Abans Group

Ikhtisar:Abans Group is a financial services company based in the United Kingdom, established in 2022. Despite being unregulated, they offer a range of trading products including Forex pairs, commodities, and cryptocurrencies, with a minimum deposit requirement of £1000. The company operates on the popular Meta Trader 4 and Meta Trader 5 platforms and provides a demo account for practice trading. Commission rates vary from 0 to 5% per lot. Abans Group offers customer support through phone (+44 (0)203 868 5803) and email (support@abansfx.com). For financial transactions, they accept bank transfers as well as credit and debit card payments.

| Aspect | Information |

| Company Name | Abans Group |

| Registered Country/Area | United Kingdom |

| Founded Year | 2022 |

| Regulation | Unregulated |

| Minimum Deposit | £500 |

| Products | Forex,forex pair,commodities,crypto currencies |

| Spreads&Commissions | Spreads:0.05-1.6 pip;Commissions:from 0 to 5% per lot |

| Trading Platforms | Meta Trader 4,Meta Trader 5 |

| Demo Account | Available |

| Customer Support | Phone:+44 168 966 0517,Email:support@bharathcapitals.com |

| Deposit & Withdrawal | Bank transfer,credit/debit card,third-party payment |

Overview of Abans Group

Abans Group is a financial services company based in the United Kingdom, established in 2022. Despite being unregulated, they offer a range of trading products including Forex pairs, commodities, and cryptocurrencies, with a minimum deposit requirement of £1000.

The company operates on the popular Meta Trader 4 and Meta Trader 5 platforms and provides a demo account for practice trading. Commission rates vary from 0 to 5% per lot.

Abans Group offers customer support through phone (+44 (0)203 868 5803) and email (support@abansfx.com). For financial transactions, they accept bank transfers as well as credit and debit card payments.

Is Abans Group Legit or a Scam?

Abans Group, established in 2022 in the United Kingdom, operates as an unregulated financial services provider.

This status implies that they are not subject to the oversight of financial regulatory authorities, potentially increasing risks for clients due to the absence of regulatory safeguards and protections commonly enforced in the industry.

Pros and Cons

| Pros | Cons |

| various Product Offering | Unregulated Status |

| Advanced Trading Platforms | High Minimum Deposit |

| Demo Account Option | Limited Customer Support Channels |

| Flexible Commission Rates | Potential for Limited Transparency |

| Multiple Payment Methods | Risk of Unprotected Funds |

Pros of Abans Group:

various Product Offering: Abans Group provides a range of trading options including Forex pairs, commodities, and cryptocurrencies, meeting various investment preferences.

Advanced Trading Platforms: The availability of Meta Trader 4 and Meta Trader 5 platforms allows traders to use sophisticated tools and features for their trading activities.

Demo Account Option: The provision of a demo account is beneficial for new traders to practice and develop their trading skills without risking real money.

Flexible Commission Rates: Their commission structure varies from 0 to 5% per lot, offering some flexibility based on the volume and type of trading.

Multiple Payment Methods: Acceptance of bank transfers and credit/debit cards provides convenience in managing deposits and withdrawals.

Cons of Abans Group:

Unregulated Status: As an unregulated entity, there is a higher risk for clients due to the lack of oversight by financial authorities, which can impact the safety and security of investments.

High Minimum Deposit: The requirement of a £1000 minimum deposit is prohibitive for small-scale or beginner traders.

Limited Customer Support Channels: While phone and email support are available, the absence of instant communication options like live chat may delay response times.

Potential for Limited Transparency: Unregulated firms may not adhere to the same level of transparency as regulated ones, potentially leading to less clarity about the company's operations and policies.

Risk of Unprotected Funds: Without regulatory oversight, there's an increased risk that client funds are not protected or segregated, which can be a significant concern in case of financial discrepancies or insolvency.

Products

Abans Group offers a variety of market instruments across different asset classes. These include:

