Versus Trade

abstrak:Versus Trade is a new-generation CFD broker launched in 2024 and registered in Saint Lucia. It provides a modern trading experience via MetaTrader 5, offering over 200 CFD instruments across multiple asset classes, including Forex, crypto, indices, stocks, commodities, and proprietary Versus Pairs

| Company | Versus Trade |

| Registered Country/Region | Saint Lucia |

| Regulation | Regulated |

| Minimum Deposit | $10 (Standard, Cent), $100 (Pro Raw) |

| Maximum Leverage | Up to 1:2000 |

| Minimum Spreads | From 0.0 pips (Pro Raw) |

| Trading Platform | MetaTrader 5 (desktop, web, Android) |

| Demo Account | ✅ Yes |

| Trading Assets | Forex, Crypto, Indices, Commodities, Stocks, Versus Pairs |

| Payment Methods | Bank cards,bank transfers, e-wallets, crypto (BTC, USDT, ETH and others) |

| Customer Support | 24/7 Live Chat, Email, social media, Multilingual |

| Islamic Account | ✅ Auto-applied swap-free on key pairs |

| Mobile App | ✅ Android app (iOS coming soon) |

Overview of Versus Trade

Versus Trade is a new-generation CFD broker launched in 2024 and registered in Saint Lucia. It provides a modern trading experience via MetaTrader 5, offering over 200 CFD instruments across multiple asset classes, including Forex, crypto, indices, stocks, commodities, and proprietary Versus Pairs.

The broker offers high leverage up to 1:2000, ultra-fast ECN/STP execution, and commission-free trading on most account types — including a Pro

Raw account with raw spreads from 0.0 pips with commission as little as 3$ maximum. A demo account is available for platform testing, and a Cent account supports strategy development in micro-lots. Islamic accounts are available for all account types, while there is also swap-free for non-muslim countries on Standard.

Pros & Cons

| Pros | Cons |

| $10 minimum deposit for Standard and Cent accounts | No bonds or ETFs No copy trading or PAMM |

| MetaTrader 5 with ECN/STP execution | Educational content not yet available |

| Swap-free mode automatically applied on major pairs | No proprietary platform |

| High leverage up to 1:2000 | iOS app in development |

| Android mobile app with full account control | |

| Unique Versus Pairs — only available on Versus Trade |

Is Versus Trade Legit?

Versus Trade is currently registered with the UK Financial Conduct Authority (FCA) under general business registration (License No.: 16589645). The registration represents standard business registration rather than full regulatory authorization for financial services.

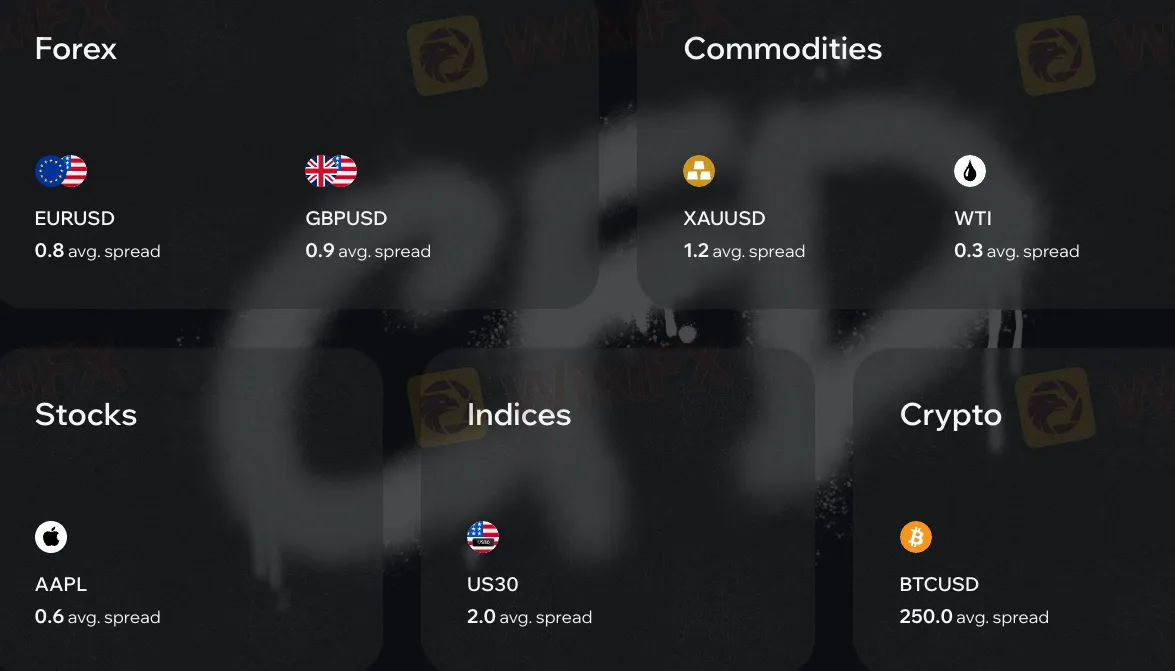

Market Instruments

Traders can access 200+ CFD instruments, including:

- 75+ Forex pairs (major, minor, exotic)

- Crypto (BTC, ETH, LTC, XRP, DOGE, and more)

- Indices (US500, NAS100, DAX, FTSE100, etc.)

- Commodities (Gold, Oil, Natural Gas)

- Stocks (US & global equities via CFDs)

- Unique Versus Pairs like Bitcoin vs Gold, Tesla vs Ford, BTC vs US500

These exclusive cross-asset pairs offer a fresh approach to speculation — allowing traders to capture the performance gap between assets across industries.

Versus Trade has added three new basket symbols—FAANG (Meta, Amazon, Apple, Netflix, Alphabet), AUTOX4 (GM, Ford, Toyota, Tesla), and USDX4 (EURUSD, GBPUSD, AUDUSD, NZDUSD)—allowing traders to trade diversified portfolios of major tech stocks, automakers, and key currency pairs in a single instrument.

Account Types

Versus Trade offers a flexible range of accounts designed for different levels of trading experience:

| Account Type | Suitable For | Minimum Deposit | Spread | Commission | Maximum Leverage |

| Standard | Suitable for all trading styles, from beginners to professionals | $10 | From 0.4 pips | $0 | 1:2000 |

| Cent | Trade micro lots, test strategies & EAs, smooth transition from demo to real | $10 | From 1.4 pips | $0 | 1:2000 |

| Pro | Designed for experienced traders | $100 | From 0.2 pips | $0 | 1:2000 |

| Raw Spread | Built for dynamic trading, scalping-ready | $100 | From 0 pips | Up to $3.00 per side per lot | 1:2000 |

| Islamic | Versus Trade accounts registered from Islamic countries are assigned swap-free automaticall | $10 | From 0.4 pips | $0 | 1:2000 |

| Demo | A risk-free demo trading account | $0 | From 0.4 pips | $0 | 1:2000 |

All accounts are accessible via MT5 and include high leverage options (up to 1:2000) and instant execution (ECN/STP model). Versus Trade also offers a demo account that allows users to practice trading without financial risk. Trading Platforms

Versus Trade offers MetaTrader 5 (MT5), a professional trading platform supporting multiple asset classes including forex, stocks, futures, and CFDs. The platform features 21 timeframes, 38 technical indicators, and 6 order types, along with Market Depth (DOM) and Economic Calendar integration.

Traders can develop automated strategies via MQL5, while low-latency execution and cross-device synchronization ensure efficient trading from analysis to execution.

Deposit & Withdrawal

| Payment Type | Representative Methods | Fee | Processing Time | Limits (per transaction) |

| Bank Cards | Visa, Mastercard | 0% | Instant - 1 day | Minimum $10, no maximum |

| Malaysia (MYR) | Duitnow QR, Affin Bank, Alliance Bank, AmBank, Bank Islam, Bank Rakyat, BSN, Hong Leong, Maybank, Public Bank Berhad, RHB, Touch ‘n Go | 0% | Instant - 2 days | Duitnow QR: 44 - 1,750 MYR Bank/Touch ’n Go: 44 - 8,600 MYR (Touch n Go: 44 - 860 MYR) |

| Indonesia (IDR) | QRIS, MOMO | 0% | Instant - 2 days | QRIS: 162,520 - 10,000,000 IDR MOMO: 255,200 - 10,000,000 IDR |

| Thailand (THB) | GSB, Thai QR, Bangkok Bank, Krungthai Bank, Kasikorn Bank, Kiatnakin Bank, TMBThanachart Bank, Krungsri Bank | 0% | Instant - 2 days | GSB/Bangkok Bank: 338 - 500,000 THB Thai QR: 338 - 50,700 THB Krungsri Bank: 10 - 500,000 THB |

| Vietnam (VND) | BIDV, DongA, Eximbank, MB Bank, MSB, Sacombank, SHB, Techcombank, Vietcombank, Vietinbank, VietQR, MOMO, ViettelPay, ZaloPay | 0% | Instant - 2 days | Bank/VietQR: 255,200 - 300,000,000 VND MOMO/ViettelPay/ZaloPay: 255,200 - 10,000,000 VND |

| Cryptocurrencies | USDT, USDC, XRP, TRX, BNB-BSC, LTC, BTC, ETH | 0% | Instant - 30 mins (USDT/USDC/XRP); up to 1 hour (others) | 25 - 10,000 USD |

Versus Trade supports fast, fee-free transactions via:

- Bank cards (Visa/Mastercard), regional e-wallets (MYR/IDR/THB/VND), and cryptocurrencies (BTC/ETH/USDT).

- 0% commission, instant - 2 day processing (crypto: 30 mins - 1 hour).

- Minimum $10 deposit/withdrawal, no maximum limit.

- Versus Trade offers a 100% deposit bonus (up to $500) that instantly doubles trading margin for all account types, allowing traders to open larger positions with the same initial funds while keeping profits withdrawable—though the bonus itself is non-withdrawable, subject to a 60-day validity period, and reduces proportionally if deposits are partially withdrawn.

Customer Support

Customer service is available 24/7 via:

- ✅ Live chat (8 languages)

- ✅ Email: support@versus.trade

- ✅ Socials: Instagram, Facebook Messenger

While the platform doesnt yet offer a full knowledge base or help center, most user queries are handled quickly through chat or email.

Education

Versus Trade has introduced a built-in Economic Calendar and real-time Market News feed, enabling users to access global macroeconomic events in real time, view integrated market-moving news within the platform, and monitor data releases without leaving the trading interface, with technical integration including TradingView widgets embedded via iframe, adapted to the platform's UI, and localized for user language and date formats. Versus Trade provides a structured learning platform—Versus Academy—offering free trading guides, essential modules on chart/technical/fundamental analysis, risk management, and strategies, with auto-generated demo accounts for new users (via partners) and manual access for existing clients.Conclusion

Versus Trade offers a streamlined trading experience with features including instant KYC verification, exclusive MetaTrader 5 platform access, Islamic swap-free accounts, and their proprietary Versus Pairs trading instrument. The broker currently operates under general business registration, which may be an important consideration for risk-averse traders.

Broker ng WikiFX

Exchange Rate