2024-12-25 21:51

IndustriOverview of the PO3 Trading Strategy

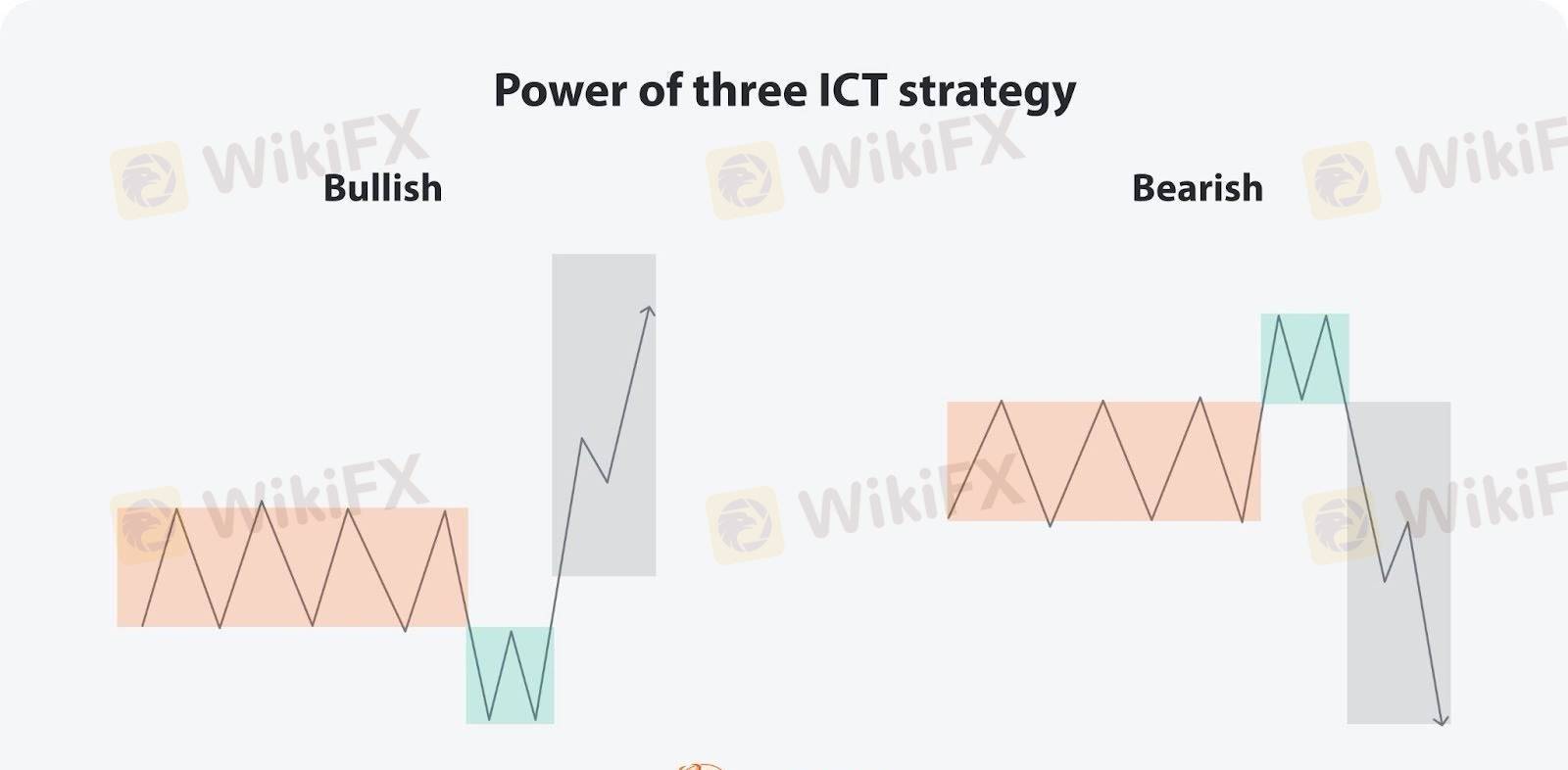

The Power of Three (PO3) is a concept introduced by ICT (Inner Circle Trader) that describes market price movements in three phases: Accumulation, Manipulation, and Distribution.

1. Accumulation Phase

During this phase, the price consolidates within a narrow range as institutional players accumulate positions. The market often exhibits low volatility, typically occurring at the start of the trading day or before significant events.

2. Manipulation Phase

Large players create false breakouts to lure retail traders into the wrong direction, clearing stop-loss orders and building liquidity. Prices may breach key support or resistance levels but quickly reverse afterward.

3. Distribution Phase

The market enters the main trend direction, with prices accelerating toward targeted zones. Institutional players distribute their positions during this phase, marked by increased volatility and a clear price trend.

---

Application and Strategy

In intraday or short-term trading, the PO3 model helps identify key market moves. For example, the opening session often corresponds to the Accumulation phase, false breakouts occur during the Asian session (Manipulation), and trend expansions usually happen during the European or U.S. sessions (Distribution).

Typical Strategy:

1. Wait for Manipulation to Complete: Identify false breakouts and look for reversal signals, such as order blocks.

2. Enter the Main Trend in the Distribution Phase: Enter at key areas (e.g., Fair Value Gaps) and set targets like previous highs or lows.

3. Leverage Time Zones: Use ICT's Kill Zones (e.g., London or New York sessions) to improve accuracy.

By understanding the PO3 concept, traders can better capture market dynamics and enhance the precision and success of their trades.

Suka 0

Kevin Cao

ट्रेडर

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

Overview of the PO3 Trading Strategy

Hong Kong | 2024-12-25 21:51

Hong Kong | 2024-12-25 21:51The Power of Three (PO3) is a concept introduced by ICT (Inner Circle Trader) that describes market price movements in three phases: Accumulation, Manipulation, and Distribution.

1. Accumulation Phase

During this phase, the price consolidates within a narrow range as institutional players accumulate positions. The market often exhibits low volatility, typically occurring at the start of the trading day or before significant events.

2. Manipulation Phase

Large players create false breakouts to lure retail traders into the wrong direction, clearing stop-loss orders and building liquidity. Prices may breach key support or resistance levels but quickly reverse afterward.

3. Distribution Phase

The market enters the main trend direction, with prices accelerating toward targeted zones. Institutional players distribute their positions during this phase, marked by increased volatility and a clear price trend.

---

Application and Strategy

In intraday or short-term trading, the PO3 model helps identify key market moves. For example, the opening session often corresponds to the Accumulation phase, false breakouts occur during the Asian session (Manipulation), and trend expansions usually happen during the European or U.S. sessions (Distribution).

Typical Strategy:

1. Wait for Manipulation to Complete: Identify false breakouts and look for reversal signals, such as order blocks.

2. Enter the Main Trend in the Distribution Phase: Enter at key areas (e.g., Fair Value Gaps) and set targets like previous highs or lows.

3. Leverage Time Zones: Use ICT's Kill Zones (e.g., London or New York sessions) to improve accuracy.

By understanding the PO3 concept, traders can better capture market dynamics and enhance the precision and success of their trades.

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama