2024-11-07 16:22

IndustriRisk Management

Risk management, also known as money management, refers to a number of trading techniques employed to lessen risk exposure. Being affected by various factors, currency rates may be quite volatile at times, thus protecting your account against adverse price fluctuations is an essential part of a trading strategy.

The core concept of money management is to avoid risking more than 1-2% of personal funds on any single trade. This principle may greatly reduce risk exposure: provided that only 1% of initial deposit is at risk, even after several losing trades you are likely to retain the majority of account balance.

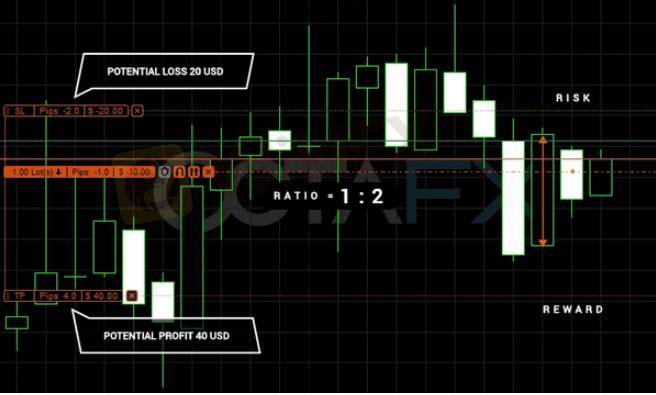

Risk to reward ratio denotes the potential profit in comparison to the amount you may lose for any given trade. For example, when you risk 100 USD on position to potentially gain 300 USD, the risk to reward ratio is1:3

Suka 0

用生命在耍帅

Trader

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

Risk Management

| 2024-11-07 16:22

| 2024-11-07 16:22Risk management, also known as money management, refers to a number of trading techniques employed to lessen risk exposure. Being affected by various factors, currency rates may be quite volatile at times, thus protecting your account against adverse price fluctuations is an essential part of a trading strategy.

The core concept of money management is to avoid risking more than 1-2% of personal funds on any single trade. This principle may greatly reduce risk exposure: provided that only 1% of initial deposit is at risk, even after several losing trades you are likely to retain the majority of account balance.

Risk to reward ratio denotes the potential profit in comparison to the amount you may lose for any given trade. For example, when you risk 100 USD on position to potentially gain 300 USD, the risk to reward ratio is1:3

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama