2024-11-07 20:03

IndustriHow to analyze EUR/USD?

Tonight the BOE will announce its November interest rate decision, and I am sticking with my previous view of a 25 basis point cut.

After Trump wins, he will promote policies that will cause economic damage to Europe, which has also been analyzed in my previous article. If at this point the BOE directly indicates that the UK economy is under threat in the press conference, the market may interpret the dovish tone, which will drive EUR/USD down.

In addition, the November FOMC meeting follows, with the market now fully pricing in a 25 basis point cut at this meeting and pricing in a 70% chance of another 25 basis point cut at the December meeting. If the Bank of England press conference indicates that they may cut rates again at the December meeting, then the dollar index has a good chance of falling; Conversely, if it signals no more rate cuts, then the dollar may rise again, driving EUR/USD down.

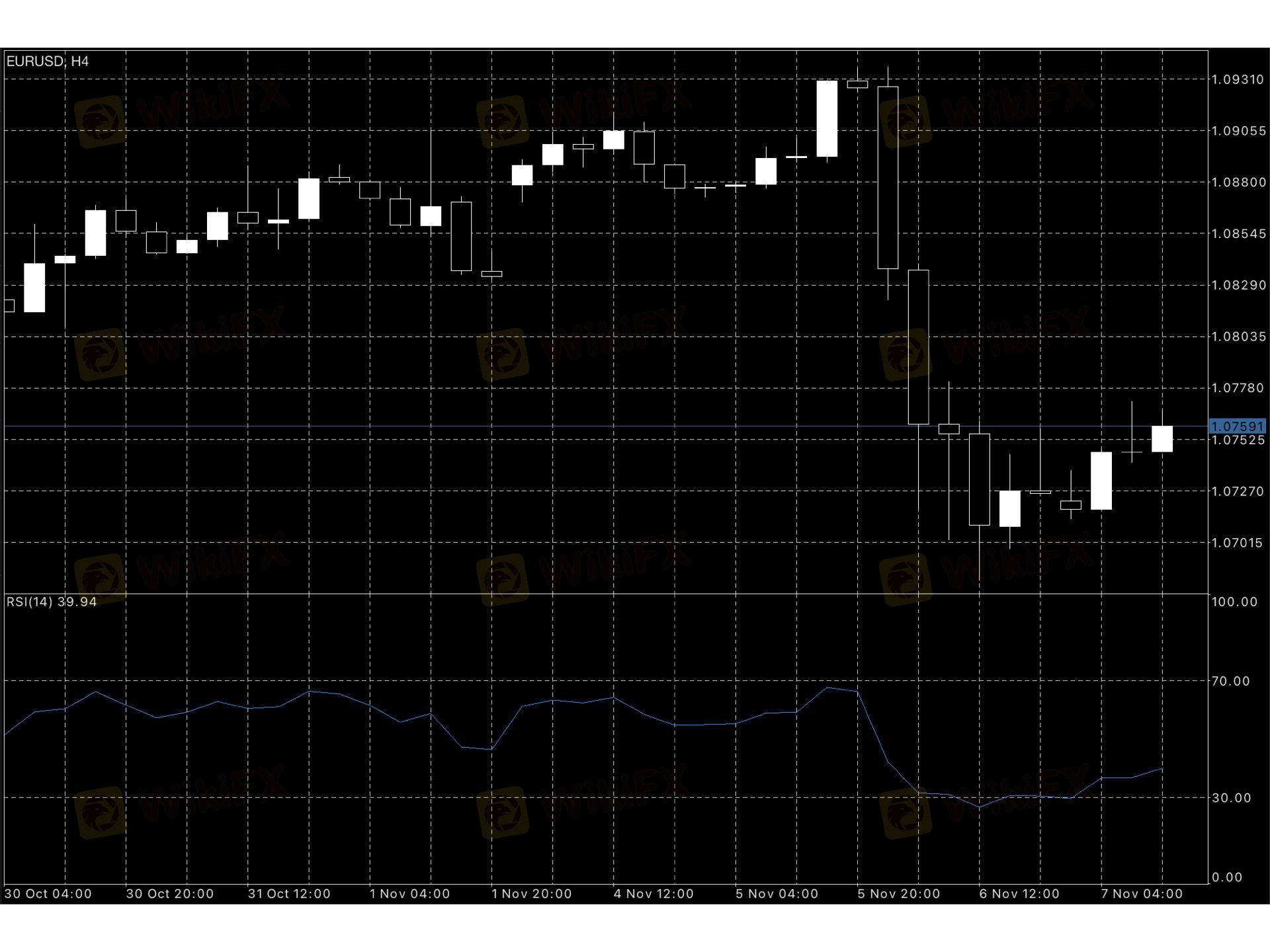

Looking at the chart below, the short-term (4-hour) chart shows the 14-day RSI holding near the neutral 50 axis, indicating that the decline is gradually abating. Here I think EUR/USD will trade between the 100-day and 200-day simple moving average (SMA) 1.2820 and 1.3000 in the short term.

On the upside, if EUR/USD is able to regain above 1.3000, this will be an important support level, with resistance on the upside at 1.3050 and 50-day SMA1.3100. On the downside, temporary support is at 1.2870, but if it breaks below this level, the 200-day SMA1.2820 will become a key support in the short term. A close below this point would attract bears and open up the downside, potentially extending the decline to 1.2760.

Suka 0

Steven123

Trader

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

How to analyze EUR/USD?

Hong Kong | 2024-11-07 20:03

Hong Kong | 2024-11-07 20:03Tonight the BOE will announce its November interest rate decision, and I am sticking with my previous view of a 25 basis point cut.

After Trump wins, he will promote policies that will cause economic damage to Europe, which has also been analyzed in my previous article. If at this point the BOE directly indicates that the UK economy is under threat in the press conference, the market may interpret the dovish tone, which will drive EUR/USD down.

In addition, the November FOMC meeting follows, with the market now fully pricing in a 25 basis point cut at this meeting and pricing in a 70% chance of another 25 basis point cut at the December meeting. If the Bank of England press conference indicates that they may cut rates again at the December meeting, then the dollar index has a good chance of falling; Conversely, if it signals no more rate cuts, then the dollar may rise again, driving EUR/USD down.

Looking at the chart below, the short-term (4-hour) chart shows the 14-day RSI holding near the neutral 50 axis, indicating that the decline is gradually abating. Here I think EUR/USD will trade between the 100-day and 200-day simple moving average (SMA) 1.2820 and 1.3000 in the short term.

On the upside, if EUR/USD is able to regain above 1.3000, this will be an important support level, with resistance on the upside at 1.3050 and 50-day SMA1.3100. On the downside, temporary support is at 1.2870, but if it breaks below this level, the 200-day SMA1.2820 will become a key support in the short term. A close below this point would attract bears and open up the downside, potentially extending the decline to 1.2760.

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama