StockPCL

abstrak:StockPCL, established in 2022 and registered in the United Kingdom, is an unregulated online trading platform offering a range of tradable assets including Forex, indices, commodities, and bonds. With a modest minimum deposit of $50 and boasting spreads as low as 0.0 pips, the platform seeks to cater to both novice and experienced traders by also providing an available demo account for risk-free practice. Users can manage their investments through the user-friendly StockPCL website platform and opt for a personal account type to facilitate their trading activities. Notably, StockPCL values customer support and interaction, extending communication channels through phone, email, and social media. Additionally, it supports multiple online payment options for deposit and withdrawal to accommodate various client preferences. In an effort to enrich user knowledge and decision-making, StockPCL furnishes traders with a variety of educational resources, such as news updates, analytical ins

| Aspect | Information |

| Company Name | StockPCL |

| Registered Country/Area | United Kingdom |

| Founded Year | 2022 |

| Regulation | Unregulated |

| Minimum Deposit | $50 |

| Spreads | As low as 0.0 pips |

| Trading Platforms | The StockPCL website platform |

| Tradable Assets | Forex,indices,commodities,bonds |

| Account Types | personal account |

| Demo Account | Available |

| Customer Support | Phone, email, and social media |

| Deposit & Withdrawal | Multiple options available(online payment) |

| Educational resource | News,analysis,blog |

Overview of StockPCL

StockPCL, established in 2022 and registered in the United Kingdom, is an unregulated online trading platform offering a range of tradable assets including Forex, indices, commodities, and bonds. With a modest minimum deposit of $50 and boasting spreads as low as 0.0 pips, the platform seeks to cater to both novice and experienced traders by also providing an available demo account for risk-free practice.

Users can manage their investments through the user-friendly StockPCL website platform and opt for a personal account type to facilitate their trading activities. Notably, StockPCL values customer support and interaction, extending communication channels through phone, email, and social media.

Additionally, it supports multiple online payment options for deposit and withdrawal to accommodate various client preferences. In an effort to enrich user knowledge and decision-making, StockPCL furnishes traders with a variety of educational resources, such as news updates, analytical insights, and a regularly updated blog, thereby aiding them in navigating the often tumultuous financial markets.

Is StockPCL Legit or a Scam?

StockPCL is unregulated, which implies it does not operate under the oversight of any regulatory body. In the trading world, especially within financial markets, regulation is crucial as it provides a framework that safeguards the interests of investors and ensures fair, transparent, and secure trading environments.

Regulated brokers are typically mandated to adhere to strict standards regarding client fund management, conflict of interest, and operational transparency. Therefore, potential investors and traders should exercise caution when dealing with unregulated platforms like StockPCL, as they might be exposed to higher risks and have limited recourse in the event of disputes or issues with the platform.

It is paramount to conduct thorough research and perhaps consider opting for platforms that are regulated by recognized financial authorities, thereby providing an additional layer of security and peace of mind.

Pros and Cons

Pros:

Diverse MSG Assets:StockPCL offers a wide array of assets for trading, including Forex, indices, commodities, and cryptocurrencies, providing traders with numerous investment opportunities and the ability to diversify their portfolio.

Low Entry Barrier:With a minimum deposit requirement of only $50, the platform allows for accessibility to a wide range of investors, including those who prefer to start with a smaller investment capital.

Educational Resources:The availability of various educational resources like news, analysis, and blogs enables traders to stay informed about market trends and make educated trading decisions.

Customer Support:Offering customer support through multiple channels, including phone, email, and social media, indicates potential availability and accessibility for customer inquiries and support.

Demo Account Availability:The availability of a demo account allows new and inexperienced traders to practice and understand the trading platform without risking their capital, enhancing their trading skills before engaging in live trading.

Cons:

Lack of Regulation:The platform is unregulated, which raises red flags regarding the safety and security of traders funds and data, and might imply a lack of adherence to standard operational guidelines and customer protection measures.

Single Account Type:Offering only a personal account type might limit the options for different kinds of traders (such as institutional investors or high-volume traders) who may require varied structures and benefits.

Platform Limitation:The trading activities being limited to the StockPCL website platform might restrict traders who prefer using alternative trading platforms, like MetaTrader 4/5, which offer advanced charting tools and automated trading options.

Potential Credibility Issues:Operating without a regulatory framework might impact the credibility and trustworthiness of the platform, potentially making it challenging to build a loyal client base in the highly competitive trading industry.

Risk Management Concerns:The absence of regulatory oversight might also mean that the platform lacks robust risk management tools and policies to protect traders from volatile market conditions, potentially exposing them to unnecessary financial risks.

| Pros | Cons |

| Diverse MSG Assets | Lack of Regulation |

| Low Entry Barrier | Single Account Type |

| Educational Resources | Platform Limitation |

| Customer Support | Potential Credibility Issues |

| Demo Account Availability | Risk Management Concerns |

Market Instruments

-

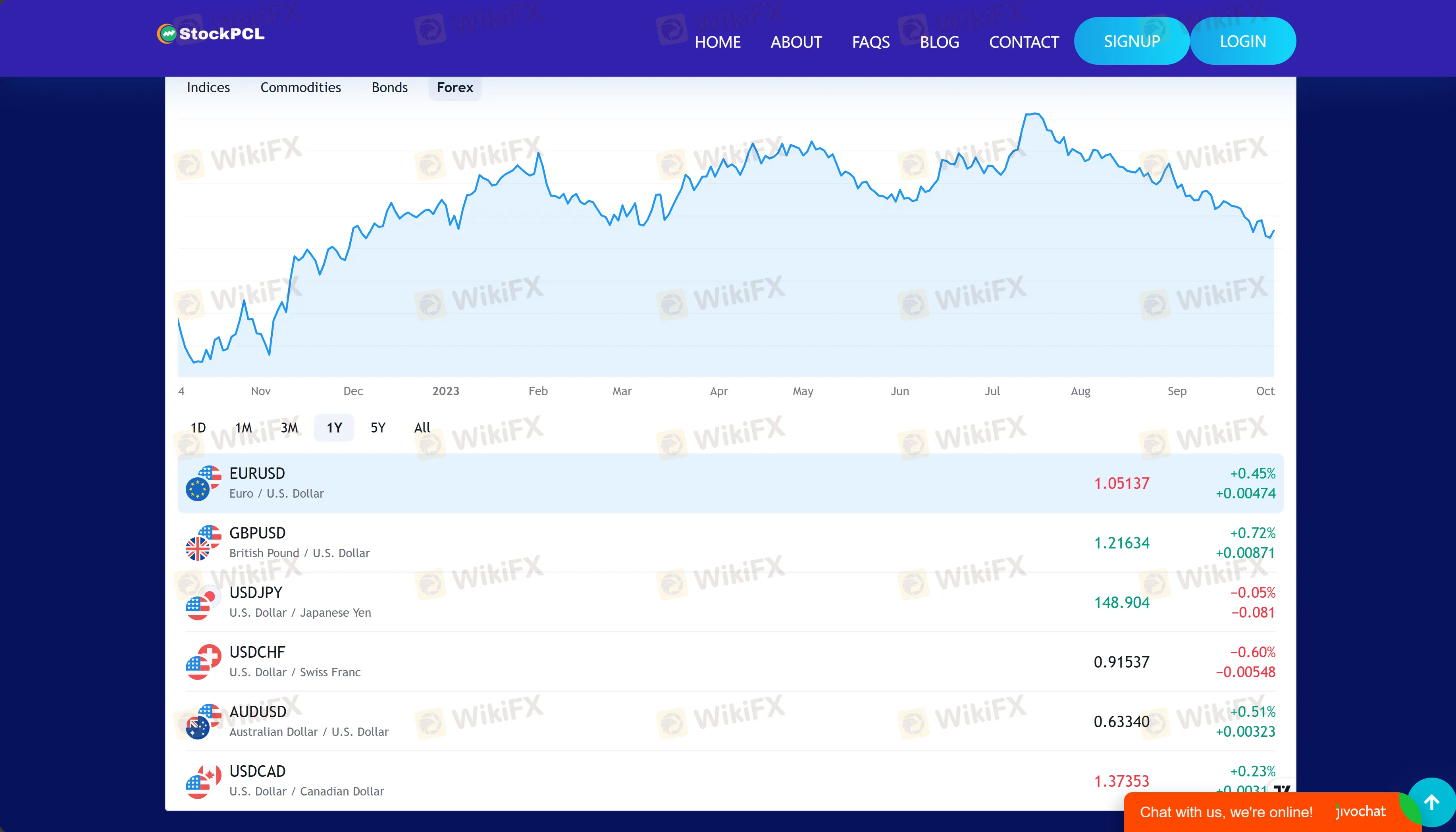

Forex (Foreign Exchange):

Currency Pairs: Involve the simultaneous buying of one currency and selling of another, and these pairs can be categorized into majors, minors, and exotics based on their trading volume and liquidity.

Indices:

Stock Indices: Offer opportunities to profit from the overall movement of a stock market without having to select individual equities, with various major global indices available like the S&P 500, Dow Jones, and more.

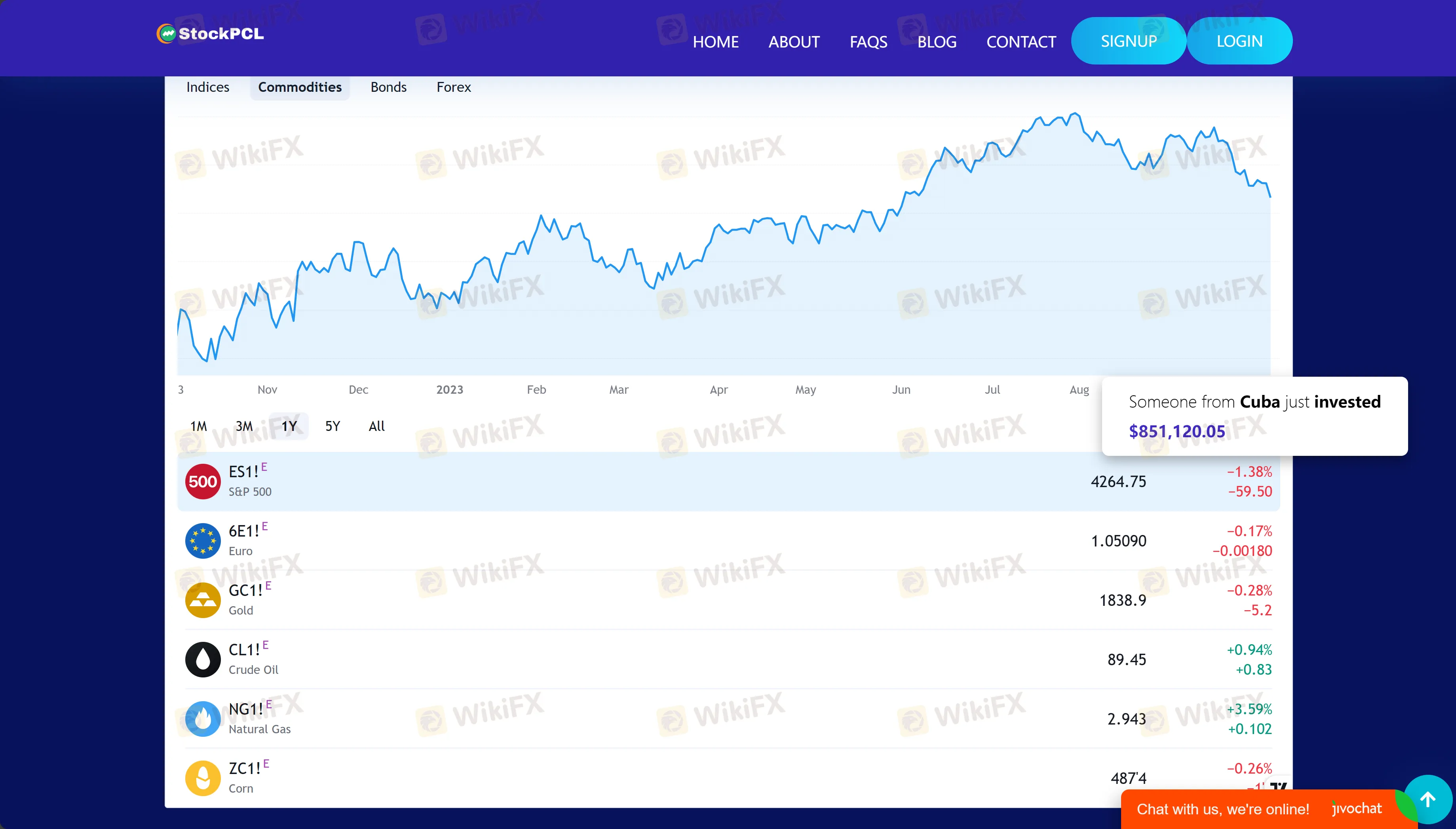

Commodities:

Hard Commodities: Engage in trading entities such as metals (e.g., gold, silver) and energy resources (e.g., oil).

Soft Commodities: Involve agricultural or livestock products like sugar, wheat, and cattle.

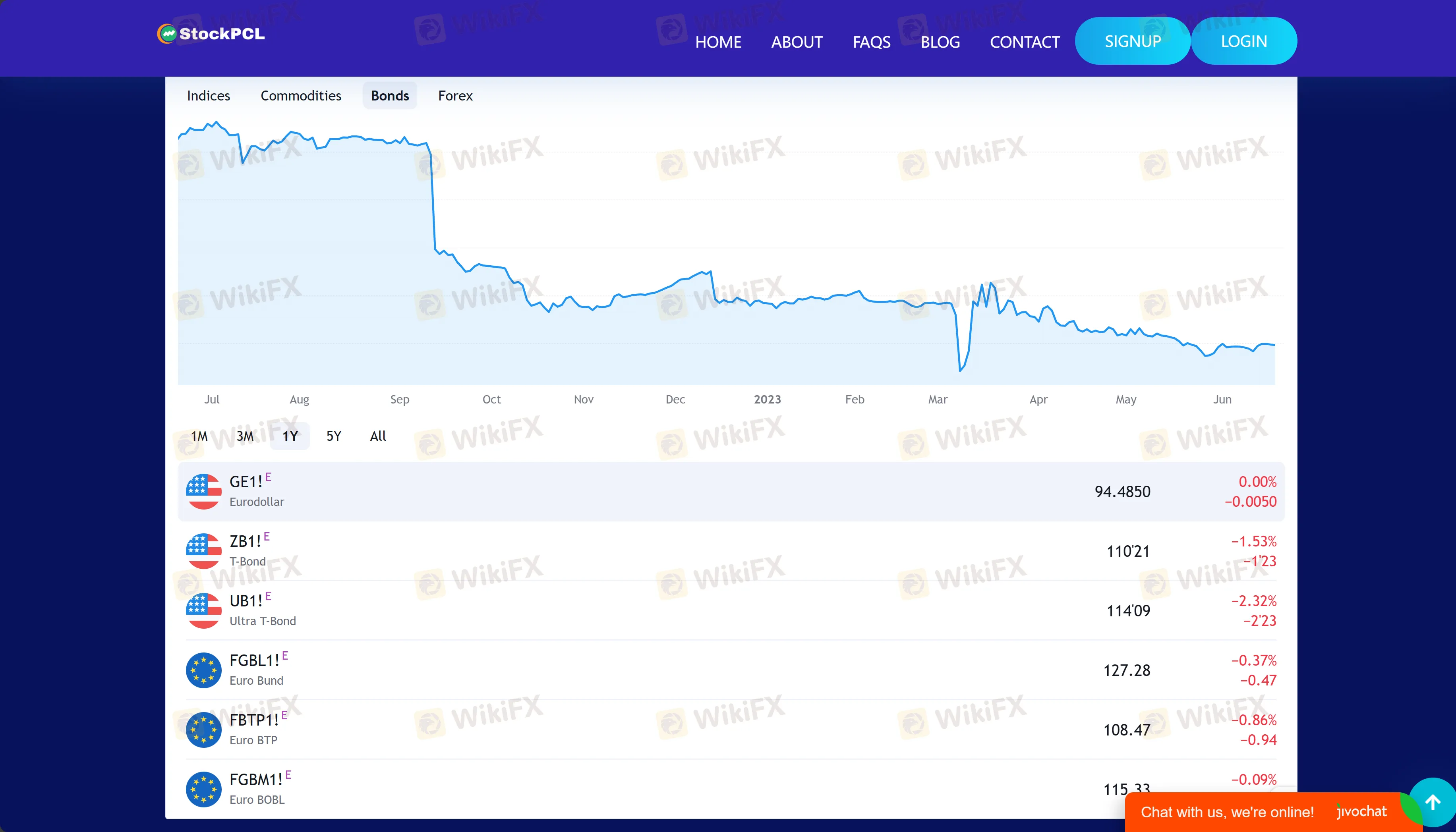

Bonds:

Government Bonds: Might include UK Gilts, US Treasuries, or bonds from other governments, which are debt securities issued to raise capital and usually have periodic interest payouts along with the return of principal upon maturity.

Corporate Bonds: Include debt instruments issued by companies aiming to raise capital for various purposes like expansion, and they, too, generally offer periodic interest payments and the return of principal at maturity.

These market instruments, across various asset classes, allow traders and investors to diversify their investment strategies, manage risk effectively by allocating assets in different investment avenues, and also capitalize on different market conditions. Traders should analyze and understand the characteristics, risks, and potential returns associated with each market instrument to build a robust and effective trading strategy tailored to their financial goals and risk tolerance.

Account Types

StockPCL provides a streamlined approach to online trading through its singular account type— the Personal Account. Tailored towards individual retail traders, this account beckons with a notably low entry threshold, requiring a minimum deposit of just $50, thereby making the trading arena accessible to a broad array of investors. Traders are furnished with a versatile suite of tradable assets encompassing Forex, indices, commodities, and bonds, enabling ample room for diversified investment strategies.

How to Open an Account?

Opening an account with StockPCLcan be achieved through a few clear steps, crafted to streamline the process for aspiring traders:

Registration:Begin by visiting the StockPCL website. Look for the “Sign Up” or “Register” button, often found at the top right corner or prominently displayed on the homepage. Upon clicking, you'll be directed to a form requesting basic personal information, such as your name, email address, and phone number, which you'll need to provide to initiate the account creation process.

Choose Your Account:Following the initial registration, its time to select your account type. Since StockPCL offers a personal account type, this step might involve specifying whether you wish to open a live or demo account, each serving distinct purposes catering to both practice and real trading needs.

Verification Process:Subsequent to registration and account type selection, you will enter the verification stage. In alignment with typical KYC (Know Your Customer) procedures, you will likely be asked to submit various documents to verify your identity and residence, such as a government-issued ID (e.g., passport or driver's license) and a proof of address, which could be a recent utility bill or bank statement.

Deposit of Funds:Once your account is verified, it's time to fund it. Navigate to the deposit section and ensure that you deposit at least the minimum required amount, which is $50 for StockPCL, using one of the available online payment options. Ensure you check if there are any bonuses or promotions available upon your initial deposit to maximize your trading capital.

Embark on Your Trading Journey:With your account active and funded, you‘re set to commence trading. Access the trading platform through the StockPCL website and explore the available trading instruments across Forex, indices, commodities, and bonds. Take the time to familiarize yourself with the platform's features and functionalities, and consider leveraging the educational resources available to enhance your trading proficiency. If you’re a novice, starting with a few trades on the demo account might provide valuable insights and acclimatize you to the trading environment without risking real capital.

Spreads &Commissions

-

Spreads: StockPCL offers spreads as low as 0.0 pips, although the exact specifications per trading instrument remain unspecified. Spreads may be variable or fixed and can differ among various market instruments, with potentially lower spreads on more liquid assets like major forex pairs.

Commissions: No specific information is provided about the commission structure at StockPCL. Traders should verify whether the platform employs a commission-free model, charges a per-trade commission, or uses a hybrid of both.

Potential traders are advised to consult StockPCL's customer service or review their platform details for explicit insights into the spread and commission structure to ensure comprehensibility of all trading costs involved.

Trading Platform

StockPCL facilitates its trading services via its proprietary web-based trading platform, thus ensuring traders can engage in financial markets directly through their website without the necessity to download additional software or utilize external trading tools. This web-centric approach allows users to access their trading account and engage with the market from anywhere, provided they have internet connectivity and a web browser.

A notable aspect of web-based platforms is their convenience and ease of access, accommodating both seasoned and novice traders. While specific functionalities and features of StockPCLs platform are not detailed, traders can typically expect essential tools such as real-time price tracking, charting capabilities, and order management functions to be inherent features.

Deposit & Withdrawal

Deposit:

Minimum Deposit: StockPCL has set a friendly entry point with a minimum deposit requirement of $50.

Payment Methods: While Bitcoin is mentioned, detailed methods of deposit are not specified. Traders interested in using alternative payment methods or who lack Bitcoin can seek guidance via live chat or WhatsApp support.

Account Activation: The account is activated post-investment and purportedly maintains its active status for a lifetime.

Withdrawal:

Withdrawal Process: Traders can initiate withdrawals upon receiving earnings from their investments, with the platform offering automatic and instant same-day withdrawals to your wallet, operational from Monday to Sunday.

Withdrawal Fee: A nominal fee of 1% is levied on each withdrawal, which negates the necessity for subscription fees and concurrently supports ongoing platform maintenance, software updates, and general operational expenditures of StockPCL.

Customer Support

StockPCL provides robust customer support, available 24/7 to assist traders in their investment journey. Immediate inquiries can be addressed via live chat and WhatsApp, while detailed queries can be sent to their email at customer@stockpcl.com. Though their physical office is located at Repton Manor, Repton Avenue, Ashford, Kent, United Kingdom, TN23 3GP, the specifics about in-person consultations are unclear. This multi-channel support ensures timely and effective resolution of issues, enhancing the traders experience on the platform.

Educational Resources

StockPCL offers a range of educational resources, focusing on equipping traders with relevant market insights through their news, analysis, and blog sections. Recent blog posts tackle pertinent cryptocurrency topics, including the significance of various cryptocurrencies, enhancing Bitcoin value, and awareness about potential Bitcoin scams.

This emphasis on education aids traders in navigating the financial markets with an informed approach, aligning their strategies with the latest market developments and trends.

Conclusion

StockPCL, a trading platform founded in 2022 and based in the UK, provides a user-friendly web-based trading platform and emphasizes customer support with a 24/7 service via various channels.

With a minimum deposit of $50 and offering resources for trader education through news and blogs, the platform accommodates trading in Forex, indices, commodities, and bonds, despite being unregulated. Always ensure to conduct thorough research and understand all terms before engaging in trading activities.

FAQs

Q: What is the Minimum Deposit to Start Trading on StockPCL?

A: The minimum deposit required to start trading on StockPCL is $50.

Q: What Trading Instruments are Available on StockPCL?

A: Traders can engage in Forex, indices, commodities, and bond markets on StockPCL.

Q: What is the Process for Withdrawals and Are there Any Fees?

A: Withdrawals can be requested any day of the week and are instant and automatic, with a 1% fee charged by StockPCL on each withdrawal.

Q: How Long Does My Account Stay Active on StockPCL?

A: Once activated through an initial investment, accounts on StockPCL are maintained for a lifetime.

Q: Can I Access Educational Resources on StockPCL?

A: Yes, StockPCL provides various educational resources like news, analysis, and blog posts to aid traders in making informed decisions.

Broker ng WikiFX

Exchange Rate