Capstone

abstrak:Capstone, an Australia-based trading entity, raises concerns with its minimal transparency and regulatory oversight. While offering multiple account types starting at a $100 deposit, the absence of educational resources leaves traders ill-prepared for the complexities of financial markets. With a maximum leverage of 1:500, variable spreads, and a lack of specified regulations, there are uncertainties regarding client protection. The company's limited customer support, absence from social media, and reported website issues have raised suspicions about its reliability, and it has even been labeled as a potential scam. Given these concerns and negative indicators, caution is strongly advised for traders considering Capstone as their trading partner.

| Aspect | Information |

| Registered Country/Area | Australia |

| Company Name | Capstone |

| Regulation | Unregulated |

| Minimum Deposit | $100 for PrimePro Lite and StandardFX |

| $100 for other accounts (assuming the same) | |

| Maximum Leverage | Up to 1:500 |

| Spreads | Varies by account type and market |

| Trading Platforms | MT4 (MetaTrader 4) |

| Tradable Assets | Forex, Bullion (gold and silver), CFDs |

| Account Types | PrimePro Plus, PrimePro Lite, StandardFX |

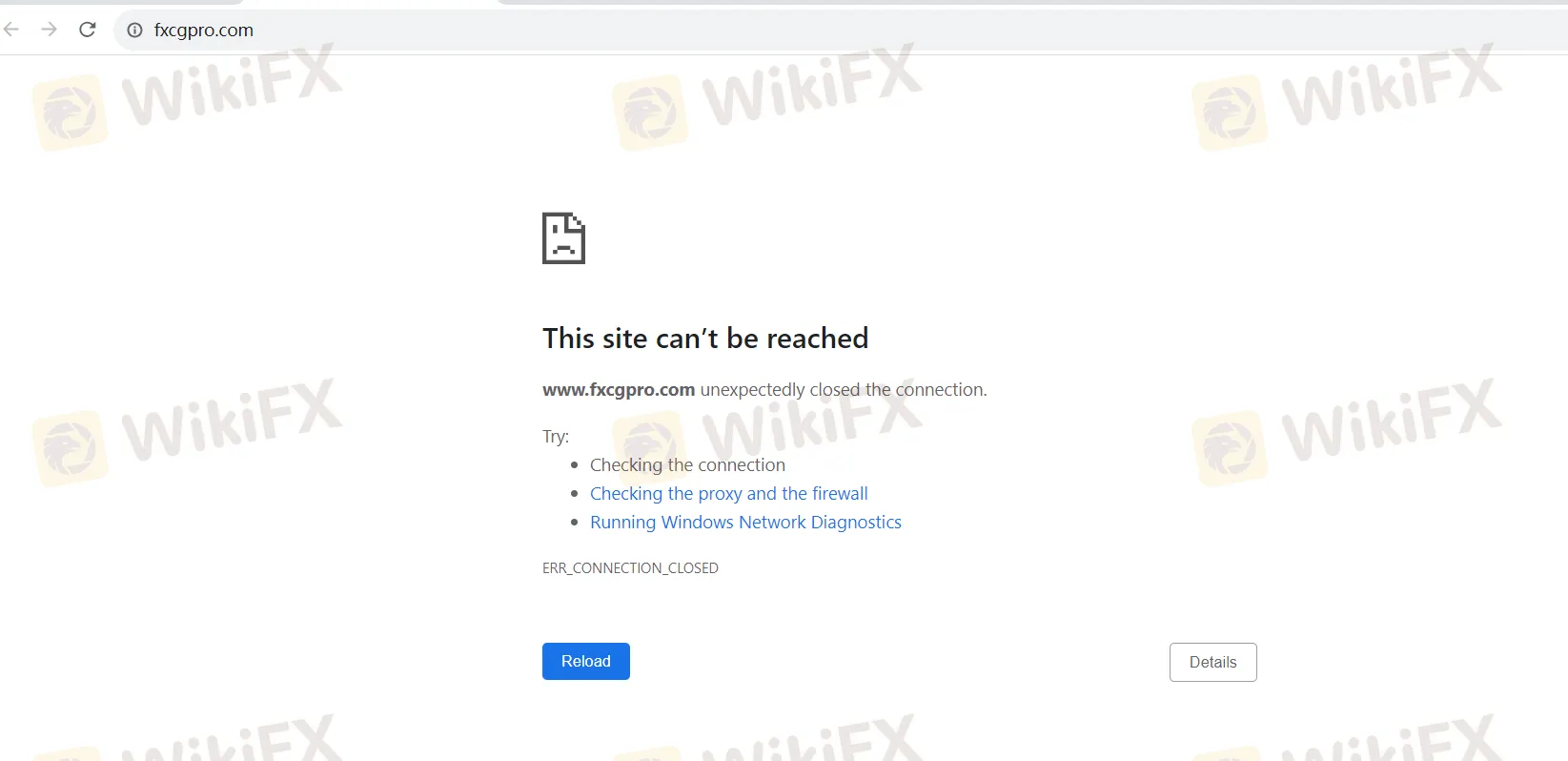

| Customer Support | Limited presence, no social media, phone number |

| Payment Methods | Wire Transfer, China Union Pay, Visa/Mastercard, AsiaPay |

| Educational Tools | Not provided |

Overview

Capstone, an Australia-based trading entity, raises concerns with its minimal transparency and regulatory oversight. While offering multiple account types starting at a $100 deposit, the absence of educational resources leaves traders ill-prepared for the complexities of financial markets. With a maximum leverage of 1:500, variable spreads, and a lack of specified regulations, there are uncertainties regarding client protection. The company's limited customer support, absence from social media, and reported website issues have raised suspicions about its reliability, and it has even been labeled as a potential scam. Given these concerns and negative indicators, caution is strongly advised for traders considering Capstone as their trading partner.

Regulation

Unregulated.Capstone has raised suspicions by allegedly operating with a clone license, casting doubts on its legitimacy as a broker. The use of such a license calls into question the company's adherence to regulatory standards and client protection measures, urging traders to exercise extreme caution when considering its services. Investigating the validity of Capstone's license and conducting thorough due diligence is imperative before engaging in any trading activities with the broker.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

Capstone , an Australia-based trading entity, presents both pros and cons for potential traders. On the positive side, it offers multiple account types with low minimum deposits, a high maximum leverage of 1:500, a wide range of trading instruments, competitive spreads, and flexible deposit and withdrawal methods. Additionally, it provides access to the user-friendly MT4 trading platform.

However, there are significant concerns regarding Capstone's transparency and regulatory oversight. It operates without specified regulations, raising uncertainties about client protection. The absence of educational resources leaves traders ill-prepared, and the limited customer support, absence from social media, and reported website issues raise questions about its reliability. Furthermore, allegations of operating with a clone license cast doubt on its legitimacy. Therefore, traders considering Capstone should exercise caution and conduct thorough due diligence before engaging in any trading activities with the broker.

Market Instruments

Capstone offers a wide range of trading instruments, including forex, bullion (gold and silver), and CFDs (Contracts for Difference) on indices and commodities.

Forex: Capstone specializes in forex trading, allowing clients to speculate on currency value. The forex market offers major, cross, and exotic currency pairs, along with flexibility, transparency, low costs, leverage up to 500:1, and institutional-grade trade execution.

Bullion: Capstone facilitates trading in gold and silver, providing narrow spreads, leverage up to 200:1, and professional-grade execution for these precious metals.

CFDs: Capstone offers CFDs on stock indices, energy products, and commodities, allowing clients to access global markets, benefit from low margin requirements, and experience 100% DMA execution. CFDs provide diversification and the ability to profit from both rising and falling markets.

Account Types

PrimePro Plus:

Capstone's PrimePro Plus account is designed for traders seeking ultra-competitive spreads and direct market access. With spreads starting from 0 pips, a minimum deposit of $100, leverage up to 500:1, and a stop-out rate of 50%, this account offers flexibility and risk management. Traders incur a transparent $4 per lot per side commission. Ideal for experienced traders valuing tight spreads and direct market access.

PrimePro Lite:

Capstone's PrimePro Lite account offers competitive pricing with spreads as low as 0 pips. It has a $100 minimum deposit, leverage up to 500:1, and a 50% stop-out rate. Traders benefit from a lower $2 per lot per side commission. Suitable for those who prioritize tight spreads and direct market access with lower commission costs.

StandardFX:

Capstone's StandardFX account provides a traditional trading experience with competitive spreads starting at 1.6 pips. It requires a $100 minimum deposit, offers leverage up to 500:1, and has a 50% stop-out rate. Notably, it offers commission-free trading. Ideal for traders who prefer commission-free trading while enjoying competitive spreads and leverage.

These Capstone account types cater to various trading preferences, offering tight spreads, competitive pricing, and flexibility to suit traders' needs.

Leverage

The broker offers a maximum trading leverage of 1:500. This means that for every $1 in your trading account, you can control a trading position worth up to $500 in the financial markets. Leverage allows traders to amplify their exposure to potential gains or losses, but it also increases the level of risk involved in trading. It's important for traders to use leverage responsibly and understand the risks associated with it.

Spreads and Commissions

For the most up-to-date information on spreads and commission rates, clients are encouraged to access the Capstone MT4 Trading Platform and follow these steps:

To view spreads:

Click on “View,” then select “Market Watch.”

Right-click and choose “Spread” to see the current spread values.

To view commission rates:

Click on “View,” then select “Market Watch.”

Right-click and choose “Symbols.”

Select the desired currency pair and click “Properties” to access detailed information, including commission rates.

It's worth noting that spreads and commission rates may differ depending on the specific trading accounts offered by Capstone. Therefore, clients should carefully review the terms and conditions of their chosen account type to understand the applicable spreads and commissions for their trading needs.

Deposit & Withdrawal

Capstone offers clients different deposit and withdrawal methods to meet their financial needs. Deposits are flexible, and withdrawals are promptly processed for timely access to funds.

Deposits:

Wire Transfer: Clients can fund their accounts using wire transfers in 10 different base currencies. Wire transfers typically take 1-2 working days to process, and bank fees may apply.

China Union Pay (CUP): CUP enables clients to deposit funds in Chinese Renminbi (RMB). CUP deposits are processed quickly, typically within 0.5-1 hour, and do not incur extra fees.

Visa/Mastercard: Capstone accepts deposits in 10 different base currencies through Visa and Mastercard. Deposits made with credit or debit cards are instant, allowing clients to start trading immediately. There are no extra fees for Visa/Mastercard deposits.

AsiaPay: Clients can deposit funds in 10 different base currencies through AsiaPay. This payment method offers instant processing, ensuring funds are available for trading without delay. No additional fees are charged for AsiaPay deposits.

Withdrawals:

Capstone strives to process all withdrawal requests on the same day they are received to provide swift access to funds. The time it takes to receive withdrawals varies based on the chosen withdrawal method.

Wire Transfer: Withdrawals via wire transfer may incur an approximate fee of USD 30, charged by Capstone's banking institutions. This fee is deducted from the withdrawal amount, and clients can expect to receive their funds within 2-3 working days.

China Union Pay (CUP): CUP withdrawals do not involve any fees, and the withdrawn amount is settled in Chinese Renminbi (RMB) based on the current onshore pricing of commercial banks in China.

Credit Cards: If the initial deposit was made with a credit card, funds will be returned to the same card within 60 days. Credit card withdrawals follow the same processing time as the initial deposit.

Trading Platforms

Capstone offers its clients the widely acclaimed MT4 (MetaTrader 4) trading platform. Renowned for its user-friendly interface and extensive features, MT4 is the preferred choice for traders worldwide. This robust platform enables clients to seamlessly execute trading strategies, access real-time market data, perform in-depth chart analysis, and automate trading using expert advisors (EAs). MT4 provides a comprehensive array of tools and resources, empowering traders to make well-informed decisions and execute trades with utmost efficiency.

Customer Support

The company's customer support is inadequate, lacking an active presence on social media platforms like Twitter, Facebook, Instagram, and YouTube. There is no disclosed company address, LinkedIn profile, WhatsApp, or QQ/WeChat accounts, indicating limited means of communication for customers. With only one provided email address, info@fxcg.com, the company's support options are limited, potentially leading to a less satisfactory customer experience.

Educational Resources

The company's provision of educational resources is notably absent. There are no available materials or tools to assist clients in enhancing their knowledge and skills in trading or financial markets. This absence of educational resources may limit clients' ability to learn and make informed trading decisions, potentially leaving them at a disadvantage in navigating the complexities of the financial markets.

Summary

In a rather disheartening assessment, Capstone, the Australia-based trading platform, appears to fall short on several critical fronts. With a lack of transparency and regulatory oversight, coupled with a glaring absence of educational resources, Capstone leaves its traders ill-prepared for the complexities of the financial markets. Despite offering a range of account types and a maximum leverage of 1:500, uncertainties surround client protection due to the vague regulatory landscape. Furthermore, the company's limited customer support, absence from social media, and reports of website issues cast a shadow of doubt on its reliability, with some even suspecting it to be a potential scam. Traders are advised to approach Capstone with caution, given these concerns and negative indicators.

FAQs

Q1: Is Capstone a regulated broker?

A1: No, Capstone is unregulated, which raises concerns about its adherence to regulatory standards and client protection.

Q2: What is the maximum leverage offered by Capstone?

A2: Capstone offers a maximum trading leverage of 1:500, allowing traders to amplify their exposure to potential gains or losses.

Q3: Are there any educational resources available for traders with Capstone?

A3: Unfortunately, Capstone does not provide any educational resources, which may limit traders' ability to enhance their knowledge and skills in trading.

Q4: How can I contact Capstone's customer support?

A4: Capstone's customer support options are limited, with only one provided email address, info@fxcg.com, and no active presence on social media platforms.

Q5: What is the minimum deposit required to open an account with Capstone?

A5: The minimum deposit required to open an account with Capstone is $100 for most account types, making it accessible to a wide range of traders.

Broker ng WikiFX

Exchange Rate