TDR

Extrait:As a UK-based private equity firm established in 2002, TDR Capital LLP, targets established European mid-market companies with growth potential. Besides of financial investments in these countries, they also partner with businesses, offering strategic guidance to unlock long-term value for both investors and partnered companies. Currently, the company operates under an FCA exceeded regualtory status.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| TDR Review Summary | |

| Registered Country/Region | London |

| Year | 2002 |

| Regulation | FCA exceeded |

| Services | Financial investment, strategic guidance |

| Customer Support | Phone, email, address |

What is TDR?

As a UK-based private equity firm established in 2002, TDR Capital LLP, targets established European mid-market companies with growth potential. Besides of financial investments in these countries, they also partner with businesses, offering strategic guidance to unlock long-term value for both investors and partnered companies. Currently, the company operates under an FCA exceeded regualtory status.

In the following article, we will analyse the characteristics of this company in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Pros & Cons

| Pros | Cons |

| Focus on Growth | Lack of Regulation |

| Diverse Portfolio | Limited Investor Suitability |

Pros of TDR Capital:

Focus on Growth: TDR goes beyond just providing capital. They offer strategic guidance and expertise in areas like operations and data science to help their portfolio companies achieve long-term growth.

Diverse Portfolio: Their portfolio spans various industries, offering potential for diversification and mitigating risk across different sectors.

Cons of TDR Capital:

Lack of Regulation: Currently, TDR operates outside the purview of financial regulatory bodies with FCA exceeded status. This can be a concern for investors seeking additional security and oversight provided by regulations.

Limited Investor Suitability: TDR's focus on illiquid, mid-market investments may not be suitable for all investors, particularly those seeking short-term returns or high liquidity.

Is TDR Legit?

When considering the safety of a financial firm like TDR or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a financial firm:

Regulatory sight: The FCA (Financial Conduct Authority) exceeded status with license no. 216708 signifies potential risks, as it lacks the guarantee of comprehensive protection for traders engaging on its platform.

User feedback: To get a deeper understanding of the financial firm, it is suggested that traders explore reviews and feedback from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

Security measures: TDR safeguards client capital with a two-pronged approach. First, they meticulously choose businesses with strong financial foundations, built to weather economic storms. Second, they limit debt and prioritize healthy cash flow within their portfolio companies. This ensures a steady financial stream to fuel growth and mitigate losses during economic downturns.

Ultimately, the choice to trade with TDR is a personal decision. It is important to thoroughly assess the risks and benefits before arriving at a conclusion.

Services

TDR Capital is a private equity firm specializing in European mid-market companies. While they provide investment capital, their strategy goes beyond just financing. TDR offers operational and data science expertise to portfolio companies, partnering with management teams to implement strategic growth initiatives. This can include digital transformation, market consolidation, or nurturing high-growth businesses. They also provide additional capital during economic downturns, demonstrating a commitment to the long-term success of their investments.

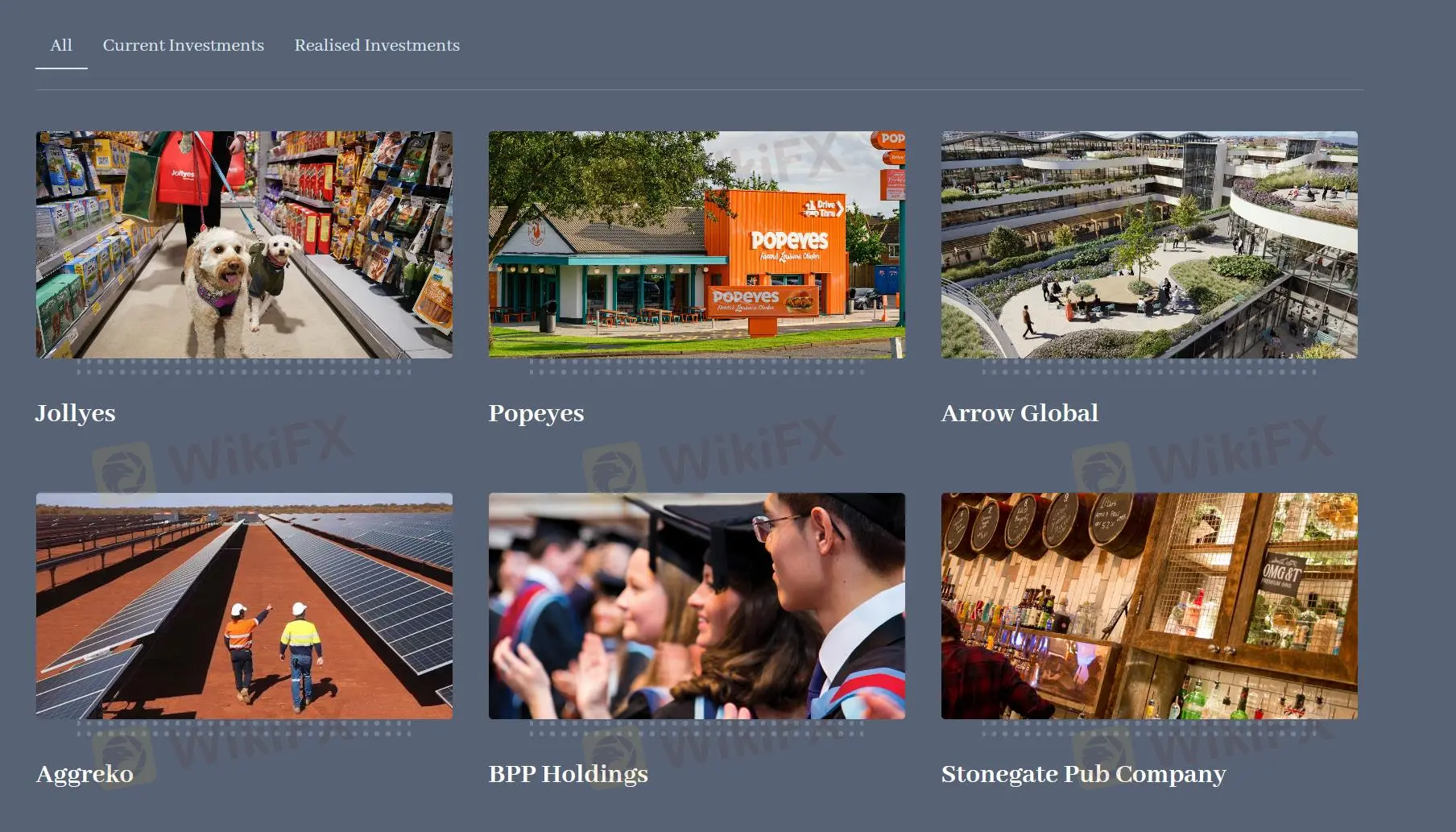

Examples of TDR's portfolio companies include Jollyes, the leading value pet retailer in the UK, and Stonegate Pub Company, the largest pub operator in the UK. Their diverse portfolio also encompasses businesses like Popeyes, a global Quick Service Restaurant brand, and Hurtigruten, a leading Norwegian cruise line.

Customer Service

TDR Capital provides customer service through multiple contact methods, including phone, email, and postal address. Clients can use these channels for inquiries, assistance, or additional information about TDRs services and portfolio. This approach ensures responsive and efficient support for all client needs.

London (Main office)

20 Bentinck Street, London, W1U 2EU

+44 20 7399 4200

info@tdrcapital.com

Jersey

IFC 5, St Helier, Jersey, JE1 1ST

+44 1534 668040

Luxembourg

20 Rue Eugene Ruppert, L-2453 Luxembourg

+352 26 49 32 98

Conclusion

TDR Capital LLP, as a London-based financial firm, focuses on fostering growth within established European mid-sized businesses. They provides capital and strategic guidance services to their partners. However, a key point to consider is their current FCA exceeded regulatory status. Regulations typically offer investor protection by ensuring financial accountability.

For these reasons, investors interested in TDR should be cautious, undertake full research and explore alternative, regulated firms that prioritize transparency, security, and client protection.

Frequently Asked Questions (FAQs)

| Question 1: | Is TDR regulated? |

| Answer 1: | No. It has been verified that this financial firm currently operates with FCA (Financial Conduct Authority) exceeded status, numbering 216708. |

| Question 2: | What kind of financial services does TDR offer? |

| Answer 2: | TDR offers financial investment and strategic guidance services to its partners. |

| Question 3: | Is TDR a good financial firm for beginners? |

| Answer 3: | No. It is not a good choice for beginners due to its FCA exceeded status. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Courtiers WikiFX

Interactive Brokers

VT Markets

IC Markets Global

EC Markets

Exness

FP Markets

Interactive Brokers

VT Markets

IC Markets Global

EC Markets

Exness

FP Markets

Courtiers WikiFX

Interactive Brokers

VT Markets

IC Markets Global

EC Markets

Exness

FP Markets

Interactive Brokers

VT Markets

IC Markets Global

EC Markets

Exness

FP Markets

Calcul du taux de change