2025-02-21 18:03

IndustriThe role of the Fed in determining dollar strength

#FedRateCutAffectsDollarTrend

The Role of the Federal Reserve in Determining Dollar Strength

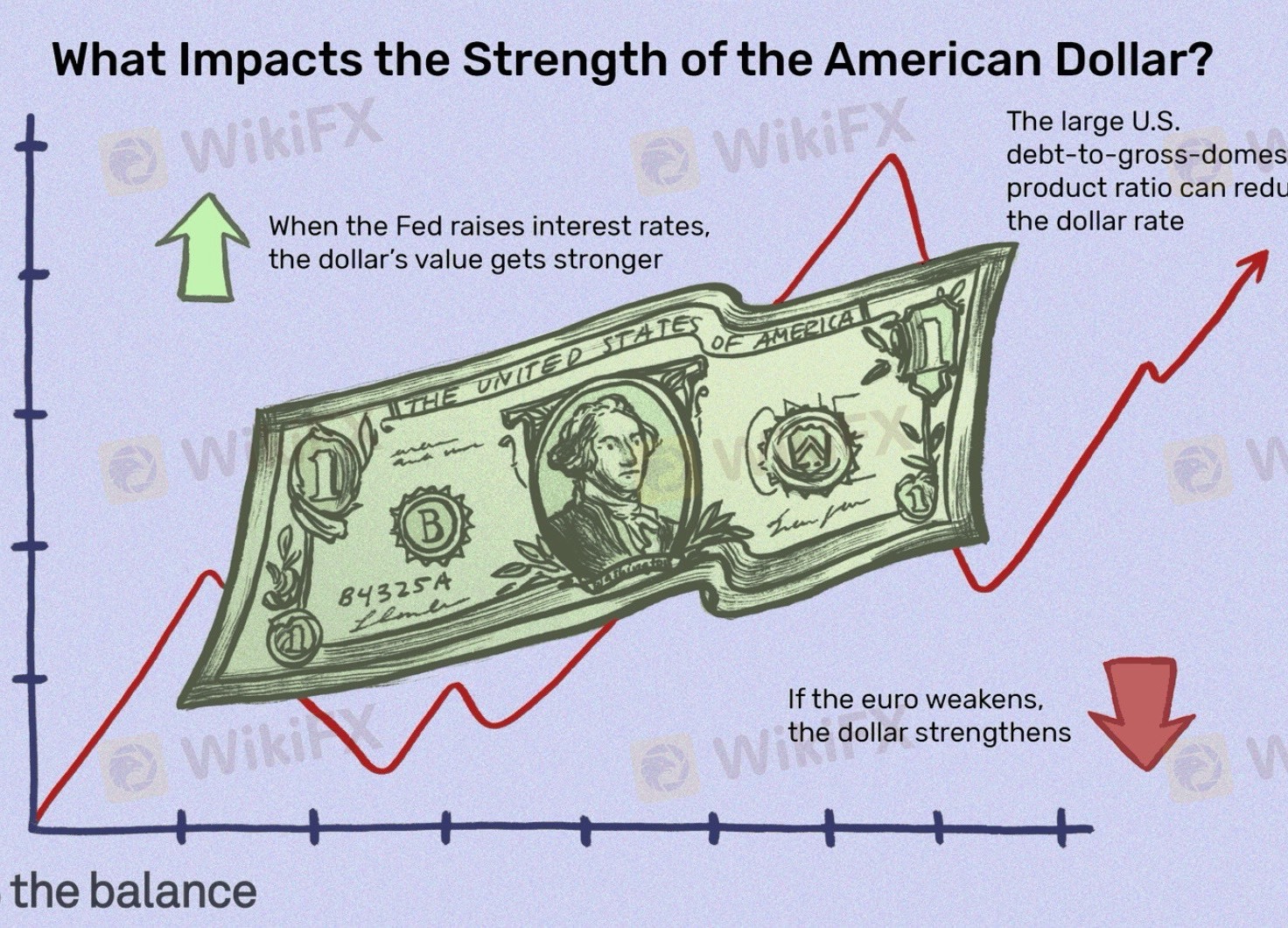

The Federal Reserve plays a crucial role in shaping the value of the U.S. dollar, but it is not the sole determinant. The Fed influences dollar strength primarily through monetary policy, interest rates, and market expectations, but global factors also come into play.

How the Fed Influences the Dollar

1. Interest Rate Policy & Yield Differentials

• The Fed sets the federal funds rate, which affects short-term interest rates.

• Higher rates → Stronger dollar (attracts foreign capital seeking higher returns).

• Lower rates → Weaker dollar (reduces demand for U.S. assets).

• The U.S. dollar’s strength depends on interest rate differentials—how U.S. rates compare to those in other economies.

2. Forward Guidance & Market Expectations

• The Fed signals future rate moves through speeches, dot plots, and policy statements.

• If markets expect faster rate cuts, the dollar weakens before the cuts even happen.

• If the Fed delays or slows cuts, the dollar strengthens due to higher-than-expected rates.

3. Quantitative Easing (QE) & Balance Sheet Policy

• QE (bond-buying programs) increases the money supply, typically weakening the dollar over time.

• Balance sheet tightening (QT), where the Fed reduces its holdings, can support the dollar.

• Example: 2009-2011 → The Fed’s aggressive QE weakened the dollar as liquidity surged.

4. Inflation Control & Purchasing Power

• If the Fed fights inflation aggressively with rate hikes, the dollar strengthens (e.g., 2022).

• If the Fed allows inflation to rise, the dollar’s purchasing power declines.

• Example: In the 1970s, high inflation weakened the dollar until the Fed raised rates sharply in the early 1980s.

Limits to the Fed’s Control Over the Dollar

1. Global Economic Conditions

• If global markets are unstable (e.g., financial crises), demand for the dollar can increase as a safe haven, even if the Fed is cutting rates.

• Example: In early 2020 (COVID crisis), the dollar surged despite emergency rate cuts.

2. Other Central Banks’ Policies

• If the ECB, BoJ, or others are also easing, the dollar may stay strong despite Fed rate cuts.

• Example: In **

Suka 0

FX2192840773

Трейдер

Diskusi populer

Industri

СЕКРЕТ ЖЕНСКОГО ФОРЕКСА

Industri

УКРАИНА СОБИРАЕТСЯ СТАТЬ ЛИДЕРОМ НА РЫНКЕ NFT

Industri

Alasan Investasi Bodong Tumbuh Subur di Indonesia

Industri

Forex Eropa EURUSD 29 Maret: Berusaha Naik dari Terendah 4 Bulan

Analisis pasar

Bursa Asia Kebakaran, Eh... IHSG Ikut-ikutan

Analisis pasar

Kinerja BUMN Karya Disinggung Dahlan Iskan, Sahamnya Pada Rontok

Klasifikasi pasar

Platform

Pameran

Agen

Perekrutan

EA

Industri

Pasar

Indeks

The role of the Fed in determining dollar strength

India | 2025-02-21 18:03

India | 2025-02-21 18:03#FedRateCutAffectsDollarTrend

The Role of the Federal Reserve in Determining Dollar Strength

The Federal Reserve plays a crucial role in shaping the value of the U.S. dollar, but it is not the sole determinant. The Fed influences dollar strength primarily through monetary policy, interest rates, and market expectations, but global factors also come into play.

How the Fed Influences the Dollar

1. Interest Rate Policy & Yield Differentials

• The Fed sets the federal funds rate, which affects short-term interest rates.

• Higher rates → Stronger dollar (attracts foreign capital seeking higher returns).

• Lower rates → Weaker dollar (reduces demand for U.S. assets).

• The U.S. dollar’s strength depends on interest rate differentials—how U.S. rates compare to those in other economies.

2. Forward Guidance & Market Expectations

• The Fed signals future rate moves through speeches, dot plots, and policy statements.

• If markets expect faster rate cuts, the dollar weakens before the cuts even happen.

• If the Fed delays or slows cuts, the dollar strengthens due to higher-than-expected rates.

3. Quantitative Easing (QE) & Balance Sheet Policy

• QE (bond-buying programs) increases the money supply, typically weakening the dollar over time.

• Balance sheet tightening (QT), where the Fed reduces its holdings, can support the dollar.

• Example: 2009-2011 → The Fed’s aggressive QE weakened the dollar as liquidity surged.

4. Inflation Control & Purchasing Power

• If the Fed fights inflation aggressively with rate hikes, the dollar strengthens (e.g., 2022).

• If the Fed allows inflation to rise, the dollar’s purchasing power declines.

• Example: In the 1970s, high inflation weakened the dollar until the Fed raised rates sharply in the early 1980s.

Limits to the Fed’s Control Over the Dollar

1. Global Economic Conditions

• If global markets are unstable (e.g., financial crises), demand for the dollar can increase as a safe haven, even if the Fed is cutting rates.

• Example: In early 2020 (COVID crisis), the dollar surged despite emergency rate cuts.

2. Other Central Banks’ Policies

• If the ECB, BoJ, or others are also easing, the dollar may stay strong despite Fed rate cuts.

• Example: In **

Suka 0

Saya juga ingin komentar

Tanyakan pertanyaan

0Komentar

Belum ada yang berkomentar, segera jadi yang pertama

Tanyakan pertanyaan

Belum ada yang berkomentar, segera jadi yang pertama