2024-12-22 11:00

Industri Dividend Yields vs. Leverage Costs

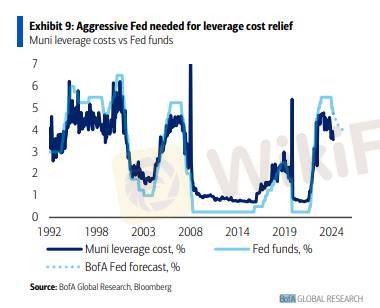

Recently, higher distribution yields have played a key role in narrowing market discounts. However, these distribution increases are essentially a gamble on favorable market conditions—namely, lower leverage costs and/or higher long-term bond yields.

If the Federal Reserve halts rate cuts at 4%, as economists predict, the decline in leverage costs may fall short of fund managers' expectations. In such a scenario, the sustainability of elevated distributions could face challenges, requiring investors to carefully weigh potential returns against underlying risks.

This uncertainty in the market environment serves as a reminder that relying solely on the narrowing of discounts driven by higher yields may lead to unexpected drawdowns. Therefore, prudent management of leverage and return expectations is more important than ever.

Suka 0

Kevin Cao

거래자

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

Dividend Yields vs. Leverage Costs

Hong Kong | 2024-12-22 11:00

Hong Kong | 2024-12-22 11:00Recently, higher distribution yields have played a key role in narrowing market discounts. However, these distribution increases are essentially a gamble on favorable market conditions—namely, lower leverage costs and/or higher long-term bond yields.

If the Federal Reserve halts rate cuts at 4%, as economists predict, the decline in leverage costs may fall short of fund managers' expectations. In such a scenario, the sustainability of elevated distributions could face challenges, requiring investors to carefully weigh potential returns against underlying risks.

This uncertainty in the market environment serves as a reminder that relying solely on the narrowing of discounts driven by higher yields may lead to unexpected drawdowns. Therefore, prudent management of leverage and return expectations is more important than ever.

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama