ES markets

概要:ES Markets, established in 2018 and based in China, operates without formal regulation. It offers a wide range of tradable assets including forex, energy, metals, and indices with account types like Standard, Professional, and Clearing, alongside a demo account for practice throught the MT4 platform. The minimum deposit starts at $500.

| ES markets Review Summary | |

| Founded | 2018 |

| Registered Country/Region | China |

| Regulation | Unregulated |

| Market Instruments | Forex, energy (crude oil), precious metals and index |

| Demo Account | ✅ |

| Leverage | Up to 1:100 |

| Spread | From 1.6 pips (Standard account) |

| Trading Platform | MT4 |

| Min Deposit | $500 |

| Customer Support | Service time: 8.30 am – 10 pm |

| Tel: +86-5318643352, +852-68516677 | |

| Email: Service@esmarketstrader.com | |

| Office address: UNIT 10 9/FW212212 TEXACO ROADTSUEN WAN NEW TERRITORIES HONG KONG | |

| Regional Restrictions | The United States, Canada, Japan, Turkey, Israel and the Islamic Republic of Iran, etc. |

ES Markets, established in 2018 and based in China, operates without formal regulation. It offers a wide range of tradable assets including forex, energy, metals, and indices with account types like Standard, Professional, and Clearing, alongside a demo account for practice throught the MT4 platform. The minimum deposit starts at $500.

Pros and Cons

| Pros | Cons |

| Security measures provided | No regulatory oversight |

| Demo account for practice trading | High minimum deposit requirement |

| Multiple account types | No information related to funding |

| Flexible leverages | Regional restrictions |

| MT4 trading platforms available |

Is ES markets Legit?

ES Markets states that their client funds are kept in separate bank accounts, ensuring complete separation from the company's working capital. These funds are managed independently within a third-party bank account at a financial institution in the European Union. ES Markets LLC employs the SSL (Secure Sockets Layer) network security protocol to secure data communications between the company and its clients. However, the company is not regulated.

What Can I Trade on ES markets?

ES markets offers forex, energy(crude oil), precious metals and index. It offers 28 foreign currency mainstream currency pairs, including US Dollar, Euro, British Pound, Japanese Yen, Canadian Dollar, etc. Besides, you have access to six precious metal pairs, including gold or silver in US dollars or Euros.

It also offers six major indexes including the Dow Jones Index, the S&P Index, the Nasdaq Index, the UK FTSE 100 Index, the German DAX30 Index, and the French CAC 40 Index.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energy (Crude oil) | ✔ |

