Dutch Prime-Overview of Minimum Deposit, Spreads & Leverage

概要:Dutch Prime securities ltd. is a broker based in St. Vincent and the Grenadines, engaging in providing global clients with various financial products and services.

| Broker Name | Dutch Prime |

| Registered Country | Saint Vincent and the Grenadines |

| Company Name | Dutch Prime Securities |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:400 |

| Spreads | Competitive spreads on currency pairs |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | - Over 50 currency pairs - 60+ shares - 13 indices CFDs - Gold and silver |

| Account Types | - Standard - Demo |

| Demo Account | Available |

| Customer Support | 24/5 multilingual support via email and phone |

| Payment Methods | USDT |

General Information

Dutch Prime securities ltd. is a broker based in St. Vincent and the Grenadines, engaging in providing global clients with various financial products and services.

They offer traders access to a variety of financial markets through the MetaTrader 4 (MT4) platform, with competitive spreads on currency pairs and a maximum leverage of 1:400. Traders can choose between Standard and Demo accounts, and there is a Demo account option for practice. While the broker provides multilingual customer support via email and phone on a 24/5 basis.

Pros and Cons

Dutch Prime Securities offers a range of trading options, including access to various trading instruments such as currency pairs, shares, indices, and precious metals.

However, there are notable drawbacks, primarily related to the absence of regulatory oversight, limited educational resources, and the need for traders to exercise caution.

| Pros | Cons |

| |

| |

|

Regulatory Status

Dutch Prime Securities is regulated by the FinCEN in the United States, with the license number of 31000270188944.

Market Instruments

Dutch Prime offers access to four popular and mainstream tradables, including forex currency pairs (over 50), shares (over 60), 13 indices, precious metals such as gold and metal. However, this broker does not support popular cryptocurrency trading and future trading.

| Tradable Instruments | Supported |

| Currency Pairs | ✅ |

| Shares | ✅ |

| Indices | ✅ |

| Precious Metals | ✅ |

| Cryptocurrency | ❌ |

| Future | ❌ |

Accounts

There are two kinds of account types for investors to choose from at Dutch Prime: Standard (Live trading account) and Demo.

- Standard Accounts: The broker provides traders with Standard accounts designed for live trading in the financial markets. These accounts offer access to a wide range of trading instruments, including currency pairs, shares, indices, and precious metals. Standard accounts are suitable for those who want to engage in real-money trading and take advantage of the broker's ultra-tight spreads on major currency pairs.

- Demo Accounts: For traders who are new to the platform or wish to practice their trading strategies risk-free, the broker offers Demo accounts. These accounts are instrumental in helping individuals gain familiarity with the broker's trading environment and test their trading strategies using virtual funds. Demo accounts replicate real-market conditions, allowing traders to experience the dynamics of trading without risking their own money.

Leverage

This broker offers a maximum trading leverage of up to 1:400. Leverage is a financial tool commonly used in trading that allows traders to control a larger position size with a relatively smaller amount of capital.

Spreads & Commissions

The spreads start from 0.01 pips. No commission is charged.

Trading Platform

Dutch Prime provides clients with access to the worlds financial markets through the MetaTrader 4 (MT4) platform (Windows, Apple, Android) which is used by millions of traders around the globe.

MT4 serves as a bridge to the trading world, providing traders with tools for technical analysis, real-time market monitoring, and the automation of trading strategies via Expert Advisors. Key highlights of MT4 with Dutch Prime Securities include access to over 100 trading instruments, competitive spreads, customizable indicators, a maximum leverage of 1:200, multi-device compatibility (desktop, mobile, tablet), full Expert Advisors functionality, one-click trading, and advanced charting tools with over 50 indicators.

This platform is available for download on Android, iOS, and Windows devices, ensuring accessibility for traders on various platforms.

Deposit & Withdrawal

Payment methods include credit cards, E-Wallet and bank transfer. Clients can make deposits via HSBC Bank, and can also use cryptocurrencies like BUSD (BEP20), USDT (TRC20), USDT (ERC20). There is 0% commission charged on deposit and withdrawal.

Customer Support

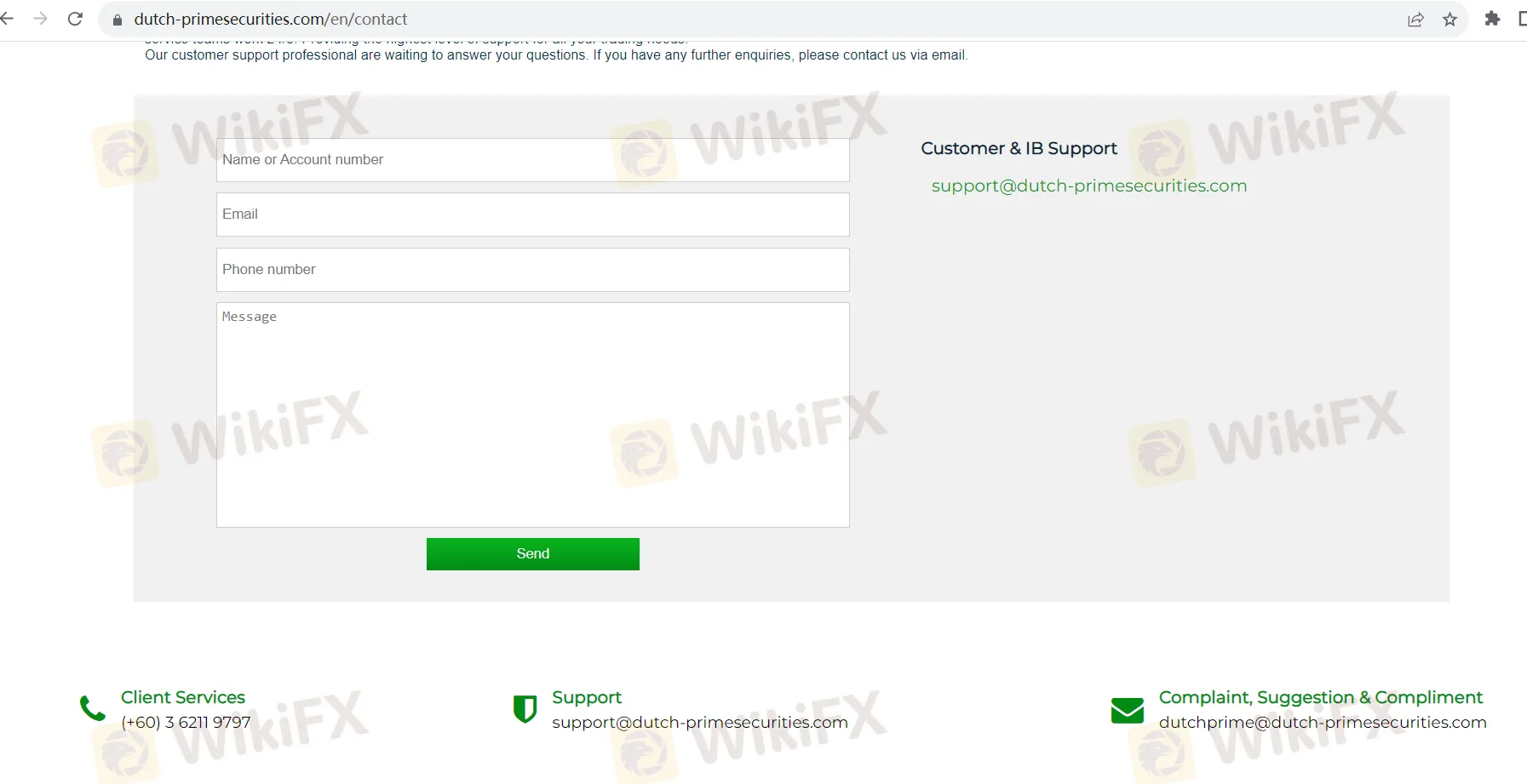

Dutch Prime Securities is known for its exceptional customer support, with dedicated multilingual teams available 24/5 to assist traders.

For specific support needs, contact details are provided, including Client Services at (+60) 3 6211 9797 and email support at support@dutch-primesecurities.com.

They also have a channel for Complaints, Suggestions, and Compliments at dutchprime@dutch-primesecurities.com.

Conclusion

Dutch Prime Securities presents a mixed bag for traders. While they offer a wide range of trading instruments, including CFDs, shares, indices, and precious metals, the absence of regulatory oversight raises significant concerns about the safety of clients' funds and fair trading practices.

Additionally, the limited educational resources provided could leave traders seeking additional support and guidance elsewhere. While their customer support is available 24/5.

FAQs

What is the minimum deposit required to start trading with Dutch Prime Securities?

The minimum deposit to begin trading with Dutch Prime Securities is $100.

What trading instruments are available on Dutch Prime Securities?

Dutch Prime Securities offers a diverse range of trading instruments, including over 50 currency pairs, more than 60 major US and German shares, 13 indices CFDs, and trading in gold and silver.

Can I practice trading before using real money?

Yes, Dutch Prime Securities offers Demo accounts for traders who wish to practice their strategies risk-free. These accounts replicate real-market conditions using virtual funds.

What is the maximum leverage offered by Dutch Prime Securities?

Dutch Prime Securities provides a maximum trading leverage of up to 1:200, allowing traders to control larger positions with a relatively smaller amount of capital.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

WikiFXブローカー

レート計算