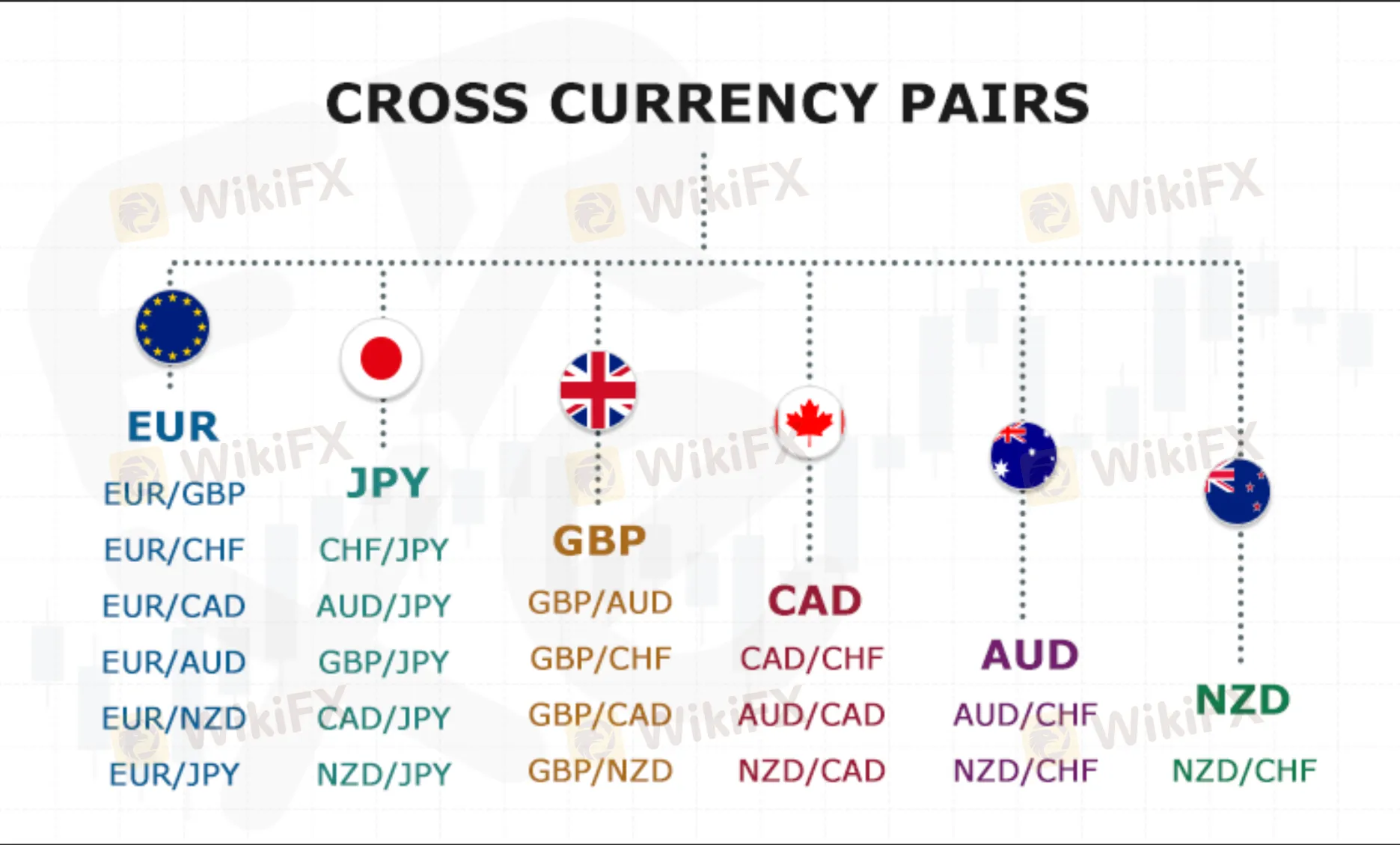

Forex (Foreign Exchange): They provide the opportunity to trade in various currency pairs. Examples of popular forex pairs offered include major pairs like EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), and USD/JPY (US Dollar/Japanese Yen), as well as minor and exotic pairs.

Commodities: This includes trading in physical goods or raw materials. Examples are precious metals like Gold and Silver, energy commodities like Crude Oil and Natural Gas, and agricultural commodities such as Wheat or Corn.

Cryptocurrencies: Abans Group offers the trading of various digital currencies. Common examples could include well-known cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC).

How to Open an Account?

Opening an account with Abans Group can typically be done in the following four steps:

Visit the Website: Start by going to the Abans Group website. Look for the option to open an account, which is usually prominently displayed on the site.

Fill Out the Registration Form: Complete the online registration form with your personal details. This will likely include your name, address, contact information, and possibly financial information related to your trading experience and investment goals.

Verify Your Identity: As part of the account opening process, you will need to verify your identity. This is a standard procedure in the financial industry. You'll be asked to upload identification documents such as a passport or drivers license, and possibly a utility bill or bank statement for address verification.

Make a Deposit: Once your account is set up and your identity verified, youll need to fund your account. The minimum deposit for Abans Group is £1000. Choose your preferred deposit method (bank transfer, credit/debit card) and follow the instructions to transfer funds to your new trading account.

Spreads & Commissions

Abans Group offers a competitive range of spreads and commission structures for its trading services:

Spreads: The spreads offered by Abans Group start from as low as 0.05 pips, extending up to 1.6 pips. This range indicates the broker's flexibility in meeting various trading strategies and styles. A lower spread, like 0.05 pips, is typically seen in highly liquid markets or major currency pairs, while a spread as high as 1.6 pips is found in less liquid or more volatile markets.

Commissions: The commission rates at Abans Group vary, starting from 0% and going up to 5% per lot. This means that for some transactions or account types, traders will not pay any commission at all, while in other cases, a commission up to 5% could be charged. The specific commission rate could depend on factors like the type of account, trading volume, and the market instruments being traded.

Trading Platform

Abans Group provides its clients with access to two of the most popular and widely used trading platforms in the industry:

MetaTrader 4 (MT4): MT4 is renowned for its user-friendly interface, robust technical analysis tools, and automated trading capabilities through Expert Advisors (EAs). It offers a variety of charting tools, indicators, and customizable features, making it suitable for both novice and experienced traders.

MetaTrader 5 (MT5): MT5 is the successor to MT4 and offers all the features of its predecessor, along with additional capabilities. It includes more advanced charting tools, more timeframes, a greater number of indicators, and enhanced trading functions.

Deposit & Withdrawal

Abans Group offers a straightforward and convenient process for depositing and withdrawing funds, with the following options available:

Bank Transfer: Clients can transfer funds directly from their bank account to their trading account. This method is generally secure and can handle large transactions, but it takes a few days for the funds to be reflected in the trading account, depending on the banks involved and their respective processing times.

Credit/Debit Card: Deposits and withdrawals can also be made using credit or debit cards. This is often a quicker method compared to bank transfers, with deposits typically being credited to the trading account almost instantaneously. However, withdrawal times can vary, and there are limits on the amount that can be processed per transaction.

Customer Support

Abans Group offers customer support primarily through two channels: telephone and email. Clients can reach out to their support team via phone at +44 (0)203 868 5803 for immediate assistance, which is particularly useful for urgent inquiries or issues requiring direct communication.

Additionally, for less time-sensitive matters or for detailed queries, customers can contact them at support@abansfx.com.

Conclusion

In conclusion, Abans Group is a relatively new financial services provider based in the United Kingdom, offering a range of trading options in Forex, commodities, and cryptocurrencies on the advanced MetaTrader 4 and MetaTrader 5 platforms.

Despite its unregulated status, which raises concerns about client protection, the company attracts traders with its various product offerings, competitive spreads starting from 0.05 pips, and a flexible commission structure.

The minimum deposit requirement is £1000, and clients have access to multiple deposit and withdrawal methods, including bank transfers and credit/debit cards. Customer support is provided via phone and email, ensuring assistance is available for various client inquiries and needs.

FAQs

Q: What types of trading instruments does Abans Group offer?

A: Abans Group offers a variety of trading instruments including Forex pairs, commodities, and cryptocurrencies, meeting various trading preferences.

Q: Is Abans Group a regulated financial service provider?

A: No, Abans Group operates as an unregulated financial services provider, meaning they are not overseen by any financial regulatory authority.

Q: What trading platforms are available with Abans Group?

A: Abans Group provides the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their advanced trading tools and user-friendly interfaces.

Q: What is the minimum deposit required to open an account with Abans Group?

A: The minimum deposit required to open an account with Abans Group is £1000.

Q: How can I contact Abans Groups customer support?

A: Customer support for Abans Group can be reached via phone at +44 (0)203 868 5803 or email at support@abansfx.com.

Q: Are there any demo accounts available at Abans Group?

A: Yes, Abans Group offers demo accounts, allowing traders to practice trading and test strategies without risking real money.

Q: What are the spread and commission rates at Abans Group?

A: Spreads at Abans Group start from 0.05 pips and can go up to 1.6 pips. The commission rates vary from 0% to 5% per lot.

Broker yang bersangkutan

WikiFX Broker

Berita Terhangat

Terjadi Di Maret 2025 ! BAPPEBTI Bekukan Broker Indonesia PT Soegee Futures

Pengumuman Rilis Aplikasi WikiFX Versi 3.6.4

Akankah Emas Menembus Batas ? Dolar Semakin Bergetar ! Dampak Aksi Trump

WAJIB Bayar 1,6 Juta Euro, Hukuman Kasus Finfluencer Neo Broker BUX Markets

WoW ! Volume Perdagangan Klien Broker ATFX Sebesar $643 miliar Pada Q4 2024

Nilai Tukar