| Precious metals | ✔ |

| Index | ✔ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

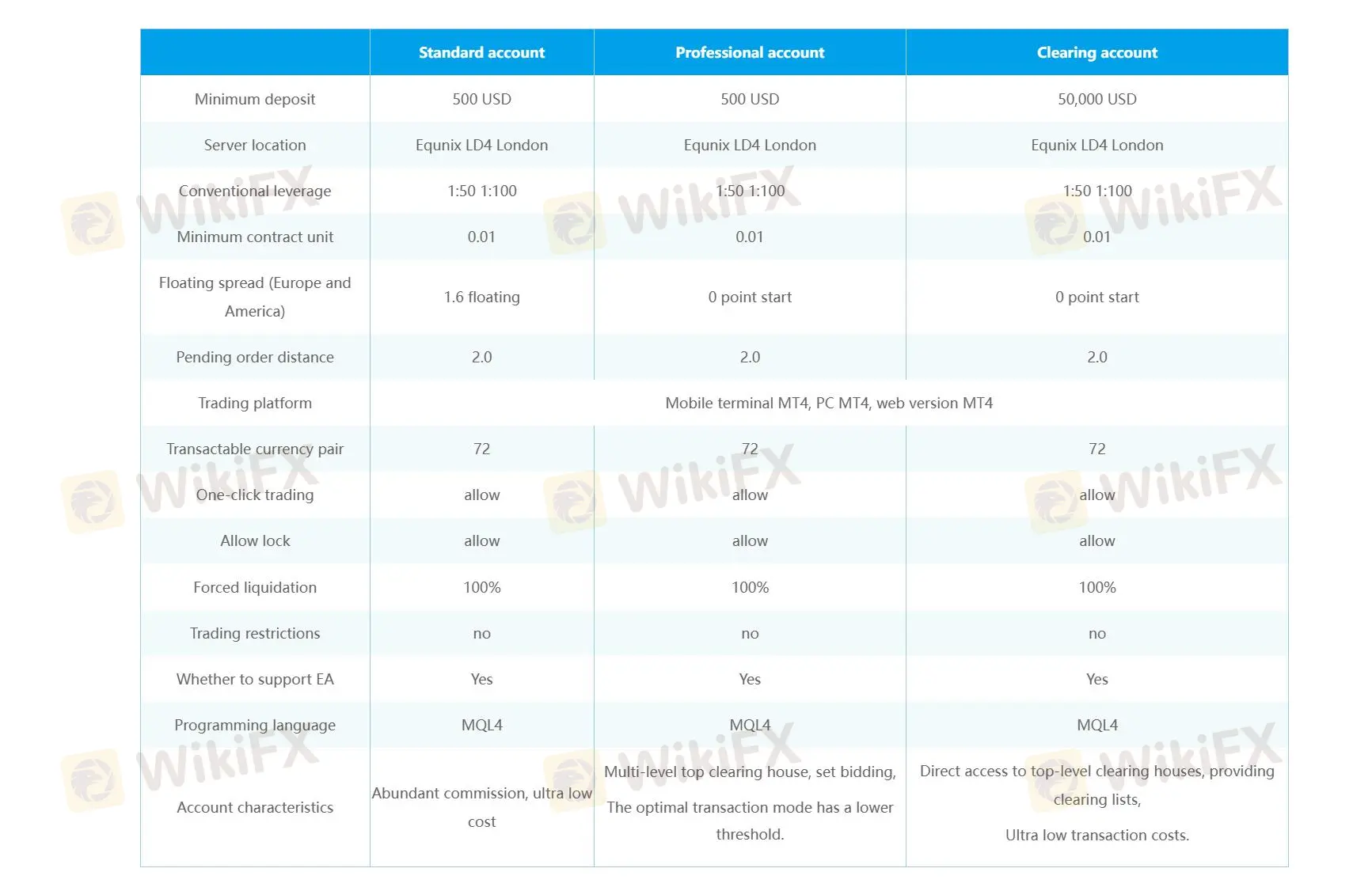

Account Type

ES markets offers three live accounts: the Standard account, the Professional account and the Clearing account with the minimum deposit of $500, $500 and $50,000 respectively.

A demo account is also available for those looking to practice without financial risk.

The details on each account are as follows:

| Account Type | Standard | Professional | Clearing |

| MinDeposit | 500 USD | 500 USD | 50,000 USD |

| Server Location | Equnix LD4 London | ||

| MinContract Unit | 0.01 | ||

| Pending Order Distance | 2.0 | ||

| Transactable Currency Pairs | 72 | ||

| One-click Trading | ✔ | ||

| Allow Lock | ✔ | ||

| Support for EA | ✔ | ||

| Programming Language | MQL4 | ||

| Features | Abundant commission, ultra low cost. | Multi-level top clearing house, set bidding, the optimal transaction mode has a lower threshold. | Direct access to top-level clearing houses, providing clearing lists, ultra low transaction costs. |

Leverage

ES Markets provides leverage options for various trading instruments: 1:50 or 1:100 for forex trading, 1:50 for crude oil and precious metals, and 1:100 or 1:20 for indices. The leverage options are available across three account types: Standard Account, Professional Account, and Clearing Account, all offering 1:50 or 1:100 leverage.

| Account Type | Forex | Crude Oil & Precious Metals | Indices |

| Standard | 1:50 or 1:100 | 1:50 | 1:100 or 1:20 |

| Professional | |||

| Clearing |

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ES markets Fees

ES Markets structures its spreads across its account offerings. The Standard account features spreads beginning at 1.6 pips. The Professional and Clearing accounts, however, offer spreads starting at 0 pips to serve high-volume.

| Account Type | Spread |

| Standard | From 1.6 pips |

| Professional | From 0.0 pips |

| Clearing | From 0.0 pips |

Trading Platform

ES Markets offers a comprehensive MetaTrader 4 (MT4) trading platform, including its Mobile terminal MT4, PC MT4, and web version MT4. The Mobile terminal MT4 enables traders to execute trades and monitor markets on the go via smartphones or tablets, while the PC MT4 provides robust charting and trading capabilities. The web version MT4 allows traders to access the platform and perform trades directly through their web browsers without any software installation.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Mobile, PC, Web | Beginners |

| MT5 | ❌ | / | Experienced traders |

WikiFXブローカー

話題のニュース

海外FXの光と影:200万円を出金拒否で失った実体験を語ります

flatexDEGIROに罰金56万ユーロ、金融庁も注視する「不適切な投資広告」の基準とは

プロップファームの黄金時代は続くか?2026年に訪れる「激震」とは?

Golden Insight Award 審査員の声 | Greg Matwejev(BCR チーフ・マーケット・ストラテジスト)

Golden Insight Award審査員の声|Taurex アジア太平洋地域統括責任者 Dennis Yeh

「仕手株」に厳罰。豪当局がSNSを利用した価格操作に警告、4人の有罪判決を受けて

1年で130倍、DeFi低迷の裏で急成長する「予測市場」

積立投資はもう古い?Z世代・ミレニアル世代が「オルタナティブ資産」に熱視線を送る理由

WikiFX クリスマス特別メッセージ&年末限定キャンペーン

レート計算