2025-02-06 23:38

IndustriCORRELATION BETWEEN FOREX PAIRS

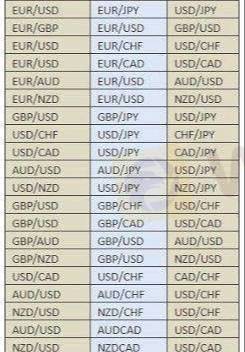

Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

Suka 0

BeastBoy2159

Trader

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

CORRELATION BETWEEN FOREX PAIRS

Aljazair | 2025-02-06 23:38

Aljazair | 2025-02-06 23:38Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama