like the MetaTrader platforms. These platforms are renowned for their advanced charting tools and an array of robust features, making them the preferred choice for traders worldwide.

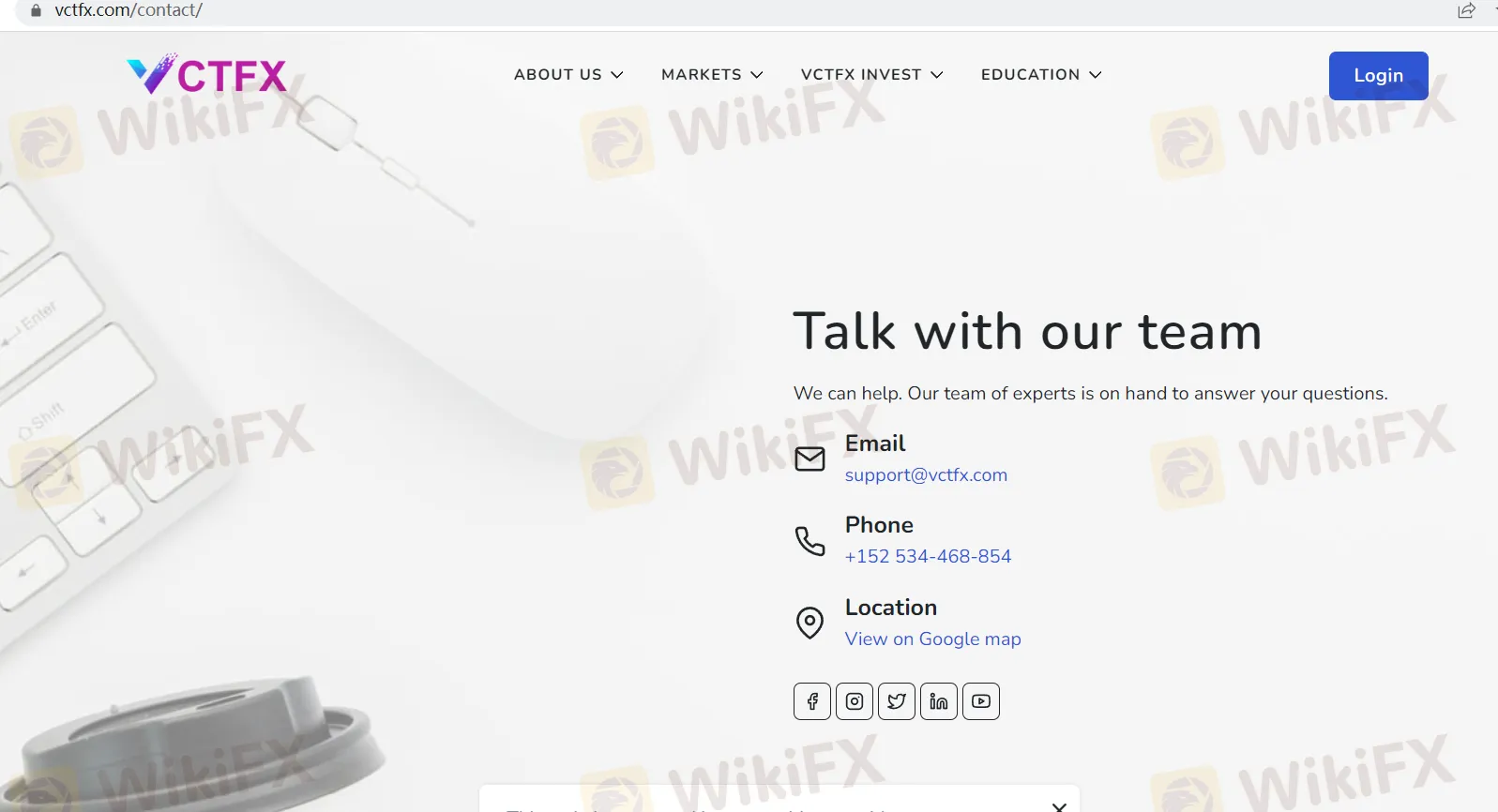

Customer Support

VCTFX's Customer Support, unfortunately, appears to be less than dependable for traders seeking assistance. Traders may encounter difficulties when trying to get their questions answered or issues resolved.

Email:

Contacting the support team via email at support@vctfx.com may not guarantee a swift or satisfactory response. Traders could experience delays or inadequately addressed concerns when using this communication channel.

Phone:

Traders attempting to contact VCTFX at +152 534-468-854 might find that their efforts are met with frustration. The phone lines may not consistently provide the necessary support, leaving traders in a challenging position.

Location:

While VCTFX may have a physical location accessible through Google Maps, it's essential to note that visiting the office may not always result in the desired level of assistance. Face-to-face interactions may not necessarily yield more satisfactory outcomes for traders.

In summary, VCTFX's Customer Support, based on available information, may not meet the expectations of traders in terms of responsiveness and effectiveness. Traders should exercise caution and consider these limitations when seeking assistance or considering this broker's services.

Educational Resources

VCTFX provides a robust educational section designed to empower traders with the skills they need. This includes a comprehensive guide to technical analysis, which aids in optimal market entry and exit. Additionally, traders can access resources for understanding fundamental analysis, crucial for predicting price movements based on factors like interest rates and inflation.

The platform also offers guidance on various forex trading strategies, emphasizing that there's no one-size-fits-all approach. With over 1,331 global instruments, including forex, commodities, metals, and cryptocurrencies, plus features like copy trading and fast order execution, VCTFX ensures a well-rounded trading experience that caters to traders of all levels.

Summary

In summary, VCTFX operates in an unregulated environment, posing significant risks to traders. The lack of oversight raises concerns about potential fraudulent activities and unethical practices. While they offer a variety of trading instruments and account types, their reliance on high leverage can lead to substantial losses. The vague information about spreads and commissions adds to the opacity of their services.

Furthermore, the reliability of VCTFX's trading platform is questionable, with doubts about the accuracy of charting data. Their customer support is unreliable, leaving traders with limited avenues for assistance. While they provide educational resources, it's important to approach them with caution given the overall lack of transparency and regulatory oversight. Traders are advised to consider alternative, reputable brokers with more transparent and regulated services to safeguard their investments.

FAQs

Q1: Is VCTFX a regulated broker?

A1: No, VCTFX operates in an unregulated environment, which means it lacks oversight from established financial regulatory authorities.

Q2: What is the minimum deposit required to open an account with VCTFX?

A2: VCTFX offers different account types with varying minimum deposits. The Micro Account requires a minimum deposit of $100, while the highest-tier VCT VIP Account requires a minimum deposit of $30,000.

Q3: What trading instruments are available at VCTFX?

A3: VCTFX offers a range of trading instruments, including Forex, Stocks, Indices, Commodities, and Cryptocurrencies.

Q4: Does VCTFX provide a demo account for traders to practice?

A4: Information about whether VCTFX offers a demo account is not provided in the available information.

Q5: Is VCTFX's customer support reliable?

A5: Customer support at VCTFX, based on available information, may not meet traders' expectations in terms of responsiveness and effectiveness. Traders should exercise caution and consider these limitations when seeking assistance or considering this broker's services.

Broker ng WikiFX

Exchange Rate