2024-07-22 11:35

IndustriAUDUSD H4 Report - 22 July 2024

combined with selling pressure following a rebound in the yen, have dampened bullish sentiment on the Australian dollar (AUD). Although Australia's employment market data should have boosted the AUD, the market reaction has been subdued. Futures suggest only a 20% chance of an interest rate hike by the Reserve Bank of Australia (RBA) at its August meeting. The data failed to provide upward momentum for the AUD. Additionally, the strong rebound of the US dollar (USD) on the day, which rose to 104.4, continued to exert downward pressure on the AUD. President Biden’s withdrawal from the election increased risk aversion, but the upcoming US GDP and PCE data releases this week could result in significant volatility for the AUD.

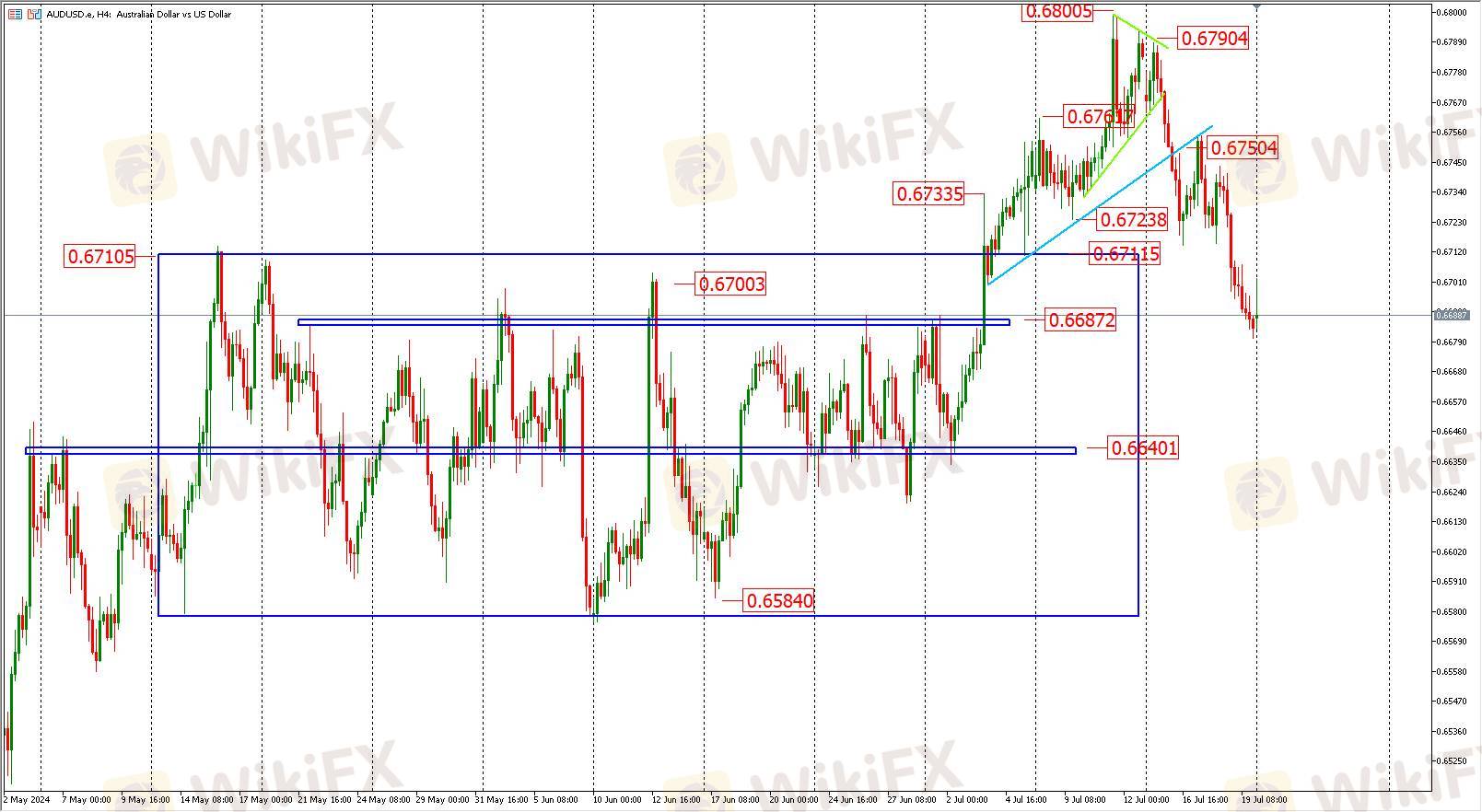

Technical Analysis:

The AUD’s decline last week wiped out the gains from the previous two weeks, closing near the high of the last week of June around 0.668, which serves as the second support platform from the past eight weeks of fluctuations. Close attention should be paid to the support level at 0.668. If this level is breached, the AUD may fluctuate within the 0.668-0.664 range. If the 0.668 support holds, the AUD may continue to trade within the 0.668-0.671 range.

Key Levels:

Resistance: First level at 0.670, second level at 0.671, third level at 0.673.

Support: First level at 0.668, second level at 0.666, third level at 0.664.

Suka 0

FPGv 我baconjellyy

Nhà đầu tư

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

AUDUSD H4 Report - 22 July 2024

| 2024-07-22 11:35

| 2024-07-22 11:35combined with selling pressure following a rebound in the yen, have dampened bullish sentiment on the Australian dollar (AUD). Although Australia's employment market data should have boosted the AUD, the market reaction has been subdued. Futures suggest only a 20% chance of an interest rate hike by the Reserve Bank of Australia (RBA) at its August meeting. The data failed to provide upward momentum for the AUD. Additionally, the strong rebound of the US dollar (USD) on the day, which rose to 104.4, continued to exert downward pressure on the AUD. President Biden’s withdrawal from the election increased risk aversion, but the upcoming US GDP and PCE data releases this week could result in significant volatility for the AUD.

Technical Analysis:

The AUD’s decline last week wiped out the gains from the previous two weeks, closing near the high of the last week of June around 0.668, which serves as the second support platform from the past eight weeks of fluctuations. Close attention should be paid to the support level at 0.668. If this level is breached, the AUD may fluctuate within the 0.668-0.664 range. If the 0.668 support holds, the AUD may continue to trade within the 0.668-0.671 range.

Key Levels:

Resistance: First level at 0.670, second level at 0.671, third level at 0.673.

Support: First level at 0.668, second level at 0.666, third level at 0.664.

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama