2020-08-12 11:38

Analisis pasarWatch out for these five banking stocks!

Varietas terkait:

Lainnya,Lainnya,Lainnya,Saham,Lainnya,Lainnya

Analisis pasar:

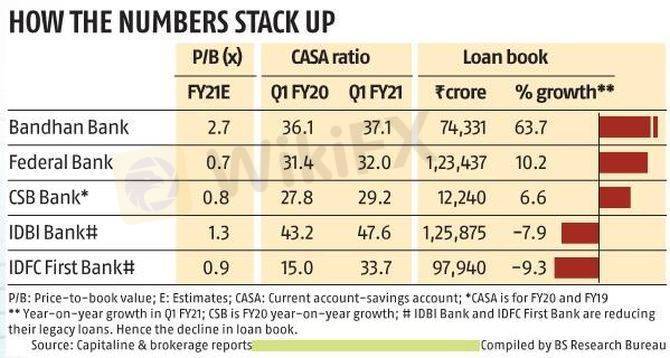

The coming years could be exciting for Bandhan Bank, IDBI Bank, IDFC First Bank, Federal Bank, and CSB Bank, reports Hamsini Karthik.

Apart from being mid-cap banking stocks, the common link between Bandhan Bank, IDBI Bank, IDFC First Bank, Federal Bank, and CSB Bank is that they have undergone a sea-change in the past two years.

While for IDBI Bank and IDFC First, their new managements have forced them to course correct, in the case of CSB, the need to reinvent may have been for existential reasons.

Notably, on a cumulative basis, slippages have come down for these banks in each of the last five quarters, and so have their non-performing assets (NPAs) ratio.

Also, in the wake of a steep fall in valuations, these stocks seem favourably positioned for investors having a three-five year horizon.

FX3886574399

ट्रेडर

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

Watch out for these five banking stocks!

India | 2020-08-12 11:38

India | 2020-08-12 11:38The coming years could be exciting for Bandhan Bank, IDBI Bank, IDFC First Bank, Federal Bank, and CSB Bank, reports Hamsini Karthik.

Apart from being mid-cap banking stocks, the common link between Bandhan Bank, IDBI Bank, IDFC First Bank, Federal Bank, and CSB Bank is that they have undergone a sea-change in the past two years.

While for IDBI Bank and IDFC First, their new managements have forced them to course correct, in the case of CSB, the need to reinvent may have been for existential reasons.

Notably, on a cumulative basis, slippages have come down for these banks in each of the last five quarters, and so have their non-performing assets (NPAs) ratio.

Also, in the wake of a steep fall in valuations, these stocks seem favourably positioned for investors having a three-five year horizon.

Lainnya

Lainnya

Lainnya

Saham

Lainnya

Lainnya

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama