INDIGOFX

Extrait:INDIGOFX, established in 2018 and based in the United Kingdom, offers international money transfer services through its multi-currency account. Despite claiming authorization by the Financial Conduct Authority (FCA), there's no verifiable online regulatory information. The platform operates on a spread-based pricing model, without charging commission fees. Clients can access their services through the IndigoPay trading platform and utilize direct contact numbers for customer support, along with email assistance. Deposit and withdrawal options include bank transfers, covering various currencies and transaction types. Additionally, INDIGOFX provides educational resources like news updates and a FAQ section to support clients in navigating the foreign exchange market effectively.

| Aspect | Information |

| Company Name | INDIGOFX |

| Registered Country/Area | United Kingdom |

| Founded Year | 2018 |

| Regulation | Uthorized by FCA but no verifiable information found online |

| Market Instruments | International money transfer |

| Account Types | Multi-Currency Account |

| Spreads | No commission fees, spread-based pricing |

| Trading Platforms | IndigoPay |

| Demo Account | N/A |

| Customer Support | Direct contact numbers, email support at info@indigofx.co.uk |

| Deposit & Withdrawal | Bank transfer (BACs, CHAPS, SWIFT, SEPA for EUR transactions) |

| Educational Resources | News and Insights, FAQ section |

Overview of INDIGOFX

INDIGOFX, established in 2018 and based in the United Kingdom, offers international money transfer services through its multi-currency account. Despite claiming authorization by the Financial Conduct Authority (FCA), there's no verifiable online regulatory information. The platform operates on a spread-based pricing model, without charging commission fees.

Clients can access their services through the IndigoPay trading platform and utilize direct contact numbers for customer support, along with email assistance. Deposit and withdrawal options include bank transfers, covering various currencies and transaction types. Additionally, INDIGOFX provides educational resources like news updates and a FAQ section to support clients in navigating the foreign exchange market effectively.

Pros and Cons

| Pros | Cons |

| Transparent pricing with no commission fees | Lack of verifiable regulatory information |

| Multi-Currency Account | No demo account |

| User-friendly trading platform | Limited variety of market instruments |

| Direct contact numbers | Restricted deposit and withdrawal methods |

| Accessible educational resources |

Pros:

Transparent pricing with no commission fees: INDIGOFX offers transparent pricing without charging any commission fees on transactions. This transparency can be advantageous for users as they can easily understand the costs associated with their transactions.

Multi-Currency Account: The Multi-Currency Account provi

User-friendly trading platform: INDIGOFX offers a user-friendly trading platform known as IndigoPay. This platform is designed to str

Direct contact numbers for prompt customer support: The availability of direct contact numbers ensures prompt communication with INDIGOFX's customer support team. This direct c

Accessible educational resources: INDIGOFX provides access to educational resources such as news updates and a FAQ section. These resources empower users with market knowledge and insights, helping them

Cons:

Lack of verifiable regulatory information: Despite claiming to be authorized by the Financial Conduct Authority (FCA), INDIGOFX's regulatory status cannot be verified online. This lack of verifiable regulatory information raise concerns about the legitimacy and security of the platform.

No demo account for users to test platform: INDIGOFX does not offer a demo account for users to test the platf

Limited variety of market instruments: INDIGOFX offers a limited variety of market instruments, primarily focusing on international money tra

Restricted deposit and withdrawal methods: The platform's deposit and withdrawal methods are restricted to bank transfers only, including BACs, CHAPS, SWIFT, and SEPA for EUR transactions.

Regulatory Status

Although INDIGOFX's website claims to be authorized by the Financial Conduct Authority (FCA) of the United Kingdom and displays relevant certificates, there is no actual regulatory information found online. They claim to be authorized by the FCA as an Authorized Payment Institution, regulated under the Payment Service Regulations, and supervised by HM Revenue and Customs for anti-money laundering affairs, with certificate number 12690590.

Market Instruments

INDIGOFX offers a suite of products that allows you to manage your currency and international payments. Their main product is international money transfer. They offer same day payments with competitive FX rates and secure transfers.

Account Types

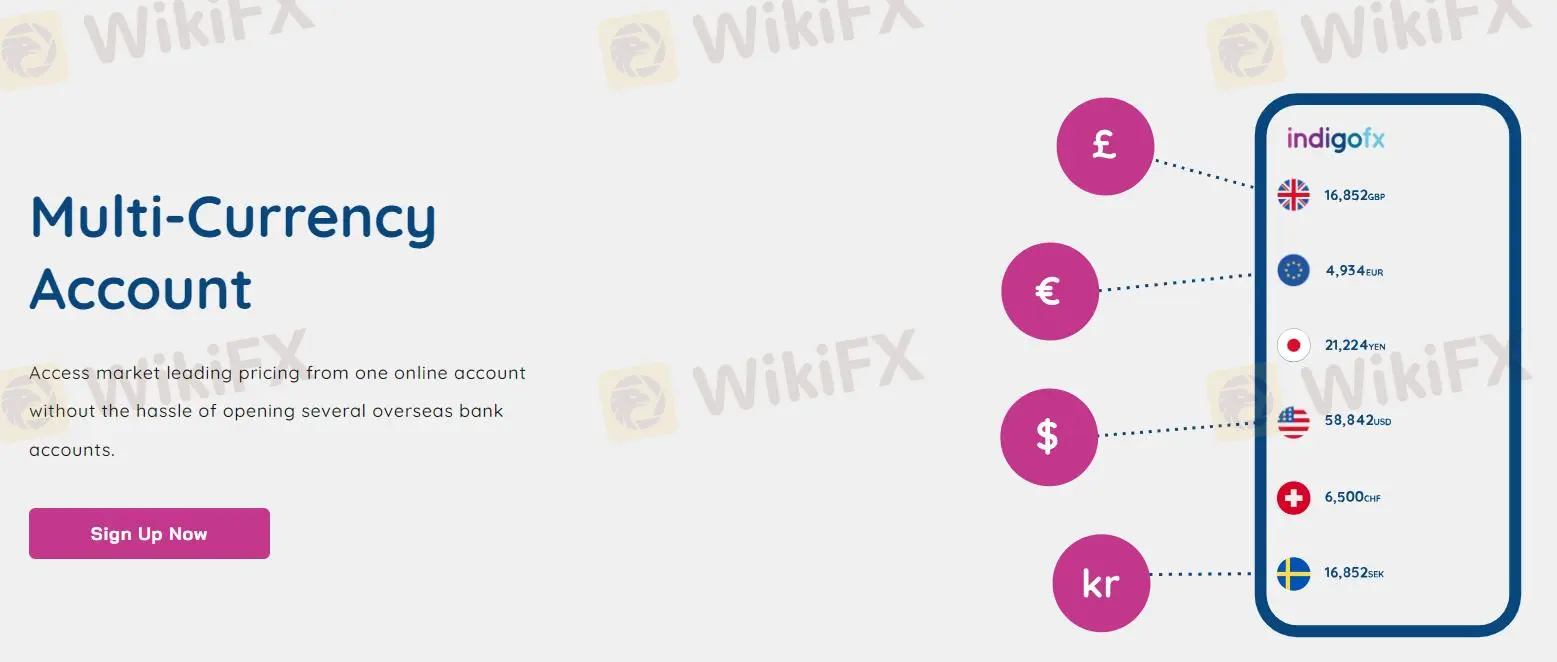

IndigoFX offers a Multi-Currency Account that simplifies managing your international finances. This account allows you to hold and manage funds in over 30 different currencies all from a single online account. This eliminates the need to open and manage separate bank accounts for each currency you want to hold. With the Multi-Currency Account, you can easily exchange currencies at competitive rates directly through your IndigoFX account. This can be helpful if you frequently make international transactions or receive payments in different currencies. Additionally, you can send and receive international payments directly through your account.

How to Open an Account?

Opening an account with INDIGOFX is a straightforward process that can be completed in several simple steps:

To open an account with INDIGOFX, begin by registering for free on their platform using your phone or laptop.

After registration, you'll need to verify your company by providing the necessary documentation as requested by INDIGOFX.

Once your company is verified, you can proceed to set up a deal by indicating the currency you wish to buy, and INDIGOFX will discuss your options and provide rates.

Add the payee details of the party you intend to pay within the platform.

Once all steps are completed, INDIGOFX will take care of the rest, facilitating the arrangement of your transactions.

Spreads & Commissions

IndigoFX focuses on transparency in their pricing by not charging any commission on foreign exchange transactions. This can be a significant advantage compared to brokers who charge commission fees on top of their spreads. However, it's important to remember that even without commission fees, IndigoFX will still make money through the spread.

Trading Platform

IndigoFX offers a versatile and user-friendly trading platform known as IndigoPay, designed to streamline international money transfers effortlessly. With an extensive array of products available, users can navigate through various currency exchange options with ease. Whether it's paying suppliers, business partners, or employees, IndigoPay simplifies the process to just a click of a button. This intuitive platform empowers users to execute transactions swiftly and securely, eliminating the complexities typically associated with international payments. IndigoPay's robust features functionality make it a trusted choice for individuals and businesses seeking efficient and reliable solutions for transferring money worldwide.

Deposit & Withdrawal

IndigoFX provides a cost-effective platform for currency exchange, offering bank-beating rates and eliminating the need for a minimum payment value. Funding your account is straightforward, as it only requires a bank transfer from an account in your name, accepted through methods such as BACs, CHAPS, SWIFT, and SEPA for EUR transactions. The platform supports a wide range of currencies, with the flexibility for specific currency requests.

Making deals and payments is convenient, whether through direct contact with the IndigoFX team or utilizing their payments platform, IndigoPay. Additionally, IndigoFX offers a variety of foreign exchange services, including Spot, Forward, and Limit Order options. With no transfer fees, users can move their money quickly and securely, ensuring efficient international transactions without incurring additional costs.

Customer Support

IndigoFX's main switchboard provides direct contact numbers for various departments, including dealing and sales, ensuring prompt and efficient communication. For dealing inquiries, clients can reach out to 020 7846 6248, while sales-related queries can be directed to 020 7846 6550. Additionally, clients can use the main switchboard number, 020 7846 6248, for general inquiries. Furthermore, IndigoFX offers email support at info@indigofx.co.uk, providing an alternative avenue for communication. This multi-channel approach to customer support ensures that clients can easily access assistance and guidance whenever needed, enhancing their overall experience with the platform.

Educational Resources

IndigoFX offers a range of educational resources to empower its clients with market knowledge and insights.

Through their “News and Insights” section, users can stay informed about the latest developments in the foreign exchange market and receive valuable market insights. This resource keeps clients updated on relevant news and trends, helping them make informed decisions when engaging in currency exchange transactions.

Additionally, the platform provides a comprehensive FAQ section, addressing common queries and concerns that clients have. These educational resources serve to enhance clients' understanding of foreign exchange dynamics, providing them with the knowledge and confidence to navigate the market effectively.

Conclusion

In conclusion, INDIGOFX offers a range of services aimed at simplifying international money transfers and currency management. Established in 2018 and based in the United Kingdom, the platform provides a Multi-Currency Account and a user-friendly trading platform, IndigoPay, facilitating transactions. However, the lack of verifiable regulatory information and limited variety of market instruments raise concerns for some users. Nevertheless, the transparency in pricing, direct contact numbers for customer support, and accessible educational resources are notable advantages that enhance the overall user experience.

FAQs

Q: Is INDIGOFX a safe and legitimate service?

A: INDIGOFX claims to be authorized by the Financial Conduct Authority (FCA) in the UK, but this information cannot be verified online. This lack of verification might raise security concerns for some users.

Q: What are INDIGOFX's fees?

A: INDIGOFX stands out for its transparent pricing structure. They don't charge commission fees on foreign exchange transactions.

Q: Does INDIGOFX offer a practice account?

A: INDIGOFX does not provide a demo account where you can try out their platform before committing real funds.

Q: What payment methods does INDIGOFX accept?

A: INDIGOFX only allows deposits and withdrawals via bank transfers, including BACs, CHAPS, SWIFT, and SEPA for EUR transactions.

Q: How can I contact INDIGOFX customer support?

A: INDIGOFX offers several ways to reach their customer support team. They have direct phone lines for dealing inquiries and sales inquiries, along with a general switchboard number. You can also reach them by email.

Courtiers WikiFX

FXTM

Exness

DBG Markets

HTFX

FOREX.com

Pepperstone

FXTM

Exness

DBG Markets

HTFX

FOREX.com

Pepperstone

Courtiers WikiFX

FXTM

Exness

DBG Markets

HTFX

FOREX.com

Pepperstone

FXTM

Exness

DBG Markets

HTFX

FOREX.com

Pepperstone

Calcul du taux de change