2025-02-06 20:00

IndustriCreating a Legacy Through Annual Investment Strate

#firstdealofthenewyearchewbacca

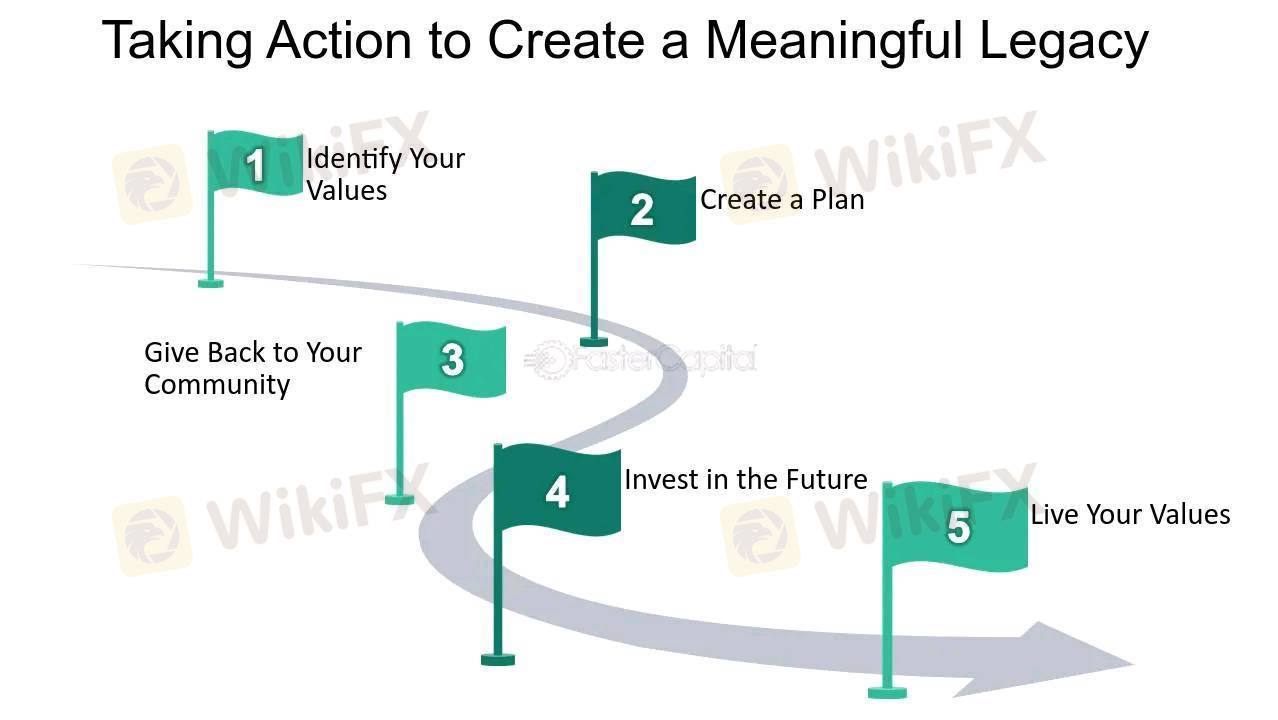

Creating a legacy through annual investment strategies requires a long-term vision, disciplined financial planning, and strategic asset allocation. Here’s a structured approach to building and sustaining a lasting financial legacy:

1. Define Your Legacy Goals

Determine whether your legacy is for family wealth, philanthropy, or business continuity.

Set clear financial and non-financial objectives.

2. Establish a Sustainable Investment Plan

Asset Allocation: Diversify across stocks, bonds, real estate, and alternative investments.

Risk Management: Balance high-risk and stable investments to ensure long-term growth.

Tax Efficiency: Utilize tax-advantaged accounts, trusts, and estate planning to preserve wealth.

3. Commit to Annual Investments

Consistently invest a fixed amount each year, leveraging compound interest.

Increase contributions over time to outpace inflation.

4. Utilize Compounding and Reinvestment

Reinvest dividends, interest, and capital gains for exponential growth.

Choose growth-oriented investments for long-term wealth accumulation.

5. Implement Estate and Succession Planning

Set up wills, trusts, and foundations to ensure smooth wealth transfer.

Involve heirs or beneficiaries in financial education.

6. Review and Adjust Annually

Evaluate investment performance and market conditions.

Adjust asset allocations and contributions based on economic changes.

Suka 0

bossbaby6527

交易者

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

Creating a Legacy Through Annual Investment Strate

Nigeria | 2025-02-06 20:00

Nigeria | 2025-02-06 20:00#firstdealofthenewyearchewbacca

Creating a legacy through annual investment strategies requires a long-term vision, disciplined financial planning, and strategic asset allocation. Here’s a structured approach to building and sustaining a lasting financial legacy:

1. Define Your Legacy Goals

Determine whether your legacy is for family wealth, philanthropy, or business continuity.

Set clear financial and non-financial objectives.

2. Establish a Sustainable Investment Plan

Asset Allocation: Diversify across stocks, bonds, real estate, and alternative investments.

Risk Management: Balance high-risk and stable investments to ensure long-term growth.

Tax Efficiency: Utilize tax-advantaged accounts, trusts, and estate planning to preserve wealth.

3. Commit to Annual Investments

Consistently invest a fixed amount each year, leveraging compound interest.

Increase contributions over time to outpace inflation.

4. Utilize Compounding and Reinvestment

Reinvest dividends, interest, and capital gains for exponential growth.

Choose growth-oriented investments for long-term wealth accumulation.

5. Implement Estate and Succession Planning

Set up wills, trusts, and foundations to ensure smooth wealth transfer.

Involve heirs or beneficiaries in financial education.

6. Review and Adjust Annually

Evaluate investment performance and market conditions.

Adjust asset allocations and contributions based on economic changes.

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama