Dask Finance-Overview of Minimum Deposit, Leverage, Spreads

Extrait:Dask Finance Limited is an online forex broker registered in the United Kingdom, with its establishment time not disclosed. Dask Finance Limited offers its clients access to the world's most trading platform-MT4, a wide range of trading instruments including forex exchange, global indices commodities and more, leverage up to 1:400, as well as 24 x7 customer support.

| Dask Finance | Basic Information |

| Registered Country/Area | United Kingdom |

| Founded year | 1-2 years ago |

| Company Name | Dask Finance Limited |

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | $1,000 |

| Maximum Leverage | 1:400 |

| Spreads | From 0.0 pips ( allegedly) |

| Trading Platforms | MetaTrader 5 trading platform |

| Tradable Assets | currency pairs, cryptocurrencies, precious metals (Gold, Silver, Platinum), energy (Brent, WTI, NATGAS) and more |

| Account Types | Not mentioned |

| Demo Account | Not mentioned |

| Islamic Account | Not mentioned |

| Customer Support | No contact info |

| Payment Methods | Not specified |

| Educational Tools | Not specified |

Overview of Dask Finance

Dask Finance, based in the United Kingdom, is a relatively young company that was founded within the past 1-2 years. It operates under the name Dask Finance Limited. However, it is important to note that the regulation of this broker raises concerns as it holds a suspicious regulatory license. Dask Finance claims to offer a variety of options, including currency pairs, cryptocurrencies, precious metals (Gold, Silver, Platinum), energy commodities (Brent, WTI, NATGAS), and more.

The minimum deposit requirement for opening an account with Dask Finance is set at $1,000, which may be considered high for some traders compared to other brokers. On the other hand, Dask Finance offers a high maximum leverage of up to 1:400. The spreads offered by Dask Finance are advertised starting from 0.0 pips.

Unfortunately, there is limited information available regarding account types, demo accounts, and Islamic accounts offered by Dask Finance. Additionally, customer support contact details are not provided, which can raise concerns regarding the availability of timely assistance and support for clients. Dask Finance provides its clients with access to the popular MetaTrader 5 trading platform, which is known for its advanced features and comprehensive trading tools. This platform may offer traders a user-friendly and efficient trading experience.

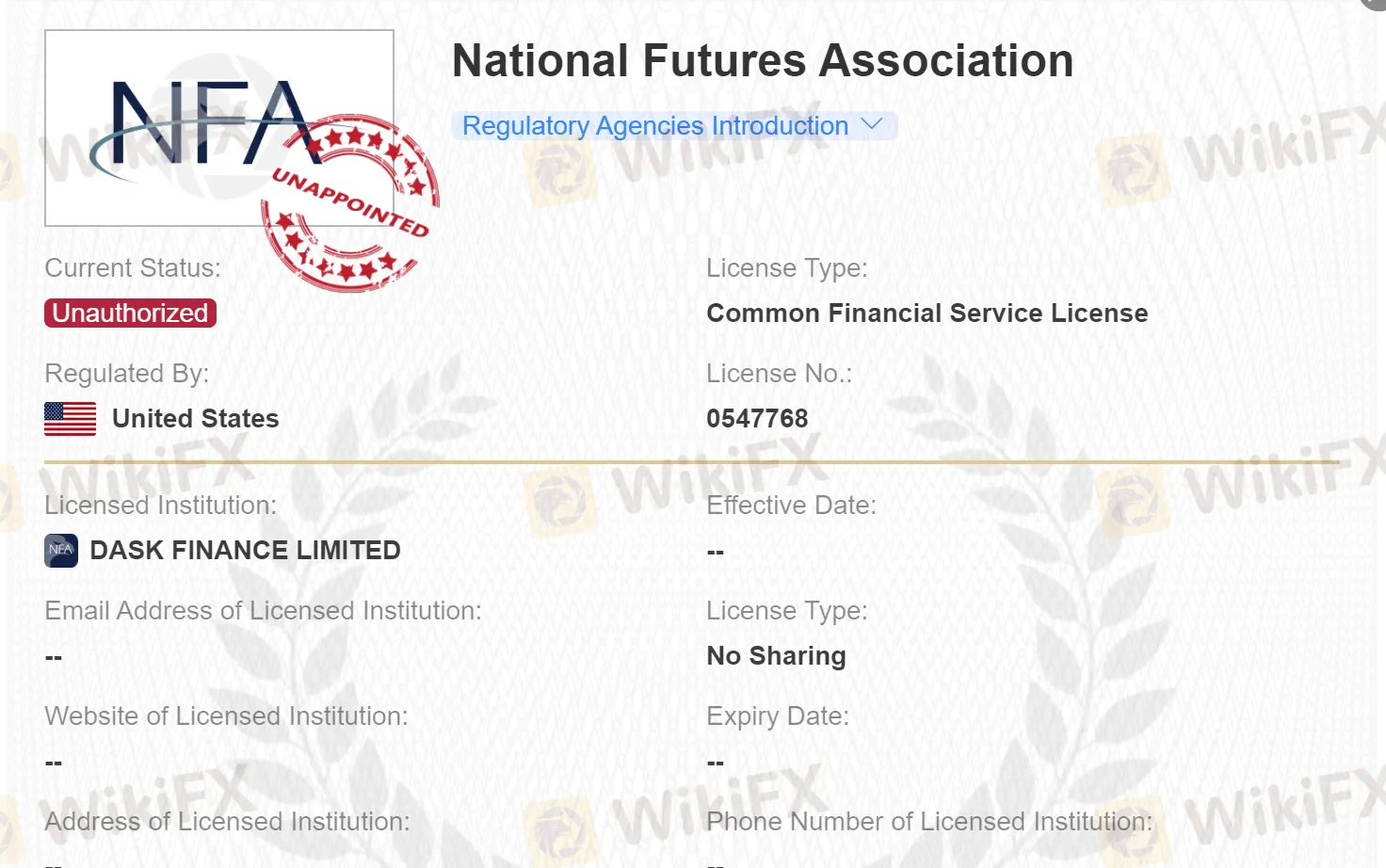

Is Dask Finance legit or a scam?

Dask Finance claims to be regulated by the NFA (National Futures Association) and holds a common financial services license with license number 0547768. However, upon conducting a thorough check on the NFA website, it was found that Dask Finance is not a member of the NFA.

Pros and Cons

| Pros | Cons |

| Offers a variety of tradable assets | Suspicious regulatory license |

| Provides access to MetaTrader 5 | Relatively high minimum deposit requirement |

| High maximum leverage of 1:400 | Unclear information about spreads |

| No mention of specific account types, demo accounts, or Islamic accounts | |

| No contact information for customer support | |

| No specified payment methods or educational tools |

Market Intruments

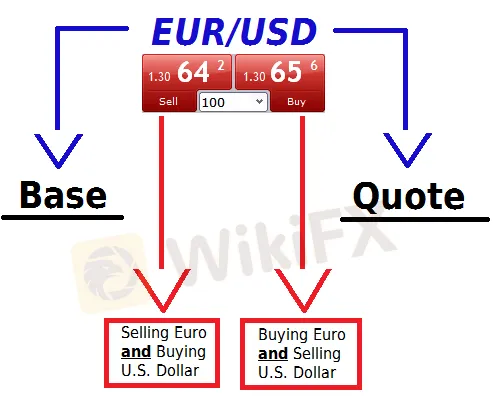

Dask Finance offers a diverse range of market instruments, catering to the preferences and strategies of a wide array of traders. Among the available options, currency pairs hold a significant place, allowing traders to engage in forex trading and explore opportunities in various forex markets.

In addition to forex and cryptocurrencies, Dask Finance provides access to precious metals such as Gold, Silver, and Platinum. The offering extends beyond traditional assets, encompassing energy commodities such as Brent, WTI, and NATGAS.

Account Types

Dask Finance operates with a certain level of ambiguity regarding its account types, as it does not prominently disclose specific information about them. However, it is worth noting that Dask Finance sets a relatively higher minimum deposit requirement of $1000, which diverges from the industry norm where many brokers offer lower minimum deposit options.

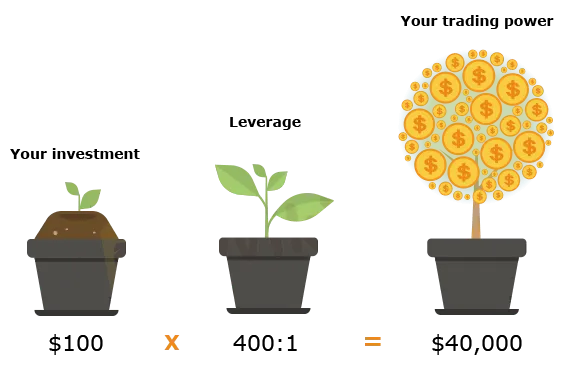

Leverage

Dask Finance offers traders the opportunity to utilize leverage in their trading activities, providing a leverage ratio of up to 1:400. A leverage ratio of 1:400 signifies that for every unit of capital allocated, traders can access up to 400 times that amount in trading positions. The use of leverage enables traders to control larger positions in the market, thereby potentially increasing the potential returns on their investments.

However, it is crucial to approach leverage with caution and exercise prudence. While leverage can enhance profit potential, it also exposes traders to heightened risks.

Spreads & Commissions (Trading Fees)

Dask Finance advertises its offering to clients with spread quotes starting from 0.0 pips. While this claim may seem appealing, it is important to note that Dask Finance is an unregulated broker, making it challenging to verify the accuracy of such statements independently.

Non-Trading Fees

In addition to trading costs, it is essential for traders to be aware of the non-trading fees associated with Dask Finance. Non-trading fees encompass various charges that may be incurred outside of direct trading activities.

Non-trading fees may include charges such as deposit and withdrawal fees, account maintenance fees, and inactivity fees. These fees can vary across brokers and are often designed to cover administrative costs or provide additional revenue streams for the brokerage firm.

Trading Platform

Dask Finance offers its clients the MetaTrader 5 trading platform, a widely recognized and popular choice among traders. The MetaTrader 5 platform is known for its comprehensive range of features, sophisticated tools, and user-friendly interface, providing traders with a robust and efficient trading experience.

One notable feature of MetaTrader 5 is its advanced charting capabilities. Traders can access a rich selection of chart types, timeframes, and technical indicators, empowering them to perform in-depth technical analysis. Another significant aspect of the MetaTrader 5 platform is its support for automated trading. Traders can utilize Expert Advisors (EAs) to automate their trading strategies and execute trades based on pre-defined parameters.

Deposit & Withdrawal

Dask Finance strictly confines deposit and withdrawal choices solely to Credit/Debit Card and Bank Wire Transfer. Furthermore, prospective clients should be aware that the minimum deposit requirement stands at $1000. While the broker claims to guarantee the processing of deposits and withdrawals within 24 hours, it is imperative to note that critical feedback pertaining to the deposit and withdrawal procedures may be readily encountered across various sources.

Customer Support

Dask Finance's approach to customer support raises concerns, as no contact information is readily provided.

Educational Resources

Lastly, Dask Finance's apparent lack of educational resources is a significant drawback for potential traders seeking to enhance their knowledge and skills in the financial markets.

Is Dask Finance suitable for beginners?

Based on some considerations, it is somewhat questionable whether this broker is suitable for beginners seeking to enter the world of trading.

The presence of a high minimum deposit requirement may pose a significant barrier for individuals starting with limited capital, as it limits their ability to initiate trades and explore different market opportunities. A lower minimum deposit requirement would provide beginners with more flexibility and the opportunity to gain practical experience without being excessively constrained by financial obligations.

The absence of demo accounts further complicates matters for novice traders, depriving beginners of a crucial opportunity to gain practical experience and hone their trading skills before venturing into live markets.

Moreover, the absence of educational resources further diminishes the suitability of Dask Finance for beginners. Novice traders often require comprehensive educational materials to acquire foundational knowledge about financial markets, trading concepts, and strategies

Is Dask Finance suitable for experienced traders?

No, it appears that Dask Finance may not be the most ideal choice for experienced traders seeking a comprehensive and sophisticated trading experience. Experienced traders often seek brokers that offer tiered accounts, allowing them to choose from a variety of account types that cater to their specific trading needs.

Furthermore, the moderate leverage offered by Dask Finance, up to 1:200, might be limiting for experienced traders who are accustomed to utilizing higher leverage ratios to maximize profit potential. Additionally, the lack of advanced trading tools is a noteworthy limitation for experienced traders. These traders often rely on sophisticated analytical instruments, advanced charting capabilities, and cutting-edge trading platforms to conduct in-depth market analysis and execute their strategies effectively.

Conclusion

In summary, after carefully evaluating the features and offerings of Dask Finance, it appears that this broker may not be the most optimal choice for most traders. With a high minimum deposit requirement and the absence of demo accounts and comprehensive educational resources, it may not be conducive to the needs of beginners who seek a supportive and educational trading environment. Additionally, the lack of tiered accounts, limited leverage options, and the absence of advanced trading tools might not fulfill the sophisticated requirements of most traders.

FAQs

Q: What is the minimum deposit requirement for opening an account with Dask Finance?

A: The minimum deposit requirement for opening an account with Dask Finance is on the higher end, starting at $1000, which can be a significant entry barrier for many traders.

Q: Does Dask Finance provide demo accounts for practice trading?

A: Unfortunately, Dask Finance does not offer demo accounts, limiting the opportunity for traders to gain practical experience in a risk-free environment.

Q: Are there educational resources available for traders on the Dask Finance platform?

A: Dask Finance lacks comprehensive educational resources, which can hinder the learning and growth of traders who are new to the markets.

Q: Does Dask Finance offer tiered account options?

A: No, Dask Finance does not offer tiered account options, limiting traders' ability to select account types that suit their specific strategies and preferences.

Q: What is the maximum leverage ratio available on Dask Finance?

A: The maximum leverage ratio offered by Dask Finance is up to 1:200, which may not be sufficient for experienced traders seeking higher leverage for potential returns.

Courtiers WikiFX

IC Markets Global

fpmarkets

STARTRADER

AVATRADE

OANDA

Exness

IC Markets Global

fpmarkets

STARTRADER

AVATRADE

OANDA

Exness

Courtiers WikiFX

IC Markets Global

fpmarkets

STARTRADER

AVATRADE

OANDA

Exness

IC Markets Global

fpmarkets

STARTRADER

AVATRADE

OANDA

Exness

Calcul du taux de change