2025-01-31 17:56

IndustriHow to Determine your forex trading lot sizes.

#firstdealofthenewyearAKEEL

Determining the correct lot size in forex trading is crucial for risk management and account sustainability. Here’s how to do it:

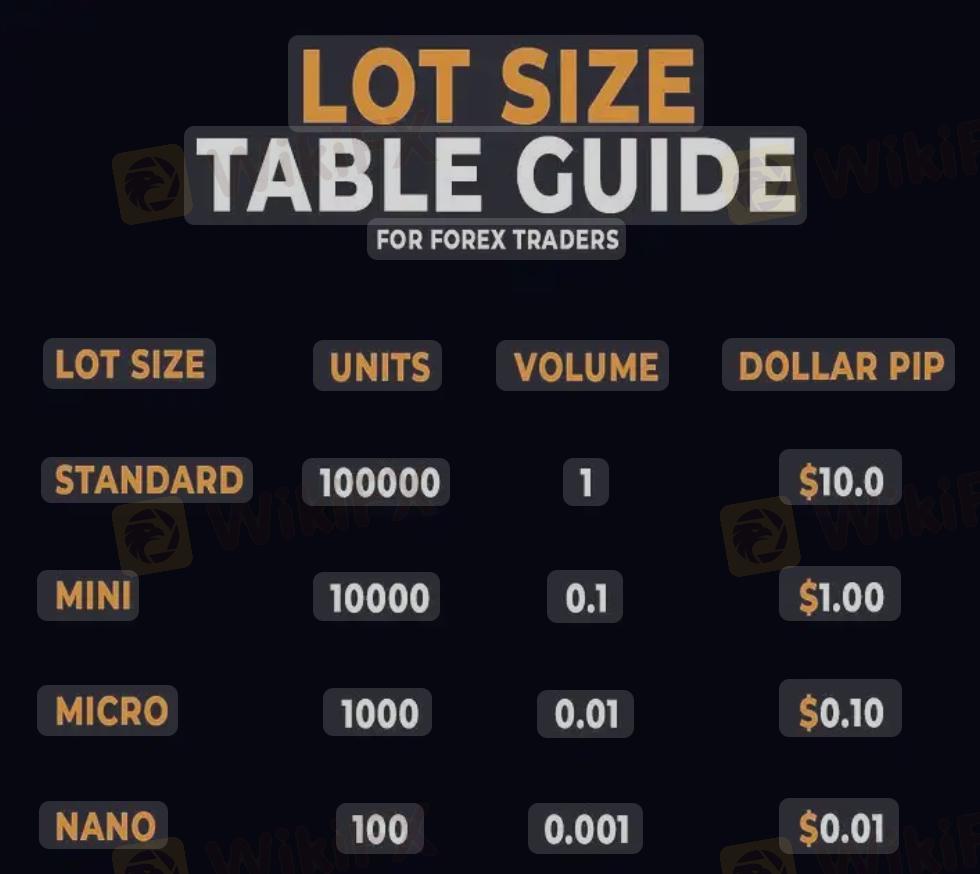

1. Understand Lot Sizes in Forex

Standard Lot = 100,000 units (1 lot)

Mini Lot = 10,000 units (0.1 lot)

Micro Lot = 1,000 units (0.01 lot)

Nano Lot = 100 units (0.001 lot) (not offered by all brokers)

2. Define Your Risk Per Trade

Risk should be 1-2% of your account balance per trade.

Example: If your account is $10,000, a 2% risk = $200 per trade.

3. Determine Stop Loss in Pips

Choose a logical stop-loss level based on market structure.

Example: If your stop loss is 50 pips, this helps determine position size.

4. Calculate the Lot Size Using This Formula

\text{Lot Size} = \frac{\text{Risk Amount}}{\text{Stop Loss (pips)} \times \text{Pip Value}}

For USD pairs (e.g., EUR/USD, GBP/USD):

1 standard lot = $10 per pip

1 mini lot = $1 per pip

1 micro lot = $0.10 per pip

5. Example Calculation

Scenario:

Account Balance = $10,000

Risk = 2% ($200)

Stop Loss = 50 pips

Trading EUR/USD (1 pip = $10 per standard lot)

\text{Lot Size} = \frac{200}{50 \times 10} = \frac{200}{500} = 0.4 \text{ lots}

6. Adjust for Leverage & Margin

Ensure you have enough free margin to open the trade.

Higher leverage allows larger positions but increases risk exposure.

Would you like a lot size calculator or help setting up a risk management plan?

#firstdealofthenewyearAKEEL

Suka 0

Boss8889

Trader

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

How to Determine your forex trading lot sizes.

Nigeria | 2025-01-31 17:56

Nigeria | 2025-01-31 17:56#firstdealofthenewyearAKEEL

Determining the correct lot size in forex trading is crucial for risk management and account sustainability. Here’s how to do it:

1. Understand Lot Sizes in Forex

Standard Lot = 100,000 units (1 lot)

Mini Lot = 10,000 units (0.1 lot)

Micro Lot = 1,000 units (0.01 lot)

Nano Lot = 100 units (0.001 lot) (not offered by all brokers)

2. Define Your Risk Per Trade

Risk should be 1-2% of your account balance per trade.

Example: If your account is $10,000, a 2% risk = $200 per trade.

3. Determine Stop Loss in Pips

Choose a logical stop-loss level based on market structure.

Example: If your stop loss is 50 pips, this helps determine position size.

4. Calculate the Lot Size Using This Formula

\text{Lot Size} = \frac{\text{Risk Amount}}{\text{Stop Loss (pips)} \times \text{Pip Value}}

For USD pairs (e.g., EUR/USD, GBP/USD):

1 standard lot = $10 per pip

1 mini lot = $1 per pip

1 micro lot = $0.10 per pip

5. Example Calculation

Scenario:

Account Balance = $10,000

Risk = 2% ($200)

Stop Loss = 50 pips

Trading EUR/USD (1 pip = $10 per standard lot)

\text{Lot Size} = \frac{200}{50 \times 10} = \frac{200}{500} = 0.4 \text{ lots}

6. Adjust for Leverage & Margin

Ensure you have enough free margin to open the trade.

Higher leverage allows larger positions but increases risk exposure.

Would you like a lot size calculator or help setting up a risk management plan?

#firstdealofthenewyearAKEEL

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama