CTI

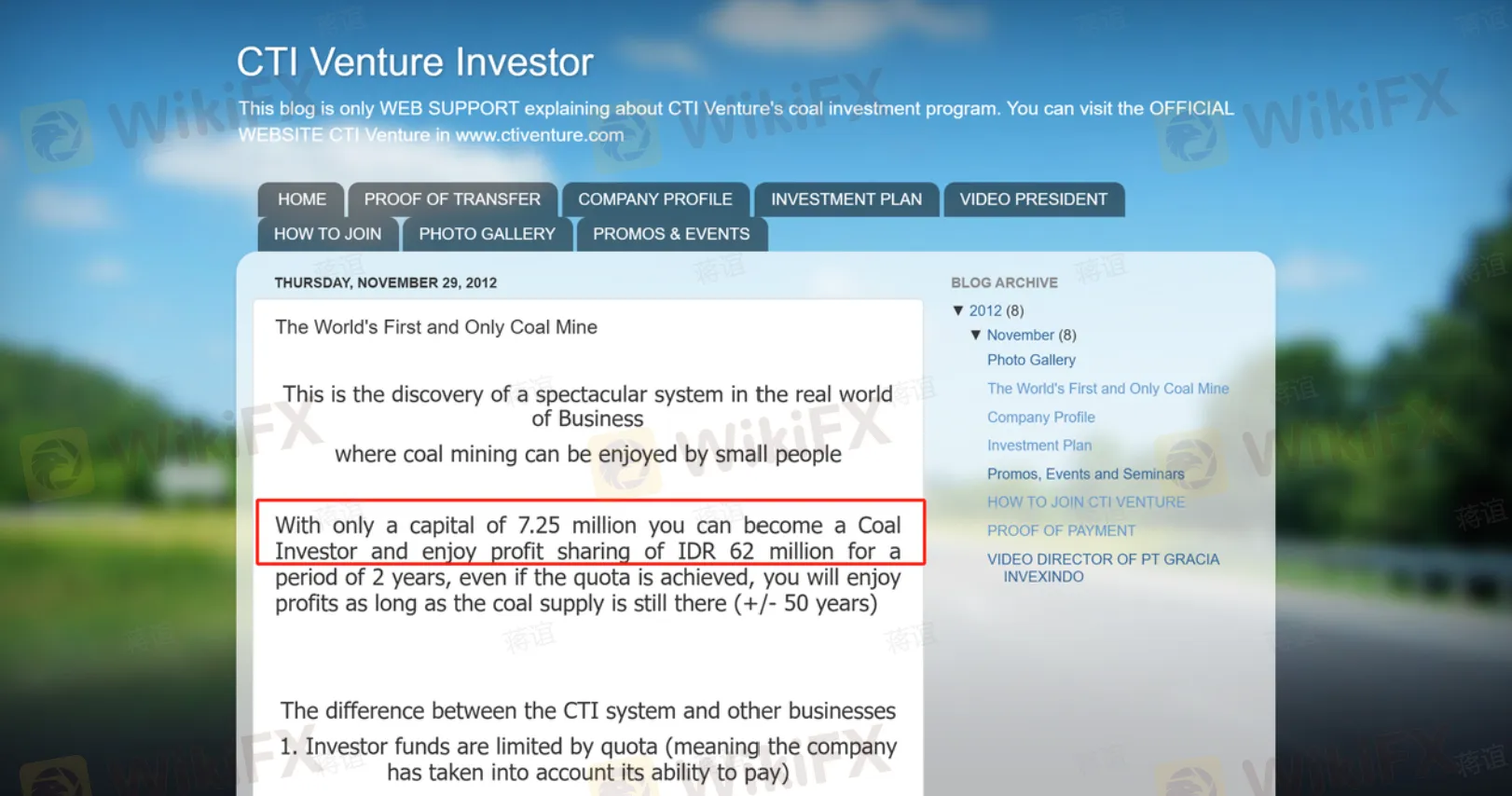

abstrak:CTI VENTURE is operated by its parent company, PT Gracia Invexindo, which was founded in 2003 and is headquartered in Jakarta, specializing in the coal mining investment business. Its core model is to raise funds from investors to acquire the ownership of coal mines (KP, Mining Power) and distribute profits based on the development of coal resources. The company claims that after investors purchase shares, they can enjoy continuous dividends until the coal resources are exhausted (approximately 50 years). If the shares are not fully sold, profits will be distributed in proportion to the actual earnings.

| CTI Review Summary | |

| Registered | 2000 |

| Registered Country/Region | Indonesia |

| Regulation | No regulation |

| Services | Coal mining investment |

| Minimum Deposit | IDR 7.25 million |

| Customer Support | Social media: Facebook |

| Tel: 081991716250 / 085376833350 | |

CTI Information

CTI VENTURE is operated by its parent company, PT Gracia Invexindo, which was founded in 2003 and is headquartered in Jakarta, specializing in the coal mining investment business. Its core model is to raise funds from investors to acquire the ownership of coal mines (KP, Mining Power) and distribute profits based on the development of coal resources. The company claims that after investors purchase shares, they can enjoy continuous dividends until the coal resources are exhausted (approximately 50 years). If the shares are not fully sold, profits will be distributed in proportion to the actual earnings.

Pros and Cons

| Pros | Cons |

| Long-term return expectation (50 years) | No regulation |

| Low threshold (7.25 million Indonesian Rupiah) | Inadequate information revealed |

| Specialized in coal mining investment | Limited contact channels |

| Fees charged |

Is CTI Legit?

CTI is not regulated. It is recommended that investors choose brokers regulated by top regulatory authorities for trading.

Services

CTI specializes in the coal mining investment business. the so-called transactions claimed by CTI essentially involve investors purchasing its investment plans. Investors can purchase shares as an investment in coal projects, and CTI claims that investors can receive dividends in proportion to their shareholdings.

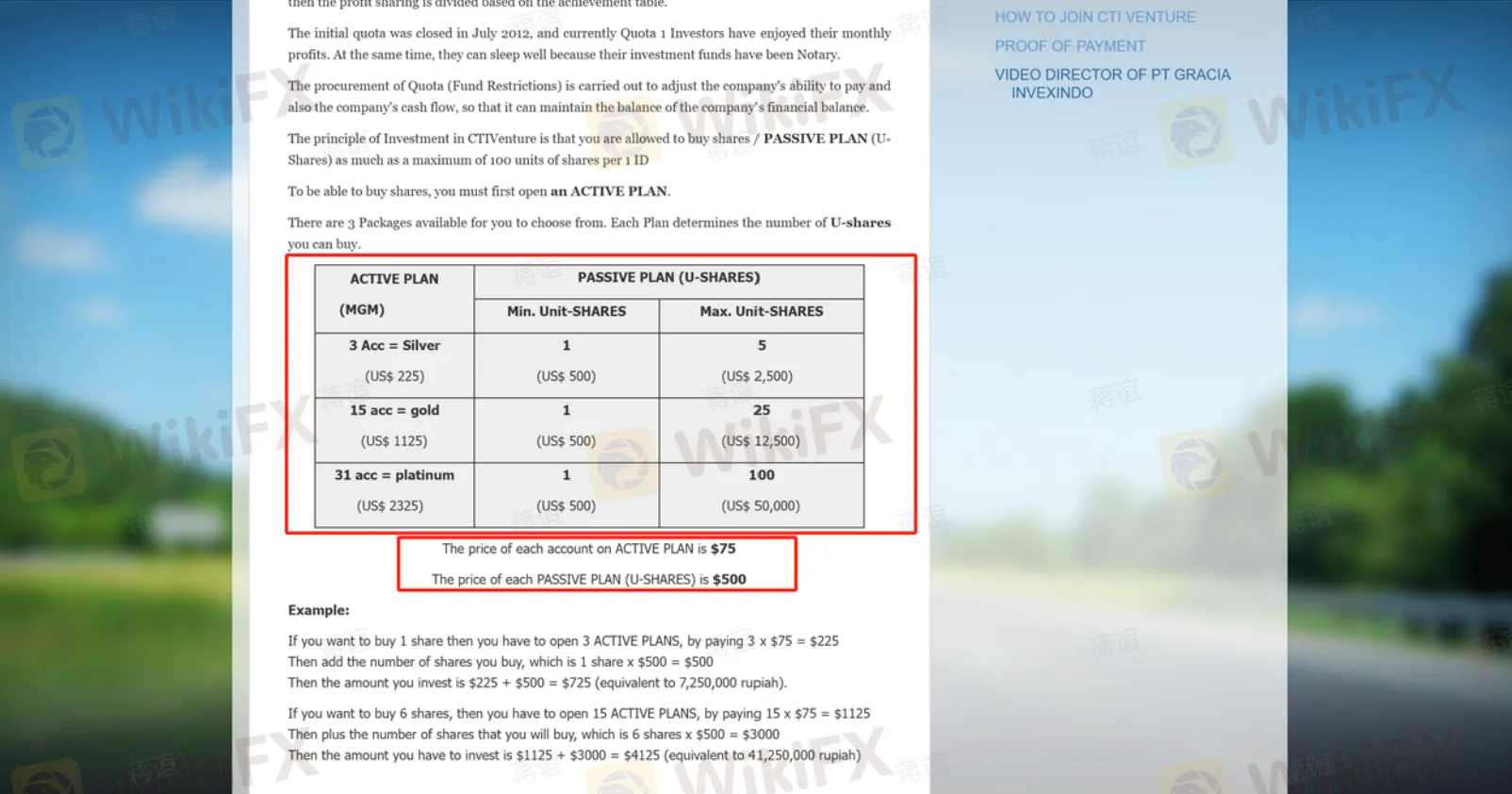

Investment Plan

| ACTIVE PLAN (MGM) | PASSIVE PLAN (U-SHARES) | |

| Minimum Unit-SHARES | Maximum Unit-SHARES | |

| 3 Acc = Silver (US$ 225) | 1 ($500) | 5 ($2,500) |

| 15 acc = gold (US$ 1125) | 1 ($500) | 25 ($12,500) |

| 31 acc = platinum (US$ 2325) | 1 ($500) | 100 ($50,000) |

CTI Fees

The price for each account in the ACTIVE PLAN is $75. The price for each PASSIVE PLAN (U-SHARES) is $500.

Deposit and Withdrawal

With just a capital of IDR 7.25 million, you can become a coal investor.

Broker ng WikiFX

Exchange Rate