Cheung's Gold

abstrak:Cheung's Gold is a regulated financial institution supervised by the Securities and Futures Commission (CGSE) in Hong Kong, offering a diverse range of market instruments tailored for precious metal investors, such as LLG, 9999TG, LKG, LLS, and HKS1.With individual and corporate account options available, clients can open accounts by visiting the website, downloading the MT4 client terminal, submitting necessary documents, and following customer service instructions.

| Aspect | Information |

| Company Name | Cheung's Gold |

| Registered Country | Hong Kong |

| Founded year | 1981 |

| Regulation | CGSE |

| Products and Services | Gold trading |

| Trading Platforms | MT4 |

| Demo Account | Available |

| Deposit & Withdrawal | Bank transfer, Credit card |

| Customer Support | phone, email, and QQ |

Overview of Cheung's Gold

Cheung's Gold is a regulated financial institution supervised by the Securities and Futures Commission (CGSE) in Hong Kong, offering a diverse range of market instruments tailored for precious metal investors, such as LLG, 9999TG, LKG, LLS, and HKS1.With individual and corporate account options available, clients can open accounts by visiting the website, downloading the MT4 client terminal, submitting necessary documents, and following customer service instructions.

The company provides leverage options, different trading spreads/commissions, multiple platforms (web-based, mobile, desktop), and convenient deposit/withdrawal methods. Investors benefit from flexible trading hours and customer support services while being protected by CGSE regulations, though it's important to consider risks associated with leverage and margin requirements before trading with Cheung's Gold.

Regulatory Status

Cheung's Gold is supervised by the Securities and Futures Commission (CGSE) in Hong Kong. This regulatory authority oversees and regulates the financial services industry to ensure that the company's operations comply with relevant regulations and standards, safeguarding the interests of investors.

Pros and Cons

Pros of Cheung's Gold:

Diverse Range of Market Instruments: Cheung's Gold offers a variety of market instruments tailored to meet the needs of precious metal investors, including Local London Gold, Hong Kong 9999 Gold, and Renminbi Kilobar Gold, catering to different investment preferences and strategies.

Regulated by CGSE: The company is supervised by the Securities and Futures Commission (CGSE) in Hong Kong, ensuring that its operations comply with relevant regulations and standards to safeguard the interests of investors. This regulatory oversight provides a level of assurance and protection for clients.

Cons of Cheung's Gold:

Leverage Risks: While offering leverage can amplify trading positions, it also introduces potential risks, such as complex margin requirements and the need for careful risk management, which may not be suitable for all investors.

Limited Customer Support Information: Although contact details are provided for customer support, specific information about 24/7 availability or support response times is not mentioned, potentially leaving clients uncertain about the accessibility and responsiveness of the support system.

| Pros | Cons |

| Diverse range of market instruments | Leverage risks may not be suitable for all investors |

| Regulated by the Securities and Futures Commission | Limited customer support information |

Market Instruments

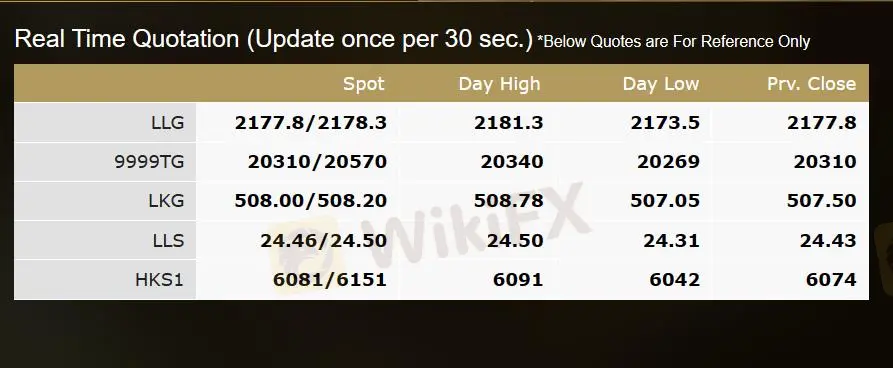

Cheung's Gold offers a diverse range of market instruments tailored to meet the needs of precious metal investors.

These market instruments include Local London Gold (LLG), which represents gold trading based on London market standards and specifications.

Hong Kong 9999 Gold (9999TG) is another prominent market instrument provided by Cheung's Gold, denoting high-quality gold products that meet specific purity standards.

Additionally, the Number 1 Local Silver Bar (LKG) caters to investors looking to trade in silver, offering a reliable and recognized form of silver investment.

Moreover, Local London Silver (LLS) presents another avenue for investors interested in silver trading, adhering to the established standards of the London market.

Lastly, Renminbi Kilobar Gold (HKS1) provides a valuable option for those seeking to invest in gold denominated in Chinese Renminbi, catering to the preferences of investors within the region.

How to Open an Account?

Here are the detailed steps for registering with Cheung's Gold:

Visit Cheung's Gold Official Website: Go to the official website of Cheung's Gold.

Download MT4 Client Terminal: Find and download the MT4 client terminal from the website.

Complete Account Opening Form & Customer Agreement: Download and fill out the account opening form and customer agreement. Then send the original agreement along with the Checklist of Documents to Cheung's Gold (click here for the company address).

Submit Documents: Ensure that the completed form and agreement are submitted to Cheung's Gold. These documents may include personal identification materials.

Wait for Contact: The customer service department of Cheung's Gold will contact you as soon as possible to confirm your registration application.

Complete Account Opening: Follow the instructions and requirements from the customer service department to complete the account opening process and start trading precious metals such as gold on the MT4 platform.

Margin Trading

Cheung's Gold offers leverage to clients, allowing them to amplify their trading positions by using borrowed funds. Different products have different initial margin and overnight margin requirements. For example, the initial margin/overnight margin for Loco London Gold (LLG) and 9999 Tael Gold (9999 TG) is $1,000, while Renminbi Kilobar Gold (LKG) requires an initial margin of $600.

In case of a shortfall exceeding 30% of the initial margin, a deposit is required to restore the initial margin level; if the shortfall exceeds 80%, the company has the absolute discretion to force liquidation, and the client is responsible for all resulting losses.

Additionally, positions in different products accrue interest based on the product and the number of days held. Furthermore, each product has a minimum trading spread, such as $0.50 for LLG and HK$110 for HKS1.

Spreads & Commissions

Cheung's Gold offers different trading spreads and commissions for various products. For instance, the trading spread for Loco London Gold (LLG) is US$ 0.50, while the trading spread for 9999 Tael Gold (9999 TG) is HK$ 10, and Renminbi Kilobar Gold (LKG) has a trading spread of RMB 0.15. Additionally, Loco London Silver (LLS) has a trading spread of US$ 0.04, and HK Silver 1 (HKS1) has a trading spread of HK$ 110. As for commission details, it is advised to contact the broker for more specific information.

Trading Platform

Cheung's Gold Traders Limited provides the MT4 trading platform. It integraes complex market data with convenient trading processes, making it a popular choice among international institutional investors and professional individual traders for precious metals trading. More than 70% of brokerage firms and banks in over thirty countries globally opt to use the MT4 trading software for their trading networks. Additionally, over 90% of retail trading volume worldwide is conducted through the MT4 platform.

Clients can utilize market chart displays, technical analysis tools, and order placement functionalities on the platform to conduct market analysis and make various types of trading decisions based on real-time market information provided by the platform. By setting “Stop Loss” and “Take Profit” levels, clients can ensure they maintain their best interests in trading without the need for frequent market monitoring or price checking.

Deposit & Withdrawal

Cheung's Gold Traders Limited provides convenient options for depositing and withdrawing funds for gold transactions. Investors can easily manage their accounts and access funds for trading purposes.

Deposit:

The processing time for deposits is between 9:00 am to 4:30 pm, Monday to Friday. If we receive your funds and confirmation of receipt during this time, the deposit will be processed within 1 business day.

Deposit by bank, automatic teller machines (ATM), e-banking, or bank wire transfer to our bank account. Please include your full name and 8-digit account number on the remittance or deposit receipt. Fax a copy to (852) 2811 4511 / 2811 4718 or email it to cs_cgt@cpmfinancialgroup.com for confirmation. Per the customer agreement, deposits via bank transfer will only be considered [back guarantee] after the Company verifies the source and amount of the deposit. Such deposits cannot be used for new positions until verified.

All bank charges related to telegraphic transfers are the client's responsibility.

Withdrawal:

| Beneficiary Bank | Bank Account | Account Currency |

| Wing Lung Bank Limited | 607-000-9538-7 | HKD |

| Wing Hang Bank Limited | 809-116198-001 | HKD |

| 809-280390-060 | RMB | |

| Bank of China (Hong Kong) Ltd | 012-676-0-010439-4 | HKD |

| 012-676-0-801397-3 | USD | |

| 012-676-0-601388-3 | RMB | |

| Hang Seng Bank | 228-739991-883 | HKD |

Withdrawal requests are processed on the day of receipt. The cut-off time for processing withdrawals is 2:30 p.m. from Monday to Friday. Any completed forms received after 2:31 p.m. on weekdays or received on weekends/holidays will be processed on the next business day. Clients are solely responsible for any delays, failures to process funds, or other issues resulting from incomplete information or documents.

Customer Support

Hong Kong Head Office:

Address: Rm 507, 5/F, Guardforce Centre, 3 Hok Yuen St E, Hunghom, Kowloon

Tel: +852 2811 4500, +86 147-1503-1666, +852 6567 2679, +86 131-4751-2584

Fax: +852 2811 4511

QQ: 800152883

Wholly Owned Subsidiary - Shenzhen Qianhal Cheung's Gold Traders Limited:

Address: Shenzhen Qianhai Modern Service Industry Cooperation Zone, No. 63 Qianwan 1st Road, Qianhai Enterprise Mansion 29B, 51800

QQ: 800152883

The customer support of Cheung's Gold provides multiple contact numbers for Hong Kong and China offices, including QQ for online inquiries. While specific 24/7 availability is not mentioned, the presence of multiple contact methods indicates a responsive support system.

Conclusion

In conclusion, Cheung's Gold offers a diverse range of market instruments and account types, regulated by the CGSE for investor protection. The variety of trading platforms and flexible hours cater to different needs, while convenient deposit/withdrawal methods enhance accessibility.

However, the use of leverage entails potential risks and complex margin requirements, necessitating caution and thorough understanding. Investors are advised to carefully assess their risk tolerance and seek clarity on commission structures before engaging in trading activities with Cheung's Gold. Overall, the company's commitment to regulatory compliance and client support, alongside its array of investment options, presents opportunities for informed and strategic precious metal trading.

FAQs

Q: What trading platform does Cheung's Gold Traders Limited provide?

A: Cheung's Gold Traders Limited provides the MT4 trading platform.

Q: How does leverage work at Cheung's Gold?

A: Leverage at Cheung's Gold allows clients to amplify their trading positions using borrowed funds.

Q: What are the margin requirements for different products at Cheung's Gold?

A: Different products at Cheung's Gold have varying initial margin and overnight margin requirements.

Q: Does Cheung's Gold charge interest on positions held?

A: Positions in different products at Cheung's Gold accrue interest based on the product and the number of days held.

Q: What is the purpose of leverage at Cheung's Gold?

A: Leverage at Cheung's Gold is intended to help clients amplify their trading positions and potential profits.

Broker ng WikiFX

Exchange Rate