2024-12-23 13:57

IndustriMarket analysis on December 23

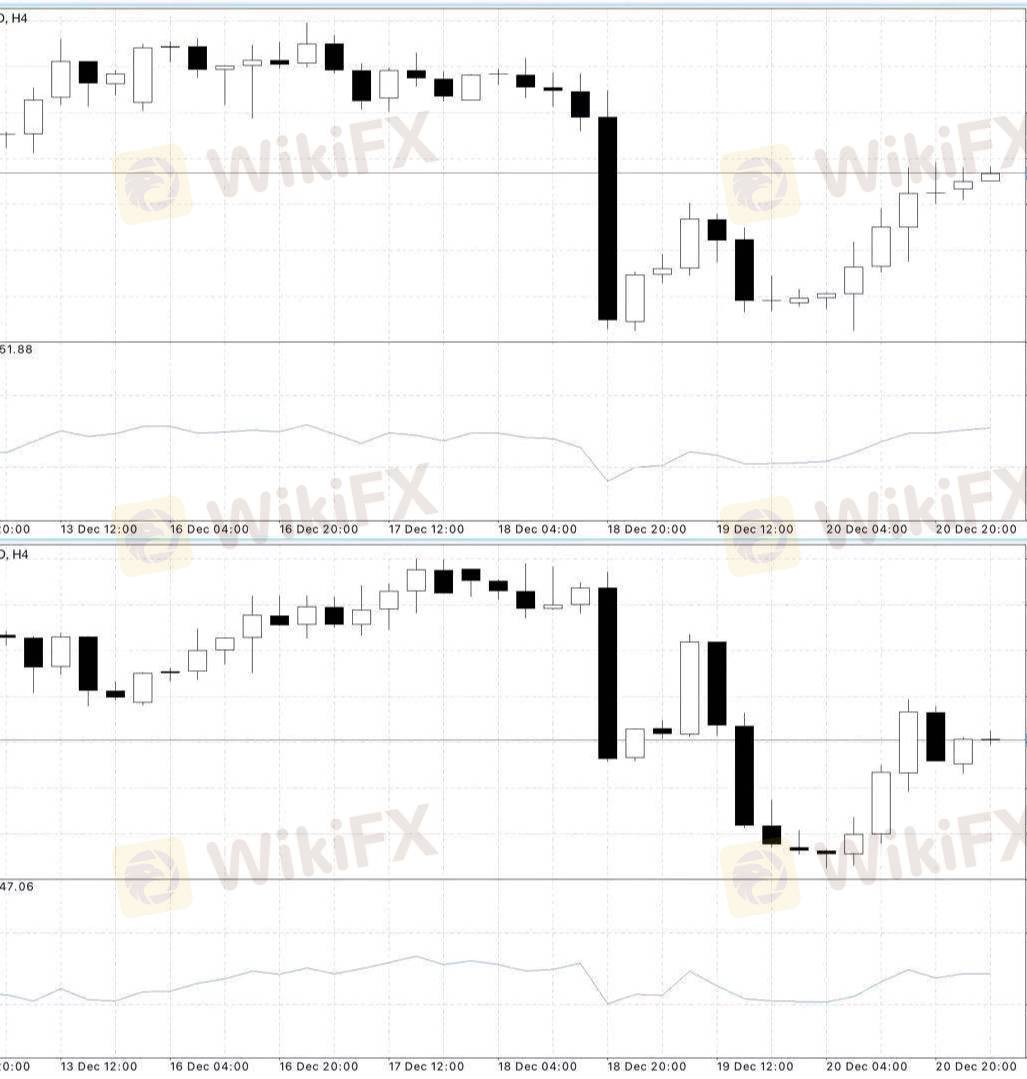

Last Friday, one of the inflation indicators that the Fed pays attention to - the US core PCE data are lower than expected, the market for March 25 interest rate cut expectations have increased, the USDX fell from a two-year high, and finally closed at 107.82, down 0.55%, but continued to rise for three weeks. Treasury yields were weaker across the board, with the 2-year yield closing at 4.317 percent and the 10-year yield at 4.519 percent.

Again, considering the arrival of Christmas, which compresses the entire trading week, the market is less volatile and the dollar is more likely to fluctuate at high levels.

At present, it seems that the Federal Reserve will only cut interest rates twice next year, respectively in March and June next year, and the major central banks may have some opposing measures.

EUR/USD:

First support: 1.0436 First resistance: 1.0444

Second support: 1.0432 Second resistance: 1.0448

GBP/USD:

First support: 1.2582 First resistance: 1.2590

Second support: 1.2577 Second resistance: 1.2593

Suka 0

Steven123

Trader

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

Market analysis on December 23

Hong Kong | 2024-12-23 13:57

Hong Kong | 2024-12-23 13:57

Last Friday, one of the inflation indicators that the Fed pays attention to - the US core PCE data are lower than expected, the market for March 25 interest rate cut expectations have increased, the USDX fell from a two-year high, and finally closed at 107.82, down 0.55%, but continued to rise for three weeks. Treasury yields were weaker across the board, with the 2-year yield closing at 4.317 percent and the 10-year yield at 4.519 percent.

Again, considering the arrival of Christmas, which compresses the entire trading week, the market is less volatile and the dollar is more likely to fluctuate at high levels.

At present, it seems that the Federal Reserve will only cut interest rates twice next year, respectively in March and June next year, and the major central banks may have some opposing measures.

EUR/USD:

First support: 1.0436 First resistance: 1.0444

Second support: 1.0432 Second resistance: 1.0448

GBP/USD:

First support: 1.2582 First resistance: 1.2590

Second support: 1.2577 Second resistance: 1.2593

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama