2025-01-29 17:05

IndustriSwing Trading Strategies

#firstdealofthenewyearFateema

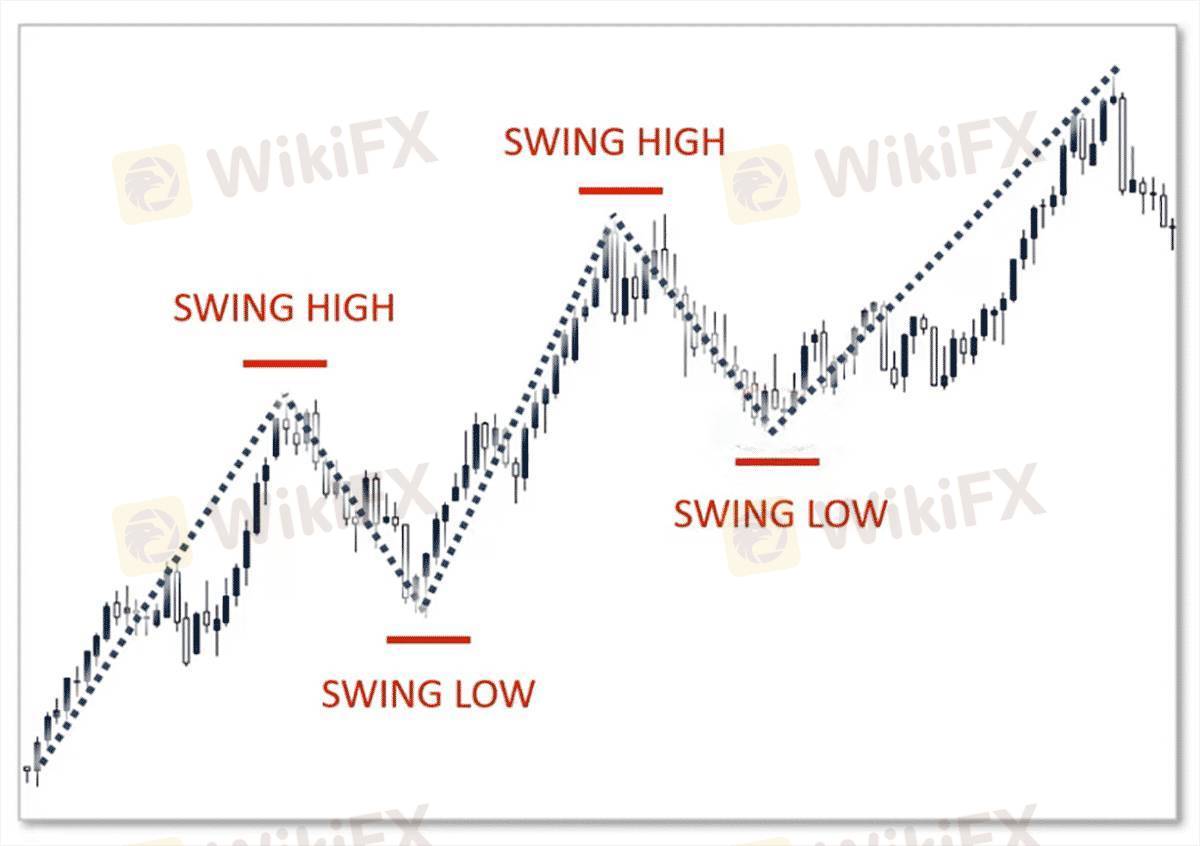

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

Suka 0

Veinticinco25

交易者

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

Swing Trading Strategies

Nigeria | 2025-01-29 17:05

Nigeria | 2025-01-29 17:05#firstdealofthenewyearFateema

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama